Join our Telegram Channel to stay up to date on the coverage of information on the breakup

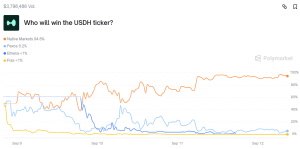

The chances of Polymarket that the native markets will win the offer for the stablecoin USDH of Hyperliquid has climbed to 94.8% after the Ethena laboratories withdrew its application.

It is after the chances of the popular decentralized Paris platform that the native markets will win the offer of more than 25% in the last 24 hours.

USDH ODDDS ODDDS (Source: Polymarket))

In a contract that asked which tenders’ issuers would win, the merchants on Polymarket also said that there was a 5.2% vote according to which Paxos, a well -known stabing transmitter which helped launch the Pyusd token of Paypal, will win the HyperLiquid Stablecoin offer.

Ethena Labs withdraws from USDH auction

The blatant confidence that the indigenous markets will win the offer of a hyperliquid stablecoin occurs after the founder of Ethena Labs, Guy Young, said that his team “will respectfully remove” his proposal for the launch of Stablecoin.

In a post X, the founder said that the decision had followed “direct discussions with community and validators”.

During these discussions, the concerns concerning Ethena are not an indigenous hyperliquid team, the other ranges of Ethena products outside the USDH, and Ethena’s ambitions which “extend beyond working with a single exchange of partners”, appeared, which declared that Young finally led to the decision.

In her proposal, Ethena said that she would make USDH 100% supported by her own stable coin. The token is currently issued via Digital Bank anchorage and is guaranteed by Blackrock’s Buidl Fund, which, according to the team, would offer the USDH institutional credibility.

Ethena Labs also promised 95% of the net income generated by USDH reserves to the hyperliquidal community via redemptions of media threshing tokens, contributions to the assistance fund and distributions to the validators. The project also initiated at least $ 75 million for the development of ecosystems and incentives.

Before Ethena Labs withdrew her proposal, Arthur Hayes had also added to his participations in the ENA token native of the project.

Earlier this week, he bought 1.34 million tokens for $ 1.02 million USD (USDC), according to chain data cited by Lookonchain in a position of Sept 12.

Arthur Hayes (@Cryptohayes) spent 1.02 m $ USDC Buy 1.34 m $ Ena Again in the last 8 hours and currently has 4.45 m $ Ena(3.48 m). pic.twitter.com/qahbrh28sh

– Lookonchain (@lookonchain) September 9, 2025

ENA has seen its price drop a fraction of a percentage in the last 24 hours while some investors were probably sold after relying on the USDH proposal. At 3:15 a.m., ENA is negotiated at $ 0.7814, according to to CoinMarketCap data. Despite the minor withdrawal, the Altcoin is still sitting on a weekly gain of more than 17%.

Crypto Community says there is a certain bias in the voting process

Indigenous markets are a newcomer to the market. It was founded by Max Fiege, who is an eminent defender, investor and manufacturer within the hyperliquid ecosystem.

Given the way in which the native markets, even if it is a newcomer, has increased, some in the cryptographic community argue that the USDH voting process has been set up to promote the project given the links of its founder with the hyperliquid ecosystem.

Earlier this week, the co-founder of Dragonfly, Haseeb Qureshi, said that the process was “a little a farce” and added that he seemed that hyperliquid initiates had already determined that the native markets would win the offer.

Starting to feel like the USDH RFP was a bit of a farce.

Hearing several tenderers that none of the validators wishes to consider anyone in addition to the native markets. It is not even a serious discussion, as if there had already been a back-shop.

Native markets’ … pic.twitter.com/qrc9xchv6z

– Haseeb > | < (@Hosseeb) September 9, 2025

Meanwhile, the chief of the farm and co -founder of the Oak Research, Lilian Aliaga, suggested There could be a “bias at stake” and wondered how the newcomer to the market was able to submit an offer so quickly after Hyperliquid opened the USDH RFP which collected the majority of the validator’s vote.

Aliaga continued by saying that he was not so confident that the native markets could “transform the USDH into a stablecoin of several billion billion”, adding that there seems to be a “big gap between the ambitions around the USDH and what is really going on”.

The co-founder of the indigenous markets Max Fiege responded to the concerns of the community in a recent post X.

“We have spent the last six days to get involved with validators and members of the community, new and old, answering the questions and concerns they had about our vision and how we will see it,” wrote Fiege in the post.

“We know that we are a new team and that we do not take the burden to prove us lightly,” added the co-founder.

You have also discussed criticism around the native markets and you said: “No one cares about your size, your history, your pedigree or your financial resources”.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup