A version of this article appeared in our Decentralized newsletter of December 10. Register here.

general manager, Tim here.

- Pump.fun is in decline.

- New analysis reveals “shocking” concentration of power in DAOs.

- Robert Leshner of Compound is bullish on XRP DeFi.

Pump.fun collapses

Users are evaporating from top memecoin platform Pump.fun after a series of controversies and a ban by the UK’s financial watchdog.

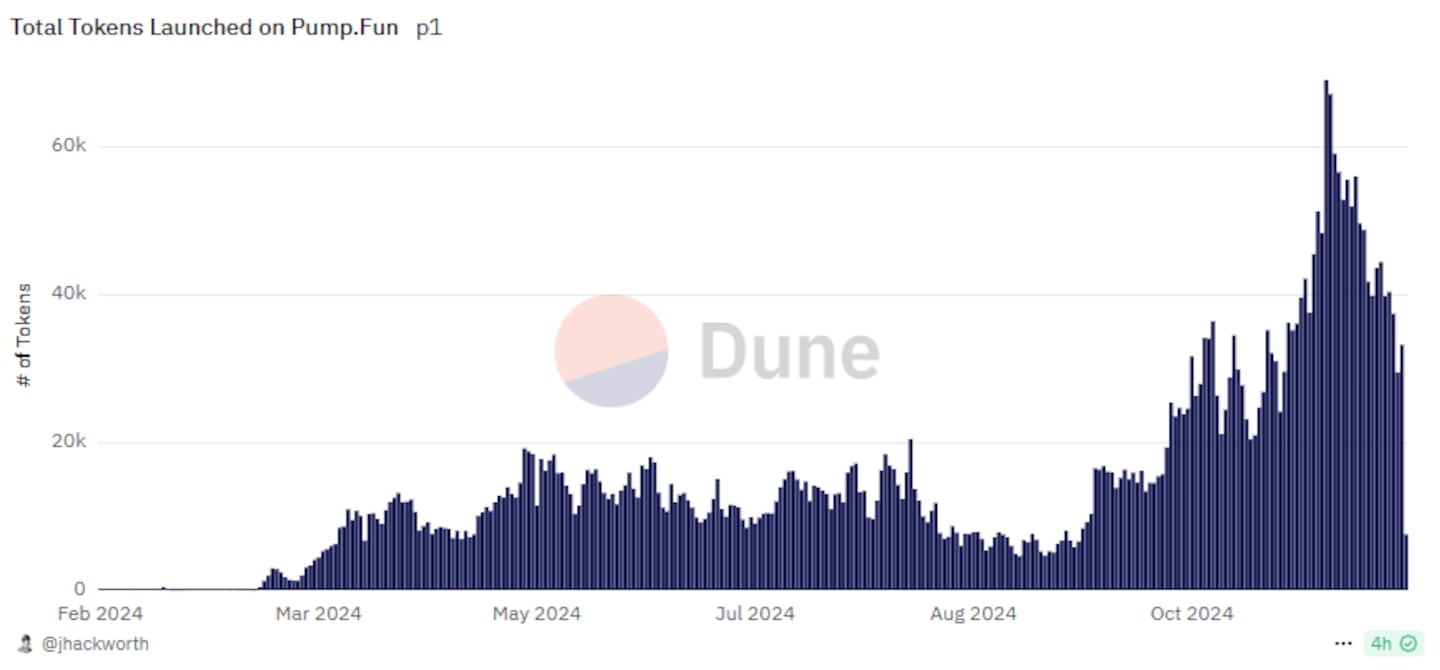

On November 20, the number of memecoins created in a 24-hour period reached an all-time high of 69,000. Today, that number has more than halved to just 33,000.

Daily active users, which peaked at 261,000 on November 29, are now down to 161,000, a decline of 38%.

Other key metrics, such as fees, revenue, and trading volume, also fell.

This drop could signal the beginning of the end for one of the main drivers of crypto attention this year.

In 2024, memecoins created on Pump.fun have created millionaires and helped propel the Solana blockchain to an all-time high in user activity.

Join the community to receive our latest stories and updates

Certainly, many memecoins that predate Pump.fun are still thriving.

But the platform has been marred by controversy in recent months.

Anyone can create a memecoin on pump.fun. There is no control and users often choose to remain anonymous. Racist memecoins, dangerous stunts, and even a fake suicide have all attracted negative attention.

After Pump.fun turned off its live streaming feature on November 25, its revenue dropped by 33%.

Since then, the UK’s Financial Conduct Authority has warned that Pump.fun is not authorized to operate in the country and blocked the platform.

Are DAOs decentralized?

DeFi protocols are not as decentralized as they seem, according to a new analysis from the Cambridge Center for Alternative Finance.

The research institute based at the University of Cambridge examined the level of centralization among the 10 largest decentralized autonomous organizations – or DAOs – as part of the launch of its new DeFi analysis tool, the Cambridge DeFi Navigator.

Among the DAOs analyzed, the consolidation of power was “shocking,” said Christopher Jack, head of the Cambridge DeFi Navigator program. DL News.

Jack’s team applied the Gini coefficient – a widely used measure to assess income or wealth inequality within a population – to assess the concentration of power within DAOs.

The analysis found that the DAOs behind DeFi protocols exhibit levels of power concentration comparable to those of the world’s most unequal countries, with governance often dominated by a few large players.

“When I talk to industry participants, they all tell me that governance is pretty concentrated in the hands of a few big players,” Jack said. “That’s really what you see here too.”

Leshner’s XRP bet

Robert Leshner, an early founder of DeFi on Ethereum, is now looking to support crypto entrepreneurs building DeFi applications on the XRP Ledger – Ripple’s answer to public blockchains like Ethereum.

“What makes DeFi on Ripple exciting is the huge retail user base they have built, even without on-chain applications,” he said. DL News.

Leshner launched Compound Finance in 2017, one of the first lending protocols on Ethereum.

There’s just one problem.

The XRP Ledger does not yet have widespread programmability for smart contracts, making its development difficult.

This is expected to change with the launch of the Ripple EVM sidechain, which would make the network much more like Ethereum.

Leshner wants to be there before he arrives.

“We see this as an inflection point for the arrival of DeFi on Ripple,” he said. “We want to meet with the teams that make up Ripple DeFi before it is ready.”

This week in DeFi governance

VOTE: Across DAO Considers Bridge Support for Kraken’s Ink Blockchain

VOTE: Arbitrum DAO elects the members of its research and development collective

VOTE: BNB Chain votes to enable new token recovery feature

Article of the week

Crypto Twitter is looking into quantum computing after Google revealed its new Willow chip.

Quantum computing has been around for about 30 years. Same with “the next billion users” and “a non-Ponzi use case”. There is no need for us to worry about these things.

– Gwart (@GwartyGwart) December 9, 2024

Do you have a tip on DeFi? Contact us at tim@dlnews.com.