- The creators of Notcoin leveraged Telegram’s user base to build a community around the NOT token.

- Key indicators show reduced potential for price recovery despite Notcoin burning 233 million tokens.

Notcoin (NOT) has shown signs of exhaustion in the spot market, with the token’s price dropping 31% over the past 30 days. Technical and on-chain metrics point to weakening momentum, suggesting that the downward price trend could persist.

Weakening price strength

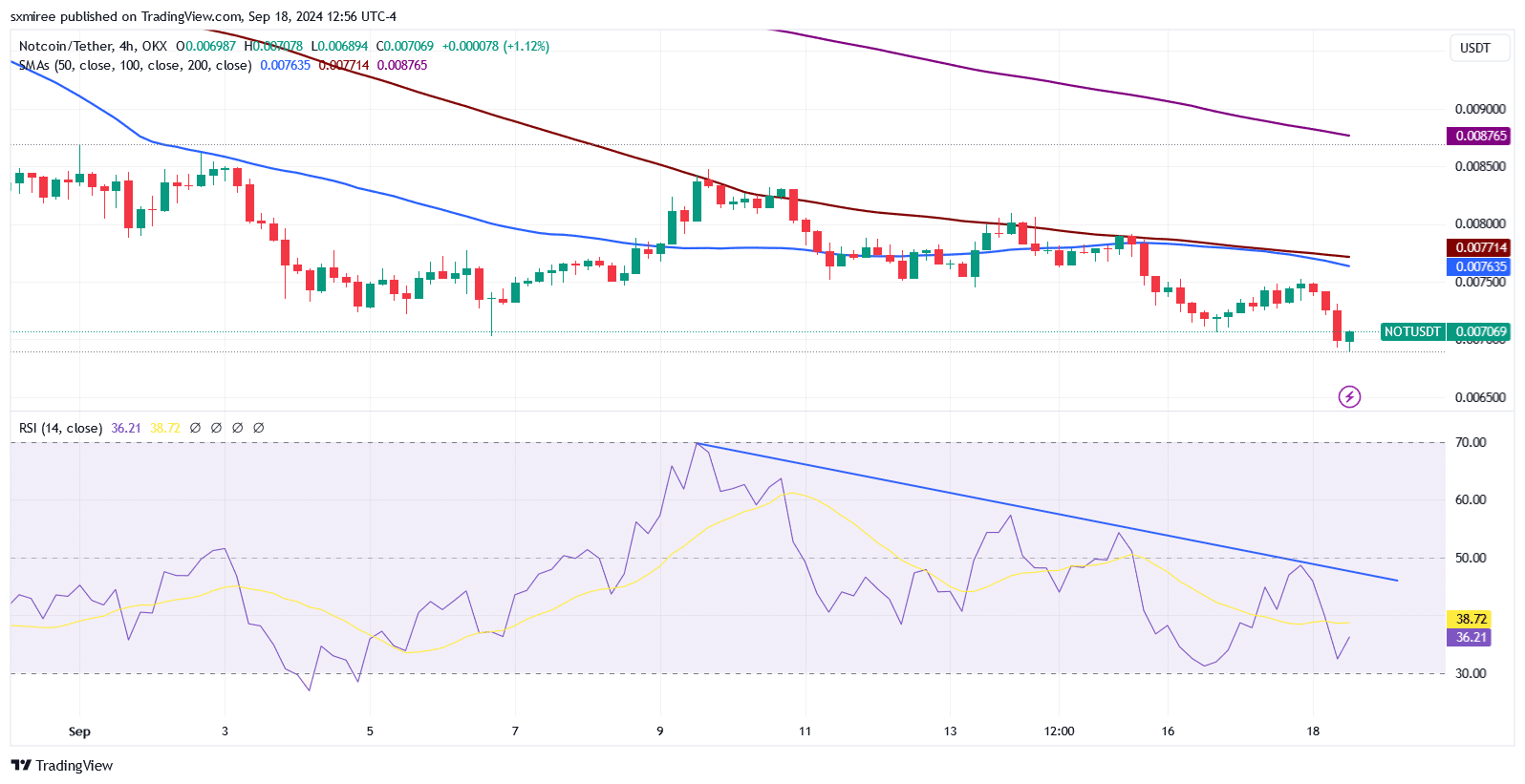

Data from the NOT/USD 4-hour chart from TradingView shows that the Relative Strength Index (RSI) has been trending lower since peaking near the overbought zone on September 9.

The downtrend in the 4-hour RSI indicates that selling pressure is weighing on the pair and could be a precursor to further price declines.

Source: TradingView

It is worth noting that only 23% of Notcoin addresses are profitable at current prices, while a staggering 65.50% are in the red, according to data from IntoTheBlock.

NOT faces notable resistance at $0.0083, where 171,780 addresses holding a total of 3.59 billion tokens are underwater.

Network activity down

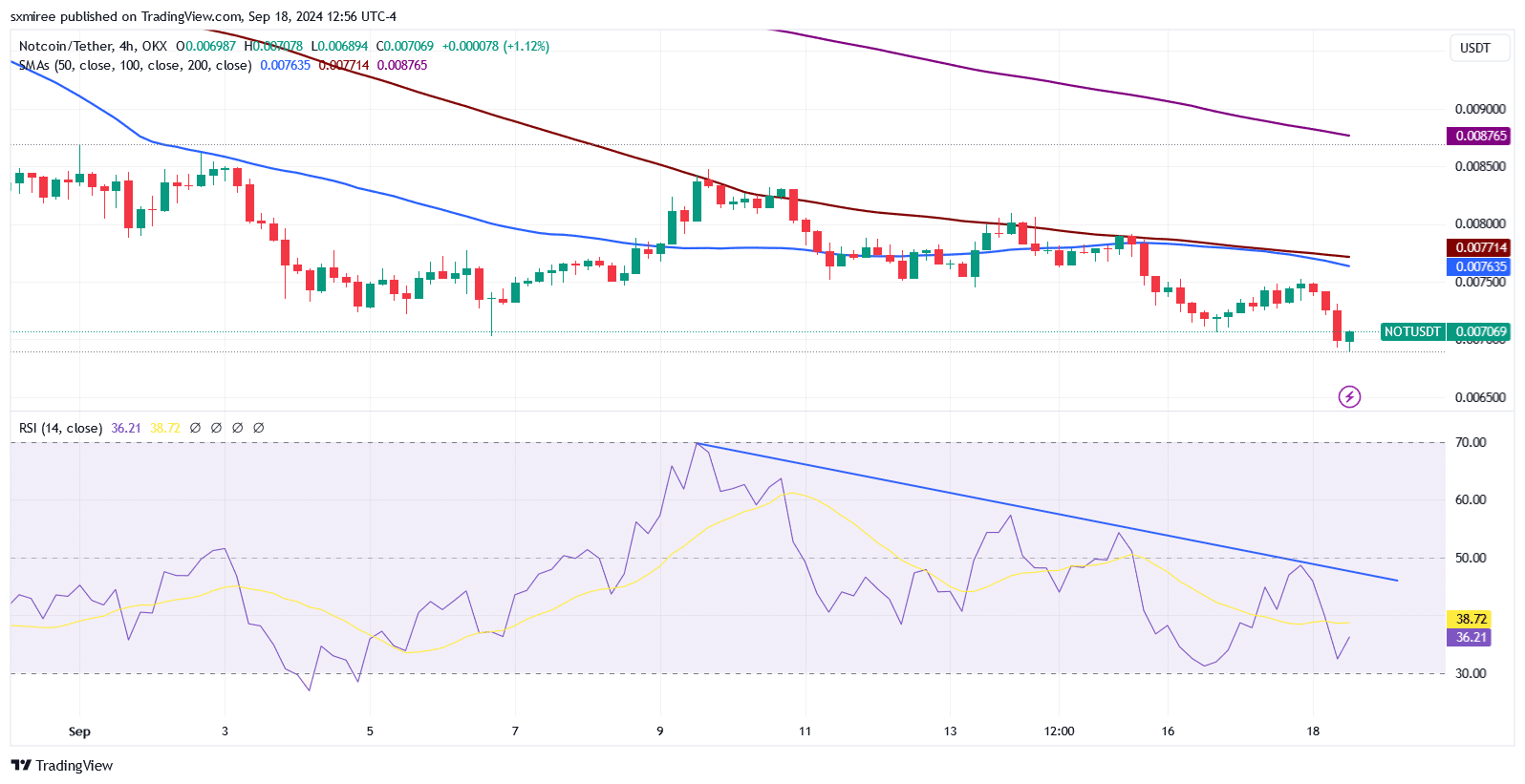

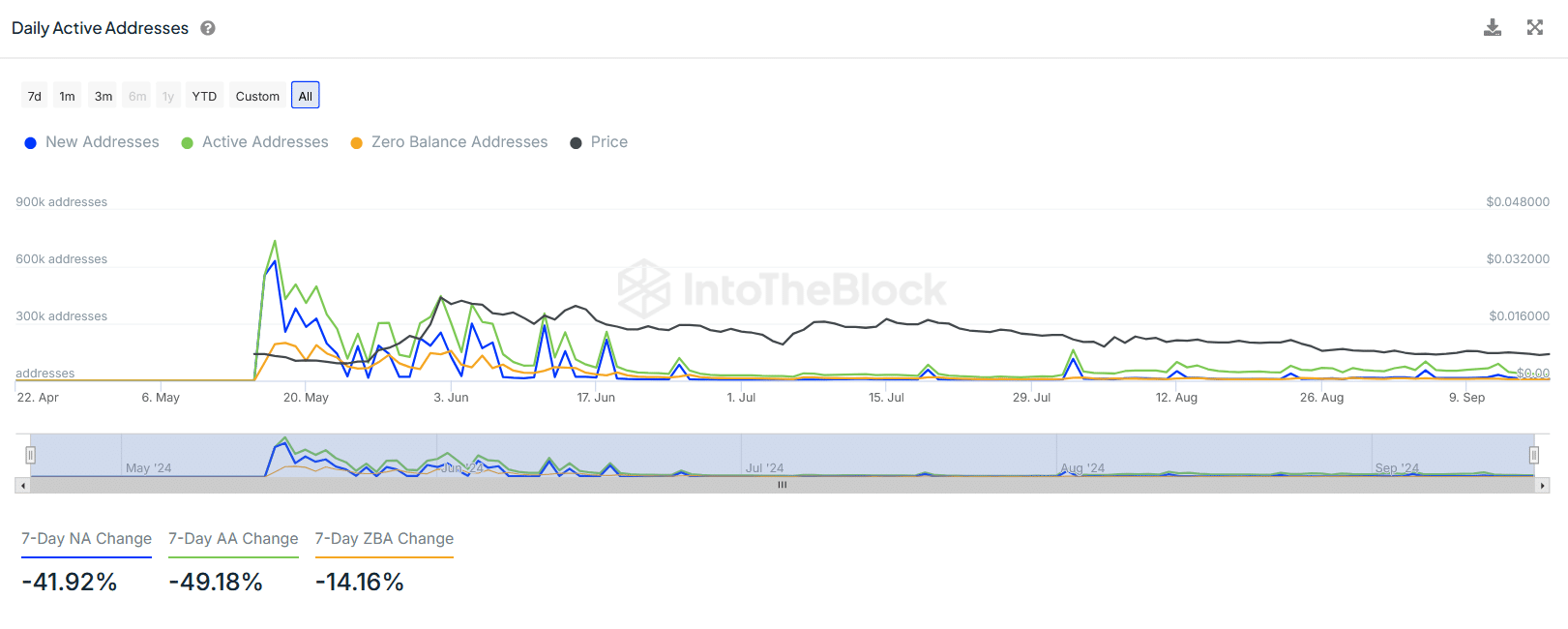

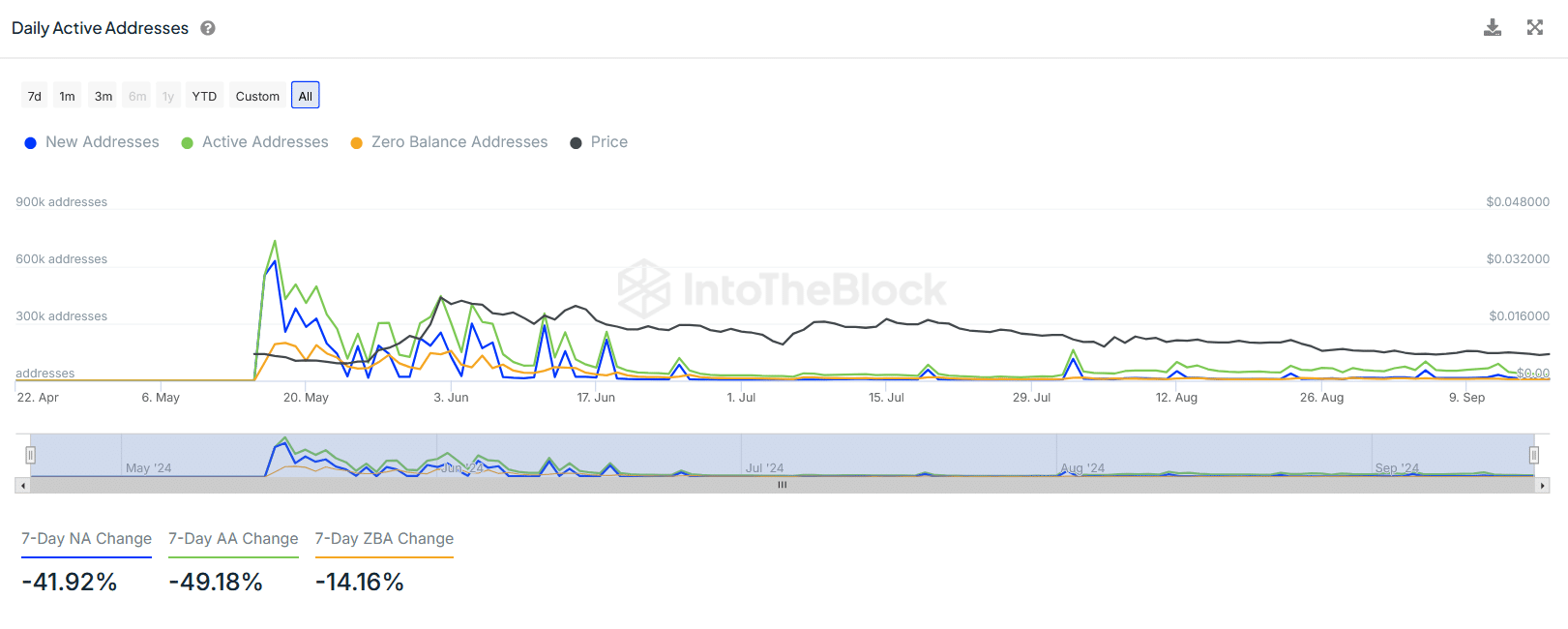

Further reinforcing the bearish outlook, on-chain metrics reveal a sharp decline in Notcoin network activity, affirming that enthusiasm around the tap-to-earn game has waned.

New addresses on the network have dropped 41.9% over the past 7 days, while active addresses have dropped 49.2% over the same period.

Source: IntoTheBlock

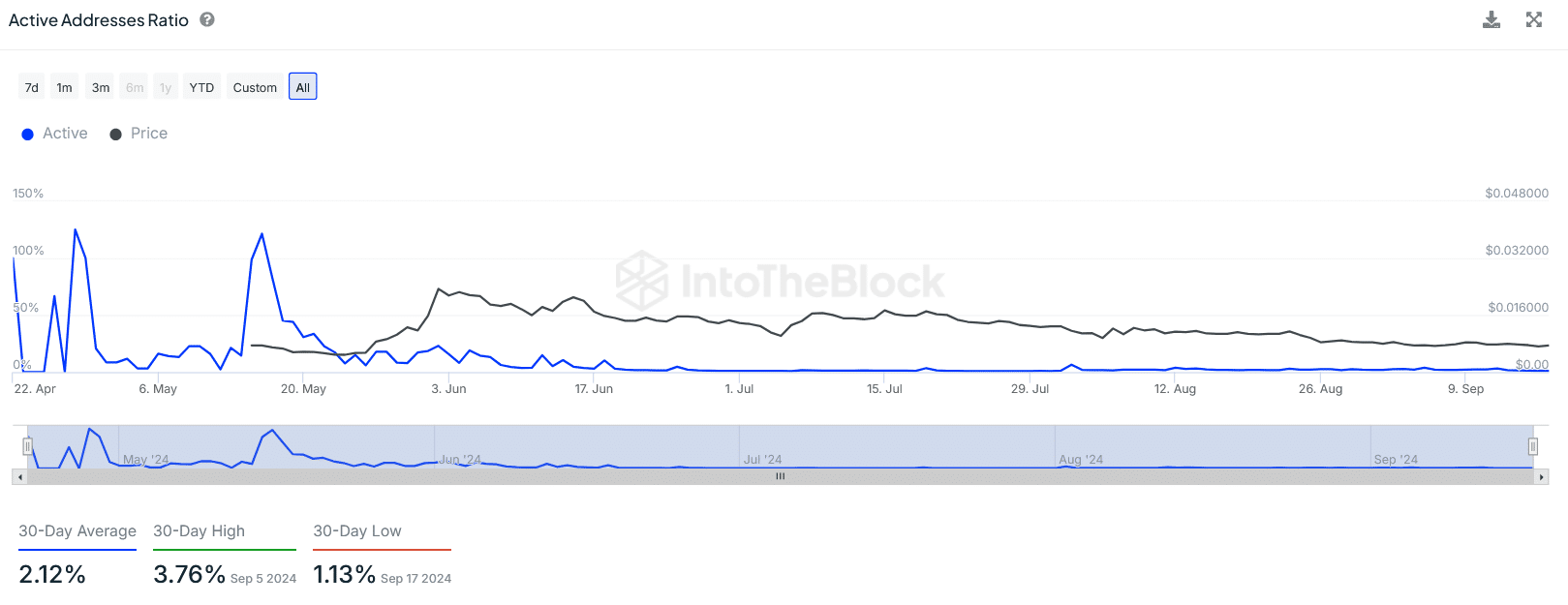

Consistent with this trend, the ratio of active addresses (expressed as a percentage) decreased during the month of September, indicating a decrease in user engagement.

Notcoin recorded a 30-day low active addresses ratio of 1.13% on September 17, down from a 30-day high of 3.76% on September 5.

Source: IntoTheBlock

Transaction volumes have also been impacted. The number of transactions on the network has remained consistently below 50,000 since September 13 and hit a 7-day low of 41,230 on September 17.

The number of daily large transactions also declined this month, hitting a 7-day low of just 3 transactions on September 16. This decline indicates reduced whale activity and implies that even the wealthiest holders are withdrawing.

NOT/USDT Outlook

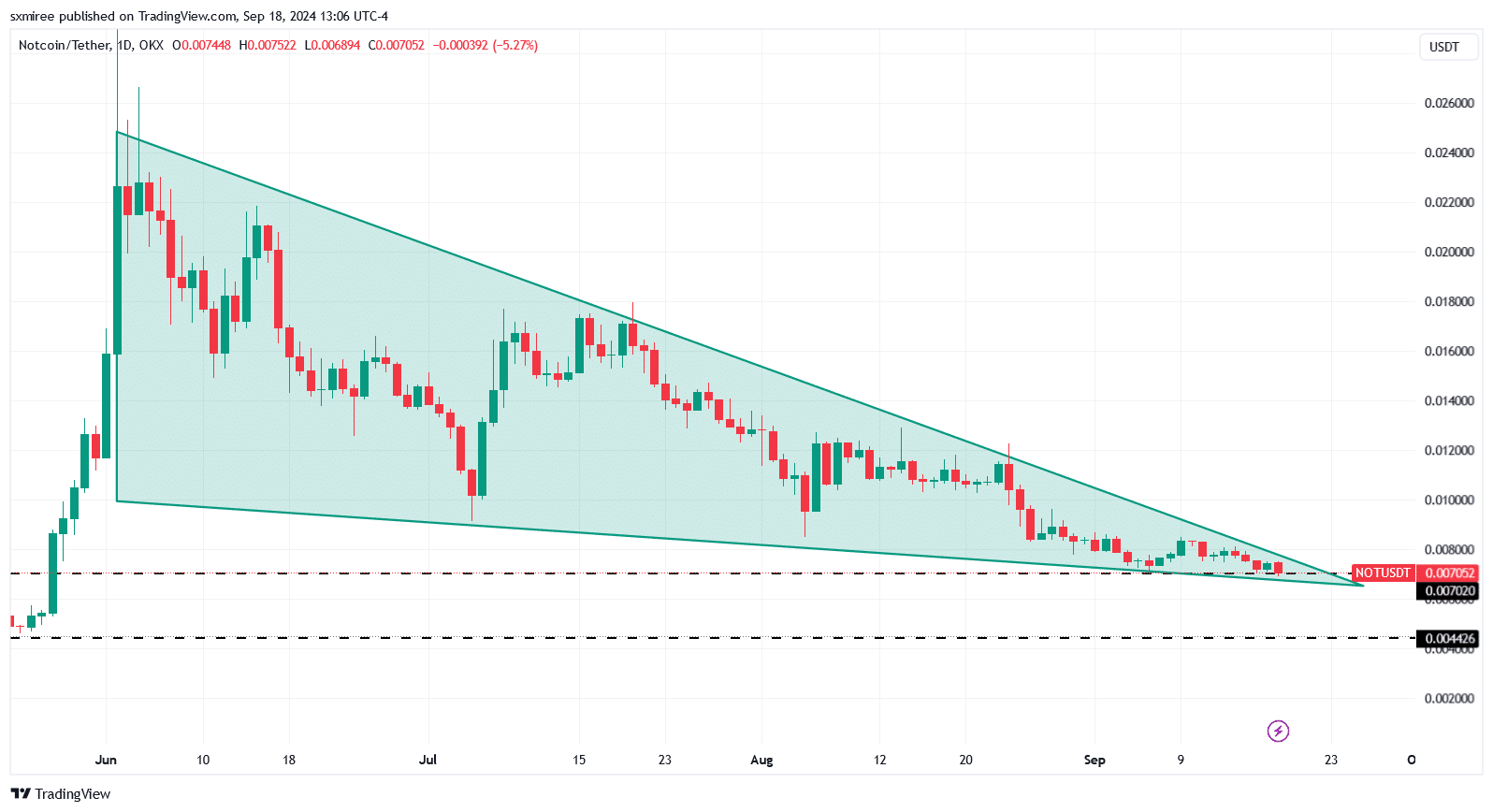

NOT was trading slightly above the $0.0070 support level at the time of writing, with the next cushion around $0.0044. The 1-D NOT/USDT chart shows that the pair has been trading inside a falling wedge pattern since June, constantly testing new lower resistances.

Given the lack of buying interest in the market, a break below the current support level could lead to prolonged losses.

Source: TradingView

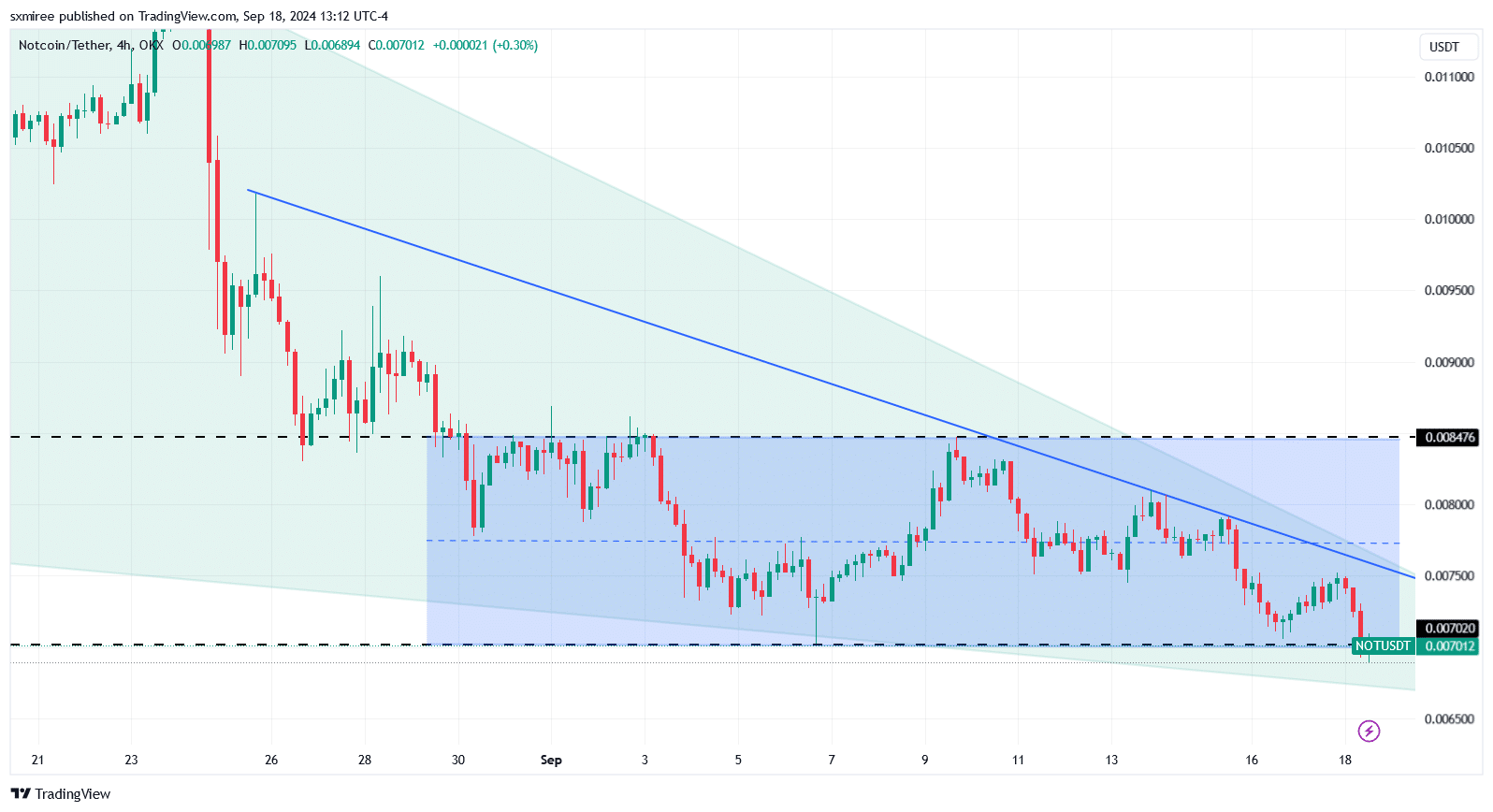

Zooming in on the 4-hour chart, NOT/USDT has been consolidating between $0.007 and $0.0084 since early September.

The pair reached as high as $0.0076 on September 17 before being rejected and reversing its trend based on its recent price action below a descending resistance line.

Source: TradingView

It is worth noting that Notcoin (NOT)’s correlation with Bitcoin (BTC) and Ethereum (ETH) increased over the month, especially for the latter.

Read Notcoin (NOT) Price Prediction 2024-2025

Data from IntoTheBlock shows that the 30-day correlation between NOT and ETH currently stands at 0.81, approaching its highest value of 0.85 seen on August 20.

The increasing correlation indicates that NOT’s price movement is increasingly tied to that of the flagship altcoin.