- Ondo left a two -month descendant channel after posting 20% gains on Wednesday

- Measures have reported an opportunity to purchase for market bulls, but investors should also be cautious about risks

Ondo (Ondo) recorded gains from 19.8% on Wednesday, and the commercial volume for the day was also above average. It was encouraging for market bulls. In fact, Ondo had formed a descending channel motif (white) in the past two months, but has seen an escape beyond the summits during his last rally.

And yet, the market structure on the graph of a day was always down.

Source: Ondo / USDT on tradingView

The technical analysis revealed that the level of Fibonacci trace of 78.6% to $ 0.915 was still a key resistance level. He marked the lowest that Nour had to beat to move the structure of the structure. The Obro did not make a new higher, compared to the last week of March. This has shown that buyers were not very strong. The RSI was in neutral 50, indicating a potential Momentum shift.

Should traders trust the escape of the chain and go for a long time? Well, metrics have shown that there can be an opportunity to buy.

Purchase opportunity for Ondo bulls because accumulation trends remain strong

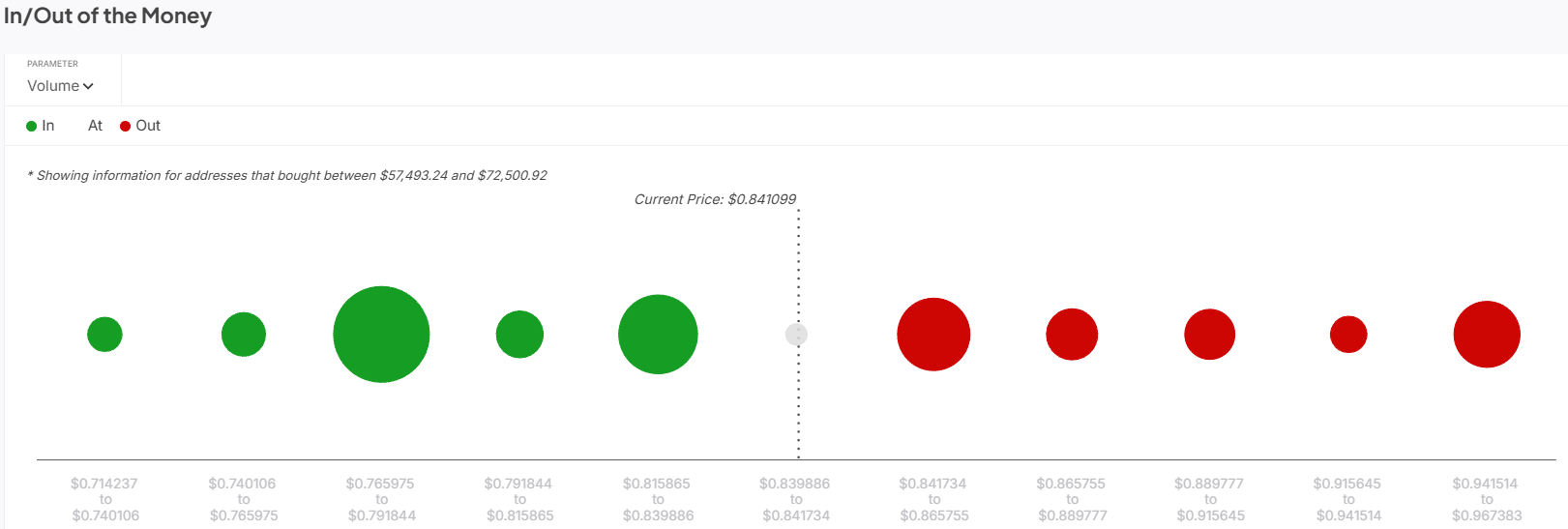

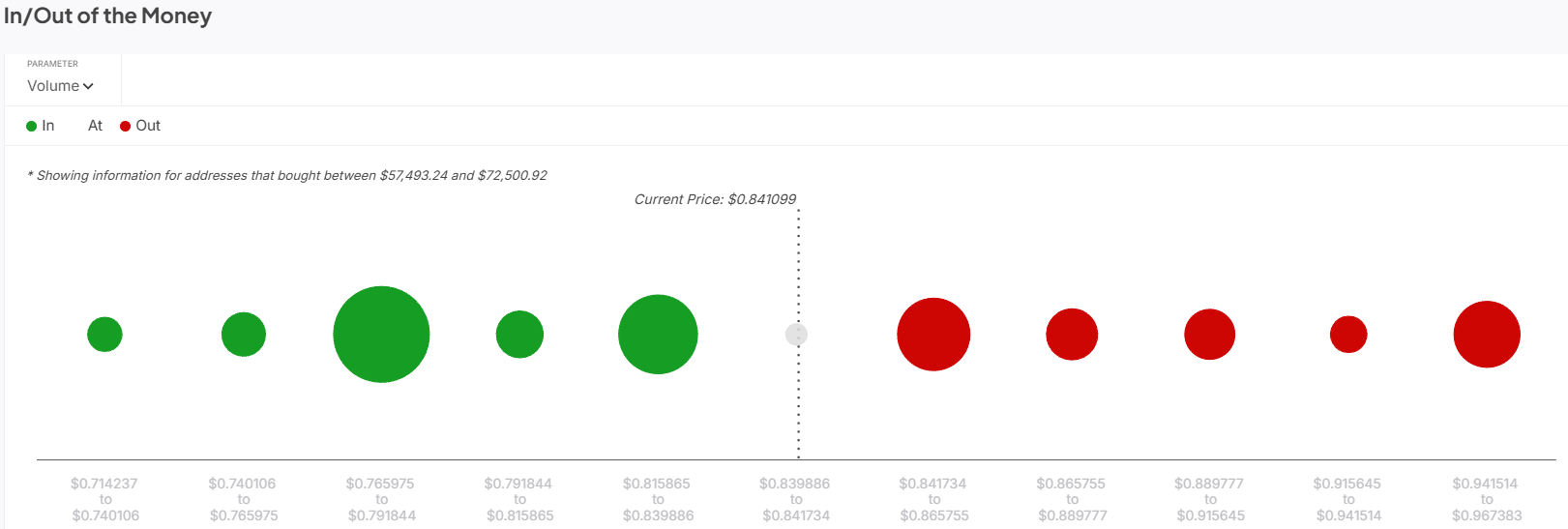

Source: intotheblock

The interior / out of money around Price Metric marked two nearby support areas for Ondo at $ 0.815 and $ 0.791. These were above the peaks of the falling canals.

Consequently, a retaining of these levels or the channel as a support would offer an opportunity to purchase in the coming days.

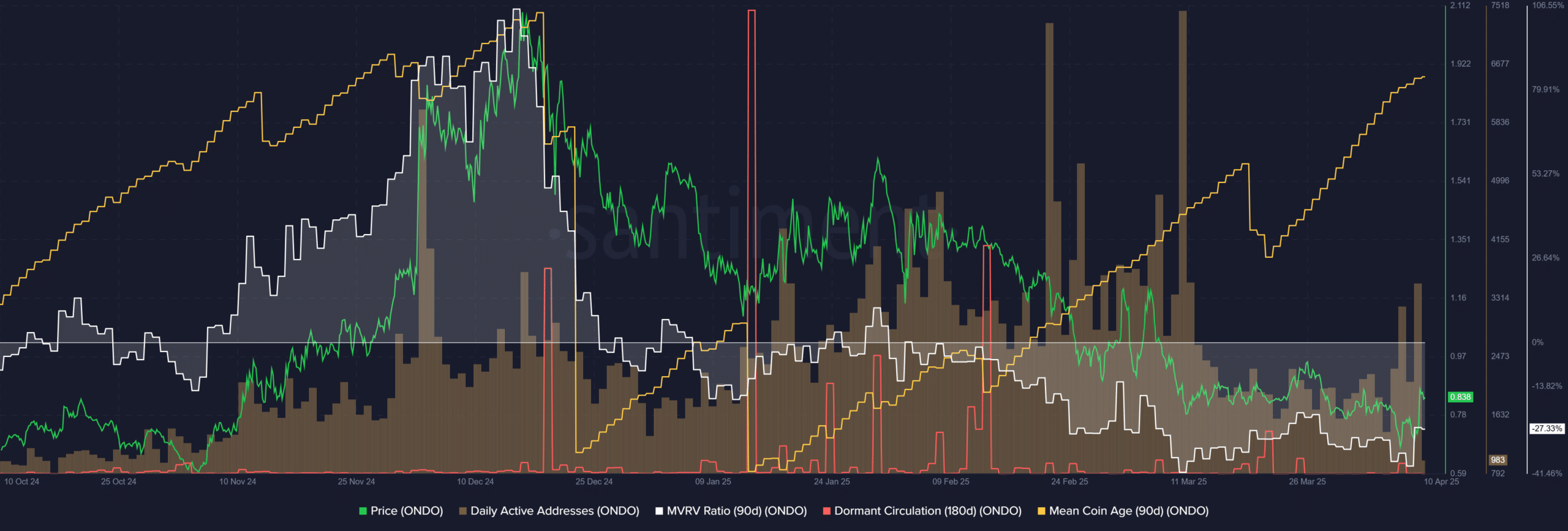

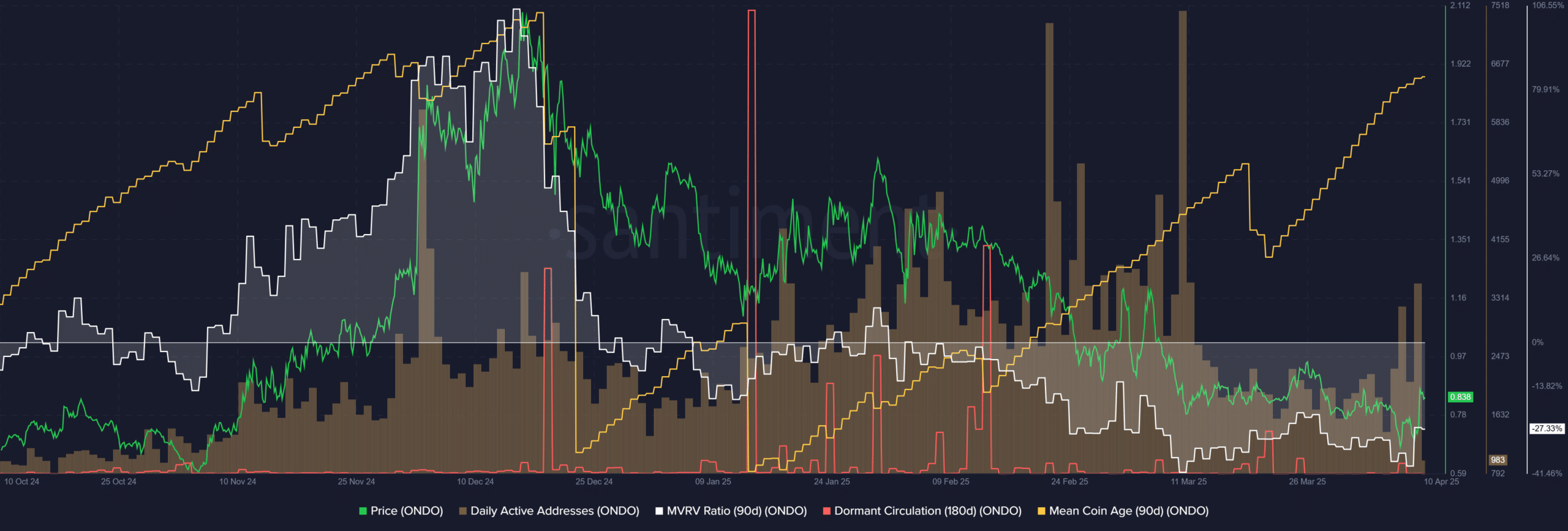

Source: Santiment

The Active Daily addresses metrics experienced a severe decrease in the second week of March. During last week, he started climbing again higher. The increase in chain activity may indicate a hike of use and demand.

The average age of money of 90 days has been up to a regular increase since January, with a minor drop in mid-March. The Croissant MCA could be a sign that the parts were less transgeated. At the same time, the metric of dormant traffic Ondo has experienced some notable peaks in recent weeks.

Together, it points to accumulation. The 90 -day MVRV report was also negative, showing that short and medium -term holders faced losses.

The accumulation trends, alongside the two -month canal break, were an early sign that Endo could be a decent purchasing opportunity. However, investors must remain cautious given the lowering feeling on a market scale.