About 440 people are responsible for billions of dollars in artificial negotiations, according to a new study published on Cornell University server arxiv.

Honglin Fu researchers, Yebo Feng, Cong Wu and Jiahua Xu have developed a tool called Perseus To follow the infamous famous pump and dumps patterns in the cryptography industry. They observed the so-called “distributors”, which can be divided into “brains” and “accomplices” depending on their role in the diagram.

More specifically, they sought brains: the entities that organize, coordinate and orchestrate these patterns. A pump and smoke scheme is a form of handling based on the trade where holders artificially inflate the price of a room – generally by a false media threshing and praise – to convince people to buy, only to throw the parts and crush their prices.

This manipulation undermines the integrity of the market and causes significant financial losses for investors, according to researchers.

According to the report, the authors are the first to investigate the brains of the pump and the defrosting of the cryptocurrency. They deployed Perseus from February 16 to October 9, 2024. The tool managed to detect 438 brains “which are effective in the pump and smoke dissemination networks”.

In addition, Perseus found these 438 brains through 322 cryptocurrencies. The distribution of brains between cryptocurrencies varies however.

Among these, only one addressed targets a huge 192 cryptocurrency. Two brains target 72, and three are after 23 cryptos.

“Remarkably, four brains target the following cryptocurrencies: Aave,, ATOM,, COOK,, Bch,, Cotic,, NetAnd LINKSaid the report.

However, the most targeted room is Bitcoin (BTC) with five identified brains.

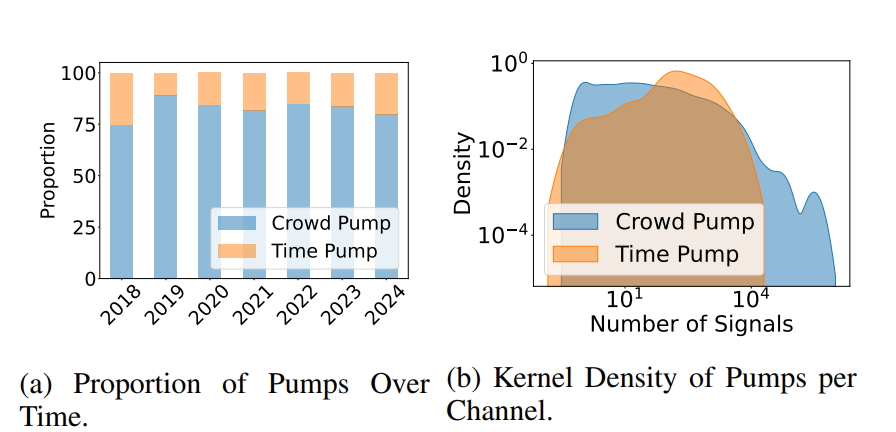

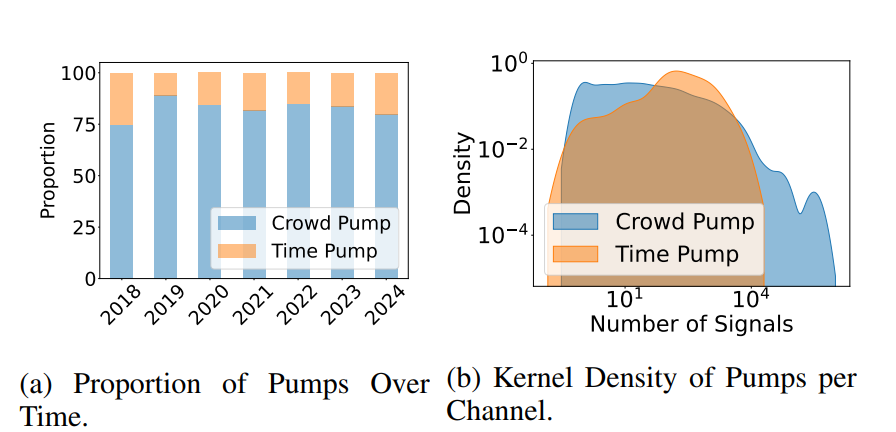

Meanwhile, to achieve these conclusions, the tool has processed “an unprecedented data set” of pump and cryptographic pumping schemes of 2,103 channels. In comparison, previous studies have examined between 50 and 700 channels.

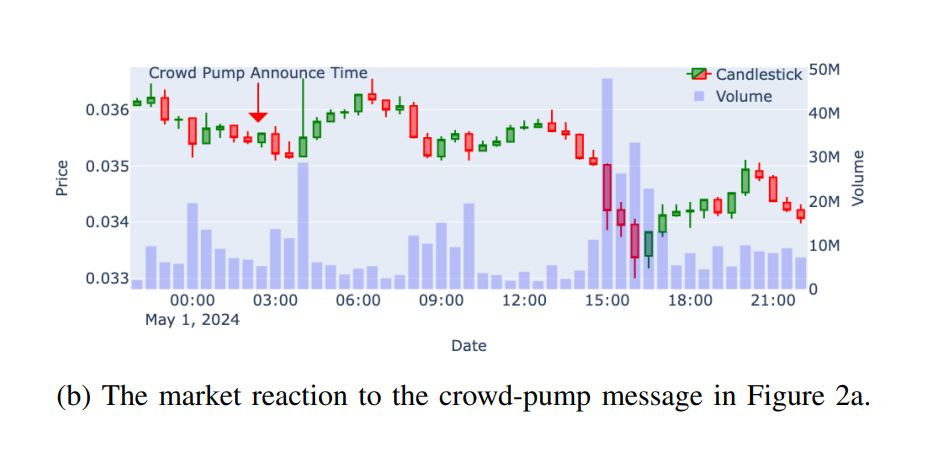

During the period of deployment of Perseus, the brains had a massive impact on the market, indicates the report. They resulted in a 167% increase in negotiation volumes.

In particular, “the total trading volumes of crowd pumps reached 8.07 billions of dollars, compared to approximately $ 4.83 billions of regular negotiations, increasing by 3.24 billions of dollars (67%)”, concluded the authors.

Telegram is the pump and rescue hub

Perseus locates brains, as they are at the source of the pumps, thus providing regulators with the risk of the risk they pose, as well as surveillance capacities to mitigate these patterns, note the authors.

The report notes that pump and pumping manipulators stole $ 241.6 million thanks to decentralized exchanges (DEX) in only 2023. This represents 10% of the total trading volume compared to centralized exchanges (CEX).

“This highlights the more substantial impact of pump and smoke activities on centralized exchanges, attracting the attention of regulators,” write the authors.

That said, Perseus successfully identified 290 brains involved in pump and defrosting activities, between February and October 2024, “potentially reducing the related negotiation impacts by around 3.24 billions of dollars”.

In addition, previous research has already shown that Telegram houses most of the pump and rescuers groups. Perseus – which collects data in real time on the OSN and Crypto markets – monitored 2,103 telegrams and 660 cryptos channels between April 2018 and February 2024.

The report concludes that the crooks massively exploit social networks online (OSN). These OSN entities, including telegram and Twitter Accounts, chatbots and others are spreaders. They distribute pump and dump messages and coordinate investors to collectively buy a specific cryptography via exchanges.

Subsequently, due to these coordinated purchases, the price of a part is artificially inflated. Therefore, some first investors can sell their for -profit assets. Most see the losses important.

The position only 440 people are responsible for billions of USD dollars in the artificial cryptography trade – research appeared first on cryptonews.