Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

Ethereum is negotiated above the bar of $ 1,500 after a week of increased volatility and uncertainty of continuous world trade. Macroeconomic tensions – pulled by prices, changing policies and the weakened feeling of investors – continue to weigh heavily in cryptographic markets. Despite the recent rebound, the action of Ethereum prices always refers to a wider decreased trend, the bulls which have trouble recovering key resistance levels which could trigger a significant recovery.

Related reading

However, there are signs of potential strength to come. If the bulls manage to push ETH above the immediate resistance zones, a change of bullish momentum could emerge. Market observers closely follow the basic cost levels to identify where high demand can resurface.

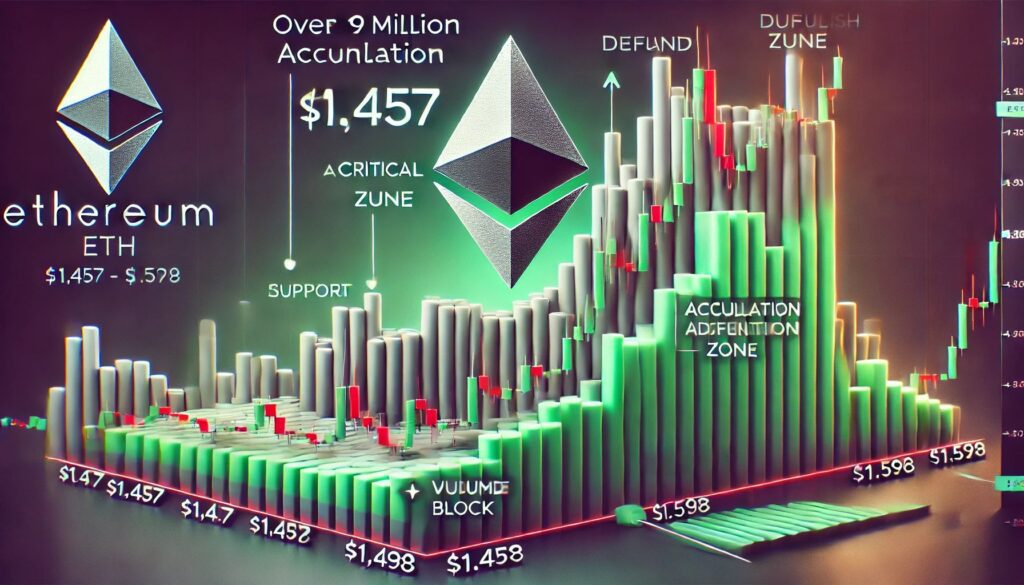

According to Glassnode data, the basic distribution of Ethereum costs reveals three key price clusters likely to shape short -term action. Among them, the level of $ 1,546 is distinguished as the most important, with 822,440 ETH accumulated before in this range. A successful socket or escape above this area could provide a solid base for greater recovery.

For the moment, Ethereum’s prospects remain cautiously neutral, the bulls needing to recover higher levels to change feeling and challenge the wider downward trend.

The basic levels of Ethereum key costs could define price action

Ethereum has lost more than 50% of its value since early February, preparing the way for a difficult but potentially pivot recovery phase. After months of high sales pressure, ETH is now negotiated just above the bar of $ 1,500, an area that could serve as a springboard if the bullish momentum is built. Although the wider market has shown signs of recovery, the action of disappointing prices of Ethereum continues to test the patience of investors. However, analysts believe that a recovery rally is possible, especially if macroeconomic feeling is improving.

Persistent global trade tensions, current pricing battles and American foreign policy changes continue to inject volatility into financial markets. These factors have removed the demand for risk assets like Ethereum, but some believe that the worst can be late.

Glassnode chain data offers a more detailed overview of Ethereum’s short -term perspectives. According to their basic cost distribution analysis, three price clusters are likely to shape the action of ETH short -term prices. About $ 1,457, around 408,000 ETH were previously accumulated. At $ 1,546, more than 822,000 ETH SIT, making it one of the most critical levels. Finally, around 725,000 ETH were acquired about $ 1,598.

These clusters reflect areas of activity on the high chain and should act as support or resistance areas during the current price consolidation phase. An escape greater than $ 1,600 could trigger a larger movement to $ 1,800 and beyond. For the moment, the price of Ethereum remains linked to the range, but market players are looking at these levels closely for signs of a decisive change.

Related reading

ETH faces crucial resistance while the bulls fight to resume momentum

Ethereum is currently negotiating at $ 1,580 after failing to break at the resistance of $ 1,700, indicating that the bullish momentum remains low. Despite a brief recovery of recent stockings, ETH has struggled to recover higher terrain, and key resistance levels continue to weigh on prices.

For the bulls to confirm the start of a real recovery phase, Ethereum must push over the 200 MA and EMA by 4 hours, both hovering around $ 1,820. A decisive decision above these indicators would indicate a renewed confidence in the market and open the door to a thrust towards the levels of critical demand around $ 2,000.

However, the risk of decline remains. If Ethereum loses the level of support of $ 1,500, the sales pressure could accelerate, which could cause the price below the bar of $ 1,400. This zone served as a key level at the beginning of 2023 and could be reteteted if the downward momentum is built.

Related reading

With macroeconomic uncertainty and trade tensions always dominating the story, investors remain cautious. The next trading sessions will be critical for ETH, because it hovers between potential recovery and the threat of a renewed decline. Merchants should monitor volume tips and reaction around $ 1,700 areas and $ 1,500 to assess the next decision.

Dall-e star image, tradingview graphic

(Tagstotranslate) ETH (T) Ethereum (T) Ethereum Analysis (T) Ethereum Senture Barsish (T) Ethereum Application (T) Ethereum News (T) Ethereum Prix (T) Ethereum Price Analysis (T) Etheruem Support (T) Ethedtedt

Source link