Warning: This is a press release provided by a third party responsible for the content. Please do your own research before taking measures according to content.

For years, the Ethereum DEFI ecosystem was defined by two giants: Aave and Makerdao. Aave was the pioneer of decentralized loans and loans, while Makedao became the backbone of Stablecoins with Dai. Together, they established the standard for what decentralized finance could achieve.

But after years at the top, the two projects show cracks. High costs, rigid structures and governance difficulties have left users looking for next leap forward. This jump, according to analysts, could be the Paydax protocol (PDP).

More than another DEFI project, Paydax emerges as a serious competitor not only to compete with Aave and Makedao, but exceed them completely. With its unique mixture of loans, loans and integrated insurance, the PDP presale already attracts attention as a chance to participate in the next Grand Challenger d’Ethereum for gains up to 2,000%.

The limits of Aave and Makedao

Aave remains one of the jewels of the Crown of Ethereum, but its structure is locked around guaranteed loans with decreasing yields. Makerdao, although essential in Defi, was slowed down by the bottlenecks of governance and rigid collateral requirements.

The two projects are also linked to the notorious gas costs of Ethereum, creating friction for everyday users. These limitations did not kill their domination, but they created a ceiling. And where Aave and Makedao have flattened, the Paydax protocol (PDP) lost.

Paydax Protocol (PDP): an overhaul of loans and loans

On the Paydax protocol (PDP), the spread of the traditional bank no longer exists. Instead, users directly capture the value. Take Jane, for example. If it deposits $ 5,000 in its bank, it could only gain 1% interest while the bank lends it to 15%. On Paydax, Jane becomes the bank. It lends directly to borrowers and wins up to 15.2% APY itself.

Borrowers also benefit enormously. Unlike traditional systems that reject millions for mediocre or unconventional credit scores, Paydax redefines what the guarantee can be. Alice can use her Bitcoin (BTC) to obtain loans in the stabbed (USDT / USDC), unlocking instant liquidity without selling her position.

Borrowers also benefit enormously. Unlike traditional systems that reject millions for mediocre or unconventional credit scores, Paydax redefines what the guarantee can be. Alice can use her Bitcoin (BTC) to obtain loans in the stabbed (USDT / USDC), unlocking instant liquidity without selling her position.

John can tokensinate his jewelry, checked by Sotheby’s and kept by Brinks, then borrow against him with an LTV of 50%, 75%, 90% or 97% (ready for value), without abandoning his prized asset. It is a level of flexibility that Aave Ni Makedao is currently not offering.

Insurance: Paydax’s advantage on Kings DEFI

One of the most disturbing characteristics of PDP is its buyout pool. In today’s challenge, lenders are exposed to risks with few protections. Aave and Makedao do not have an integrated safety net, at least not in terms of the Paydax protocol solution (PDP).

Imagine Bob ready Alice $ 10,000. Jack joins as an assurer, subscribing the loan for an attractive bonus. If Alice reimburses, Jack keeps the premium. If it is lacking, Bob’s losses are covered by the buyout basin, and stakers like Jack gain up to 20% APY.

This creates a durable triangle where lenders, borrowers and insurers all win. It is a piece of the puzzle even missing from the most established defi protocols.

Why investors support PDP

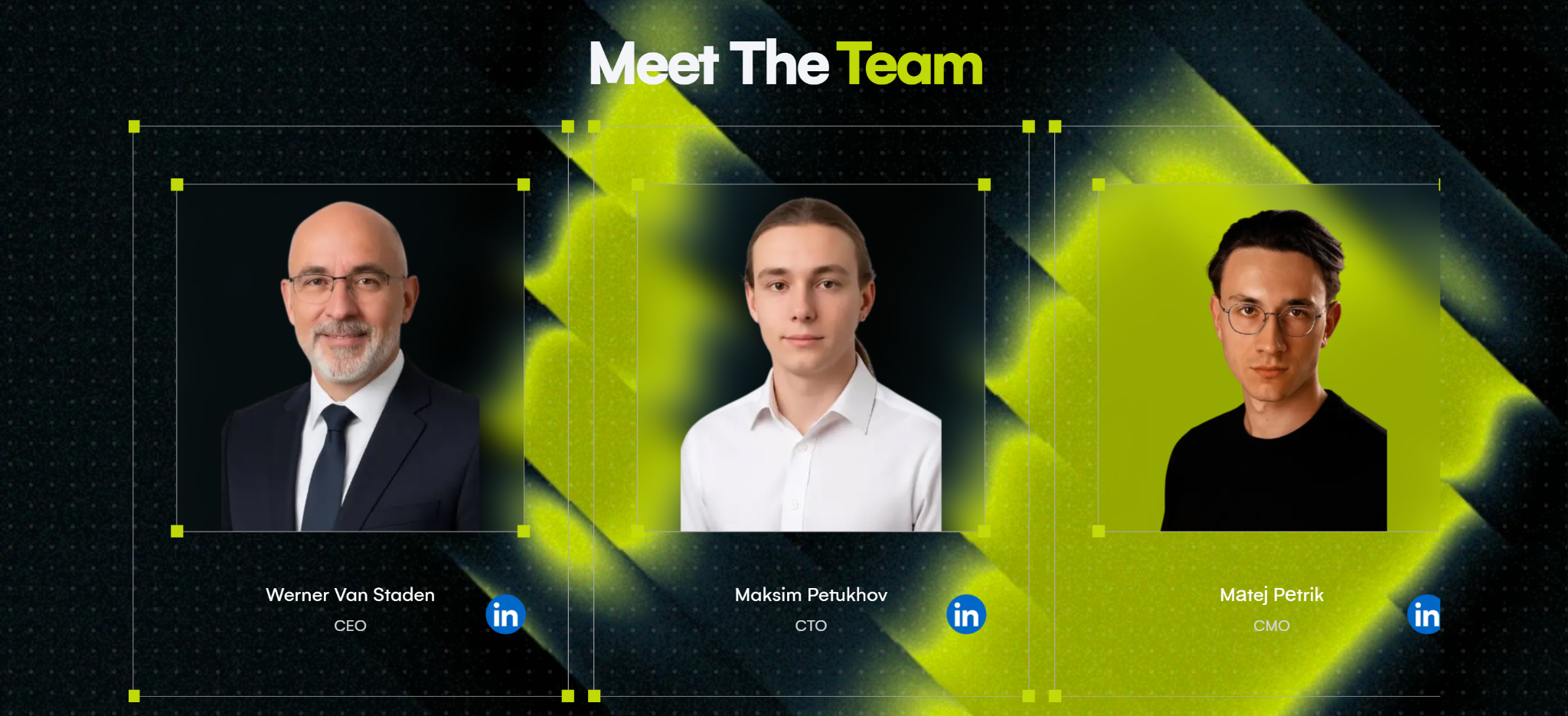

The Paydax Completely Doxxed (PDP) team, led by CEO Werner Van Staden and CTO MAKSIM PETRUKHOV, has undergone a complete verification of KYC, making them legally responsible. It is a level of confidence that 90% of the best presales in cryptography do not offer, which defines the PDP more as one of the best altcoins to buy now.

Intelligent contracts have also been audited by Ensure DEFI, adding another protection layer. This transparency results in partnerships with VCs, collaborations, integrations with other deffi and an easier way to announcements. According to experts, Paydax is well placed to attract institutional donors, which is a strong signal for investors for healthy ICO.

Intelligent contracts have also been audited by Ensure DEFI, adding another protection layer. This transparency results in partnerships with VCs, collaborations, integrations with other deffi and an easier way to announcements. According to experts, Paydax is well placed to attract institutional donors, which is a strong signal for investors for healthy ICO.

The PDP’s presale window: an opportunity for a rare king of 2,000%

In the center of the Paydax ecosystem is its native token, at the price of only $ 0.015 in the turn 1 of the PDP presale. Analysts project up to 2,000% return on investment this quarter, which makes early participation particularly lucrative.

The investors of the Round 1 not only have access to the PDP at its lowest price and position themselves for maximum gains, but they can also take advantage of the PD80Bonus code for an 80%discount. About 20% of tokens at this stage have already been sold in days, and with the planned Bull Run on the horizon, demand increases rapidly.

Like the adopters Aave and Makedao have seen massive gains, PDP donors now have a similar chance. The difference is that this time, the opportunity is accompanied by more confidence, more features, more upwards, but a shorter window.

Join the Prévente and the Paydax Protocol community (PDP):

Join the Prévente Paydax Protocol (PDP) | Website | White Paper | X (Twitter) | Telegram

Non-liability clause: This multimedia platform provides the content of this article on a “such” basis, without any guarantee or representation of any kind, express or implicit. We assume no responsibility for inaccuracies, errors or omissions. We assume no responsibility for accuracy, content, images, videos, licenses, completeness, legality or reliability of the information presented here. Any concern, complaints or copyright problems linked to this article must be addressed to the content provider mentioned above.

/ Div>