- On the 4 -hour deadlines, Pepe was about to break down to $ 0.00,00078.

- Pepe won 3.94% in last week.

During the last month, Pepe (PEPE) made considerable gains. After a sharp drop in the market, the same recovered from a local hollow of $ 0.00,00052 to a local summit of $ 0.00,00075.

In fact, at the time of writing the editorial staff, Pepe was negotiated at $ 0.00,00073 to negotiate itself over its simple 200-day mobile average.

This marked a 3.94% increase in weekly graphics, the upward perspectives extending on monthly and daily graphics.

Source: tradingView

After a recent price wave, Pepe showed a golden cross.

In the analysis of the same – MA) means of the MA in the short term was higher than the long -term MA, at the time of the press. In addition, the 9 -day MA was $ 0.00,00072, while the 21 -day MA was $ 0.00,00069.

After having experienced a drop, the same has recovered and a golden cross emerged within 4 hours.

If this trend continues, Pepe could also see a golden cross appear on daily deadlines.

What does PEPE graphics suggest?

According to Ambcrypto’s analysis, Pepe experiences a strong and bullish feeling as the ascending momentum is built.

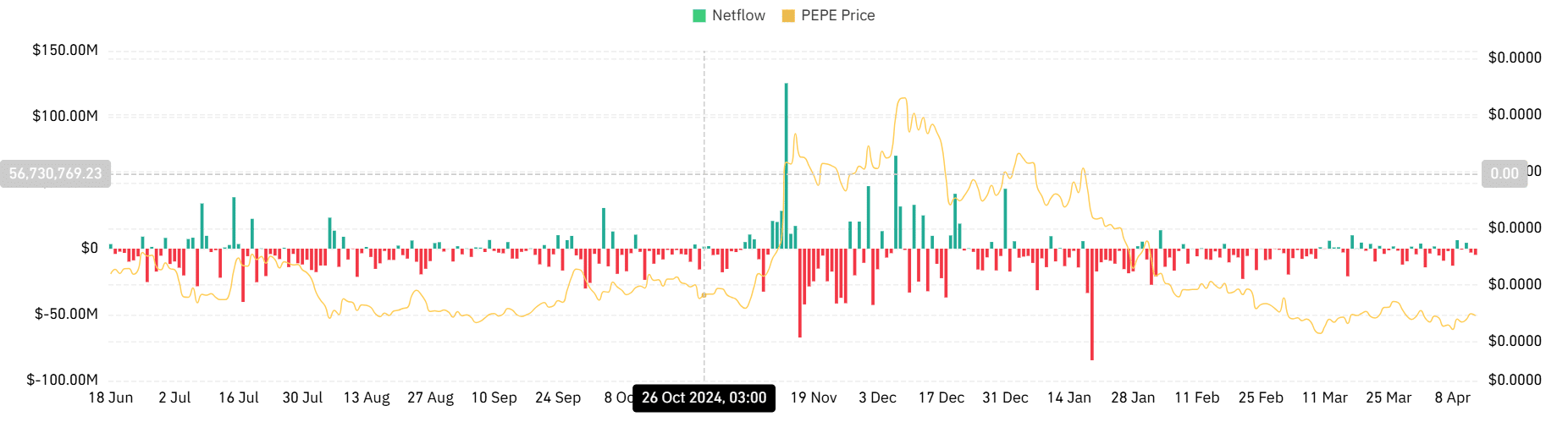

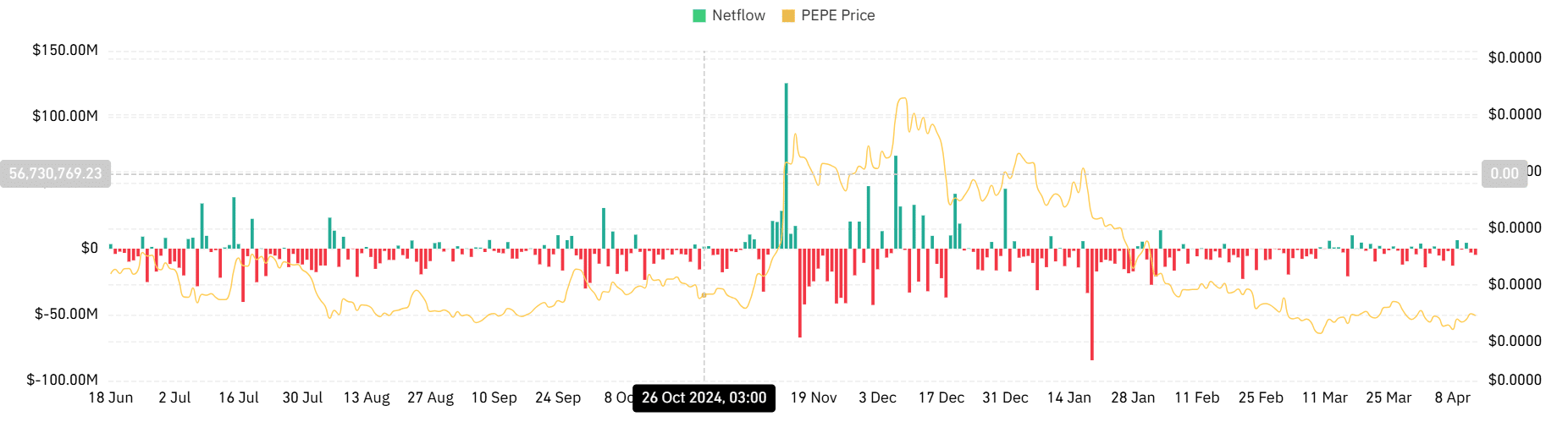

To begin with, Pepe experiences the request while investors turn to the accumulation of the same. Looking at the Netflow spot of the same, the market see more exchange exits than entries.

As such, Netflow from Pepe remained negative for two consecutive days, reporting more exchange withdrawals. When discussion spices of exchanges reflect growing upper feelings on the market.

Source: Coringlass

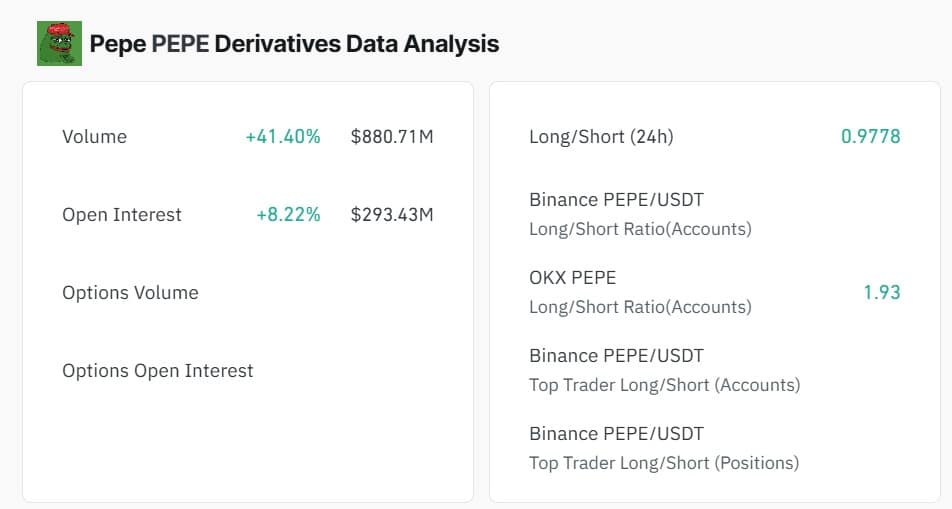

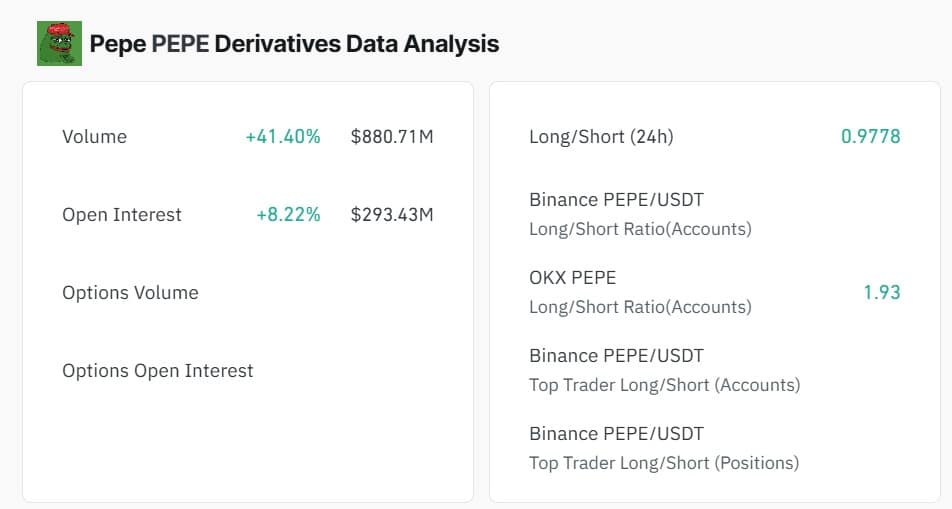

In addition, Pepe’s open interest (OI) jumped 8.22% to 293.43 million dollars. A peak in OI suggests that investors open new positions.

Usually, an increase in the OI reflects the growing demand for an asset.

Source: Coringlass

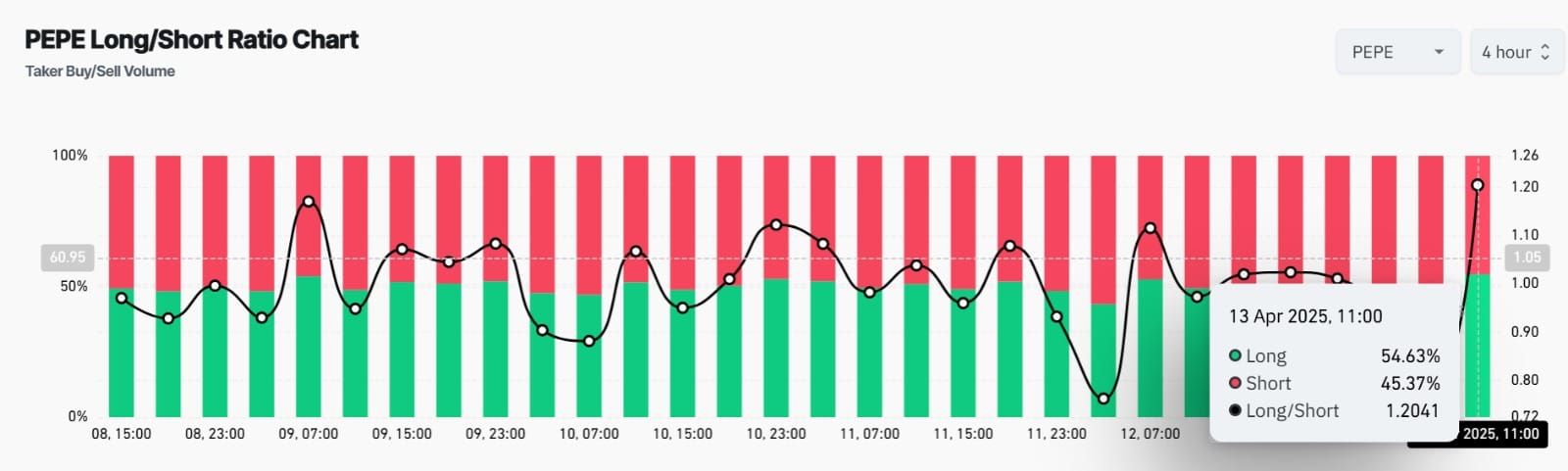

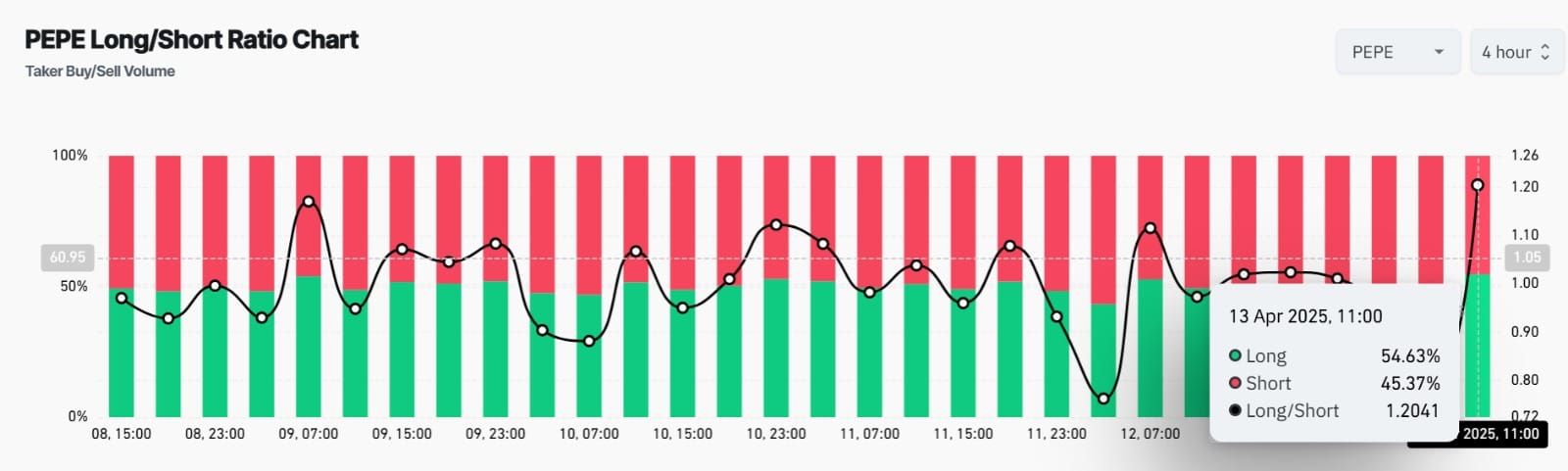

Most of these positions open on the market are long.

Looking at the long / short ratio within 4 hours, there are more long positions than shorts.

In fact, 53% of term accounts are long. When long -term post holders dominate the market, this suggests that the majority of investors are optimistic and expect prices to increase more.

Source: Coringlass

What on the side for the same

The same is moving towards a bullish feeling, the markets expecting strong gains.

The recent bullish crossing on the MacD indicates a strengthening of the ascending momentum, suggesting a continuation of the gains.

If this trend persists and the request zone holds, Pepe could see new price increases. A golden cross -reason for 4 hours can report a potential break, allowing the same to recover $ 0.00,00078.

Conversely, if sellers take advantage, a decline could drop the price to $ 0.00,00069.