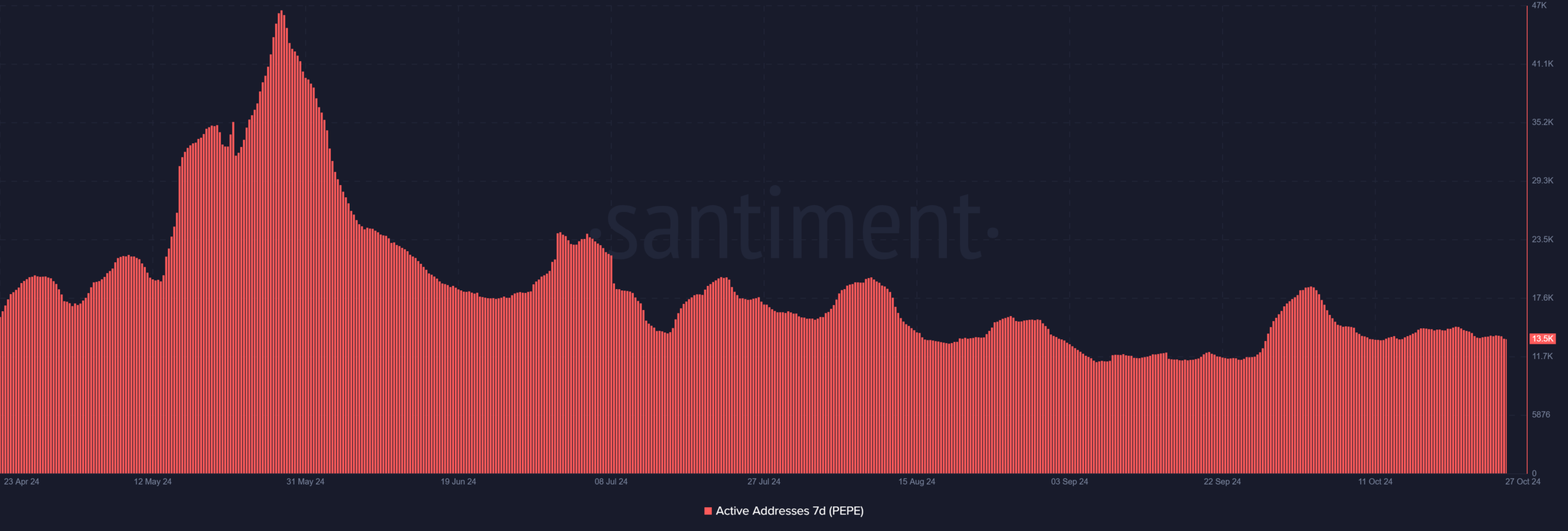

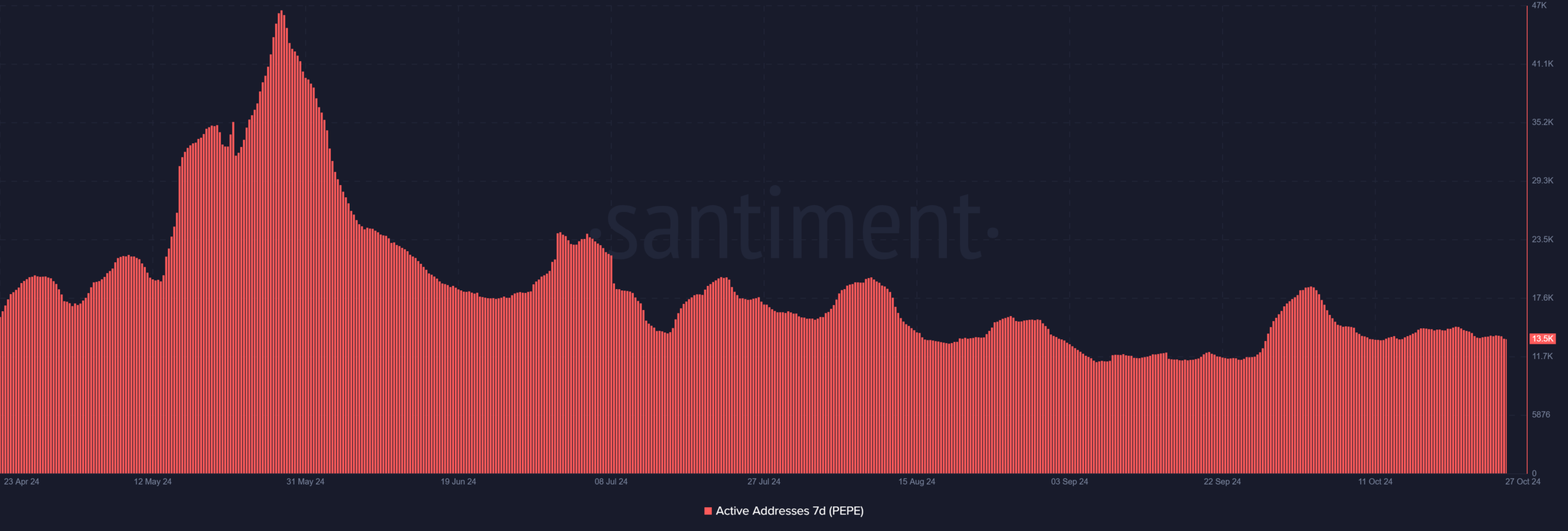

- Pepe’s active addresses are down to around 13.5k.

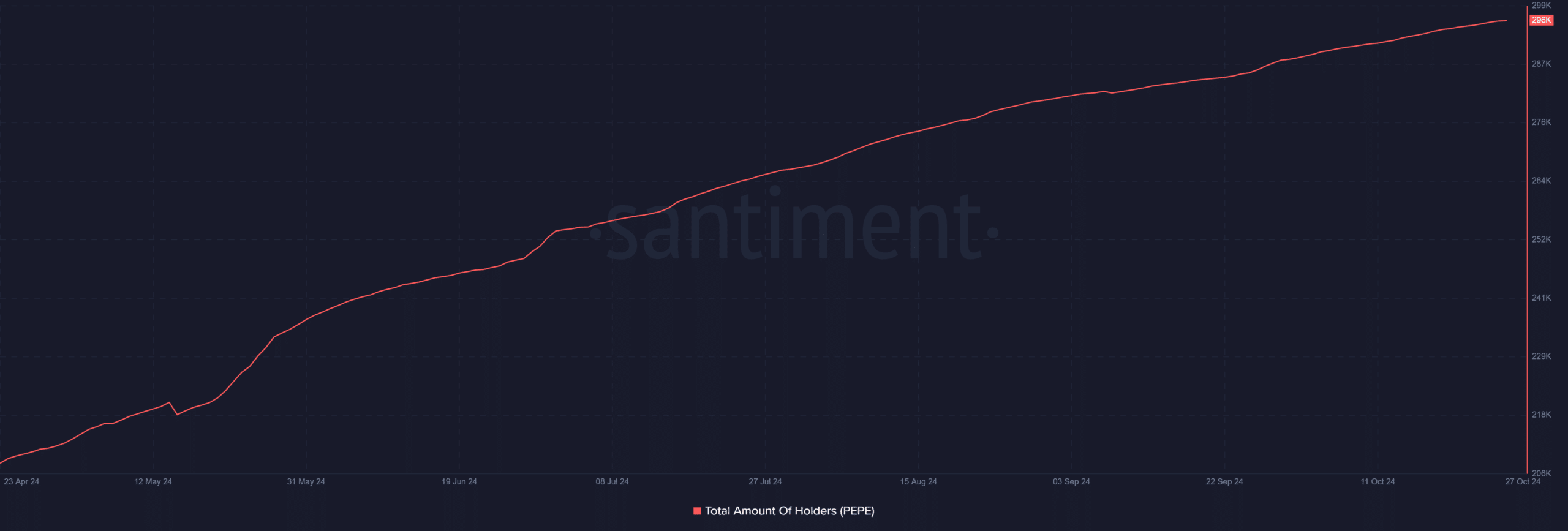

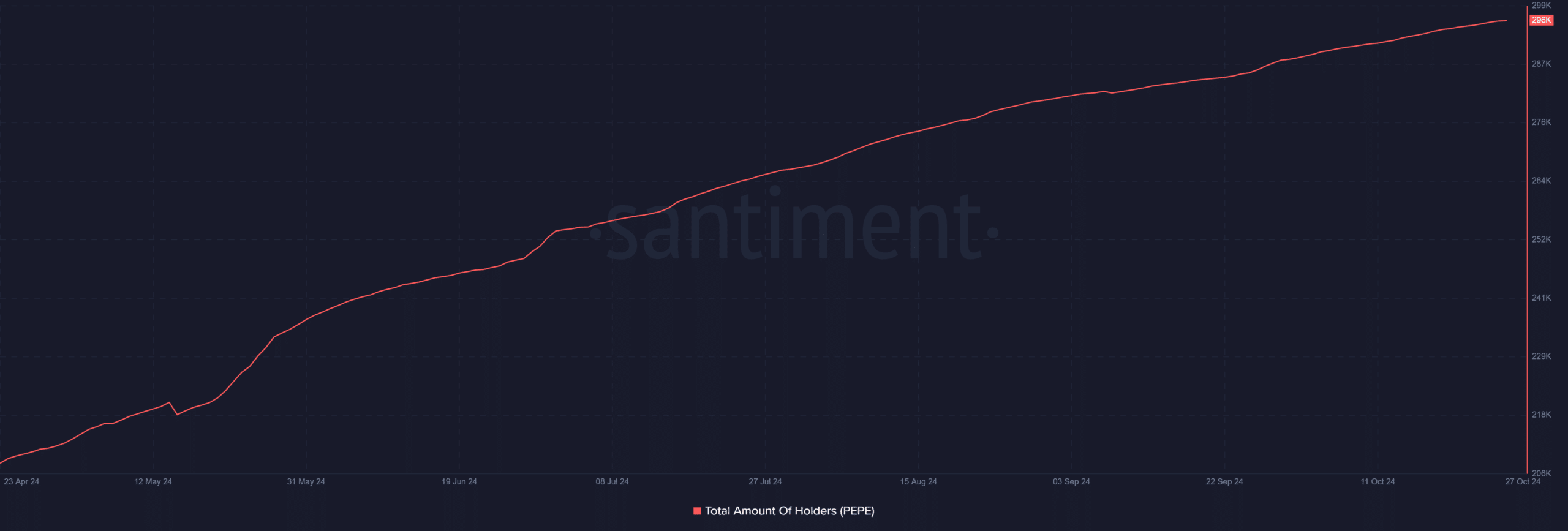

- Despite pricing concerns and reduced activity, its holder base has grown steadily to nearly 296,000.

Pepe (PEPE) has had a rollercoaster ride after its debut, attracting high trading volumes and sparking investor interest. However, recent metrics suggest momentum is losing steam as it faces a range of challenges, including a decline in engagement.

On the positive side, a growing holder base shows that the asset has retained a dedicated investor community.

Pepe’s price weakness reflects cautious sentiment

PEPE price has been on a downward trend recently, trading around $0.000000900 at press time. With the relative strength index (RSI) at 43.80, the token is hovering just below the neutral line, indicating that sellers have a slight advantage.

This analysis suggests that while the price is not yet in oversold territory, the buying interest to propel it higher is limited. To change momentum, memecoin would need to regain investor confidence and break through key resistance levels.

Otherwise, it risks slipping even further if sellers retain control.

Source: TradingView

The moderate price action reflects a more cautious sentiment among traders. Even though prices have already seen impressive gains, it appears some investors are choosing to wait on the sidelines, perhaps due to market-wide uncertainty or changes in the meme token landscape.

If the price remains under pressure, we could see further declines before PEPE finds solid support.

Pepe’s active addresses show a decline in user interest

The level of activity on the PEPE network has seen a notable drop. Active addresses declined to around 13.5k, a sharp drop from record levels earlier this year.

This reduction suggests a cooling of user interest, which could be a warning sign for PEPE’s near-term prospects.

Fewer active addresses generally result in decreased trading volume and liquidity as fewer users transact or interact with the token.

Source: Santiment

This drop in active addresses could indicate that initial enthusiasm about it has faded, perhaps as investors look for new memecoin opportunities. Without an increase in engagement, memecoin may struggle to regain the levels of market activity it previously enjoyed.

Growth in holders reflects long-term confidence

Despite the drop in prices and engagement, one notable positive remains: the number of PEPE holders continues to climb steadily, now approaching 296,000. This steady growth indicates that a core of investors remains loyal to the active, potentially in anticipation of future recovery.

The growing holder base suggests that while its trading activity has cooled, there remains a layer of long-term trust in the token.

Source: Santiment

Realistic or not, here is the market capitalization of PEPE in terms of BTC

The steady increase in the number of holders is a sign that PEPE may still have potential, especially if general market conditions improve.

For now, however, the lack of active participation combined with weak pricing places PEPE at a critical juncture, relying on its committed holder base to maintain stability.