The year 2025 has become a year of massive influx into DeFi and a new wave of interest in decentralized finance. With growth of more than 50% per year, the global market capitalization of cryptocurrencies has reached $3.85 trillion. As institutional investors and DeFi users increasingly demand transparent, decentralized and leveraged markets, perpetual decentralized exchanges are becoming the new cornerstone of the entire cryptocurrency ecosystem.

According to the latest industry reports, more than 40% of total DeFi trading volume is now accumulated by perpetual DEXs. This marks unprecedented new interest on major networks like Ethereum, BNB Chain, Solana and Arbitrum. Growing trading volume and investor activity have sparked new interest in on-chain leveraged trading, spurring trading platforms to offer advanced trading features.

The era of Perp DEXs: how Hyperliquid, Aster and Lighter dominate the DeFi segment

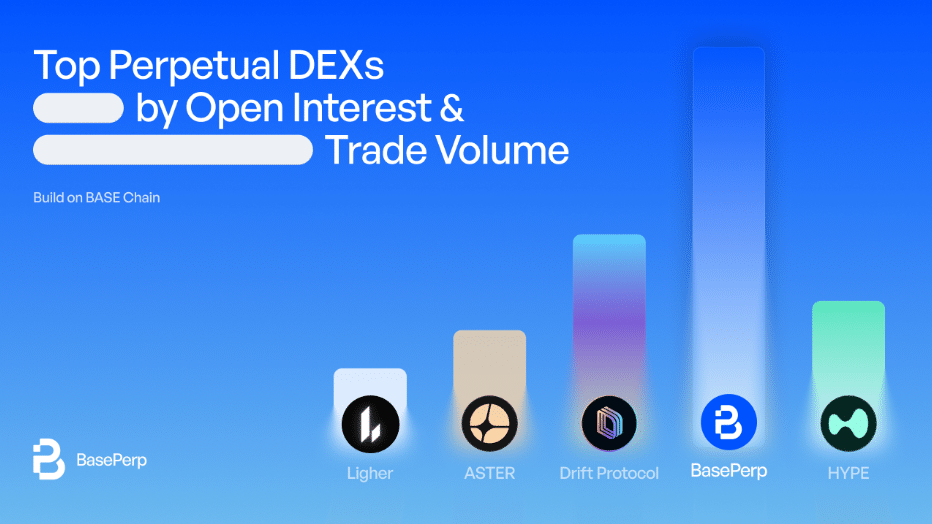

By October 2025, the top perpetual DEXs by trading volume and open interest are Hyperliquid, AsterEdgeX lighter and Drift protocolL. They incubate user activity with liquidity mechanisms, funding markets and advanced trading tools. Unlike spot DEXs, perpetual swaps create a more stable on-chain economy with recurring volume and continuous liquidity cycles.

Hyperliquide has become a pioneer in the perpetual trading market, offering lightning-fast performance and near-instant settlement times. It leads in open positions with $15 billion and holds a position over $9 billion in daily trading volume. With its hybrid design combining an advanced off-chain order book and on-chain verification, Hyperliquid ranks at the top of the DeFi leaderboard in terms of liquidity and open interest.

Lighter, built on a custom Ethereum Layer-2 for derivatives, now ranks second among other perp DEXs with $10.13 billion in daily trading volume. With its unique no-fee trading model option, it has attracted huge attention from ordinary traders. Lighter focuses on retail users and brings growth to institutional adoption of DeFi.

Aster, with its aggressive airdrop events and highly leveraged instruments, now dominates the market. It leads all perp DEXs with daily volume of over $42 billion, surpassing Hyperliquid, EdgeX, and Lighter together. Its unique power on the multi-asset perpetual engine attracts speculative traders with a high volume to open interest ratio. Ordinary traders and retailers can trade with 1,000x leverage on various assets with minimal slippage.

BasePerp: Main engine of on-chain activity for the base ecosystem

As ecosystems like Ethereum, Solana, and Arbitrum experience a massive influx of institutional interest and traders driven by perpetual DEXs, Base Chain, a rapidly expanding layer 2, can unlock this potential with the BasePerp launch by Q1 2026. Designed as the first perpetual DEX built on Base, it can combine scalable infrastructure with deep on-chain liquidity. Analysts expect a new wave of DeFi developers and institutional capital that could grow Base TVL to $7-9 billion by mid-2026. BasePerp can accumulate major trading instruments thanks to Base’s scalable infrastructure.

About BasePerp

Decentralized finance has been transformed by the DEX race underway in 2025. The industry is demonstrating that on-chain derivatives represent not only the future of trading, but also the catalyst for blockchain adoption, as evidenced by the billion-dollar liquidity of Hyperliquid, the speed of Drift, the inventiveness of Aster, and the institutional focus of Lighter.

With BasePerp preparing to debut, the Base network could soon become part of this group, paving the way for a new wave of DeFi growth driven by perpetual markets.

X:

Disclaimer: This is a paid article and should not be treated as news/advice.