Join our Telegram Channel to stay up to date on the coverage of information on the breakup

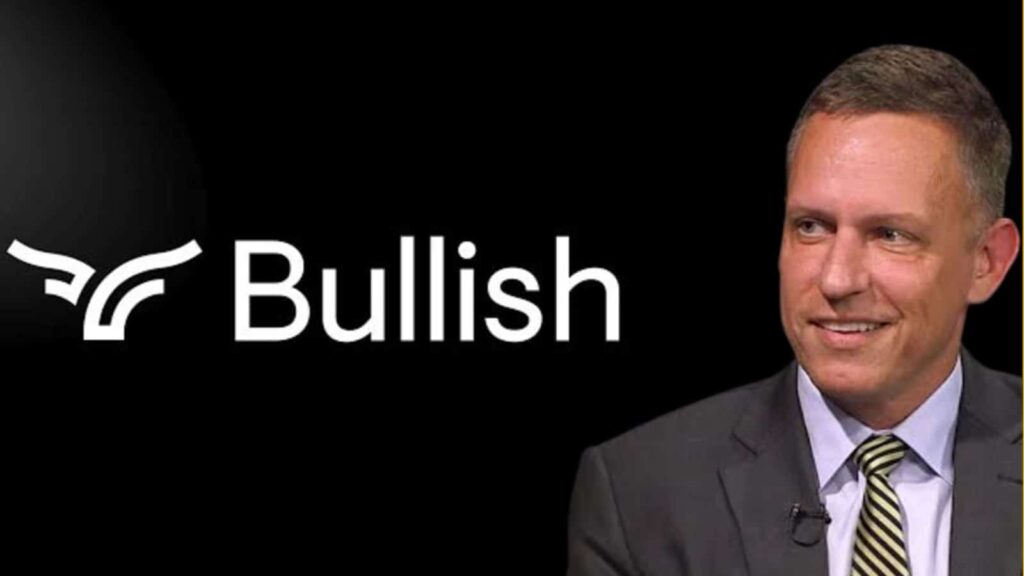

Crypto Exchange Bulshish, supported by billionaire Peter Thiel, filed confidential documents with the Securities and Exchange Commission of the United States for a first public offer (IPO), the Financial Times reported.

The deposit allows the company to progress their registration plans before publicly revealing their finances closer to the continuation of a flotation.

American Investment Bank Jefferies was proposed as the main subscriber of the IPO, according to the report, citing sources familiar with the issue.

There was no confirmation of the Bulnish or Jefferies deposit.

Not the first time that Haussier has been trying to become public

This is not the first time that Thiel’s dosage exchange has been trying to become public.

In 2021, the company tried to list via a special acquisition vehicle. This attempt dropped in 2022 following a stock market decline due to the increase in interest rates.

The list of companies from Peter Thiel joins companies that try to capitalize on Trump’s pro-Crypto position

Bullish joins an increasing list of cryptographic companies that try to capitalize on the pro-Crypto position of the Trump administration.

Competing crypto exchange Gemini, founded by the Winklevoss Twins, also filed confidential documents for an American list on June 6.

Last week, Circle, the transmitter of the second largest stablecoin by the USD Coin market capitalization (USDC), is also made public, lifting $ 1.1 billion in its offer. Circle also exceeded the expectations of analysts and posted a huge gain of 167%.

Circle is now officially a public company, listed on the @NYSE below $ CRCL.

With @UsdcEURC, Circle Payments Network and more, we advance a future of exchange of value without friction.

We don’t just build financial products. We build the monetary layer of … pic.twitter.com/spbzjmzsvy

– Circle (@circle) June 5, 2025

Even if there has been an increase in the activity of the IPCI in recent weeks, an April 3 report in CoinmarketCap shows that crypto lists continue to surpass lists on traditional scholarships.

According to the report, 68% of cryptographic announcements provided a positive return on investment (king). This was higher than the success rate of the New York Stock Exchange (NYSE) and Nasdaq, which amounts to around 54% and 51% respectively.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup