- The Pi Network Pi token is $ 0.40 because it rebounds in a downward channel model.

- The increase in greed on the cryptography market reflects a growing risk of risk among investors.

- A potential season of Altcoin could catalyze the next race raised in the Pi token.

PI Network (PI) is held at $ 0.40 at the time of the press on Thursday, extending the consolidation beach observed in recent days in a larger down canal model. The pi pi oint bulls the next leg as the sale pressure fades, potentially leading to a break from channel.

While the wider market of cryptocurrencies reaches a record summit of 4.15 billions of dollars, the increase in the feeling of risk and the potential of an Altcoin season could act as additional PI catalysts.

Optimism goes out among cryptographic investors

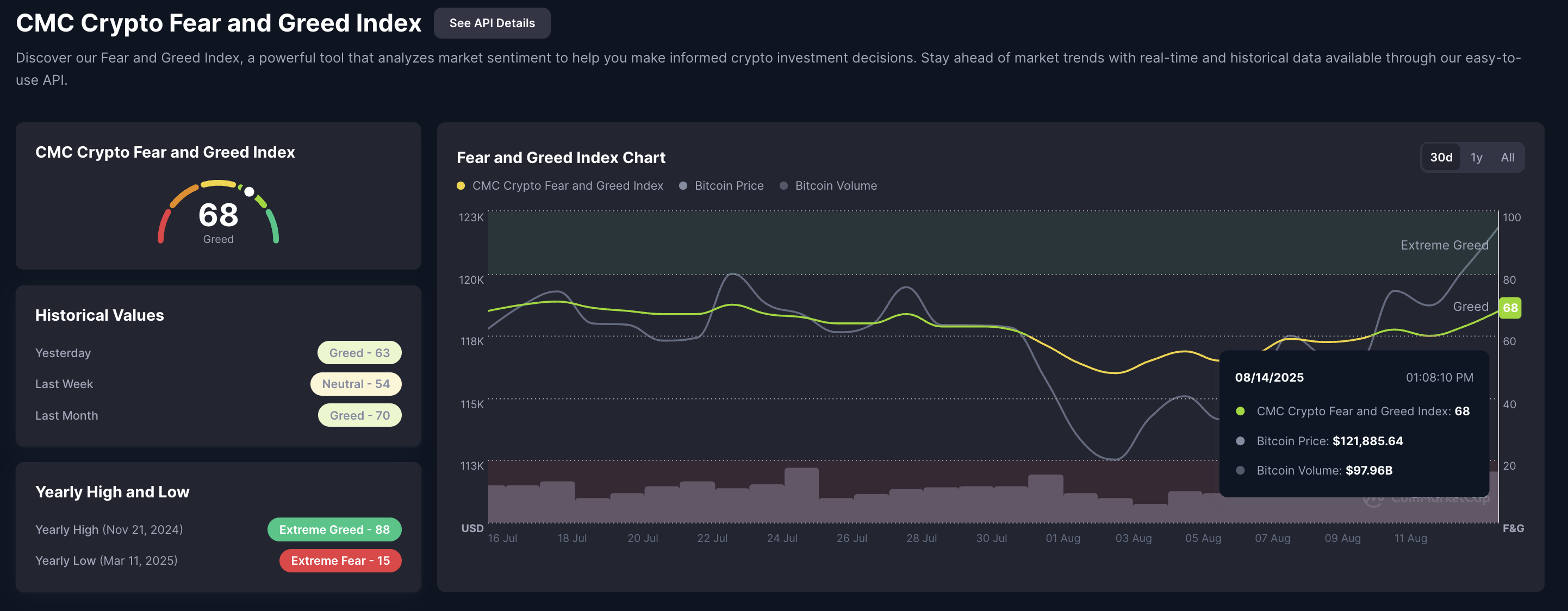

Coinmarketcap data show that the greed of investors, on a scale from 0 to 100, is 68, against 63 Wednesday. This increased greed is correlated with the return of the feeling of risk among investors, fueling capital entries and leading Bitcoin (BTC) and other high altcoins to reach peaks of all time.

Crypto fear and greed index. Source: CoinmarketCap

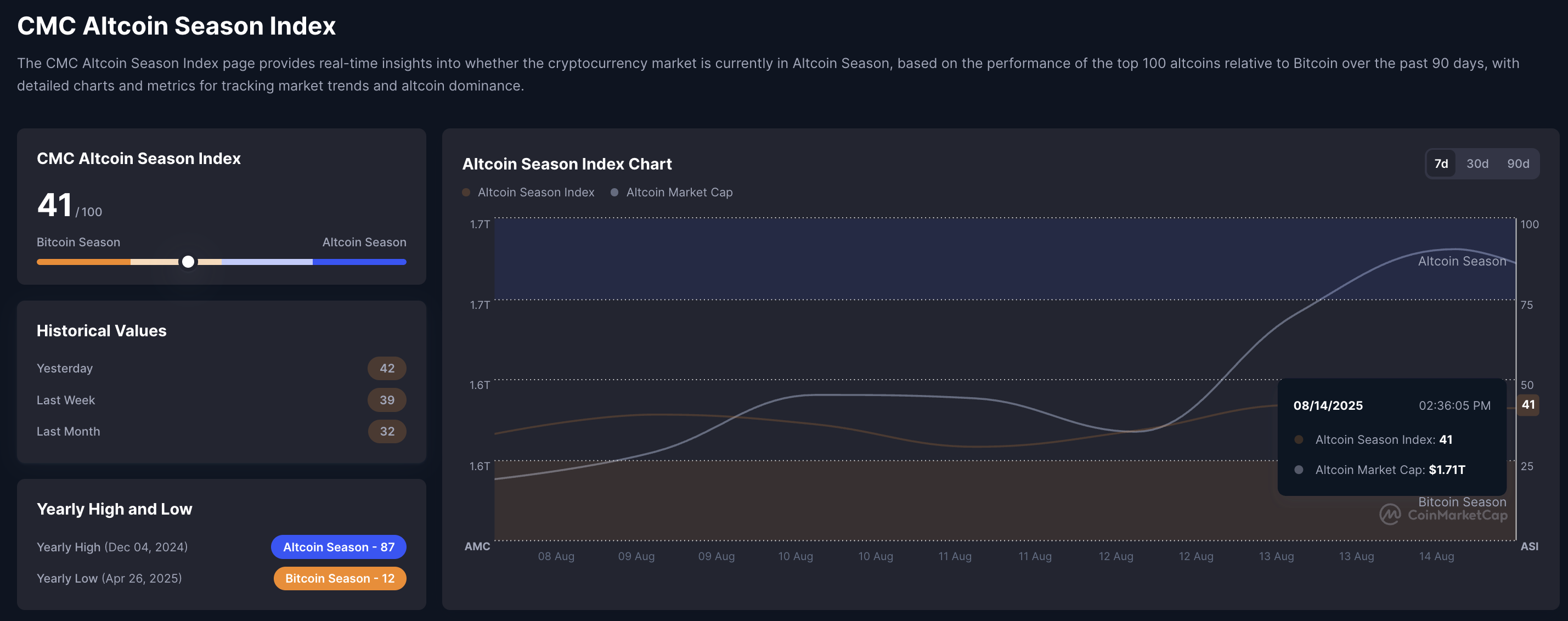

In addition, the Altcoin season index is 41 years old, compared to 39 of last week and 32 of last month, indicating growing chances of a potential season in Altcoin. In the next potential Alts-Season, the PI network could undergo an increase in capital entries while capital runs from Bitcoin and other higher altcoins to risky and more volatile cryptocurrencies such as PI.

Altcoin season index. Source: CoinmarketCap

Network Pi is looking for a broken channel rally

The Pi token is stable near the level of $ 0.40, extending the lateral drinking price action after the net drop of 9.32% on Sunday. The reversal of Pi Token marks a negative cycle in a falling channel because it fell from the air trend line formed by connecting the summits of May 21 and June 25.

A trend line connected by the bottom of May 17 and June 22 forms the lower limit of the falling channel model. To strengthen a trend reversal, PI should exceed the air trend line, which is close to the 50 -day exponential average day (EMA) at $ 0.45.

The trend of the divergence of Mobile Average Convergence (MacD) is up, indicating the increase in the bullish momentum. However, the relative resistance index (RSI) reads 47 on the daily graphic, while it moves flat under the line halfway. This indicates the drop in sales pressure near the neutral level, but also a lack of purchase pressure.

PI / USDT Daily price that.

Looking down, a correction extended in the PI network could test the support area of $ 0.37, followed by the level of $ 0.33 marked from the bottom of August 6.