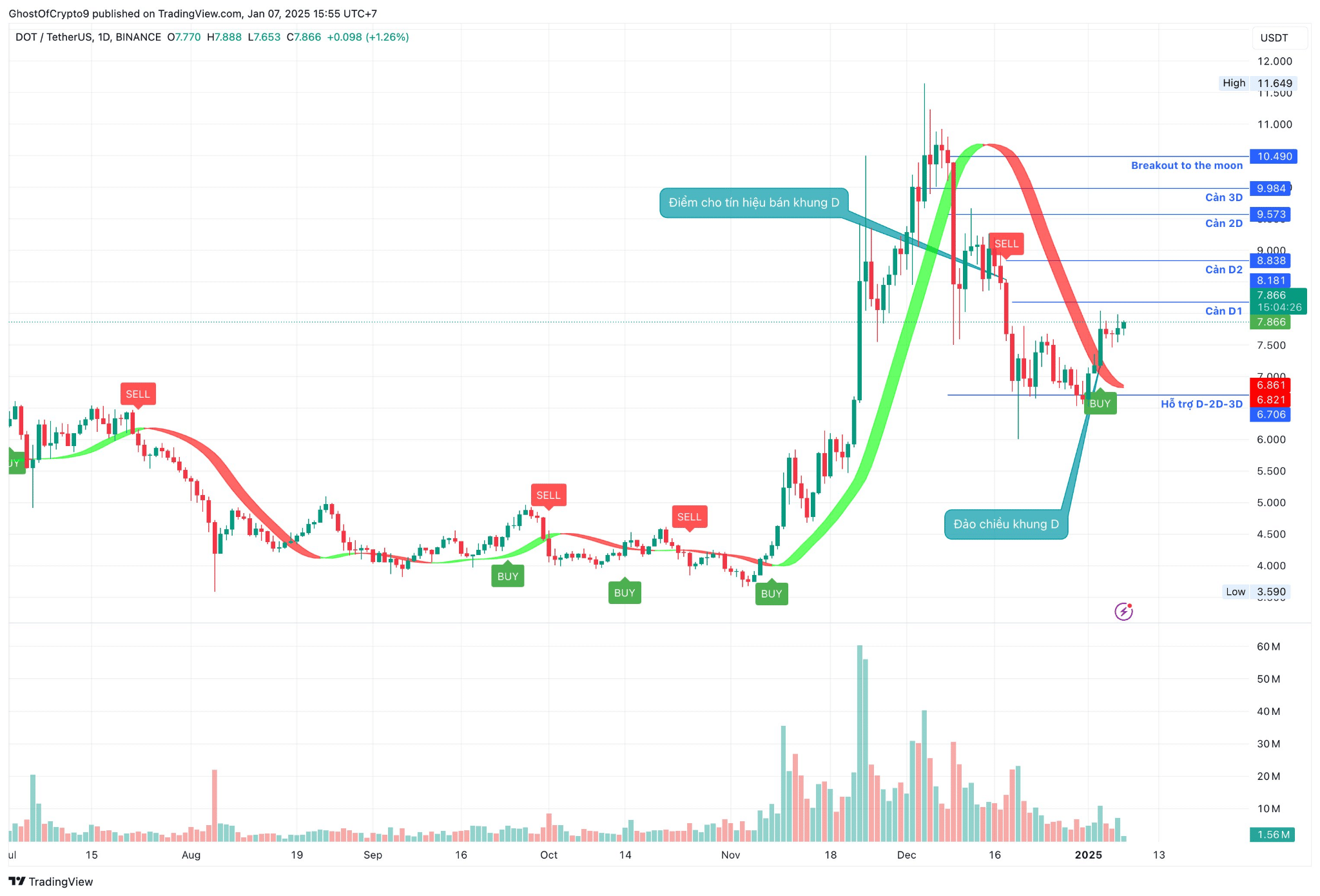

- A significant breakout led to a high, followed by a correction, with support identified at $6.861.

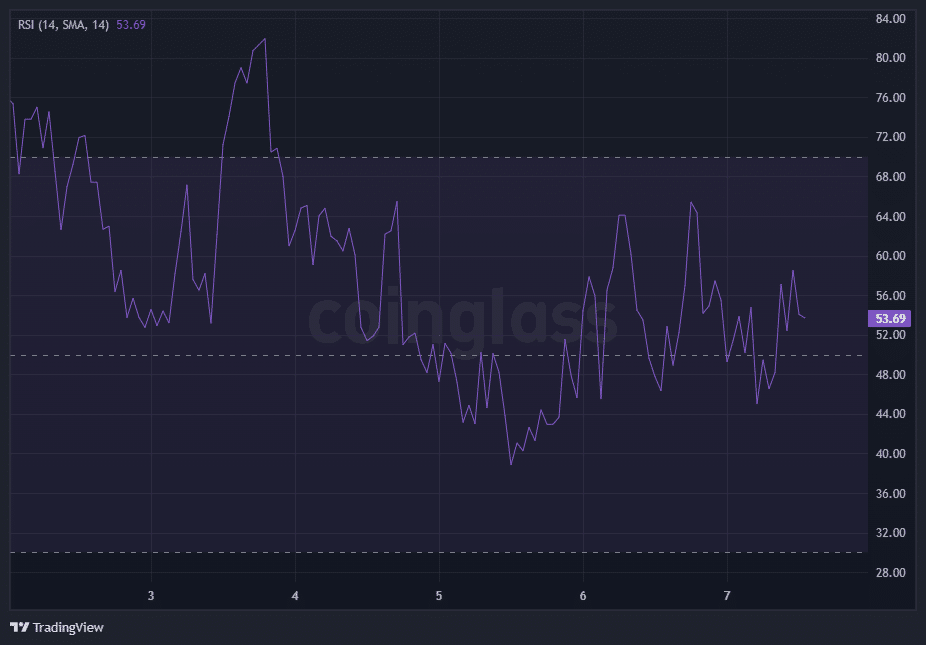

- The RSI was hovering around 50, indicating a balance between buying and selling forces.

Polkadot (DOT) showed dynamic price movements, piquing traders’ interest with key resistances, support levels, and on-chain metrics.

DOT exhibited notable price movements, with key resistance levels at $8.181, $9.573, and $10.490.

Source: TradingView

A significant breakout led to a high, followed by a correction, with support identified at $6.861.

Volume spikes during the uptrend indicated strong buying interest, while a consolidation near $7.866 suggested a potential recovery.

Evaluating Polkadot Momentum Using RSI

Traditionally, an RSI above 70 indicates overbought conditions, suggesting a potential price reversal or pullback, while an RSI below 30 indicates oversold conditions, implying a possible price increase.

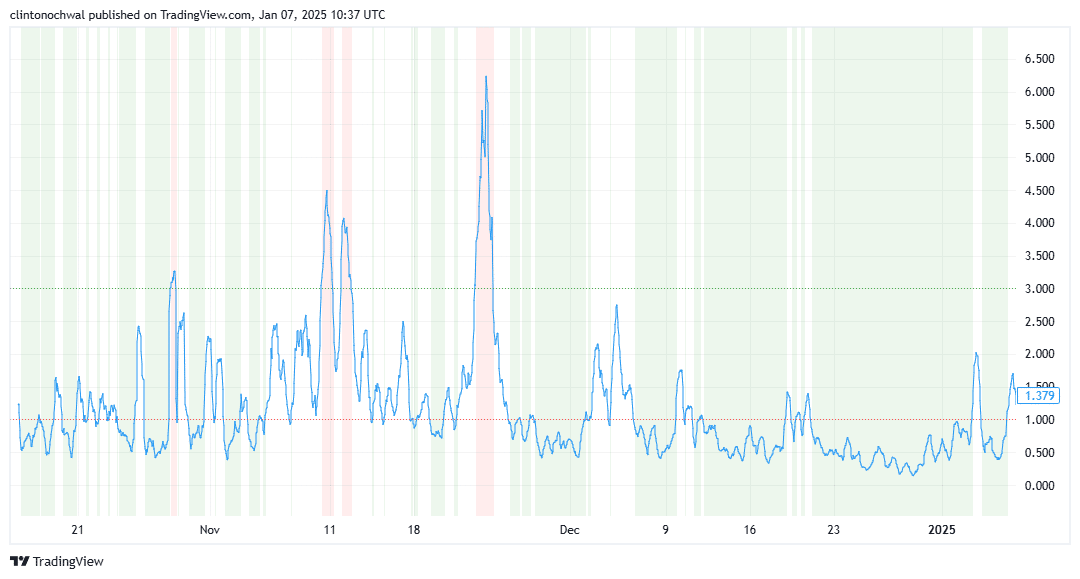

Source: CoinGlass

In Polkadot’s recent chart, the RSI approached overbought territory during the uptrend, signaling strong bullish momentum. As price peaked and corrected, the RSI fell towards neutral levels, reflecting the easing of buying pressure.

At the time of writing, the RSI was hovering around 50, indicating a balance between buying and selling forces. If the RSI moves back above 70, it could suggest renewed bullish momentum, potentially leading to a retest of resistance levels.

Conversely, a fall below 30 could indicate increased selling pressure and a possible decline towards support levels.

DOT MVRV Ratio: Is It Overvalued or Undervalued?

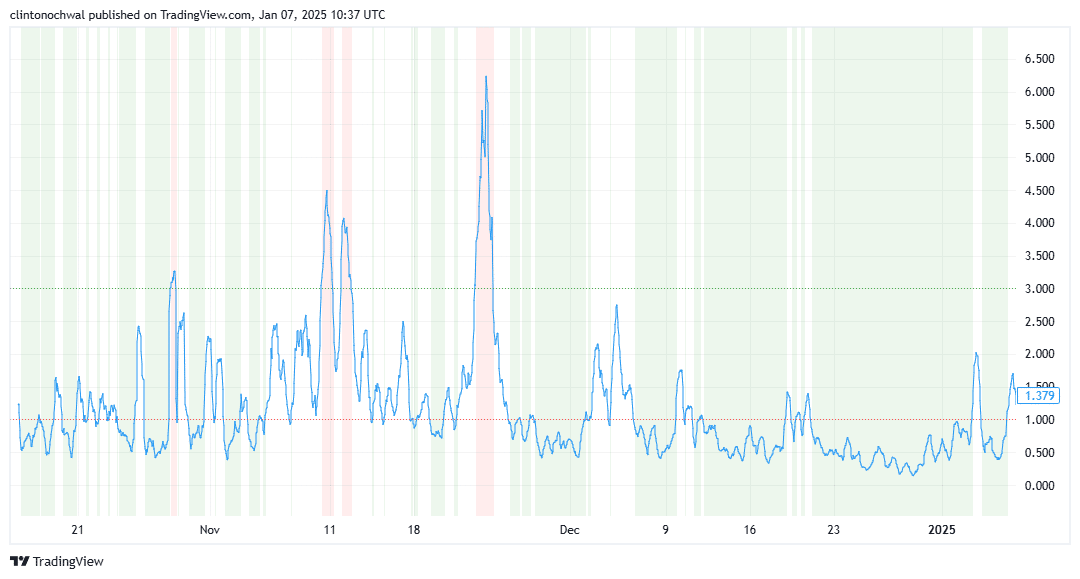

An MVRV ratio greater than one indicates that market value exceeds realized value, suggesting potential overvaluation, while a ratio less than one implies undervaluation.

Source: TradingView

For Polkadot, the MVRV ratio rose above 1 during the recent uptrend, indicating that the market value was higher than the realized value, which is typical of bullish phases.

As the price corrected, the MVRV ratio decreased towards 1, reflecting a move towards a more neutral valuation. Currently, the MVRV ratio is slightly above 1, suggesting that Polkadot is slightly overvalued.

Read Polkadot (DOT) Price Prediction 2024-2025

A significant increase in the MVRV ratio could indicate increased bullish sentiment and potential price appreciation, while a decline below 1 could signal bearish trends and further price corrections.

Polkadot’s recent price movements have been characterized by significant fluctuations, with key resistance and support levels playing a crucial role.

The RSI and MVRV ratios provide valuable information on the dynamics and valuation of the asset, respectively.