Polygon saw a notable increase in on-chain activity despite the crypto’s bearish reversal that sent MATIC plummeting.

While Polygon (MATIC) price may continue to struggle due to the weakness currently engulfing Bitcoin (BTC) and the broader cryptocurrency market, analysts say the surge in on-chain activity suggests a potential reversal for MATIC.

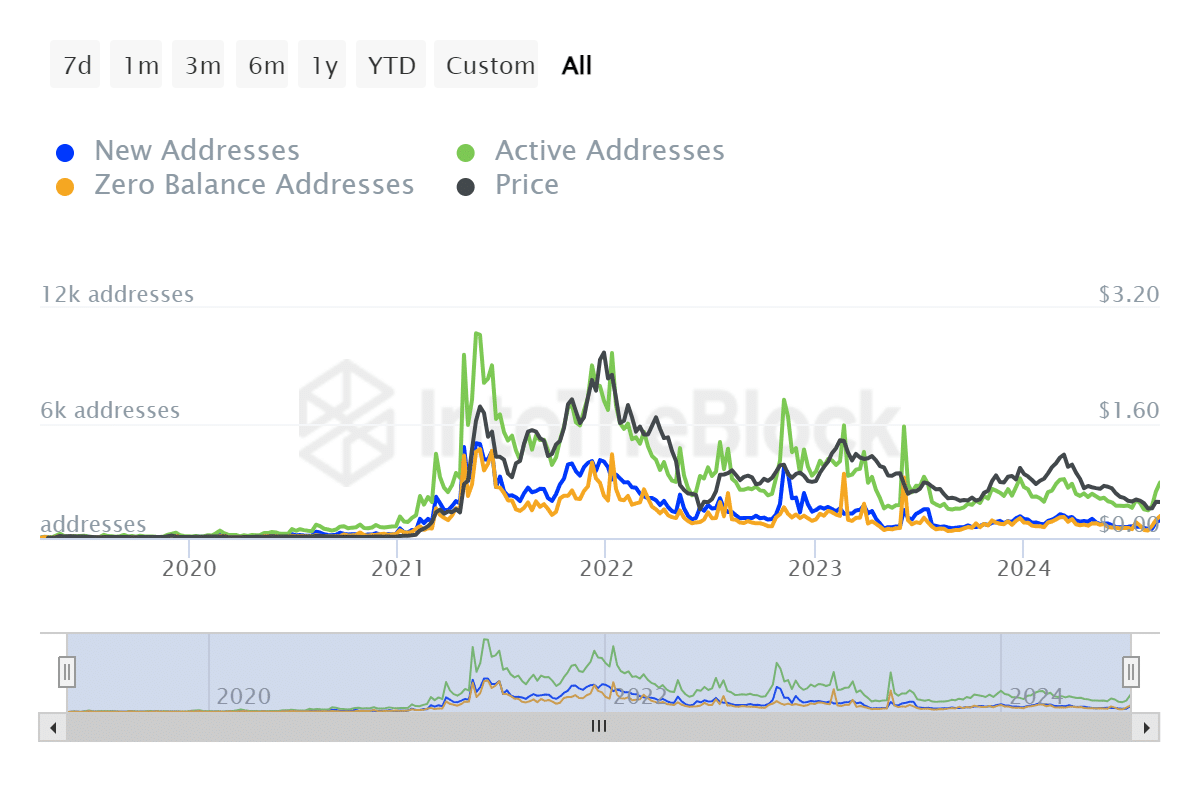

Data shows that Polygon’s network has seen an increase in daily active addresses and dormant coin movements.

Activity spikes on the Polygon channel

Santiment notes that Polygon has seen a significant increase in the number of dormant MATIC coins moving. The platform points to the Age Consumed metric, a metric that tracks the movement of dormant tokens by measuring the number of long-held coins moving from one address to another.

The age data consumed is a calculation that multiplies the number of moving parts by the time since their last transfer.

Also worth noting is the sharp increase in the number of daily active addresses. According to Santiment data, a total of 3,369 addresses interacted on-chain on Polygon as the Age Consumed metric peaked. The number of active addresses was the second highest day of the year.

IntoTheBlock data also shows an increase in active addresses since August 26, with over 1,000 new addresses on August 27.

What does this mean?

An increase in the Age Consumed indicator often suggests a change in sentiment among long-term holders. Historically, this has coincided with notable changes in the price of the token in question.

Polygon is among the many networks that have been declining since the cryptocurrency retracement began in March. However, a notable spike in on-chain activity may be a sign that a MATIC reversal could be brewing soon. Active addresses and dormant coin spikes are common signals preceding this phenomenon.

Santiment wrote about X.

In Polygon’s case, the Age Consumed metric has surged to 69 billion MATIC as the altcoin’s price has plummeted due to the cryptocurrency’s latest weakness. The local high related to this was around $0.58, and Polygon’s price has fallen 14% so far.

Despite this weakness, both on-chain indicators suggest that investors may view MATIC’s decline as an opportunity to buy low.