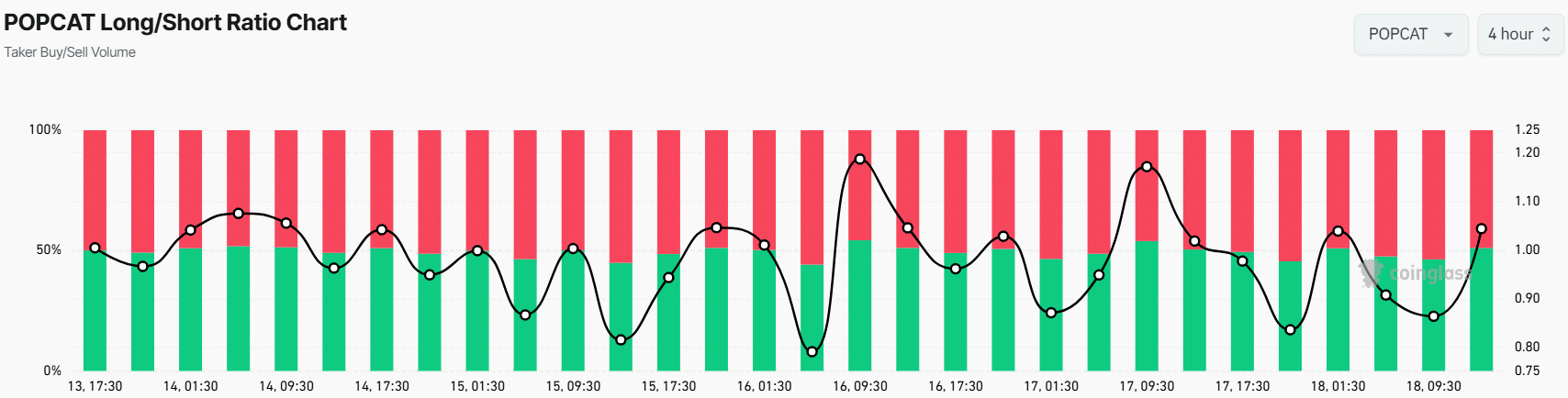

- POPCAT’s Long/Short ratio was 1.05, indicating strong bullish sentiment among traders.

- POPCAT’s RSI Suggested There Could Be Enough Room for Memecoin to Rally

As the broader market is on the road to recovery, the Solana-based memecoin POPCAT has attracted the attention of many traders and investors. This, after the altcoin went through a prolonged consolidation phase on the charts, which lasted for more than eight days.

POPCAT emerges from prolonged consolidation

Following this breakout, sentiment around POPCAT could be about to shift from a downtrend to an uptrend. In fact, memecoin has already seen a price increase of over 23%. However, at press time, a minor price correction appeared to be underway.

The last two and a half months have not been kind to memecoin, as it has faced sustained periods of bearish momentum leading to price declines of over 70%. In addition to the price decline, memecoin also faced resistance from a trendline. This contributed to a price reversal whenever the POPCAT price approached it.

POPCAT Technical Analysis and Key Levels

This time too, after registering a price increase of over 23%, the price reached the trendline. At the time of writing, it appeared to be facing a price correction at this level.

According to AMBCrypto technical analysis, if POPCAT breaks this strong trendline and closes a daily candle above the $0.75 level, there is a high chance that it will surge 50% to reach the next resistance level of $1.15 going forward.

Source: TradingView

Currently, memecoin is trading below the 200 exponential moving average (EMA) on the daily time frame, indicating that it is on a downtrend.

On the positive side, with POPCAT’s relative strength index (RSI) at 43, a technical indicator suggests that there could be enough room for memecoin to rally significantly in the future.

On-chain bullish metrics

In light of the bullish technical data and memecoin price action, intraday traders are now excited.

In fact, as revealed by on-chain analytics firm Coinglass, they are betting significantly on the long side. The POPCAT Long/Short ratio stood at 1.05, highlighting bullish sentiment among traders.

Source: Coinglass

Additionally, 51.50% of top traders on the exchanges held long positions, while 48.5% held short positions. However, the percentage of the long side seems to be constantly increasing.