- Popcat recently violated a descending channel and can watch a major price push

- Despite the support of the Binbit, Binance and Hyperliquid whales, spot traders on the market will play a key role

Popcat won 37% in the last 24 hours, in addition to its Haussier movement in last week. Due to the same thing, Altcoin now returns 41% for investors who bought the assets in last month.

While the feeling remains mainly optimistic, in particular with a high interest in whales and a bullish technical configuration, Ambcrypto has spotted certain factors which could hinder the potential rally of the asset.

Haussier escape on the edge

Popcat presented a configuration for a possible price rally on the graph, with the formation of a downward price channel. This model is formed by parallel support and resistance lines.

According to the same thing, if the movement of the dynamism of the popcat momentum is maintained and the asset manages to cross the level of resistance, the price could reach $ 0.9822. This would represent a price boom of 370%.

Source: tradingView

For a 3.7x rally to occur, it is likely that the price will be along the way, rather than a single recovery. However, if the overall feeling of the Haussier market is true, Popcat could possibly violate this level, negotiating up to $ 2.08.

Whales are after a rally

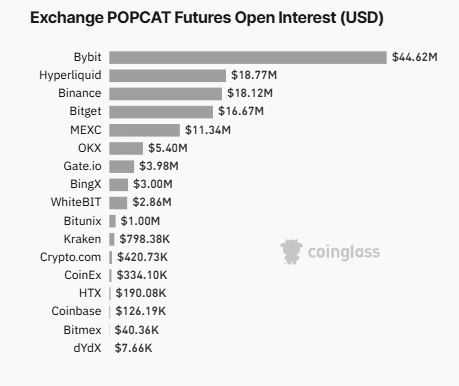

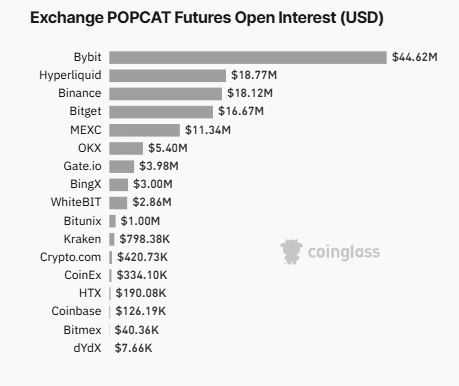

An analysis of the short-short ratio of Coinglass and the open interest on the market revealed that the whales have put pressure for a major price rally.

First of all, the broader feeling of the market remains optimistic, the volume of purchase on the market exceeding that of the sellers. This was highlighted by the long to short ratio having a reading of 1.0513.

When this ratio crosses 1, this implies a bull market phase. On the contrary, below 1 implies that bears or sellers are dominant, with more inconvenience to come.

A more in -depth analysis has shown that a majority of purchase contracts on the derivative market are motivated by whales or superior merchants who have major positions open to assets.

Source: Coringlass

At the time of writing the time of writing, Parbit, Binance and hyperliquid whales dominated unstable contracts on the market. This cohort of merchants had a collective position of $ 80.7 million out of the $ 127.89 million in the market.

The general market being optimistic, in particular with the dominant purchase volume – this means that these whales have more long open contracts than short.

In fact, traders who bet against these whales have experienced major market losses because their positions have been closed with force. Short merchants in the last 24 hours have lost $ 1.24 million as the price moved against them. This type of major market liquidation highlighted the strength of bulls.

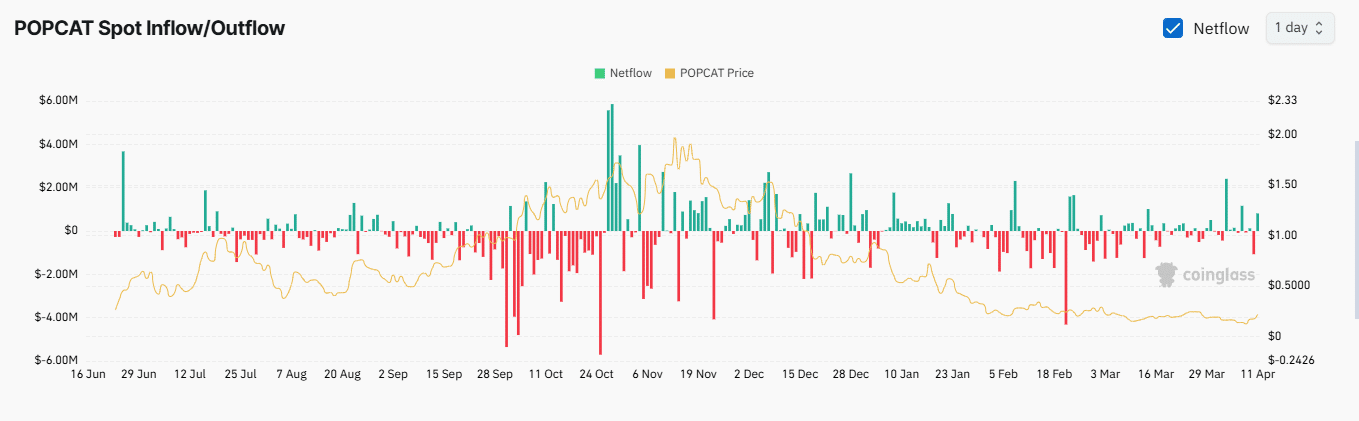

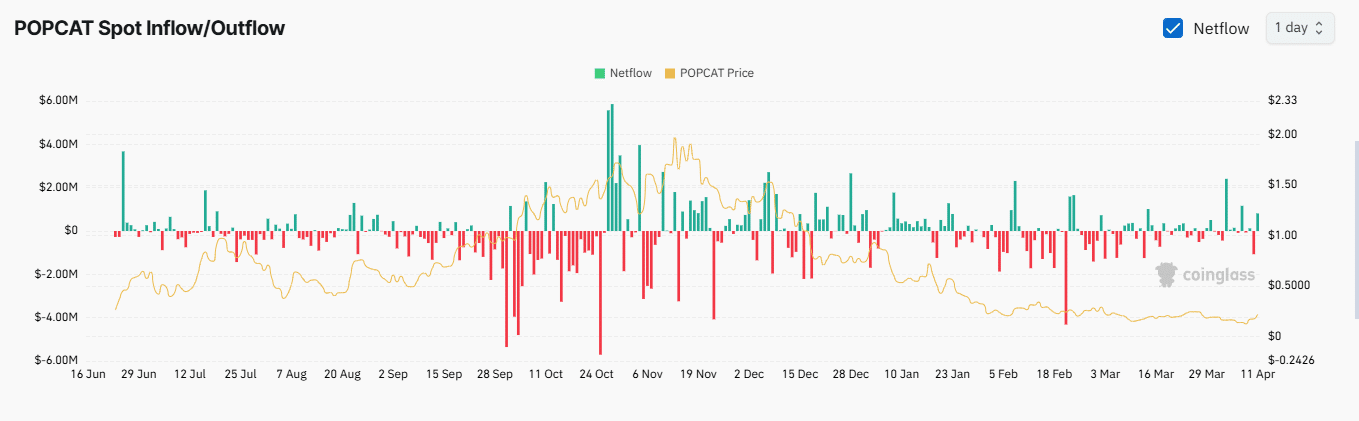

Taking advantage could slow the rally

It is worth emphasizing, however, that the bullish feeling would not be aligned with spot traders on the market. At the time of the press, there were notable sales activities among cash traders – reaching around $ 850,000 according to the Netflows of the exchange.

Source: Coringlass

When a major amount of an asset is sold like this in the middle of a bullish market configuration, this means that long-term traders probably obtain profits. Especially since they move their popcat private wallets in the exchanges to sell.

If this trend continues among long -term merchants, it could hinder the potential popcat violation of the level of higher resistance on the graph. This would slow up the upward perspectives, as planned.