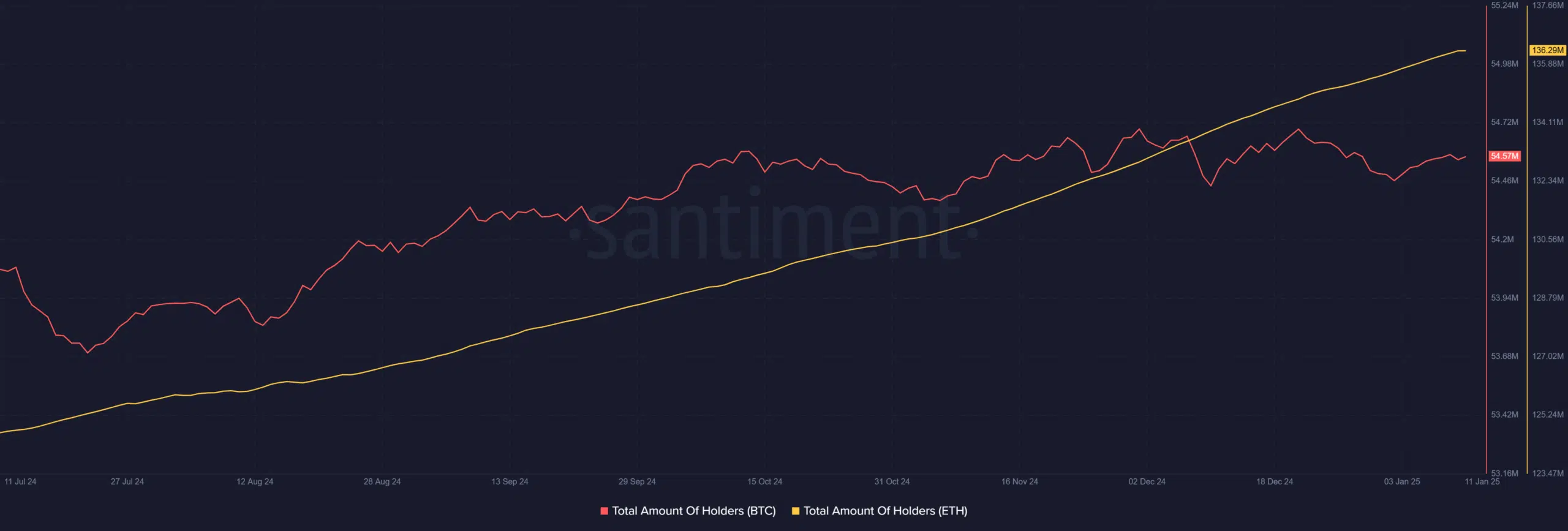

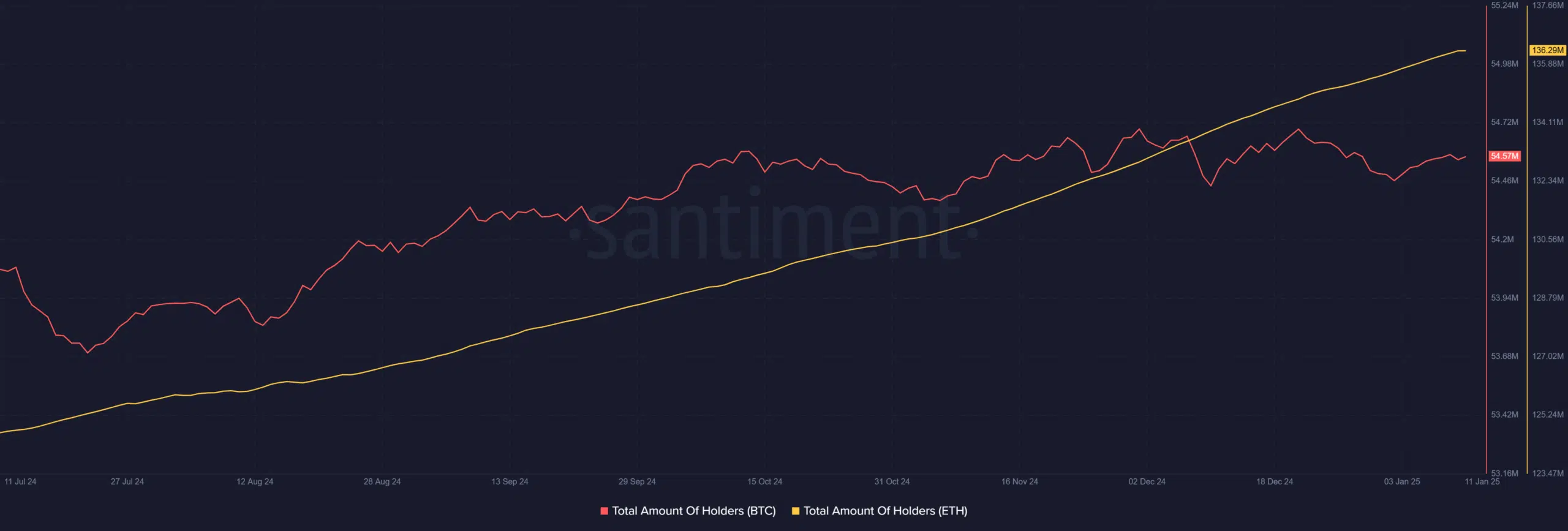

Bitcoin and Ethereum – Market Leaders

Bitcoin added over 102,000 new wallets in 2025, reaffirming its position as the unshakable anchor of the market. The appeal lies in its simplicity and strong narrative that it is a hedge against macroeconomic uncertainty. Even during turbulent times, BTC’s ability to attract new holders demonstrates its unparalleled trustworthiness among investors.

Source: Santiment

Meanwhile, Ethereum’s explosive growth – with 645,000 new wallets – underlines its dominance as a multi-faceted blockchain. This rise highlights market confidence in Ethereum’s expanding ecosystem, particularly in its scaling solutions such as Layer 2 networks.

These innovations make Ethereum more accessible and profitable, thus driving its adoption. Together, Bitcoin and Ethereum have highlighted that market confidence in established giants remains unwavering, despite challenges.

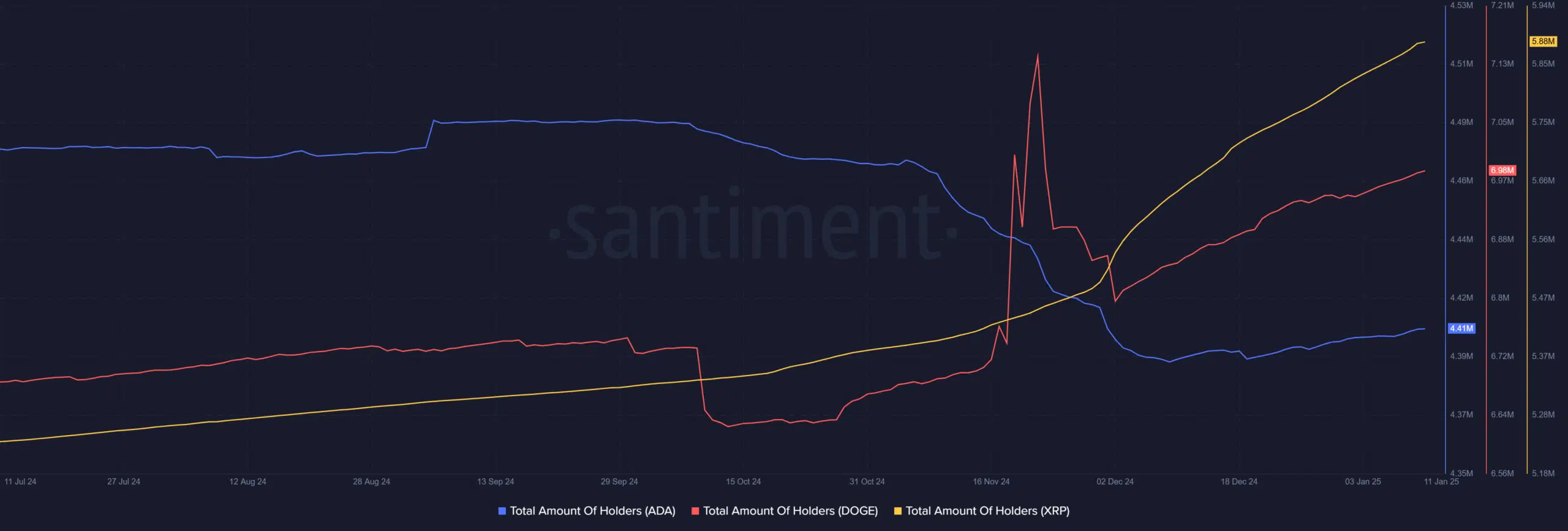

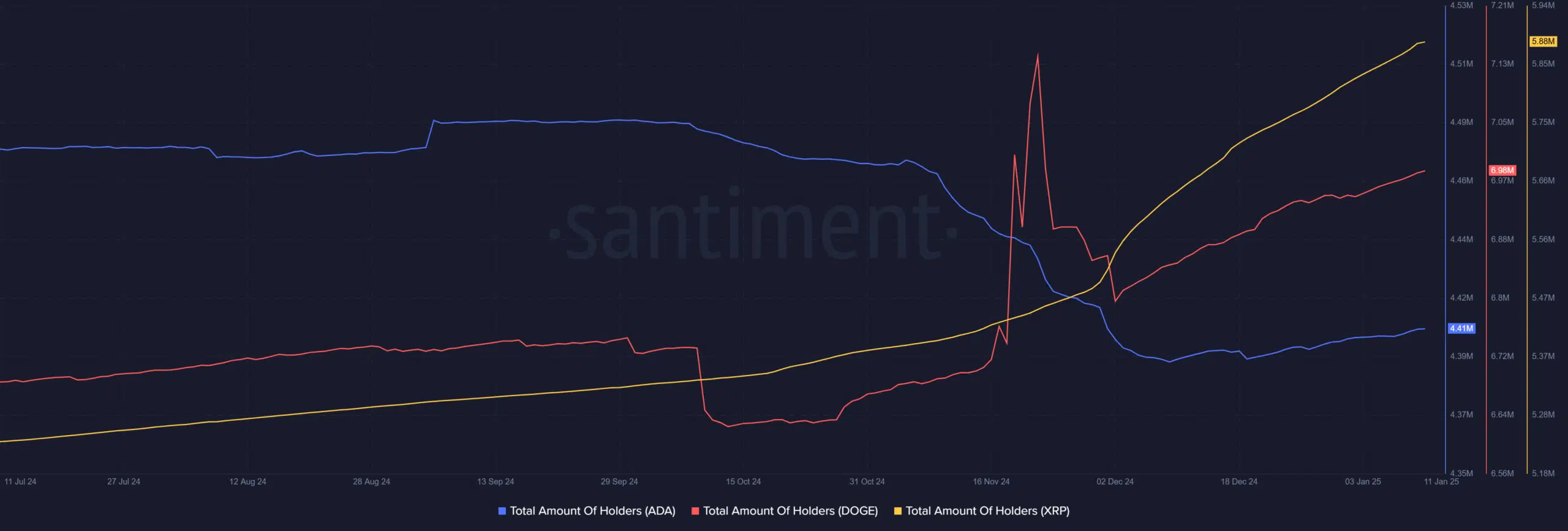

Other assets showing positive growth

Since the start of 2025, XRP has seen the creation of 58,000 new wallets. This rise has been bolstered by Ripple’s recent regulatory achievements, such as the NYDFS’ approval of its stablecoin, RLUSD, in December. This approval improved Ripple’s digital payments platform, attracting more users and increasing the value of XRP.

Source: Santiment

Dogecoin (DOGE), despite its inherent volatility, added 29,000 new wallets during the same period. Its enduring appeal comes from its meme origins and a vibrant community that actively engages in fundraising and promotional activities. This popular support continues to drive adoption, even in a fluctuating market.

In contrast, Cardano (ADA) only saw a modest increase of 2,800 new wallets, indicating a slower adoption rate. This can be attributed to the platform’s deliberate development approach and the competitive landscape of smart contract platforms, which could influence investor interest.

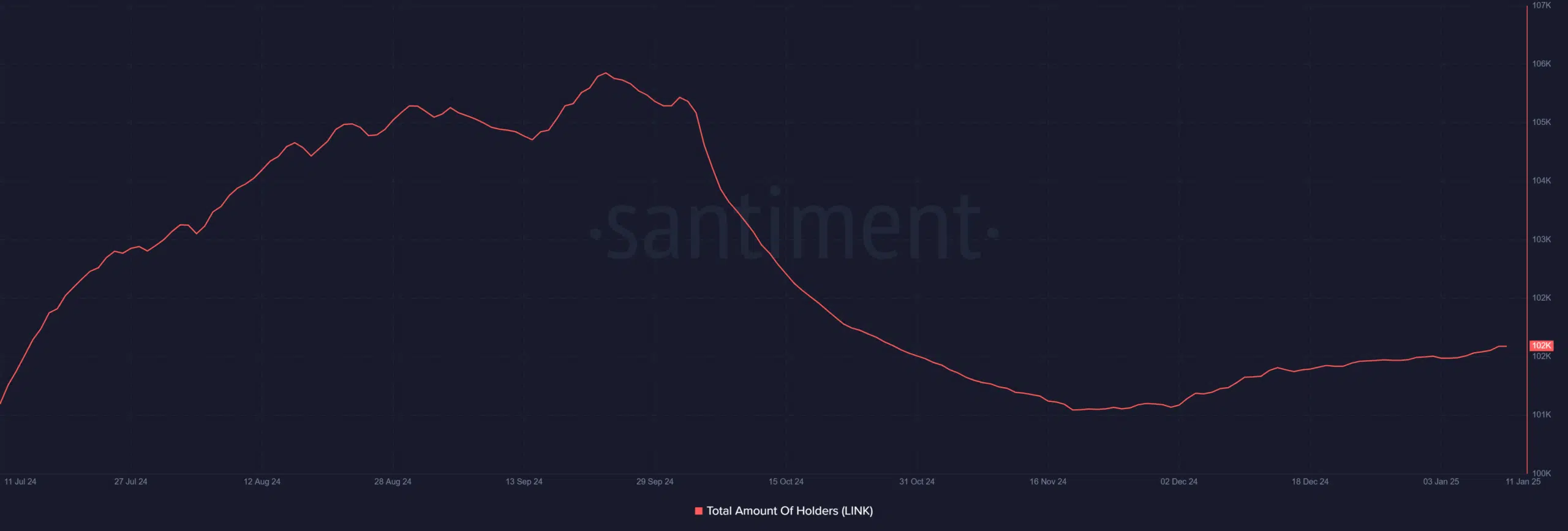

Chainlink’s counter-trend

Chainlink (LINK) saw a 3.3k wallet decline – This decline reflects a change in market sentiment, potentially driven by several factors. This list included – Increased competition from emerging decentralized oracle networks, market-wide downtrends, or doubts regarding scalability.

Source: Santiment

Interestingly, such a decline in the number of wallet holders could be considered a contrarian indicator. Historically, massive sell-offs and portfolio declines have often preceded recovery phases. For savvy investors, this scenario may present an opportunity to accumulate LINK while others remain cautious.

Read Bitcoin (BTC) Price Prediction 2025-26

Why portfolio growth is a better indicator than price fluctuations

Price volatility often gets attention, but it can obscure underlying investor sentiment. In contrast, portfolio growth is a more reliable measure for assessing long-term confidence in a project.

For example, short-term price fluctuations are part of natural market cycles, determined by trading psychology, macroeconomic events and external speculation. The growth of the portfolio, however, indicates a growing number of holders who believe in the future of the asset. This steady accumulation reflects true adoption and engagement with the network, signaling a more optimistic outlook.

By focusing on portfolio growth, investors can get a clearer idea of an asset’s potential, even during price corrections. In this context, the regular additions of more than 102,000 wallets for Bitcoin and 645,000 for Ethereum illustrate how strong fundamentals continue to attract new participants to established networks.