Prediction markets are emerging as one of the fastest growing areas of crypto, just as meme coins are retreating from their recent highs, opening a broader industry debate about where speculative capital will go in 2026.

The comparison gained momentum after Kalshi head of crypto John Wang described prediction markets as “the meme coins of 2023,” arguing that both attract attention during periods when traders seek asymmetric opportunities.

The remark came as meme coin activity has cooled sharply after a volatile period that defined much of the past two years.

Meme Coins Have Had Their Moment: Is This The Collapse Phase?

Meme coins surged in 2023, thanks to the launch of new tokens and strong exposure on social media.

The industry’s total market capitalization reached nearly $22 billion by the end of that year, while trading activity expanded significantly.

Data from the period shows that the average trading volume increased more than nine times in the first eleven months.

Two intense rebounds marked the year, in particular an April-May surge fueled by highly speculative launches.

This speculative energy continued through 2024, when meme coins reached an estimated peak market cap of around $150 billion in December, aided by Dogecoin, Shiba Inu, Pepe, and a wave of politically themed tokens.

The reversal was just as brutal. By the end of 2025, the total value of the sector had fallen below $42 billion, with daily volumes declining and individual tokens losing most of their previous gains.

Market data now shows that memecoin trading volumes are down about 85% from their peaks, reflecting a broad decline in risk appetite.

Are Traders Done with Meme Coins? Prediction markets are quietly taking over

As meme coins disappeared, prediction markets moved in the opposite direction.

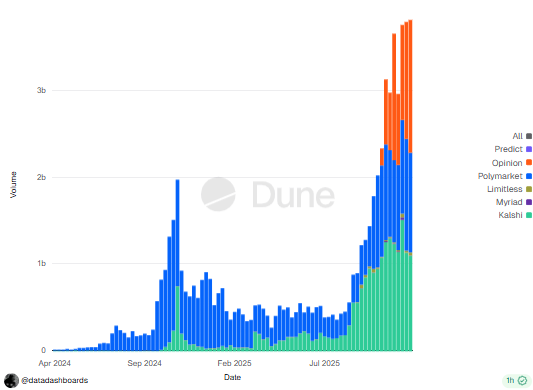

Platforms such as Kalshi, Polymarket and Limitless have seen a combined $44 billion in trading volume this year, with Kalshi alone reaching $1 billion in weekly volume, largely driven by sports and political contracts.

Source: dune/data tables

On-chain prediction markets have grown even faster. Monthly volume has grown from less than $100 million at the start of 2024 to more than $13 billion today, a 130-fold increase, according to a joint study by Keyrock and Dune Analytics.

Non-sports markets, including events related to economics, politics and technology, accounted for most of the growth in 2025.

The structure of prediction markets differs greatly from that of memecoins, a point raised repeatedly by industry players.

Prediction contracts allow traders to buy “yes” or “no” actions tied to a specific outcome, with prices reflecting implied probabilities and settled through oracles once events have concluded.

Proponents argue that this creates clearer pricing and limits some of the manipulation risks that have plagued low-liquidity token markets.

Critics counter that returns are capped by design, making it harder for small traders to make outsized gains compared to early-stage memecoin trades.

Can Prediction Markets Kill Meme Coins?

Presenting the trend as “prediction markets killing memecoins” misses the point.

Memecoins are not dead. Liquidity has simply retreated, and this contraction is affecting many other crypto sectors as well.

History shows that meme-driven markets tend to hibernate rather than disappear. When volatility returns and risk appetite increases, memecoins can quickly resurface.

At the same time, prediction markets are clearly gaining a sustainable user base. Their growth is not purely cyclical hype; it is driven by real-world events, regulatory clarity in certain jurisdictions, and demand for structured speculation. This gives them a resilience that memecoins often lack during economic downturns.

The most likely outcome is coexistence, not replacement.

Memecoins will continue to dominate during speculative surges and attention-driven cycles. Prediction markets will attract traders seeking clarity, probability-based pricing and event-driven exposure. They meet different psychological and financial needs.

If anything, the current shift shows a maturing crypto market, one in which capital rotates rather than evaporates and speculation takes multiple forms instead of coalescing around a single narrative.

The article Prediction Markets vs Meme Coins: Is This Where Crypto’s Next Alpha Lives? appeared first on Cryptonews.

(@shaams)

(@shaams)