For an ephemeral moment, World Liberty Financial (WLFI), the crypto project with a direct line to the Trump family, looked like a golden ticket. Prévente buyers have seen their money multiply 20 times, at least on paper.

Anyone who bought at the top was burned and looked at 60% of his investment disappear. It was not only another launch of Crypto; It was a MasterClass in the way in which media, politics and greed can explode a market.

Why did he soar?

The WLFI explosion began on September 01, 2025, the day it struck renowned exchanges. Suddenly, anyone on Binance, Okx or Bybit could buy, and a flood of money spilled in a room with the name of the Trump family stamped as co-founders. This political connection, supercharged by a huge $ 550 million collected even before its public return, has prepared the land for chaos.

According to fractions of one penny, the price exceeded $ 0.46, briefly giving the project a paper assessment north of $ 30 billion. The market was seized by a classic fear of missing, with $ 4.46 billion drugs negotiated in the first 24 hours while people rushed against a piece of action.

And then, the inevitable collapse …

The summit did not last. The price of the Altcoin collapsed, cramming at around $ 0.179. For what? To start, people who arrived early wanted their money. The rules allow them to sell 20% of their hiding place at the launch, and with profits of up to 2,000%, which could blame them for collection?

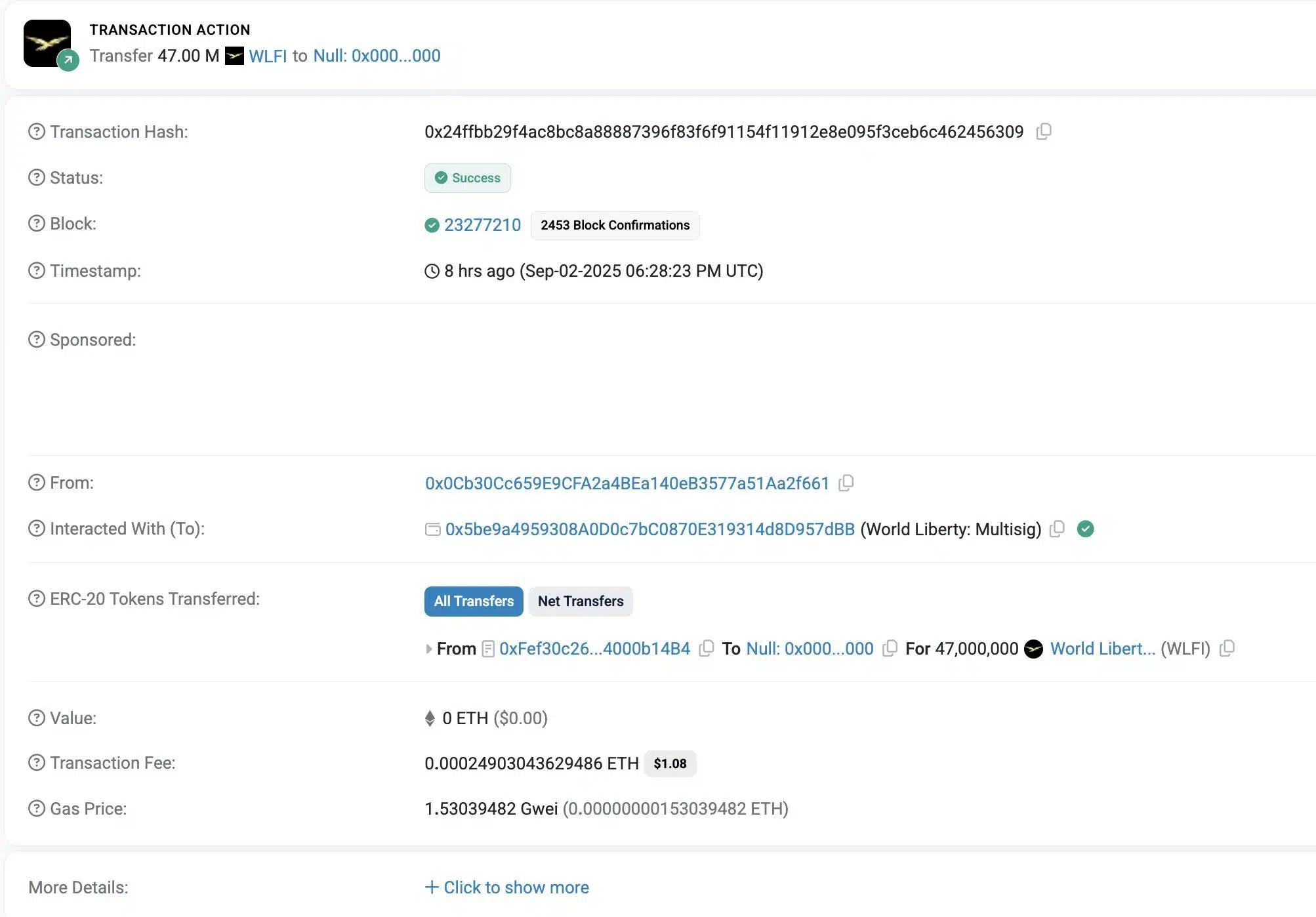

Blockchain observers saw the big movements arriving. Giant “whales” wallets have been seen moving huge quantities of WLFI to exchange just after launch – a dead gift that a massive sale was imminent. A single transaction alone saw three premature birds of 160 million tokens, worth $ 51.2 million at the time, in a Binance portfolio.

Source: Lookonchain / X

Digging Deeper revealed a trembling foundation. A small group of wallets contains almost all WLFI tokens, which gives them terrifying power to swing the price as they wish. It is a configuration that shouts market manipulation.

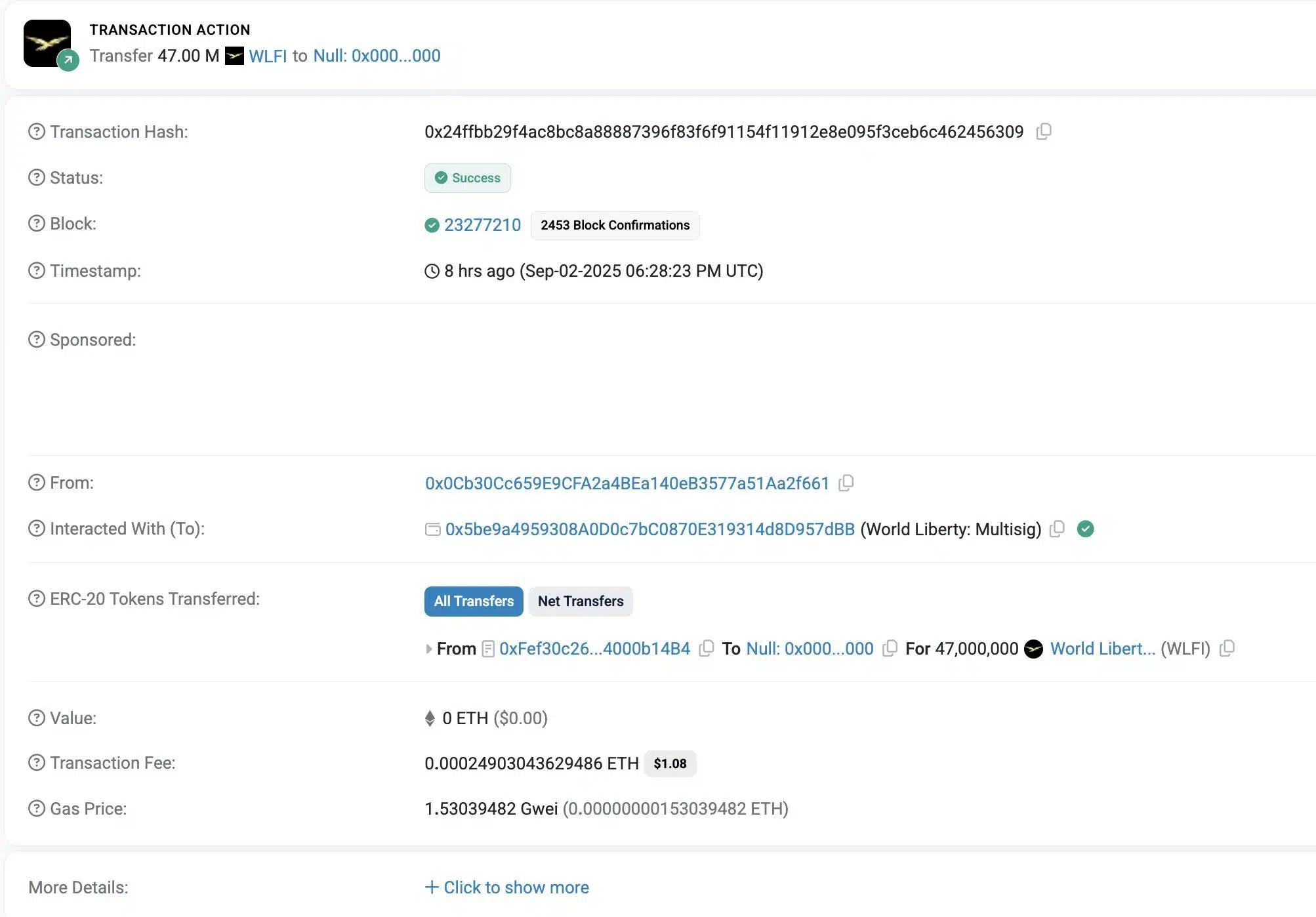

The team tried to stop the bleeding by “burning” 47 million tokens. However, it was a drop in the ocean, less than 0.2% of the supply, and did nothing to slow down the sale of panic.

Source: Etherscan

What are the merchants watching now?

After all this chaos, traders are always glued at a few key prices.

The floor seems to be between $ 0.17 and $ 0.18 – the lowest it has ever been. If he breaks and stay below, expect more pain.

To interest the bulls again, WLFI must go up above the range from $ 0.23 to $ 0.25. This is where the price was blocked before, so taking it back would be a first step towards recovery.

A team with a troubled past

The credibility of the project is also under fire, thanks to the people who direct the show. While the names Trump and Witkoff lend a political and real estate weight, the co-founders, Zak Folkman and Chase Herro, have a story.

They were the duo behind Dough Finance, a DEFI project that made smoke after a hacking of $ 2.5 million in 2024. People who lost their money at the time say that the pair simply jumped the ship to a new project without doing things.

With 100 billion existing tokens and initiates who hold a huge piece, nobody knows that WLFI is a real long -term business or simply a cash seizure. Right now, it is a player paradise, a piece led by the big titles and the whims of its greatest holders.