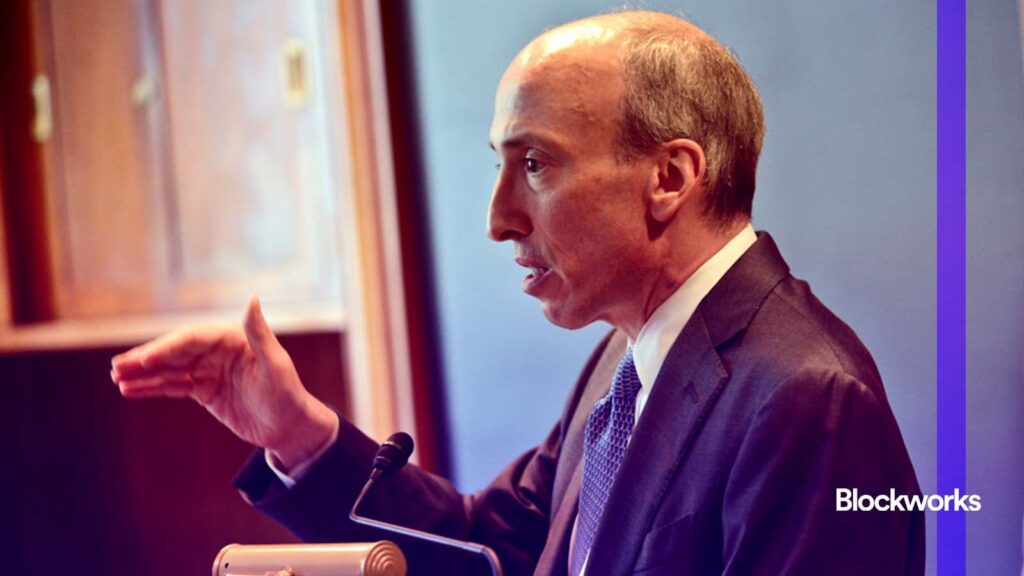

The U.S. Securities and Exchange Commission’s approach to crypto regulation, under the leadership of Gary Gensler, is stifling innovation and preventing U.S. digital asset companies from expanding in the United States. Instead of fostering growth through clear, constructive rules, the commission has relied on aggressive enforcement measures that create uncertainty and spur overseas employment, investment, and innovation.

To restore confidence and maintain U.S. competitiveness in this emerging sector, the SEC must abandon its “regulation by enforcement” approach in favor of a rulemaking process that is transparent and informed by public input. This change would allow the digital assets sector to thrive under clear guidelines, keeping American innovation at the forefront of global finance.

Even if there is a change in SEC leadership with the next change in administration, the SEC needs to seriously consider how it approaches the regulation of digital assets.

Learn more: Traders bank on Trump’s pro-crypto action

U.S. digital asset companies have spent more than $400 million defending themselves against SEC enforcement actions under Gensler’s presidency – a figure that should serve as a proxy for the considerable opportunity costs of delaying the innovation, loss of jobs and misappropriation of capital. Just recently, a major software company in the digital assets industry announced that it would lay off dozens of workers, noting that its battles with the SEC were costing it millions. The SEC’s strategy is anti-innovation and must stop.

The commission’s strategy reflects a fundamental misalignment between the means and ends of regulation. Rather than pursuing rulemaking through notice and comment—the legally required route to establishing regulatory frameworks—the SEC has opted for “regulation by enforcement.” This approach effectively transforms enforcement proceedings into de facto policymaking, circumventing the Administrative Procedure Act’s requirements for public notice and comment and eliminating any public voice in the process.

Learn more: Is the world leaving America behind when it comes to crypto regulation?

The industry has repeatedly urged the commission to establish clear rules and has sought clarity in several meetings with the agency. Instead of engaging productively with industry stakeholders, the commission obstructed and took enforcement action. The regulatory strategy by the Commission is so egregious that others in the industry have proactively pursued them for clarification. In Lejilex v. SEC, for example, the company explains that it cannot launch its non-custodial exchange for fear of SEC enforcement. In another case, Mann v. SEC, two artists describe their fear of SEC enforcement by creating NFTs of their art.

Learn more: SEC continues to engage in ‘strategic ambiguity,’ lawyer says

The consequences are both predictable and measurable. According to HarrisX survey data, voters believe the United States has taken the wrong approach to crypto and that the SEC has been too heavy-handed. Indeed, voters prefer clear rules and regulations over enforcement by a factor of two to one. And what’s even more critical: Two-thirds of voters agree that the SEC should wait for clearer guidance from Congress. More worrying is the effect on the US digital asset ecosystem: promising projects that never came to fruition, investments never made, and innovations redirected to more welcoming international jurisdictions.

The legal and business communities have long recognized that regulatory certainty creates economic value. When businesses can accurately assess compliance requirements, they can allocate capital efficiently and innovate with confidence. The current enforcement-focused approach reverses this principle, creating a regulatory environment in which even well-resourced legal departments struggle to provide definitive advice to their clients. Investments are increasingly heading to jurisdictions with clearer regulatory frameworks, while entrepreneurs choose to develop products in markets with more predictable oversight.

America’s position as a global financial leader rests on its ability to effectively balance innovation and regulation. The current enforcement-centric approach risks ceding leadership in an emerging technology sector to other jurisdictions – a mistake that could take decades to correct, if that is even possible. If the United States wants to remain a leader in technological development, the SEC must change course.

A policy-making process driven by stakeholder input is the only way forward. Regulation by enforcement is not the way a vibrant, innovative economy should work: it wastes taxpayer dollars, hurts investors, kills innovation, and drives capital out of the country. Now is the time for transparent and thoughtful regulation before the United States loses its competitive edge in the digital economy.

Start your day with the best crypto news from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, politics, and finance with Ben Strack, Casey Wagner, and Felix Jauvin. Subscribe to the Forward Guidance newsletter.

Get alpha delivered straight to your inbox with the 0xResearch newsletter: market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all about Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.