- The price of Ethereum has recovered $ 2,350, with technical indicators supporting a potential rally to $ 3,260

- Altcoin’s Netflow analysis alluded to the feeling of change of market

The action of Ethereum prices recently attracted the attention of traders, with key indicators alluding to the potential of a strong rise. In fact, the crypto has shown resilience, recovering critical price levels and demonstrating models that historically precede gatherings.

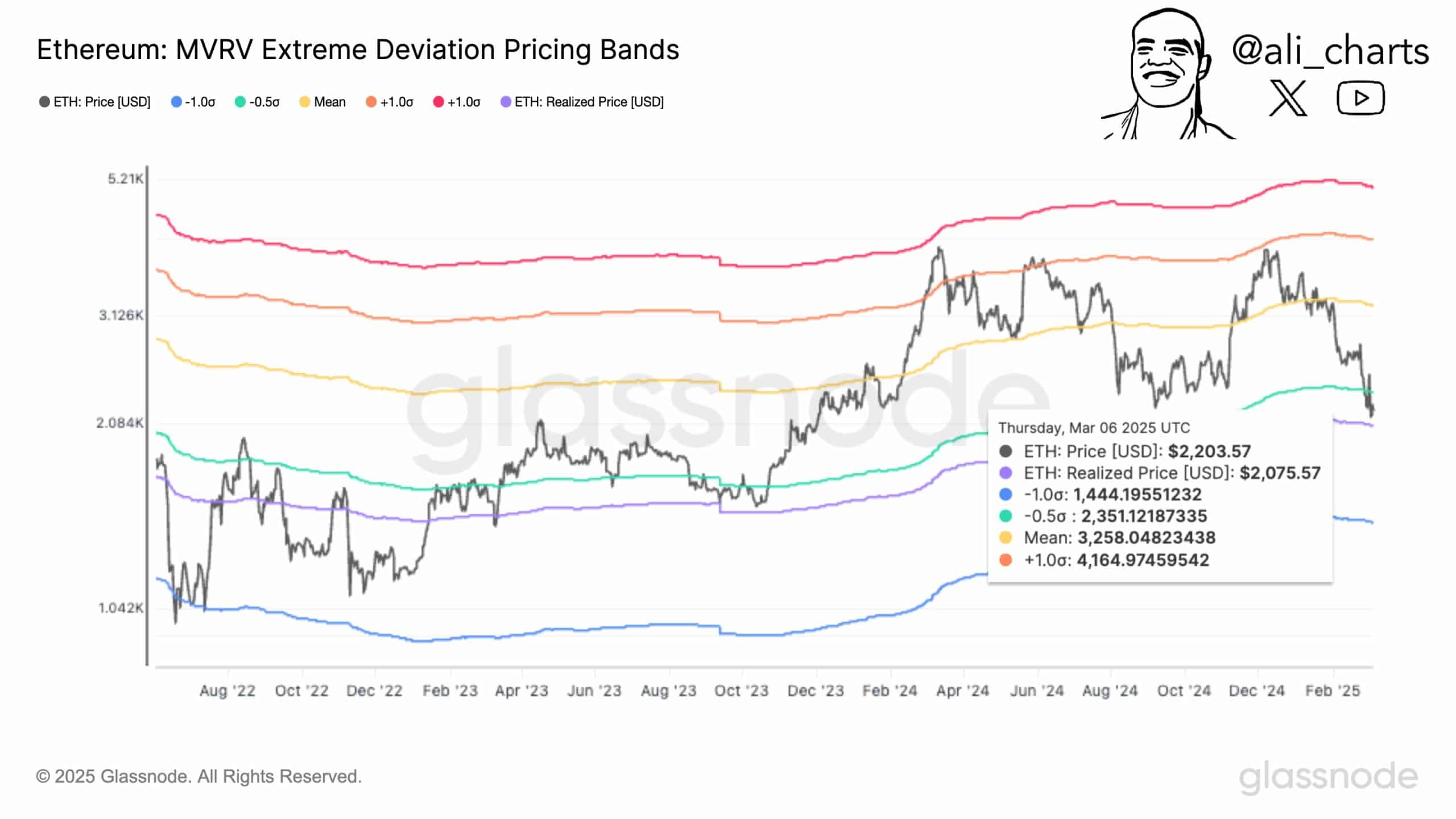

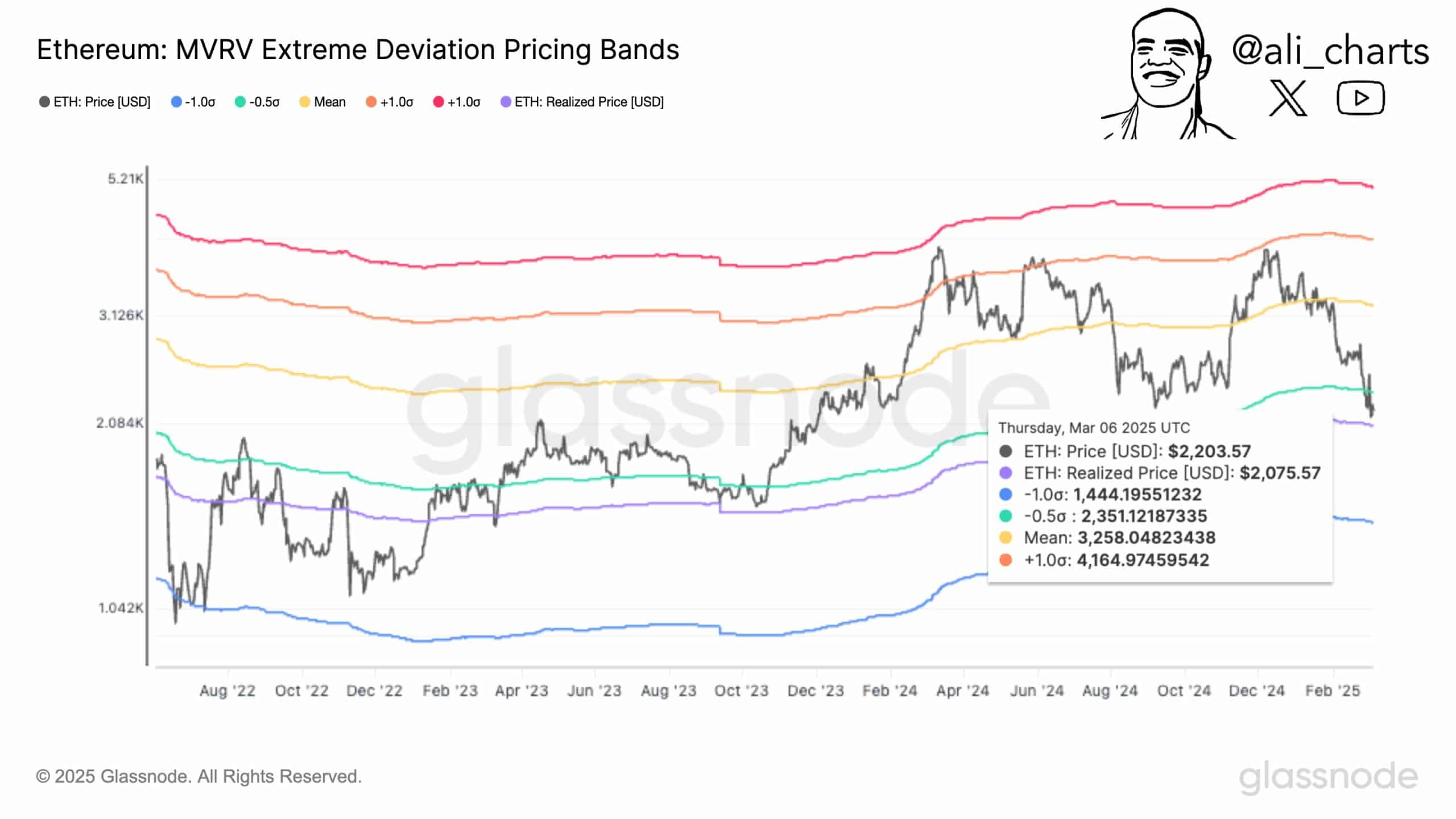

Ethereum (ETH) has recovered $ 2,350 from the graphics, with technical indicators supporting a potential rally to $ 3,260. On March 6, ETH was traded at $ 2,203.57, with the price made at $ 2,075.57.

Altcoin’s pricing bands have identified key levels, with ETH exceeding a crucial threshold – a sign of a strong bullish dynamic.

Source: Glassnode

Historical trends have revealed that similar eruptions have led to prices overvoltages, such as the increase from $ 1,042K in August 2022 to $ 3,126k by August 2024. This model suggested that ETH’s last decision alluded to accumulation and reduces the sales pressure.

Therefore, a rally at $ 3,260 may be possible, providing a potential of 48%. However, the failure to hold $ 2,351 could push the ETH to $ 1,444 – a possible decrease of 34%.

Exchange of exchange – Meaning?

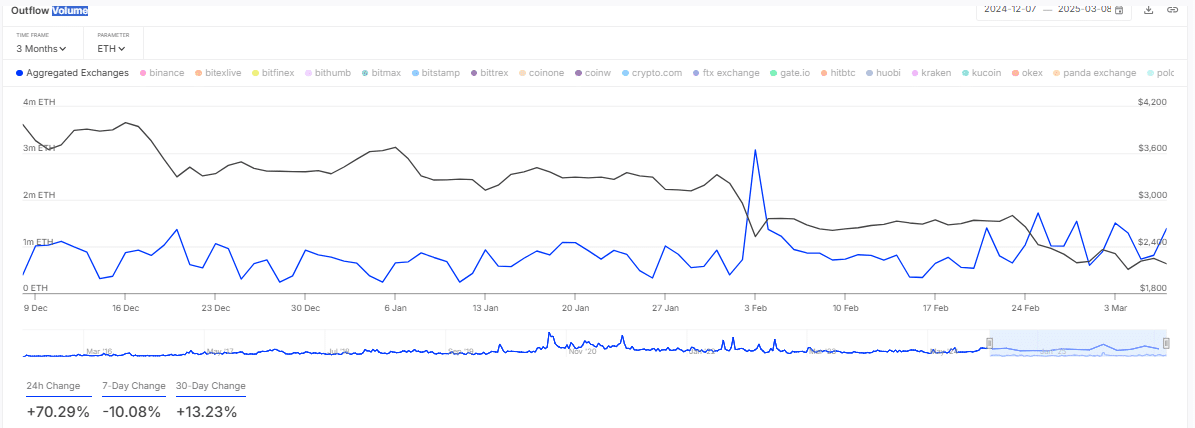

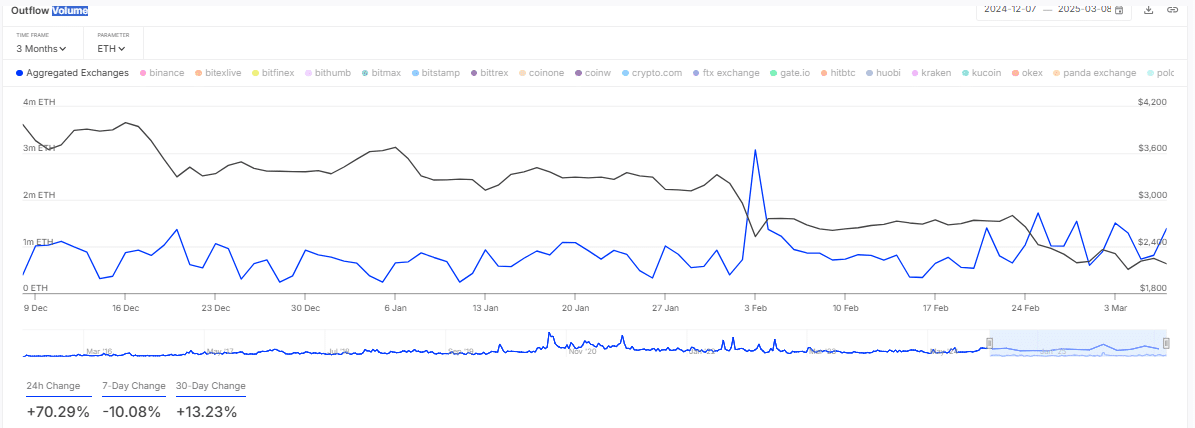

More than $ 500 million ETH have been removed from scholarships, indicating an increase in accumulation among traders. The table of exit volumes of March 8 showed a variation of 24 hours of + 70.29% – a variation of 7 days of -10.08% and an increase of 30 days of + 13.23%.

Source: intotheblock

On March 3, outings culminated at 1 million Eth eth, worth 2.4 billion dollars, before switching to 400K ETH ETH by March 6. The high 24 -hour increase reflected high purchase pressure, reducing the food available on major exchanges.

The 30 -day trend has strengthened the long -term accumulation model, often a precursor of price hikes. However, the drop of 7 days underlined the short -term profits, which could momentarily slow down the momentum.

This model looked like the start of 2024 when the outputs preceded a 20%price leap. If the outings continue, ETH could evolve around $ 2,600. Conversely, if the sale of pressure yields, ETH could resume $ 2,200 on the graphics.

Sleeping signals in the middle of exit trends

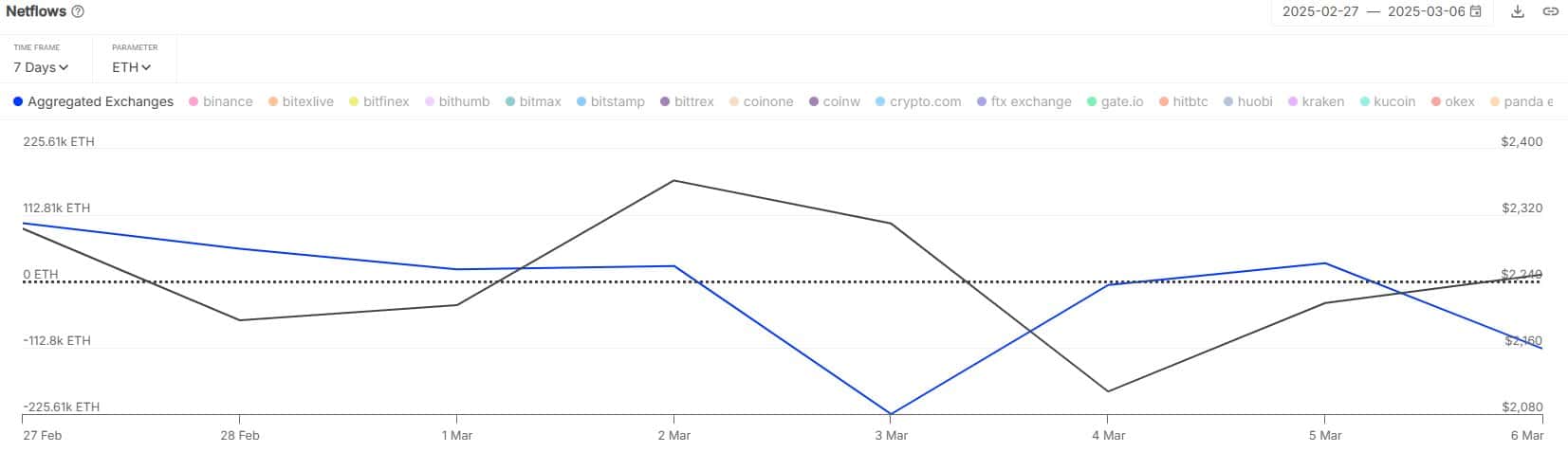

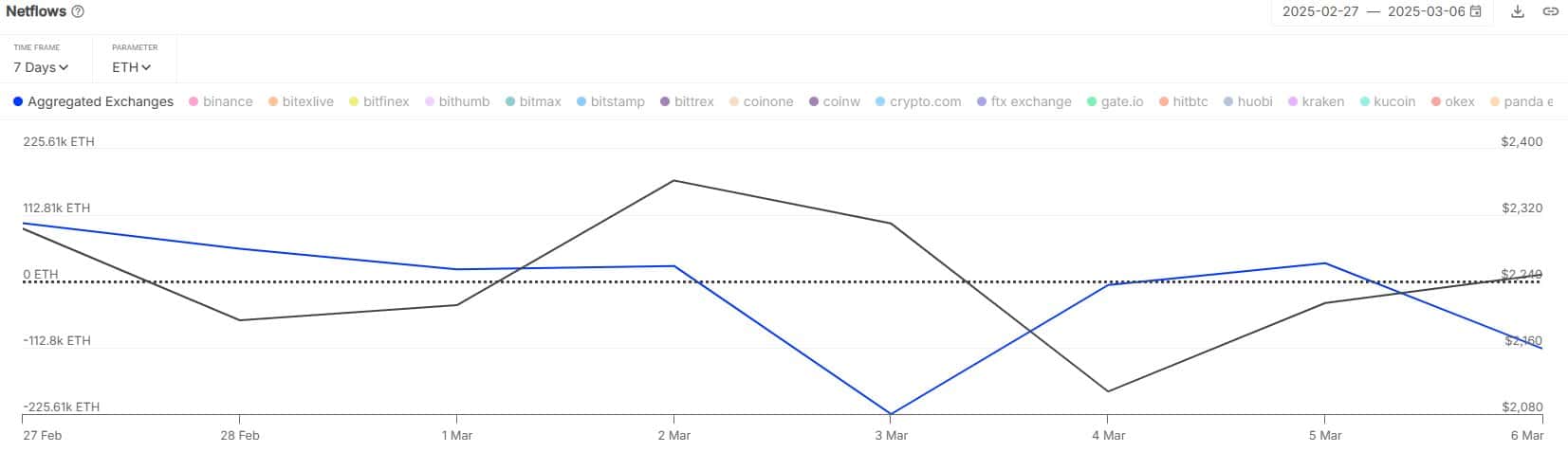

Ethereum’s Netflow analysis highlighted the feeling of change of change.

Source: intotheblock

Net outings culminated at -225.61K ETH on March 5, equivalent to $ 540 million to $ 2,400 per ETH, before reducing to -12.81K ETH the next day. The drop in Netflow of 7 days and 30 days indicated a continuous accumulation, reducing the supply available on platforms like Coinbase and Kraken.

This trend has historically preceded rallies, as shown in February 2024, when a similar exit model resulted in a price increase of 15%. If sustained, this trend could push ETH to $ 2,800. However, if the inputs increase, the sales pressure could push ETH to $ 2,100 – reporting a possible overthrow.

A bullish horizon for Altcoin?

At the time of writing the editorial staff, Ethereum’s trajectory appeared optimistic, motivated by strong technical indicators and accumulation trends. ETH was traded at $ 2,203.57, with projections alluding to a potential increase at $ 3,260, which marks an increase of 48%.

Exchange withdrawals also climbed to 400,000 ETH, worth $ 960 million, while Netflows remained negative and strengthening the reduced sales pressure. Historically, ETH jumped 20% in 2024 following similar models, supporting a movement around $ 2,800 in mid-March.

If the ETH has a company more than $ 2,351, it may be likely that the increase could be likely. A drop below $ 2,200, however, could indicate a correction to $ 1,444, reflecting a potential decrease of 34%.