Join our Telegram Channel to stay up to date on the coverage of information on the breakup

The XRP price has increased a fraction of one percent in the last 24 hours to negotiate $ 2.79 to 1:17 AM, even if the negotiation volume plunged from $ 2.8 billion to $ 2.8 billion.

This occurs while six applications for the STOPS XRP SPOTS In exchange (ETF) approach decision times.

The American Securities and Exchange (SEC) commission should rule them between October 18 and 25, which will determine if XRP becomes the third cryptocurrency after Bitcoin and Ethereum to access the ETF Spot listed in the United States.

🔥 The FNB XRP could provide enormous institutional entries and push $ XRP In New ATH $ 8 at $ 10!

13 transmitters 💵

19 products 🎁 (9 spot / 9 future)

10 live 🟢 | 9 Pending 🔴 pic.twitter.com/gifer1ipfr– xrp_cro 🔥 ai / gaming / deppin (@SsedS) September 27, 2025

The XRP ETF de Grayscale should be revised on October 18, 21 Shares Core XRP Trust ETF on October 19, Bitwise’s XRP ETF on October 22, Canary Capital and Coinshares on October 23, and The ETF XRP ranking of Wisdomtree on October 24.

Nate Geraci, President of Novadius Wealth Management, says “get preparing for October” after positive regulatory developments in the last two weeks which included a series of first that he detailed in the following post:

Last 2 weeks …

First ETF offering an exhibition to the XRP spot

First ETF offering an exhibition to Spot Doge

SEC approves generic registration standards

First ETF of Crypto Spot based on the index

First ETH ignition

First Deposit of Hype ETF

Vanguard capitulates on Crypto FNB

Prepare for October.

– Nate Geraci (@nategeraci) September 27, 2025

XRP at a crossroads: can bulls defend the key support area?

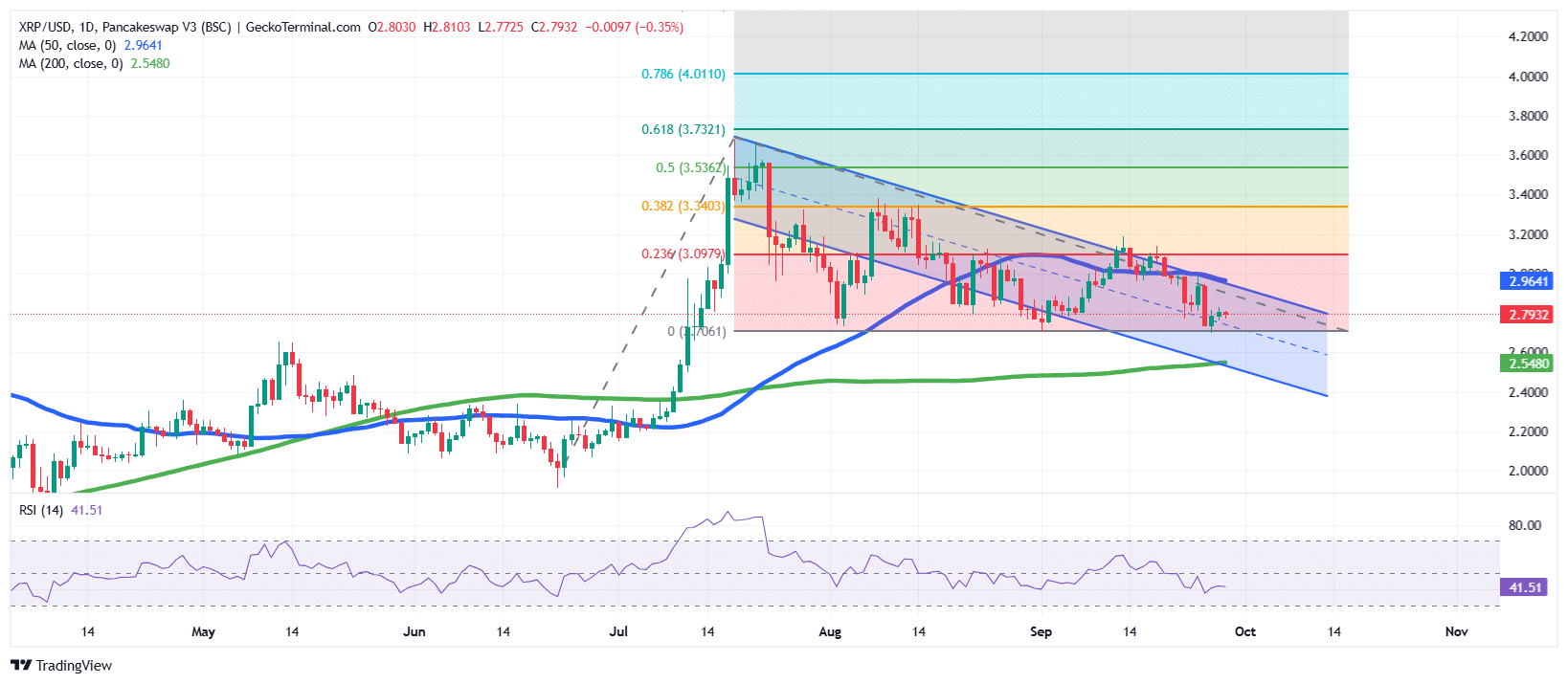

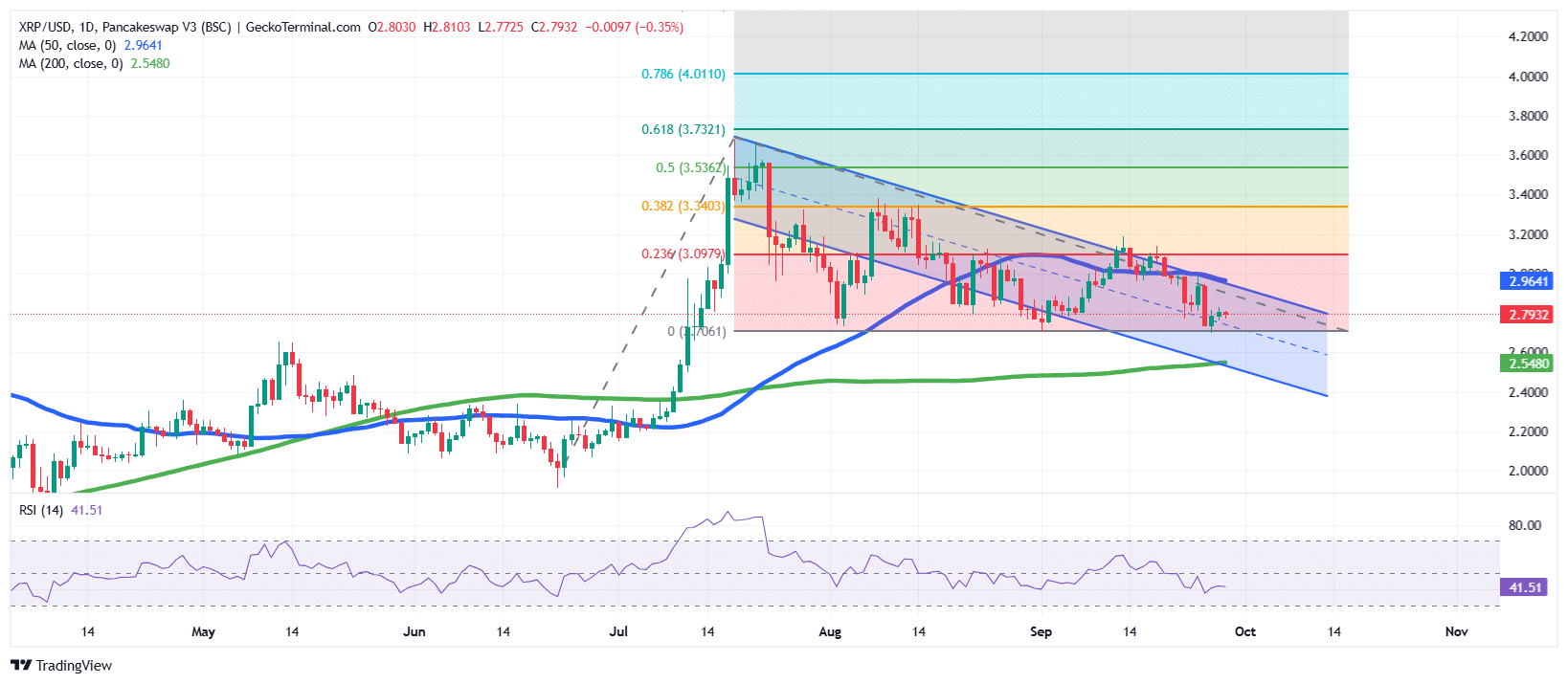

THE XRP price On the daily graph, shows a pressure market, trading nearly $ 2.79 after a constant drop in its peaks in mid-July.

The action of the Ripple token prices has formed a descending channel model, reflecting a clear downward trend in recent weeks.

Each rally attempt was encountered by a sale pressure, keeping XRP locked under the upper resistance of the canal. XRP oscillates just under the 50 -day simple mobile average (SMA) ($ 2.96), while the 200 -day SMA ($ 2.54) remains a crucial long -term level of support.

Fibonacci’s retrace from the July rally highlights resistance at $ 3.09 (23.6%), $ 3.34 (38.2%) and $ 3.53 (50%). These levels remain critical obstacles if XRP tries a recovery.

Meanwhile, the relative force index (RSI) is currently at 41.5, placing it in lower but not occurrence territory. This suggests that there could still be room for further before strong accumulations appear.

Meanwhile, the 50 -day SMA has crossed the XRP price, acting as a dynamic resistance, while the 200 -day SMA remains favorable, creating a battle between short -term lowering and the stability of long -term trends.

For the future, the action of XRP prices will probably depend on whether it can keep above the support area of $ 2.55, which aligns the 200-day SMA.

Ventilation below this level could trigger a deeper retirement to $ 2.40.

Uplining, the recovery of $ 3.00 would be the first signal of force, with a potential escape greater than $ 3.34 opening the path to $ 3.53 and beyond. For the moment, XRP remains at a crossroads, with the market awaiting confirmation of its next major movement.

Related news:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup