Privacy-focused cryptocurrencies have surged over the past week, even as Bitcoin and most altcoins fell, with the sector soaring 13%, while nearly $1 billion in positions were liquidated in broader markets following Trump’s tariff threat to Europe over Greenland.

The rally pushed privacy tokens including Monero, DashAnd DUSKin the spotlight amid widespread crypto weakness, indicating what analysts describe as selective capital turnover rather than traditional risk-averse behavior.

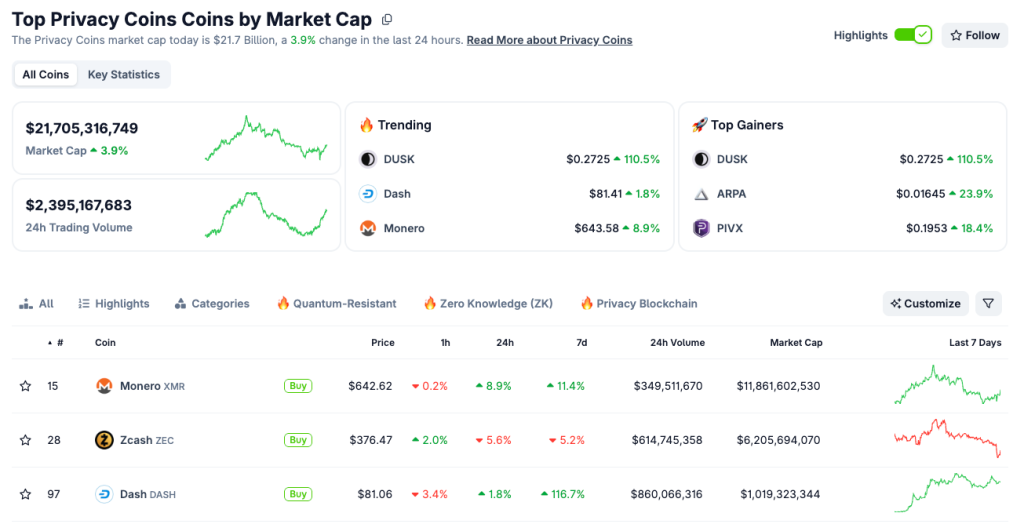

Over the past 24 hours, Bitcoin has fallen almost 3%, while most altcoins have fallen between 3% and 10%; Privacy coins, however, have moved in the opposite direction, according to CoinGecko data.

Dash was trading at $81.61, up 1.9% on the day and 119% on the week, while Monero, which hit a new all-time high last Thursday, was trading around $644, gaining 8.9% in 24 hours.

DUSK saw the largest gains, rising 110.5% daily and over 354% weekly, bringing the market cap of the privacy coin category to $21.7 billion with a trading volume of $2.4 billion.

Structural demand replaces stablecoins as safe haven

Speaking to Cryptonews, Ray Youssef, CEO of crypto app NoOnes, explained that the strength of assets like Monero, Dash, and DUSK reflects investors looking to preserve their capital without completely exiting their crypto positions.

“The outperformance of privacy coins during a broad market downturn is an indicator of selective risk-taking by investors who prefer not to completely de-risk or abandon their positions in crypto markets.» Youssef said, adding that while stablecoins have traditionally served as the preferred safe haven during volatility, “Privacy coins now offer a compelling alternative by aligning with the censorship-resistant trend.“

This renewed interest comes amid ongoing debates over stablecoin rewards in the U.S. Market Structure Bill and escalating trade tensions, creating conditions in which some market participants expect continued volatility.

Investors are increasingly seeking assets that can decouple themselves from broader market weakness and demonstrate resilience during times of macroeconomic stress.

Youssef highlighted strengthening KYC and AML requirements worldwide as key catalysts pushing users toward in-protocol financial privacy.

The massive freeze of stablecoins hastened this change, including the freezing of more than $182 million in USDT by Tether across five addresses on January 11.

From 2023 to early 2026, Tether froze more than 7,000 wallets totaling approximately US$3.3 billion, primarily citing illegal activities.

“This raises the question of fully centralized control over assets previously considered immutable and decentralized,» noted Youssef, arguing that “Privacy coins are playing a new role, becoming a form of financial independence from corporate and regulatory structures.“

The ban announced last week by the Dubai International Financial Center on trading privacy tokens due to money laundering and sanctions risks has failed to interrupt the uptrend.

Despite these regulatory hurdles, the sector has continued to post gains.

“Remarkably, even the ban on trading confidential coins announced last week by Dubai authorities did not interrupt their uptrend.» observed Youssef.

Technical momentum indicates further upside

Privacy coins have outperformed large-cap assets during several recent market downturns, establishing divergence patterns that could solidify their role in strategic portfolios.

“Confidentiality is once again recognized as fundamental to decentralization,» declared Youssef, emphasizing that “The core use case and technology of privacy coins remains relevant, especially amid ongoing concerns about peer risk, sovereign surveillance, and the future of digital finance.“

As DUSK posts growth of over 540% in 30 days, market participants are wondering if it can maintain its momentum and join the established privacy leaders.

“If the strength of privacy coins continues, we could see XMR at $650, Dash at $90, and DUSK at $0.28 in the coming days.» projected Youssef.

Pavel Nikienkov, founder of Zano, also stressed last week that privacy is more than a passing trend.

“Privacy is not a passing trend,» Nikienkov said, pointing to a16z’s 2025 State of Crypto report, which highlights a sharp increase in Google search interest for privacy-related terms.

He argued that traditional blockchains like Ethereum and Solana, by integrating optional privacy layers, indicate the maturation of the sector, although “only systems designed for privacy» can significantly protect users in an increasingly monitored digital landscape.

The article Privacy Coins Defies Crash, Rises 13% Amid Market-Wide Liquidations appeared first on Cryptonews.

Trump’s European tariff threats wipe out $875 million in crypto positions as Bitcoin falls 3% to $92,000 amid geopolitical market shock.

Trump’s European tariff threats wipe out $875 million in crypto positions as Bitcoin falls 3% to $92,000 amid geopolitical market shock. Dubai has banned privacy tokens and anonymity tools in DIFC to align with global anti-money laundering and sanctions standards.

Dubai has banned privacy tokens and anonymity tools in DIFC to align with global anti-money laundering and sanctions standards.