Polymarket has opened a new prediction market centered on Pump.fun, the Launchpad of money based on Solana which has quickly become one of the most active platforms of the cryptographic ecosystem.

The market allows users to bet if the pump token. Fun, pump, will reach a new record of all time by December 31, 2025.

Currently, the ratings of Paris are divided uniformly, with results “yes” and “no” at a price of 50%. Balance reflects uncertainty among traders, who weigh the pump.

Pump.fun causes token launches of nearly 13 million on Solana, $ 500 million in fees collected

Since its launch at the beginning of 2024, Pump.fun has facilitated the creation of more than 7 million tokens, according to Galaxy Research. Almost 13 million of the 32 million tokens on Solana were launched by Pump.fun, marking an increase of almost 300% in less than two years.

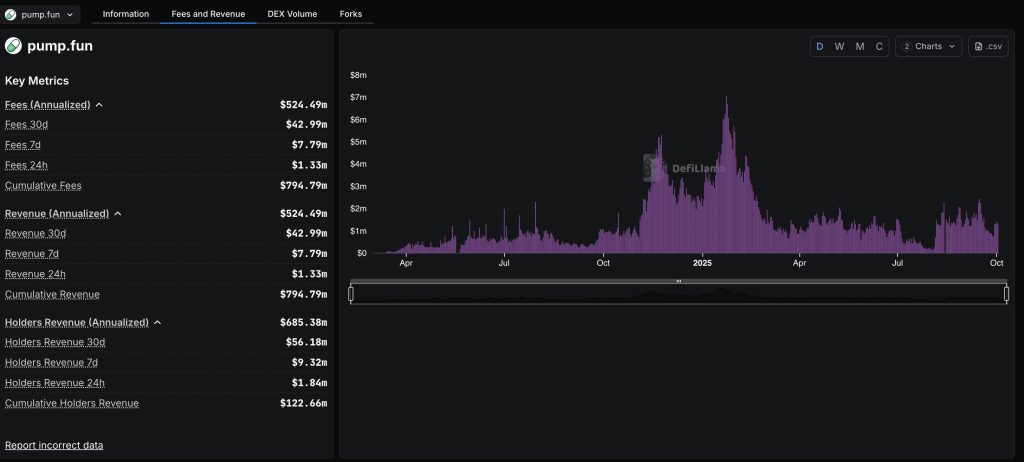

The tokens on the platform represent 4.8 billion dollars of fully diluted market value, while Pump.fun himself generated almost $ 500 million in fees.

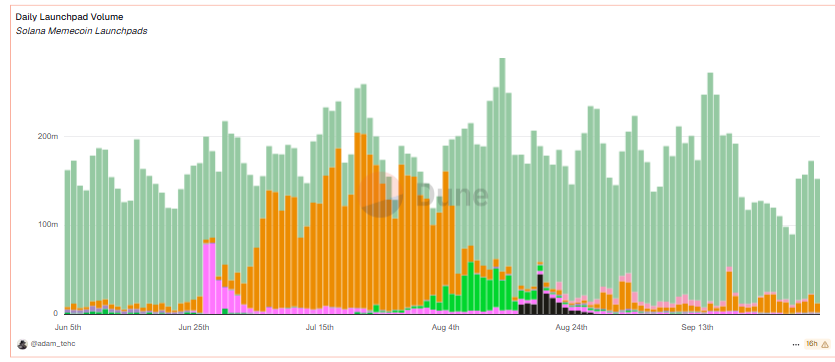

The expansion of the platform had a direct impact on the wider ecosystem of Solana. Trading volumes raised on the pump.

At its peak, Pump.fun’s revenues reached $ 13.48 million in a single week between August 11 and August 17, its strongest performance since February. In the past 30 days, the Launchpad has generated about $ 120 million in fees, according to Defilma.

Daily activity remains high. In the past 24 hours, Pump.fun recorded $ 134.3 million in negotiation volume and 114,457 active addresses. More than 20,000 new tokens were deployed on the platform, while 95 “graduates” increased beyond the stadium of the liaison curve. The costs collected during the same period totaled $ 1.29 million.

Despite these steps, concerns persist. The data show that 98.6% of pumping tokens.

The median maintenance times for the solana memes parts have also collapsed at around 100 seconds, against 300 seconds a year earlier, showing the domination of bots and scalpors in commercial activity.

Pump.fun launched his own token, Pump, in July thanks to an initial range of parts that raised $ 500 million in less than 12 minutes. The token has since seen net movements.

He reached a summit of $ 0.0088,19, but is now negotiated at $ 0.007028, around 20% below this peak, but still up 75% in the last 30 days. Its market capitalization amounts to 2.48 billion dollars, which classified it 66th on Coingecko.

The introduction of the new Polymarket Paris market adds another dimension to history, giving investors a structured means of quantifying feeling.

With chances currently divided, the market highlights confidence in the explosive growth of Pump.

Pump.fun in token grows in the middle of ecosystem upgrades and institutional interest

Pump.fun continued to draw attention with a mixture of updates of ecosystems, exchange announcements and adoption of companies, fueling the bullish feeling for its native token, the pump.

The major upgrade of the platform, Project Ascend, announced on September 2, presented a new structure of creator costs aimed at improving the sustainability of tokens. The system, called Dynamic Fees V1, reduces costs as market capitalization increases, encouraging long -term projects rather than short -term speculative launches.

The move, associated with faster approvals for the control of the community -led tokens, helped pump more than 10% on the day of revelation.

Expansion efforts followed quickly. In mid-September, Binance added a pump to its cash market, offering merchants a chance to share in a 350 million token tample pool.

On October 1, Pump.fun announced new payment integrations with Apple Pay, Robinhood, Phantom and others, rationalizing onramps for users with low costs and access to instant trading

Institutional interest has also emerged. On October 2, Australia Foretell Corporation revealed a purchase of 216.8 million pumping tokens worth 1.5 million dollars, adding them to its treasury as part of an investment strategy focused on wider.

The company, rebrandage under the name of Solana Australia Corporation, recently obtained a credit line of $ 100 million to deepen its exposure to cryptography.

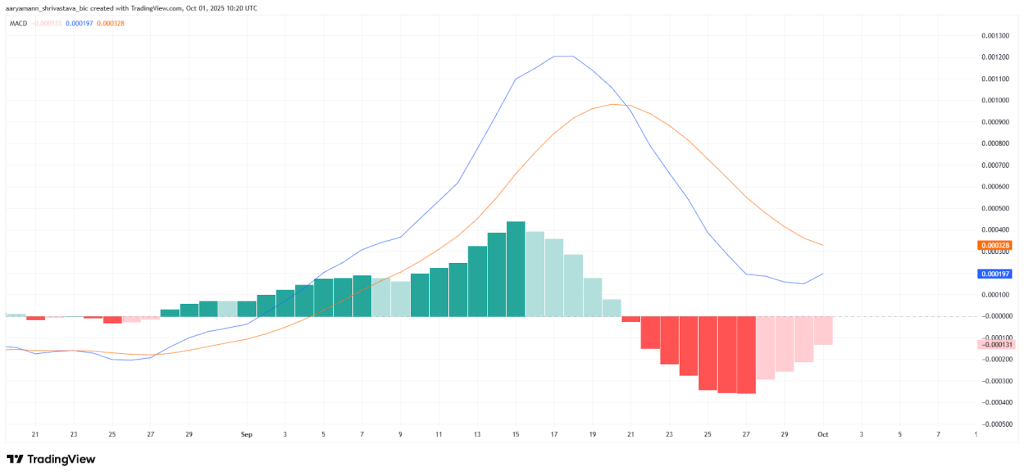

The technical indicators suggest that the momentum can be built. Analysts highlight a potential optimistic crossing on the MACD and the increase in capital entrances shown by the Silver Flow of Chaikin, both reporting a stronger request for investors.

Pump, negotiate nearly $ 0.0066, tries to contain $ 0.0062 as a support, with objectives of $ 0.0077 and $ 0.0090 if the purchase pressure continues.

The post Pump.Fun Ath this year? Polymarket Split 50/50 while $ 500 million same corner Factory faces fears of crash appeared first on Cryptonews.

New Polymarket: Pump .Fun Ath this year? Https: //t.co/jqbmmjqszn

New Polymarket: Pump .Fun Ath this year? Https: //t.co/jqbmmjqszn A new cost structure paid to creators more than Twitch, generating $ 2.1 million in 24 hours while the same platform recovers domination.

A new cost structure paid to creators more than Twitch, generating $ 2.1 million in 24 hours while the same platform recovers domination. Australia

Australia