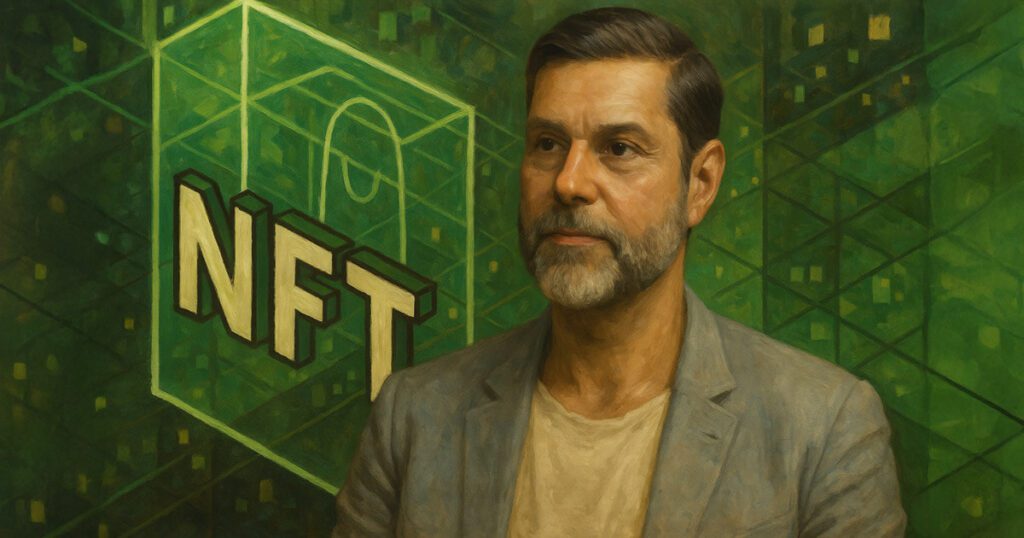

Raoul Pal, CEO of Real Vision and an important voice in macro investment, again aroused a debate in the space of digital assets, this time by declaring the NFTS the “best long -term wealth store”.

The commentary, made in the comments of comments on social networks, captured by the community, followed its broader thesis according to which the tendencies of currency and exponential technological trends lead to a historical change in the ownership of assets.

PAL wrote:

“You do not have enough cryptowhen that you do, you do not have enough NFT, because art is upstream of wealth. The two will no longer be as cheap.”

The declaration was encountered with a mixture of support, skepticism and outright ridiculous, highlighting a clear fracture in feeling while the NFT market continues to recalibrate after its speculative peak.

The influencer Lark Davis echoed from Pal’s point of view, admitting that he had little NFT and intended to change this cycle. PAL responded with a suggestion for “simply buying a punk as a starter”, referring to cryptopunks, one of the nft collections based on Ethereum the oldest and most recognizable.

Divided opinion

PAL supporters argued that it was often ahead of the curve, pointing to macro trends such as the institutional adoption of Bitcoin and the rise of web3. For them, NFTs, in particular those linked to cultural provenance, represent digital property in its earliest and most undervalued form.

However, the majority of the community was quick to oppose the concept, stressing the fact that the NFT sector remains significantly lower than the peaks observed in 2021. Some were more critical and argued that the NFT were “overheated” and “drowned in a desert of liquidity”.

The investor and analyst Fred Krueger cited the NFT declaration of PAL with incredulity, writing:

“I don’t laugh at you.

Gary Cardone echoes the feeling, while other criticisms questioned the calendar and the substance of the call.

The confrontation on PAL’s comments reflects the growing feeling in industry that NFTs are speculative instruments whose long -term value is not proven, despite the sector which continues to arouse a certain support in a fucking interest.