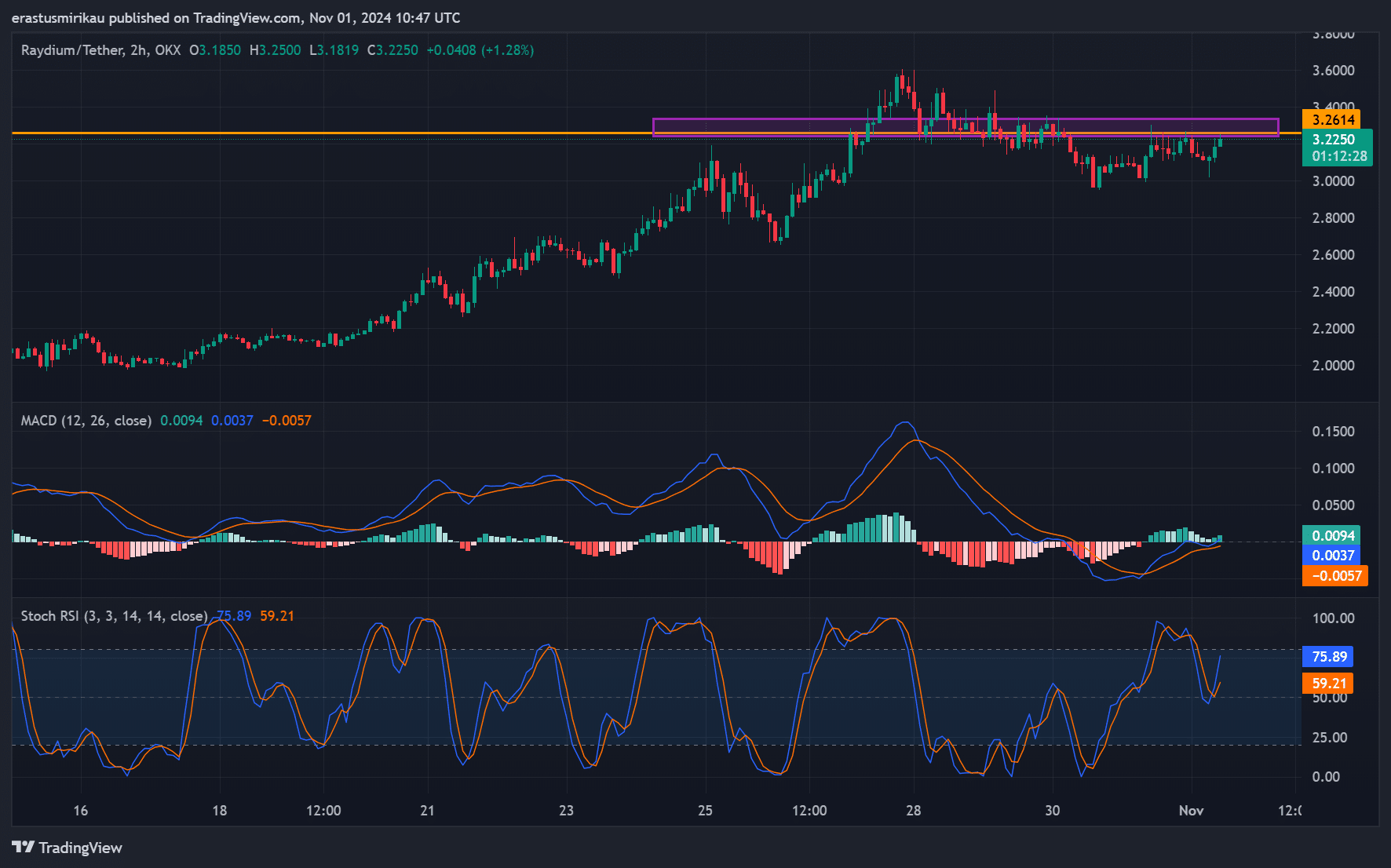

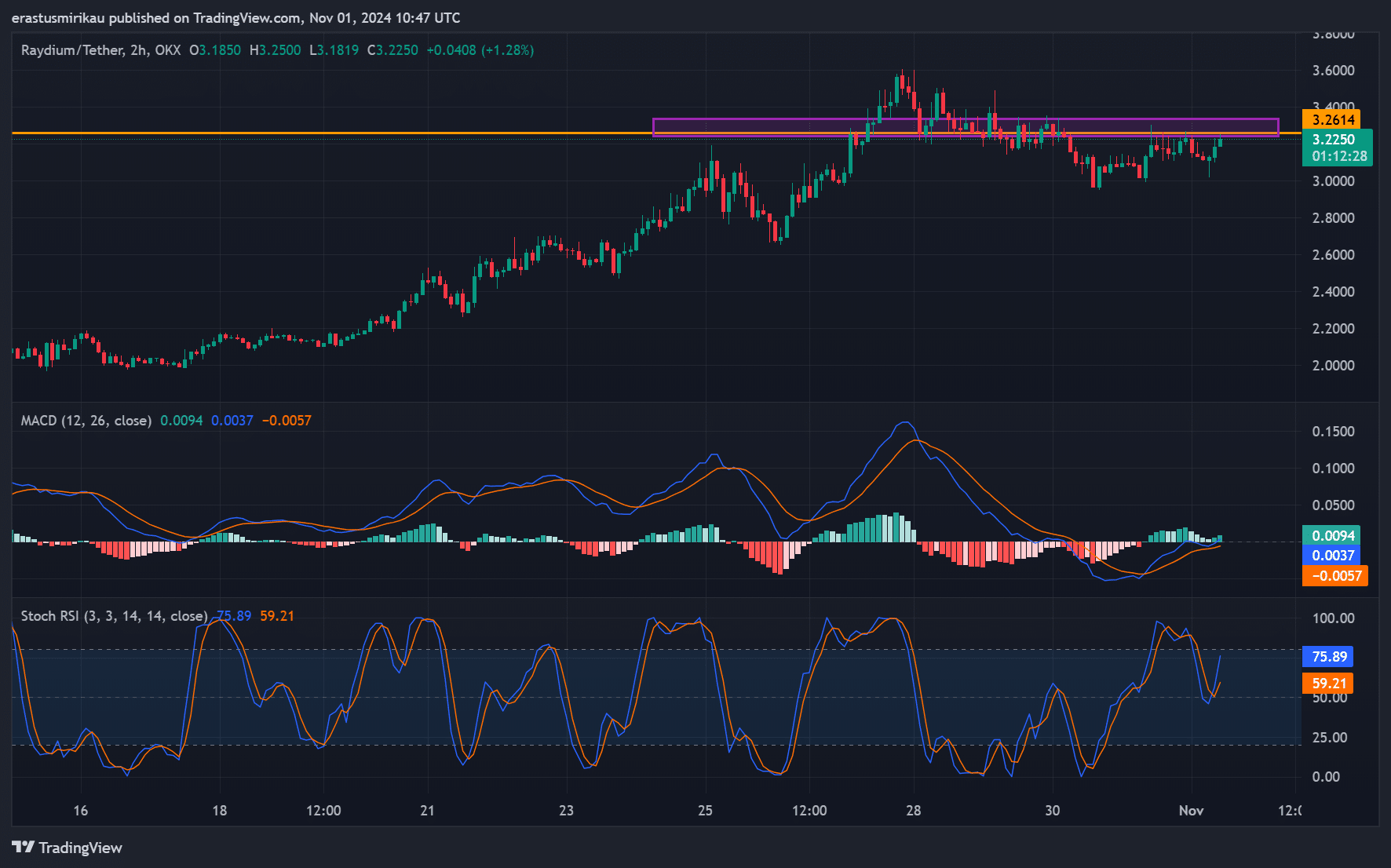

- RAY price action highlighted a strong uptrend, with key resistance at $3.26.

- Whale Accumulation and Increase in Open Interest Indicate Strong Investor Confidence

Raydium (RAY) saw a remarkable rise on the charts, hitting a 7-month high with $1.8 billion in total value locked (TVL) on the Solana blockchain. In fact, its recent performance has allowed Raydium to surpass Ethereum in terms of 24-hour fee generation. This solidified its position as the leading decentralized exchange (DEX) on Solana.

Trading at $3.22 at press time, RAY noted a 9.56% rise over the past 7 days. With these metrics in evidence, a key question arises: can RAY maintain its momentum and break through new resistance levels?

RAY Price Analysis – Will it Break Its Key Resistance?

RAY’s price trajectory revealed a strong upward trend. However, at press time, it faced significant resistance at $3.26. Although the altcoin recently tested this level, it has yet to break through.

If RAY breaks through this resistance, it could indicate a potential continuation of its uptrend.

Conversely, if it fails to break above $3.26, the price could consolidate around the $3 support. Key indicators such as the MACD and Stochastic RSI were projecting slight bullish signals, suggesting that RAY’s bullish move could continue with sufficient buying pressure.

Therefore, a decisive break above $3.26 would likely attract more bullish momentum.

Source: TradingView

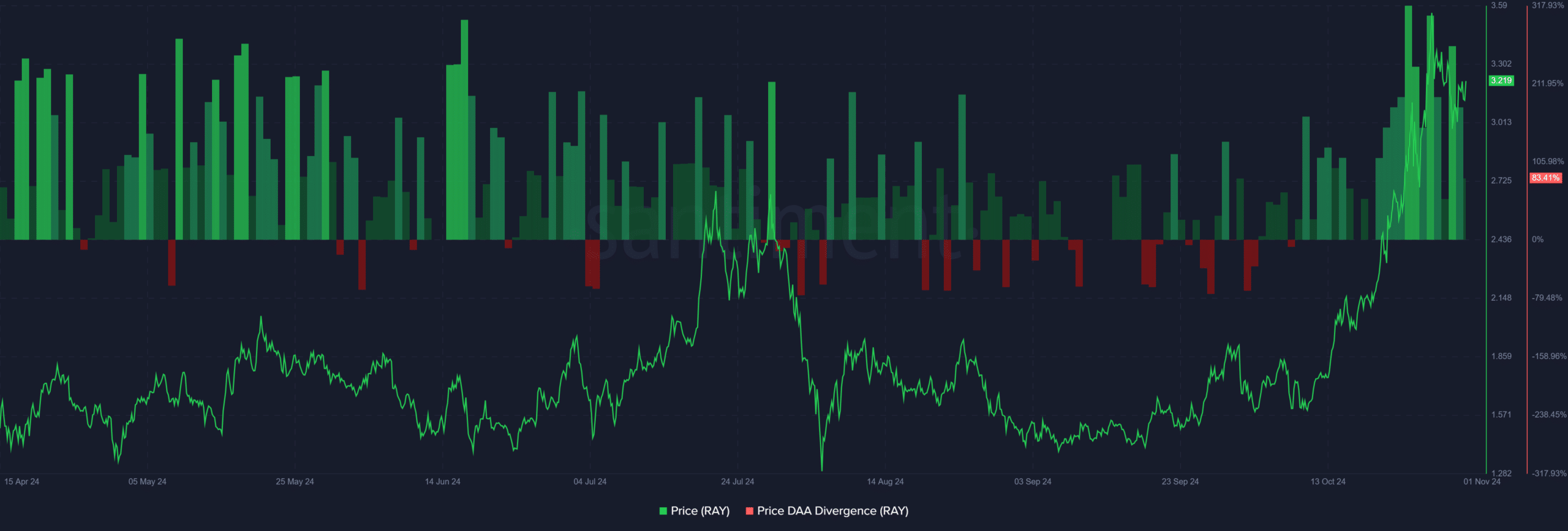

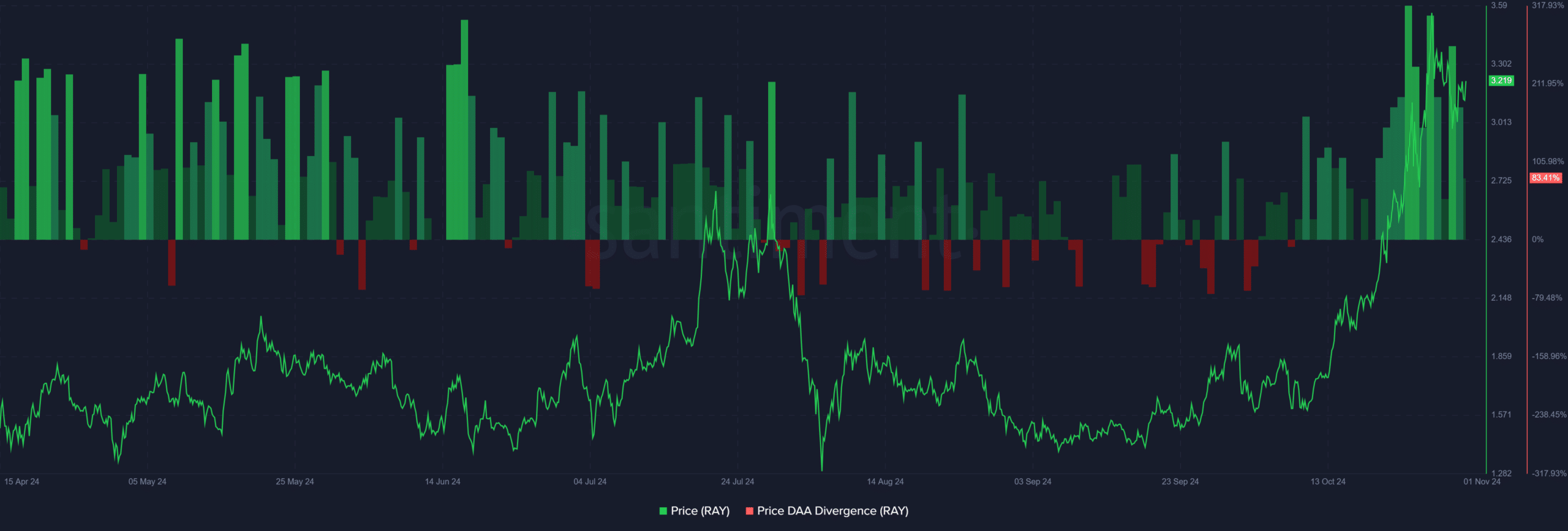

Price-DAA Divergence – What does this signal for RAY?

Interestingly, RAY’s recent price rally aligns with a positive price-DAA (daily active addresses) divergence of 83.41% – a sign of strong community engagement and increased user activity . A positive DAA divergence generally means organic growth rather than speculative trading.

In this case, it seems to indicate that more users are interacting with the platform, which could support sustained growth. As daily active addresses increase alongside price, RAY’s ecosystem will show signs of strengthening. This could further fuel investor interest.

Source: Santiment

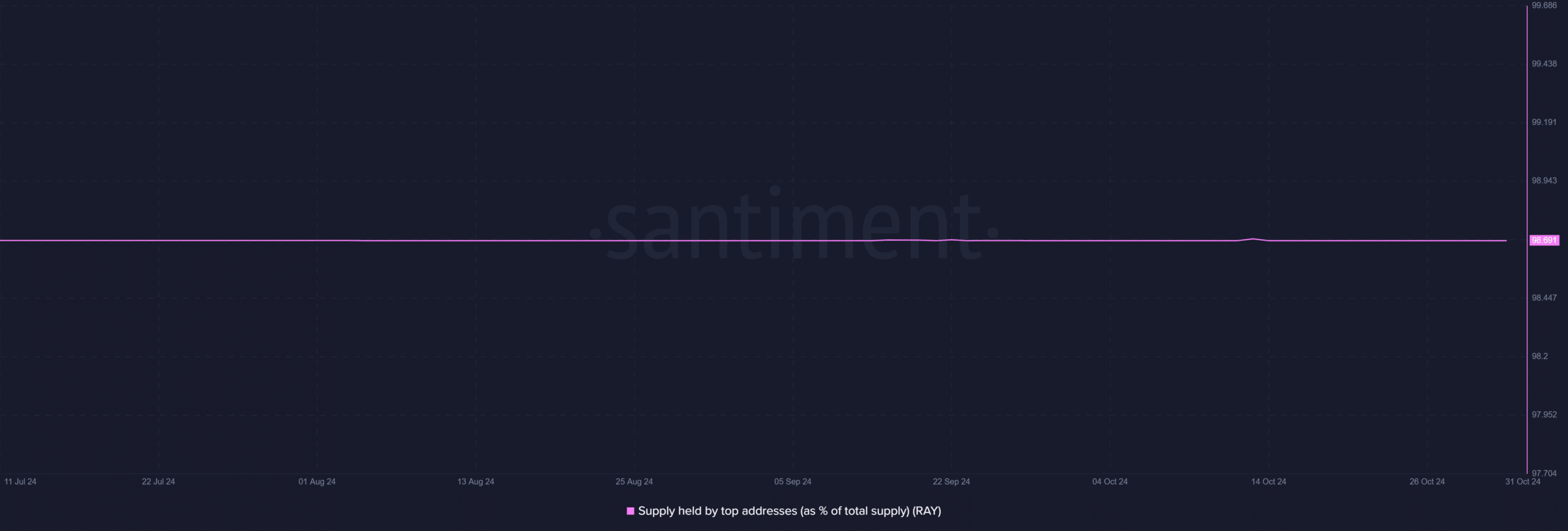

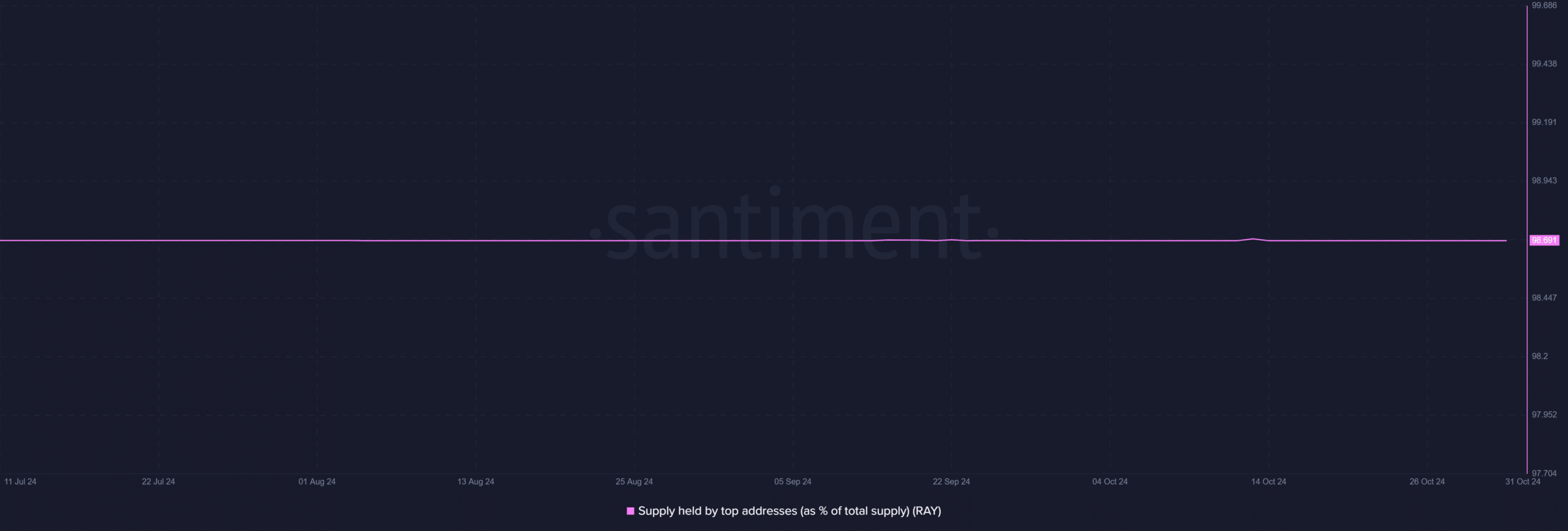

Whale Activity – Are Major Holders Supporting RAY’s Rise?

On-chain data revealed that top holders control 98.69% of Raydium’s supply. This high concentration among large holders implied significant interest in whales, potentially creating sharp price movements.

When whales hold a majority share, their actions can strongly influence the price direction of the altcoin.

Additionally, the fact that these holders are maintaining their positions is a sign of confidence in RAY’s potential. This level of whale activity often stabilizes price volatility, although it can also lead to sudden changes if large holders decide to adjust their positions.

Source: Santiment

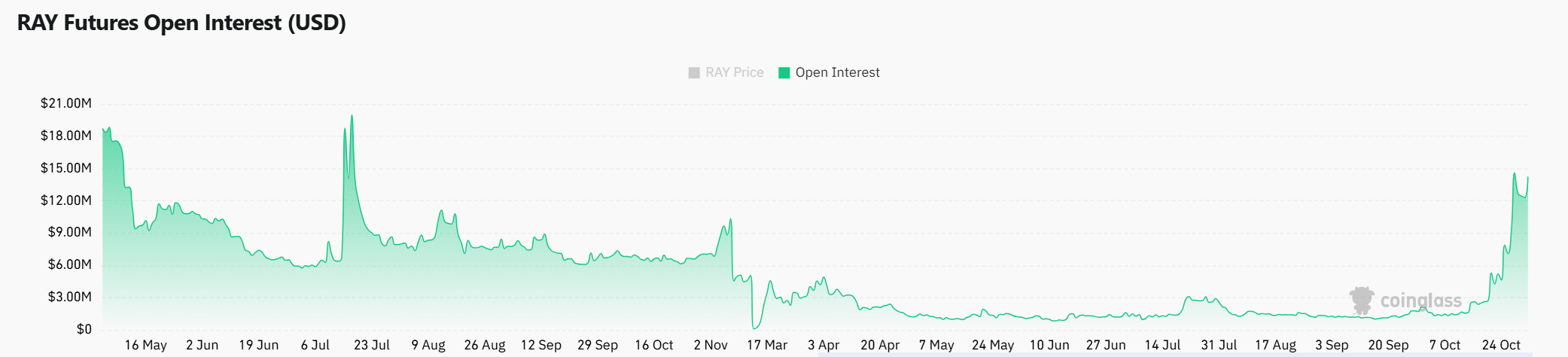

Market Sentiment and Open Interest – Bullish or Bearish?

Market sentiment for Raydium has been positive, as evidenced by a slight increase in open interest to $12.40 million, up 0.35%. A rise in open interest generally means increasing commitment from traders on both the bull and bear sides.

By extension, this means that the market is expecting notable price movements soon.

Source: Coinglass

Realistic or not, here is the market capitalization of RAY in terms of BTC

Raydium’s large TVL, strong price-DAA alignment, and concentrated whale activity all suggest it could be well-positioned for sustained growth.

However, the token needs to cross the critical resistance level of $3.26 to confirm its bullish stance. If Raydium manages to overcome this obstacle, it could strengthen its role as a DeFi leader on Solana. This will drive further adoption, while cementing its place in the DeFi landscape.