Main to remember

- Ray Token jumped 28% after Raydium announced his Launchlab platform to compete with Pump.fun.

- The sector of the same has decreased, the market capitalization lowering considerably since its peak.

Share this article

Ray, the token of usefulness and governance of Raydium, increased by around 28%, going from $ 1.6 to $ 2 Tuesday following reports according to which the company deploys its own pavement of memes which could challenge Pump.fun, the essential platform for the beginnings in Jeques.

According to Blockworks, the Raydium parts factory, called Launchlab, will retain a connection curve similar to Pump.Fun but will differentiate by allowing third -party user interfaces to fix the costs.

In addition, the platform will support several quote tokens and link with the Liquidity Supplier of Raydium for the perpetual safety of swap costs.

The development of Launchlab has surfaced less than a month after Pump.

This could have a considerable impact on Raydium, which has drawn substantial income from Pump.

The rumors of the PUMP.Fun AMM function triggered a 30% drop in the value of Ray, show the CoinmarketCap data.

This drop has intensified when the cryptography market experienced a widespread correction shortly after, fueled by the climbing of pricing tensions and deterioration of the macroeconomic environment.

During the last month, Ray dropped by around 60%.

Interest declining for coins

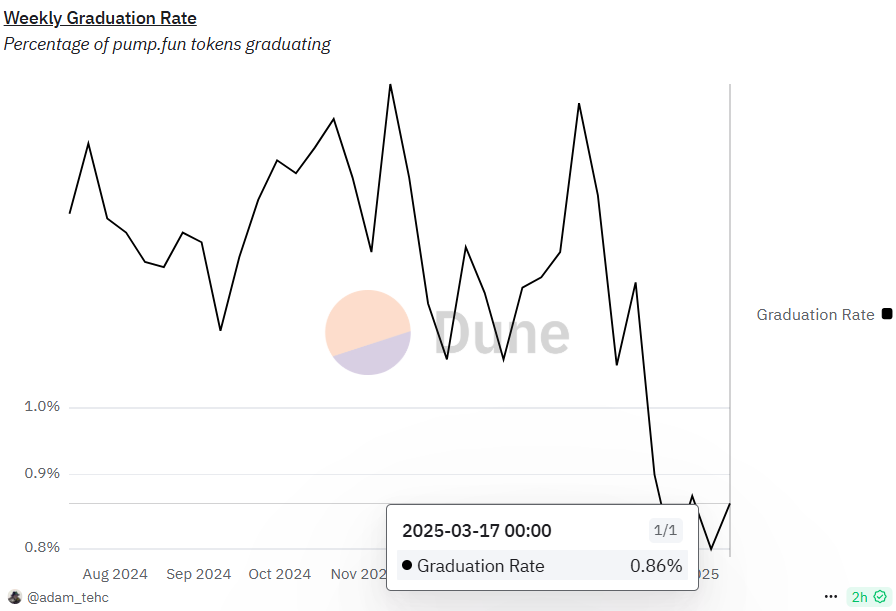

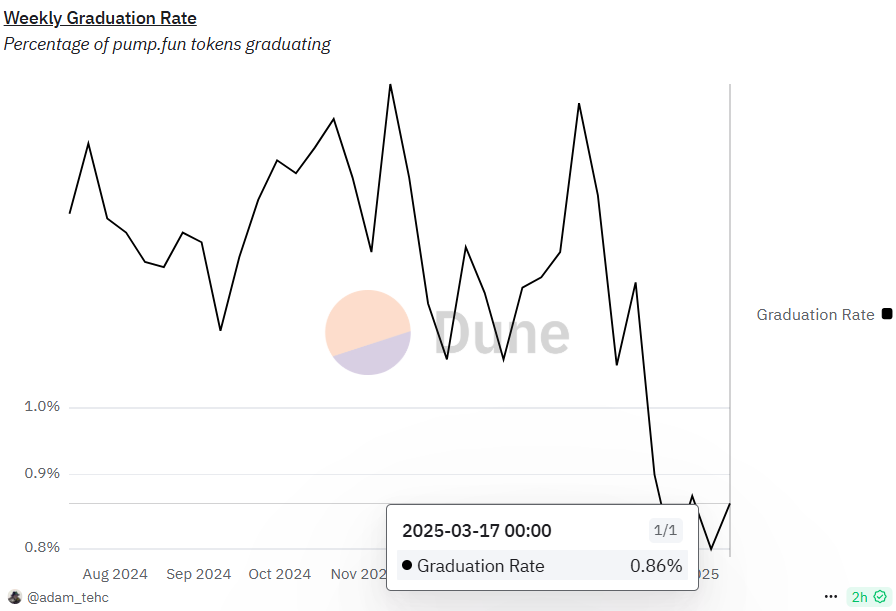

The rate of pump grab. Fun, which refers to the percentage of tokens which successfully pass from the incubation phase to full traffic on a Solana Dex, is less than 1% since February 17, according to Dune Analytics.

Historically, the highest graduation rate was 1.67% in November 2024, but even then, the absolute number of successful tokens was significant due to the large volume of launches.

The low rate of current diplomation reflects the drop in investors’ interests in coins, generally perceived as high -risk investments.

According to CoinmarketCap data, the market capitalization in the parts sector even is down approximately 65% compared to its peak on December 9 of last year.

Despite short-lived optimism before Trump’s inauguration, the majority of tokens even were in a post-iraigation blood coil date.

And despite slight improvements in liquidity, the overall cryptography market, including Bitcoin, remains under pressure without major recovery in sight for coins.

That being said, although the established presence of Raydium can provide a competitive advantage, the beginnings of its launch of the same corner can face initial obstacles.

Commenting on Raydium’s decision, Ceteris, research manager at Delphi Digital, said Raydium will likely meet a fundamental question of user engagement.

While Raydium provides the underlying liquidity infrastructure, platforms like Pump.Fun and aggregators such as Jupiter effectively control the interface and user experience, according to the analyst.

“Pump.fun is the owner of the user, Raydium is just an infra back-end. Even when users go to negotiation after the link, they go to Jupiter. (Most likely) do not even realize that they are Raydium Pools,” said Ceteris. “Much more difficult to have the user than to create a vanilla MA.”

Jongwon Park of Story Protocol added: “In fact, the cryptocurrency improves when you abstain 10s of AMMS products.

Share this article