- Ethereum recorded losses of 2.70% in the last 24 hours

- While investors turn to buy the drop, Ethereum must recover $ 2,350 for a potential rally

Over the past two weeks, Ethereum (ETH) has experienced extreme volatility on graphics. During this period, the price of ETH climbed to a local summit of $ 2.7,000. On the contrary, the period also saw the Altcoin drop below $ 2,000 for the first time since November 2023.

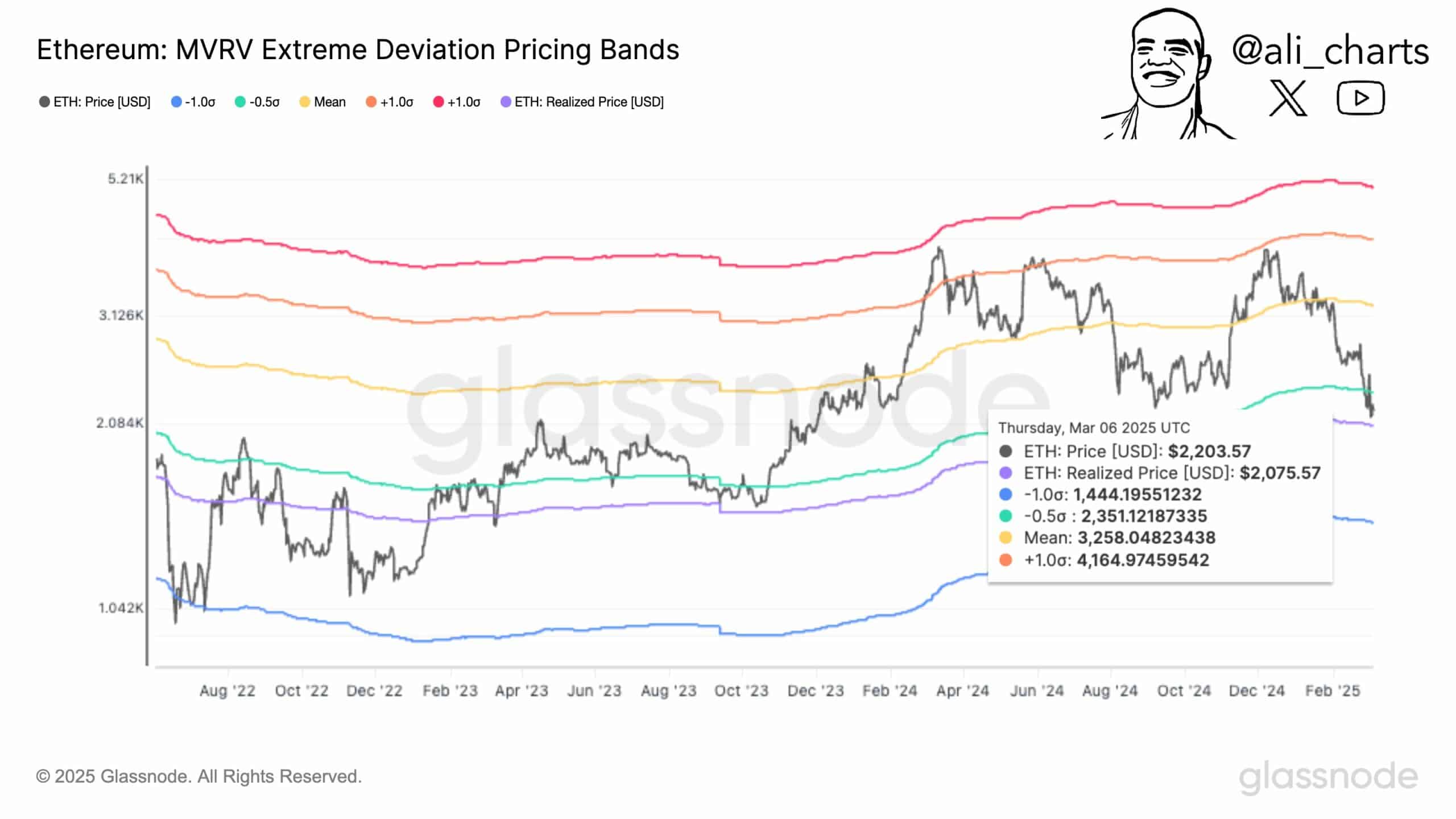

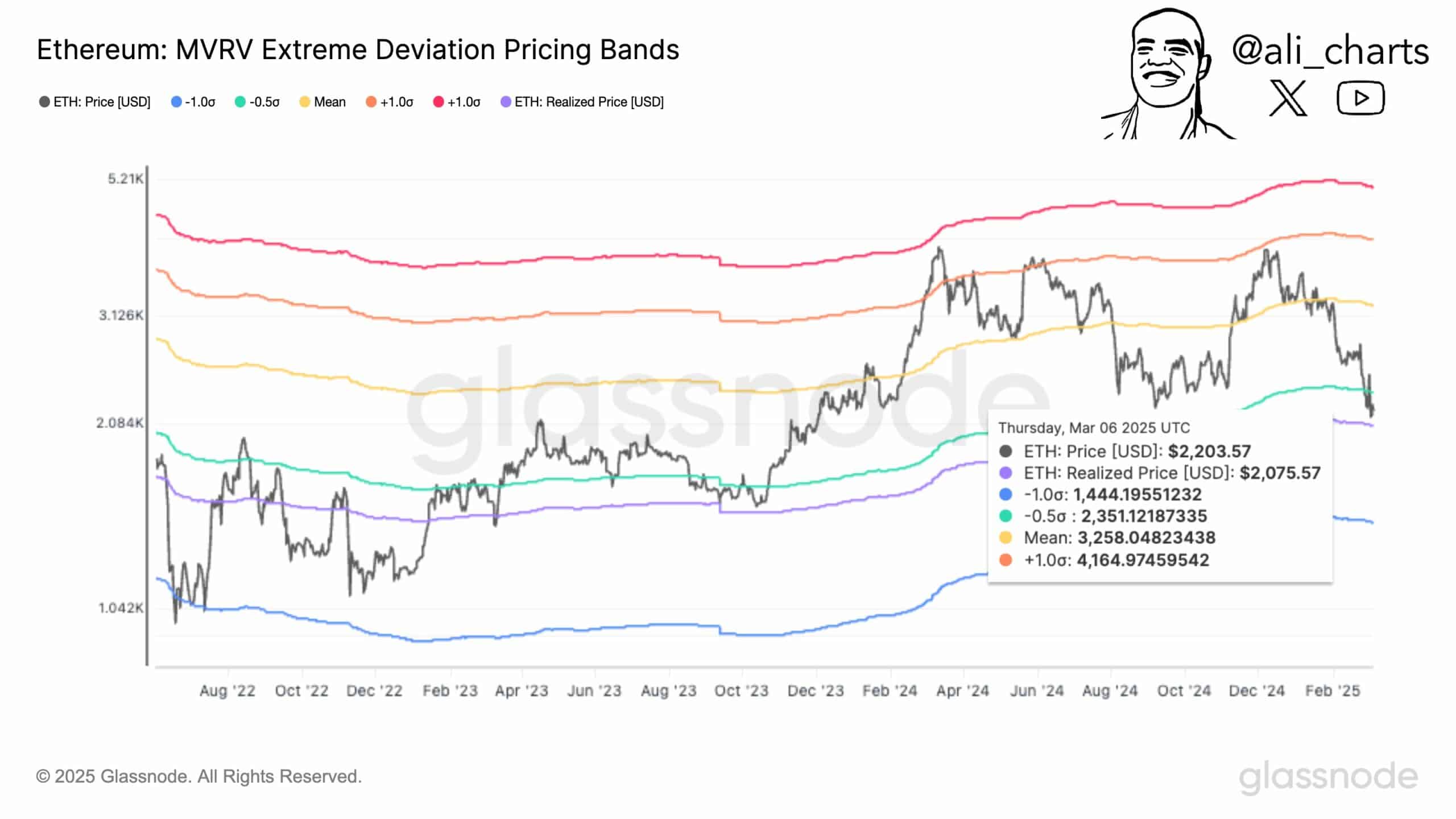

The last price fluctuation has left the main stakeholders sharing different opinions, some still optimistic about ETH. One of them is Ali Martinez, with the cryptographic analyst alluding to a potential rally at $ 3,260 citing the pricing bands and the MVRV.

Can Ethereum get back to $ 3,260 on graphics?

In his analysis, Martinez observed that the market conditions in force left $ 2,350 as the most important level of resistance for Altcoin.

Source: X

Therefore, if ETH comes out of this level and moves above, it could trigger a significant purchasing momentum and try the following significant level around $ 3,260. The recovery of this level could have a psychological effect by confirming a change of bullish trend. This would encourage investors to buy altcoin and take long positions.

According to Martinez, the prices of Ethereum lowering below his MVRV, he created a perfect buying opportunity. Historically, purchase at these levels has generally provided the most yields – a trend that has persisted since 2016.

Source: cryptocurrency

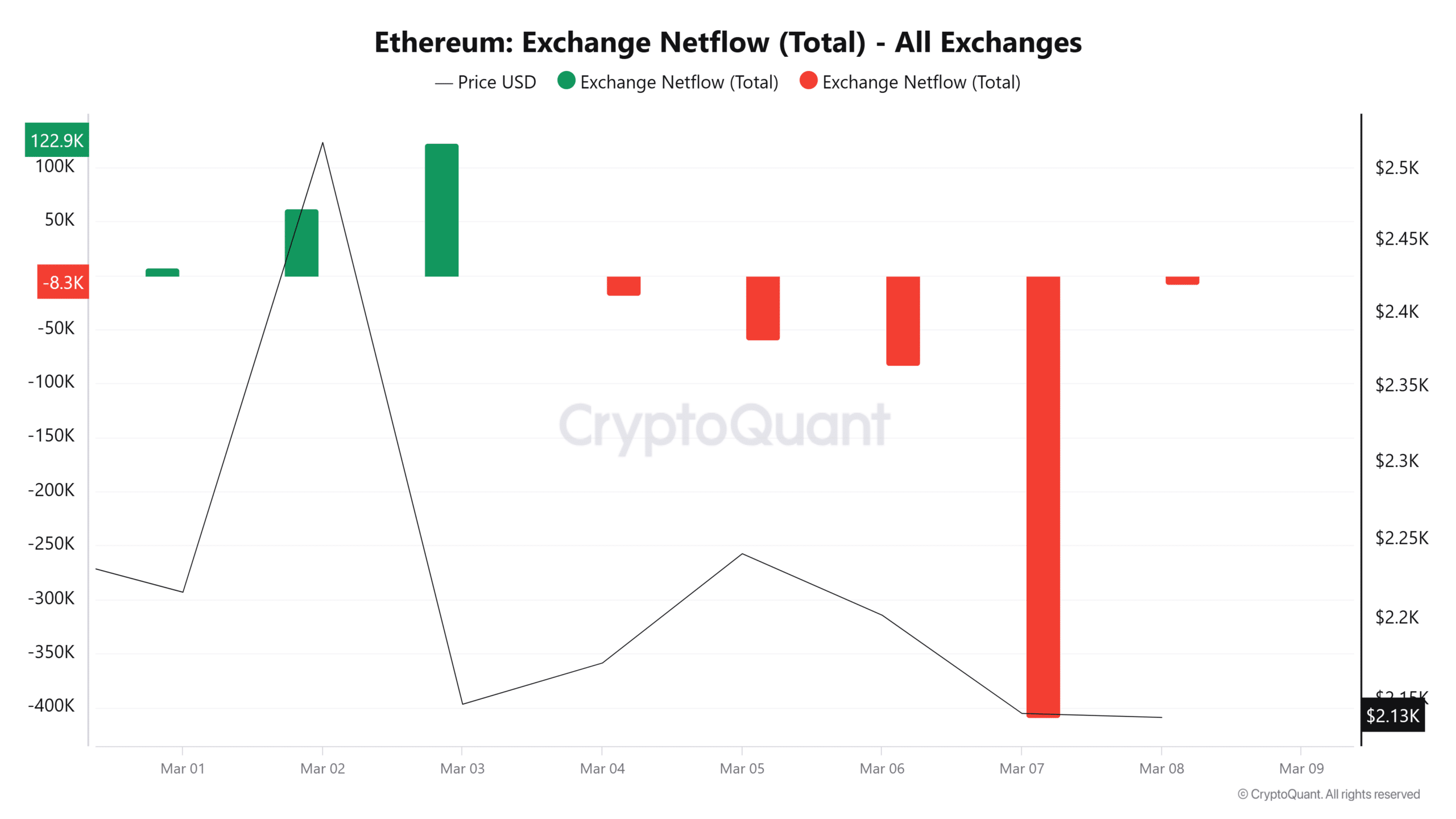

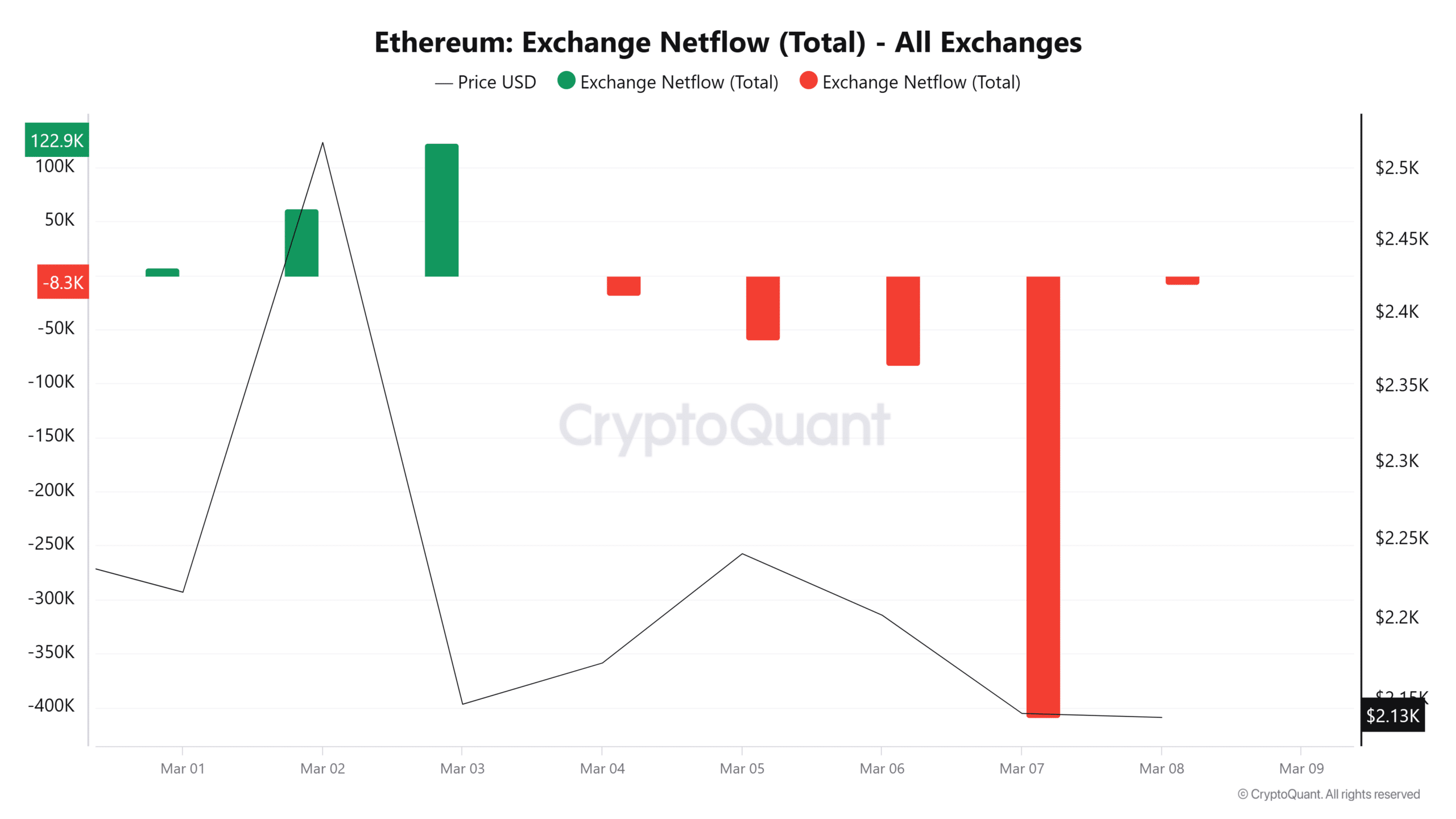

Thanks to this drop, it seems that investors have turned to purchase the decline.

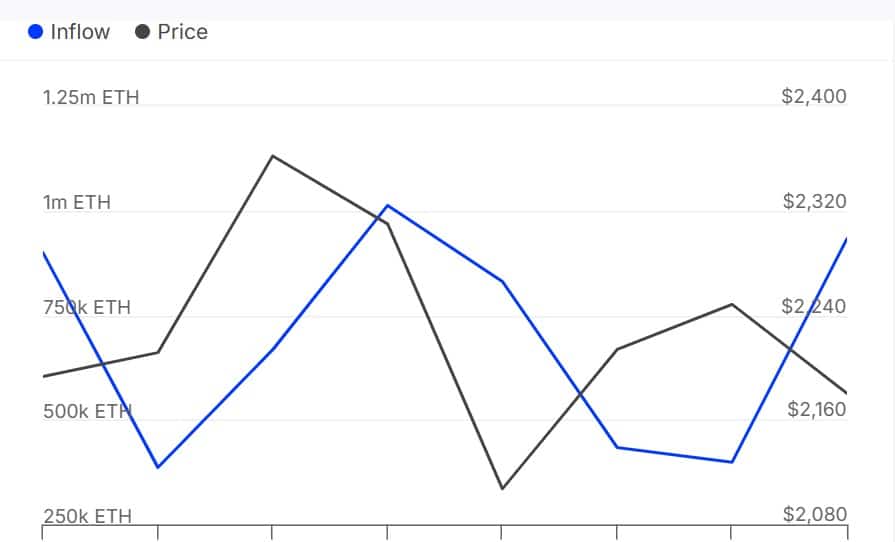

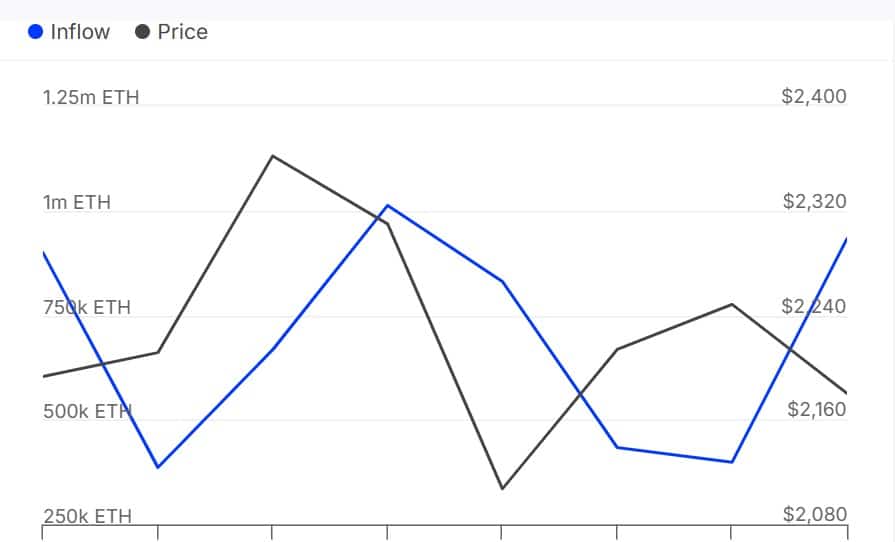

This purchase activity can be highlighted by the Ethereum exchange netflows which have remained negative in the last 4 days. A negative Netflow means that buyers dominate the market, with more exchange exits than entries.

Source: intotheblock

Looking at the activity of whales, this purchase activity is more widespread among the whales. According to Intotheblock, Ethereum whales are back on the market after accumulating more than 932.79k ETH tokens during the last day.

Likewise, the Netflows of major holders increased to 474.89K. This suggested that there were more capital entries than outings. When the whales turn to accumulation, it alludes to strong bullish feelings as they anticipate the price of rebound. It would make the dip a perfect buying opportunity.

Source: cryptocurrency

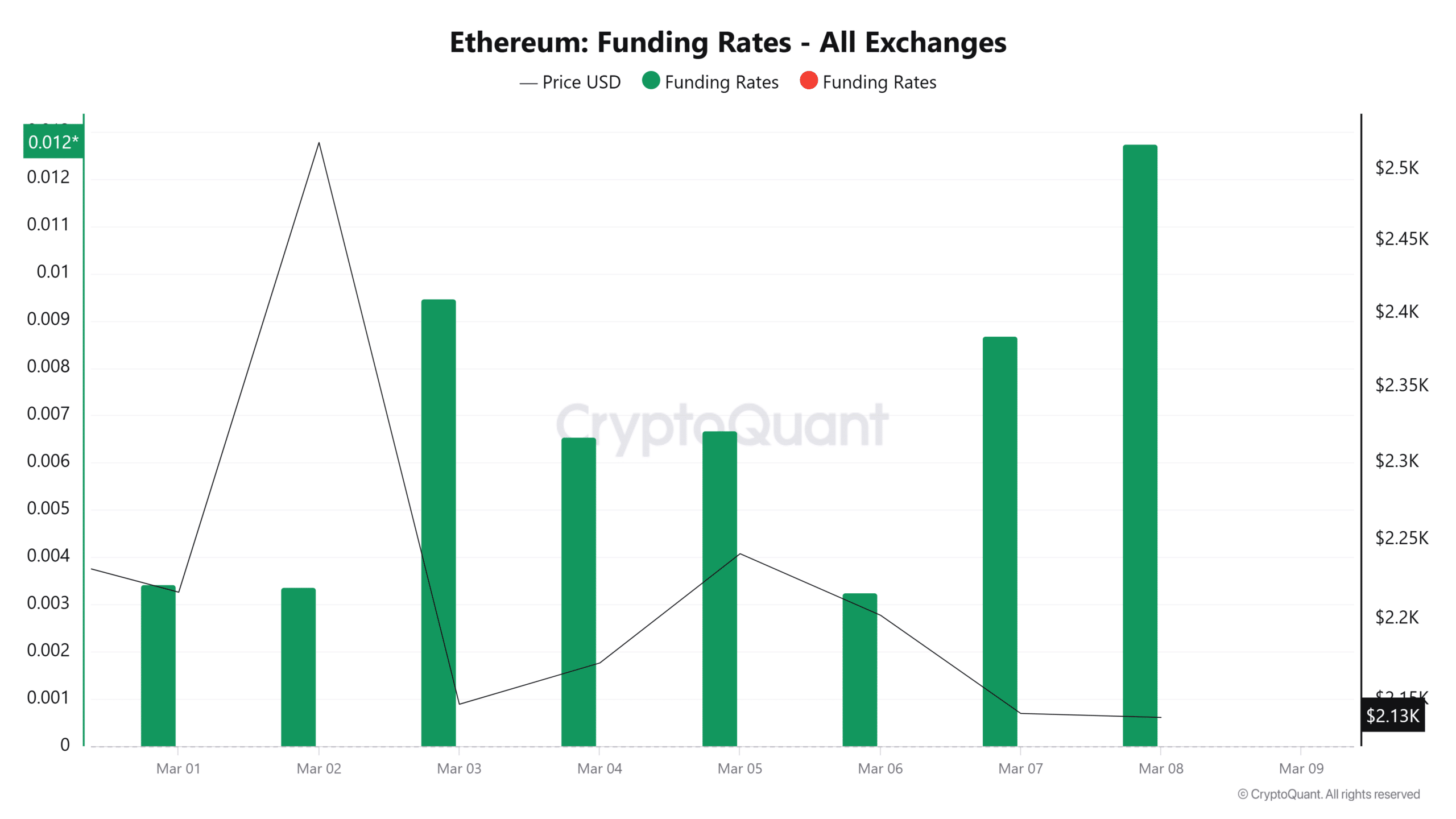

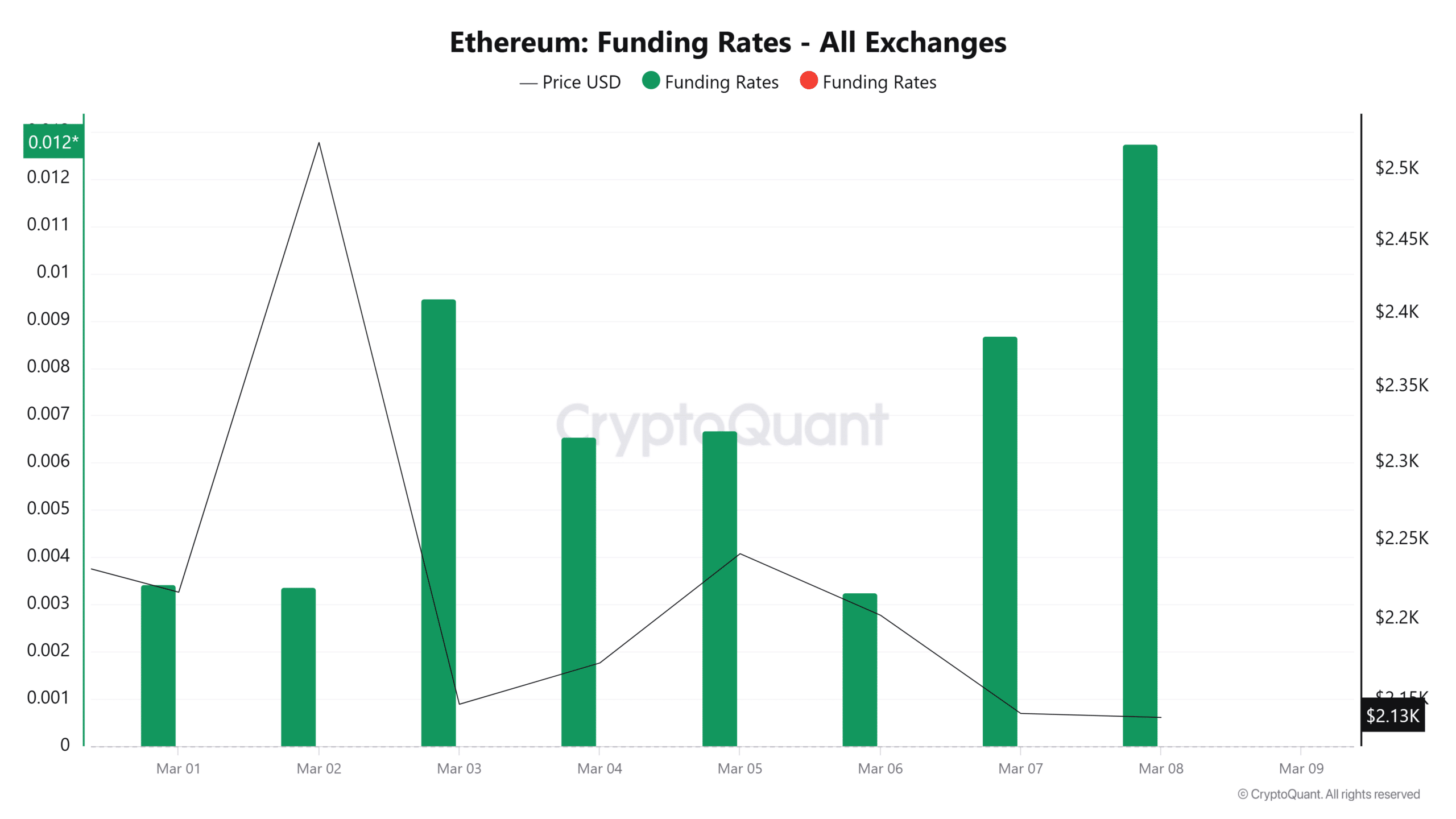

This increase can be confirmed by the increase in the funding rate, the same climbs to a weekly summit of 0.01.

When the funding rate increases, this implies that traders pay funding costs to hold their long positions. Since this increase is supported by increased accumulation, it supported a potential price rally.

What is the next step for ETH prices action?

In conclusion, Ethereum buyers entered the market – both whales and retailers. Sellers seem exhausted, the ETH can be well placed for recovery. If the request observed during the last day takes place, we could see ETH recover $ 2,325 and try a gathering around $ 2.7,000.

However, if the move by Bulls fails, we could see the Altcoin continue to negotiate between $ 2,114 and $ 2,300. To reach the levels provided by Martinez, he must first recover $ 2.7,000 and $ 3,000 – unlikely in the short term, unless macroeconomic data become favorable.