This article is also available in Spanish.

Ripple Labs is approaching a watershed moment with a potential initial public offering (IPO), a development that has been speculated about for some time. An IPO could be a transformative moment reminiscent of Amazon.com Inc.’s initial public offering (IPO) in 1997. Jake Claver, a qualified family office professional (QFOP), articulates this perspective in a discussion thread on

According to Claver, the company has solidified its position within the blockchain ecosystem through its robust cross-border payment solutions, which currently support more than 300 financial institutions worldwide. The Company’s use of XRP enables significantly faster and more cost-effective transactions compared to those processed through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network. Claver emphasizes: “This positions Ripple as a faster and more transparent SWIFT 2.0. »

Despite these achievements, Ripple has overcome significant challenges, including its legal battle with the United States Securities and Exchange Commission (SEC). However, recent court rulings have favored Ripple, potentially paving the way for larger opportunities, including a public offering. Claver notes: “Recent court rulings in favor of Ripple could open the door to bigger opportunities, such as going public. »

Why Ripple is like Amazon in 1997

Drawing a parallel with the evolution of Amazon, Claver observed: “Just as Amazon was known as an online bookstore before its IPO, Ripple is recognized for its blockchain solutions. But there is potential for much more. He added: “When Amazon went public, it raised $54 million, enabling expansion into new markets. » Ripple is also expected to unlock potentially massive growth opportunities through a public listing.

Related reading

Ripple’s strategic acquisitions, notably that of Metaco, now renamed Ripple Custody, demonstrate its intention to expand its market presence. Claver notes: “With acquisitions like Metaco, now Ripple Custody, they are already showing interest in expanding their reach. This could just be the beginning.

The potential implications of Ripple choosing an initial public offering (IPO) or direct listing are multiple. Claver points out that an IPO would provide Ripple with new capital, enabling rapid scaling and entry into new markets such as tokenized securities, real-world assets (RWA), and decentralized finance (DeFi ). He says: “An IPO would provide Ripple with new capital, allowing it to scale quickly and enter new markets like tokenized securities, RWA or DeFi. »

Additionally, the influx of capital from an IPO could facilitate new acquisitions, allowing the company to expand its offerings and strengthen its portfolio. Claver draws a direct comparison to Amazon’s acquisitions, noting: “Ripple could use the IPO funds to acquire other companies and expand its offerings.” Like Amazon’s acquisitions of Whole Foods and Twitch, Ripple could enter new markets and strengthen its portfolio.

Increased financial resources would also allow Ripple to accelerate its research and development efforts. Claver explains: “More resources would allow Ripple to accelerate R&D, improve the XRP Ledger, and explore new applications such as smart contracts, real-world tokenized assets, and central bank digital currencies (CBDCs). ).

Related reading

Claver differentiates between the two main routes to going public: an IPO and a direct listing. He explained: “An IPO involves issuing new shares to raise capital, usually underwritten by investment banks, but carries costs such as underwriting fees and regulatory requirements. On the other hand, a direct listing does not involve the issuance of new shares; instead, existing shareholders sell their shares on the market. This method is generally less expensive and faster than an IPO.

Given Ripple’s strong financial position, with over $1.3 billion in cash reserves, Claver suggests that a direct listing could be a viable option. “Ripple could opt for a direct listing because it already has a strong balance sheet,” he says. “A direct listing provides transparency and avoids lock-up periods that restrict insider selling in a traditional IPO.”

Beyond the financial mechanisms, Claver emphasizes that the IPO constitutes a legitimizing force for Ripple. He draws a parallel with the Amazon IPO, saying: “Amazon’s IPO legitimized e-commerce. For Ripple, a public listing would legitimize its role in global finance, signaling to banks and regulators that it is here to stay.

Recent favorable court rulings in the Ripple v. SEC case have significantly strengthened its position, making the prospect of a public listing more feasible. Claver concludes: “Ripple is at a critical juncture, much like Amazon before its IPO in 1997. If Ripple follows a similar path, we could see the emergence of a new tech giant. Whether through an IPO or direct listing, this move could unlock significant growth for Ripple and the blockchain industry.

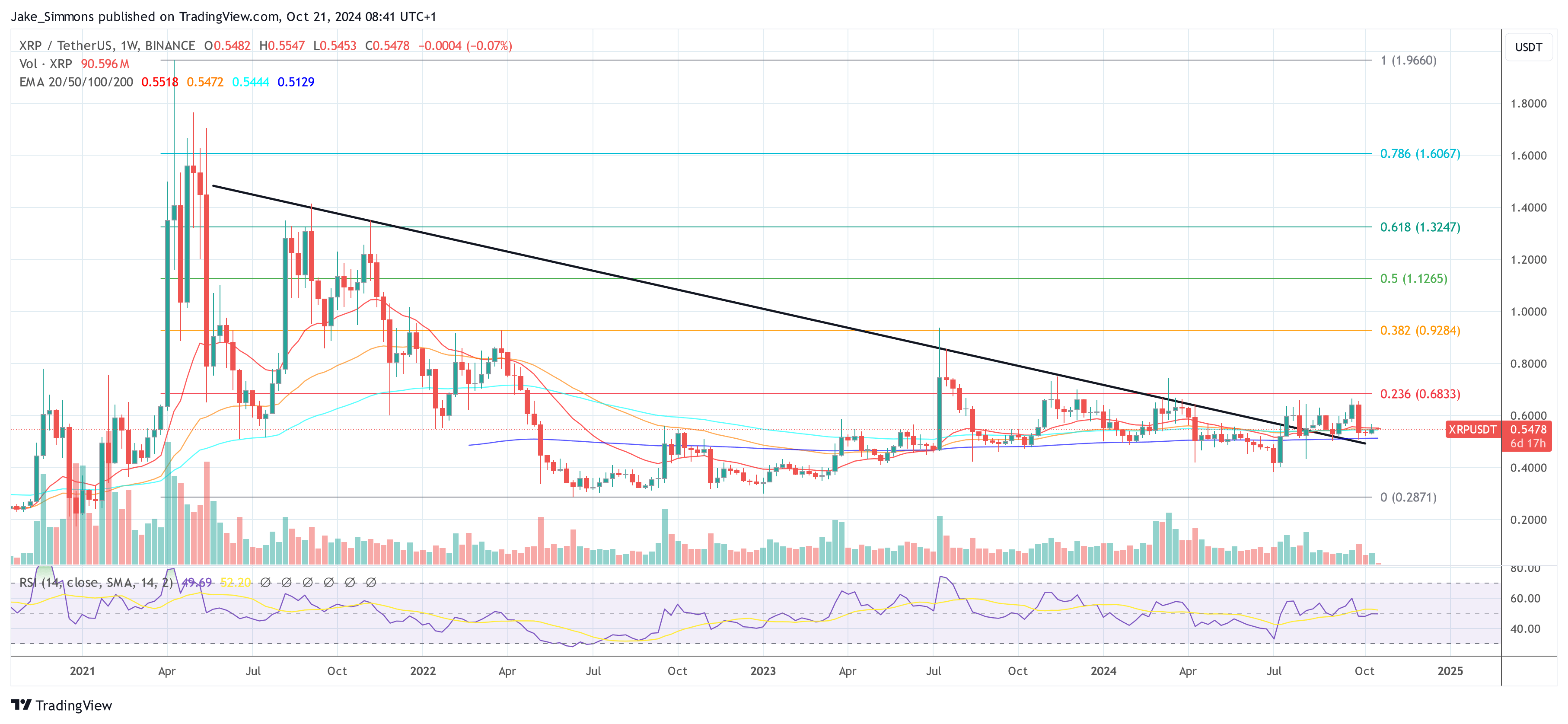

At press time, XRP was trading at $0.5478.

Featured image from Shutterstock, chart from TradingView.com