Ripple’s technology director David, “Joelkatz” Schwartz, has decided to explain the gap between the Ripple banking relationship list and the largest activity on the Ledger XRP (XRPL), responding at length on July 30 to a widely shared question of the investor and Youtuber Andrei Jikh. In a series of messages on X, Schwartz highlighted the realities of conformity, institutional behavior and articles of the product roadmap – in particular an upcoming model of “authorized areas” – as key reasons that institutional flows remain largely out of absence today.

300+ banking offers, little volume? CTO Ripple responses

The invite of Jikh has captured long -standing criticism: after more than a decade and “300+ banking partnerships”, why does the XRPL do not compensate “billions of daily volumes on the head”, why would the payers choose a volatile asset like XRP on the floors and – and – in a world saturated with fiatels – The active ingredients? He also raised questions about the tokenization strategy, especially why a company like Blackrock would select XRPL rather than exploiting a captive chain and geopolitical risk for non -American users.

The central explanation of Schwartz for the settlement of chain regulations is frank on the constraints to which regulated entities cannot transform without knowing it against illicit counterparts on the public liquidity of Dex: “Even Ripple cannot use the XRPL DEX for payments, because we cannot be sure that a terrorist will not provide liquidity for payments. The position recognized “it was very slow” to move the institutional flows on the channel, even if it argued that the institutions “begin to see the advantages”.

Pressed by another user on the fact that the same counterpart risk problem exists on other L1, Schwartz said that, according to how the functionality is used, “the generally decentralized exchanges on the public layer 1 give you no control or do not know who your counterparts are.” The point was procedural rather than moral – “the regulations are not always completely logical,” he added – explaining why regulated payment flows had trouble moving through open liquidity.

Schwartz has supervised the “authorized areas” as a design intended to maintain the opening of the big book while giving participants of participants linked to compliance with counterparts respected by the rules. In the follow -ups, he described a structure in which “retail is welcome in the parts authorized provided that they can prove that they are not sanctioned” and declared that “the net effect” should be that liquidity in these areas remains comparable to the open side due to market manufacturing between the two.

XRP vs. Stable

On the issue of Stablecoin, Schwartz rejected the idea that XRP volatility automatically disqualifies it for payments. He argued that there are uses of use where volatility “is not a less, or even a plus” and – distinctly – a content that a functional bridge requires an inventory: “A bridge currency only works if someone holds it so that you can get it precisely when you need it.” He added that if users do not know which asset they will need then, they can rationally hold the “dominant bridge” because it is cheaper to rotate from an active liquid hub in everything that comes.

Schwartz has also examined whether bridge assets are still important if stablecoins are increasingly covering most trading pairs. It made it possible that “if a stablecoin wins”, he could act as the bridge, but said that he did not think that a single stablecoin can win because everyone is “only … stable compared to a particular fiduciary currency” and anchored to jurisdictions. This multi-stable reality, he argued, leaves room for a neutral bridge to connect a “long tail” of tokenized active ingredients.

When he was asked why a heavyweight like Blackrock would not simply build his own chain for tokenization, especially as certain brokerage houses – Chwartz has minimized the importance of the homogeneity of the chain in a world of interoperability and portability. He urged skeptics to “ask the same question about Circle – why don’t they launch USDC only on their own blockchain?” Implying the obvious answer: omnipresence and liquidity come from the meeting of users where they are, on many networks.

In geopolitics, he drew a line between XRPL, which he described as a neutral infrastructure, and Ripple’s corporate products, which are segmented by competence. “If you ask questions about XRPL, this is not really based on the United States,” he wrote, adding that the big book “never discriminated against participant in particular”, and conceding that, for the own Ripple products, the license realities apply and certain corridors-“North Korea or Cuba at any time”-are out of the limits.

Schwartz also argued that the role of XRP in the pile of Ripple payments remains material even if a large part is not visible on public books. “I do not have the figures in front of me,” he wrote, “but I am almost sure that the use of XRP as a bridge in Ripple Payments eclipses all the other assets.” In a related point on the XRPL design, he reminded readers that “XRP has a privileged place on the large XRP book”.

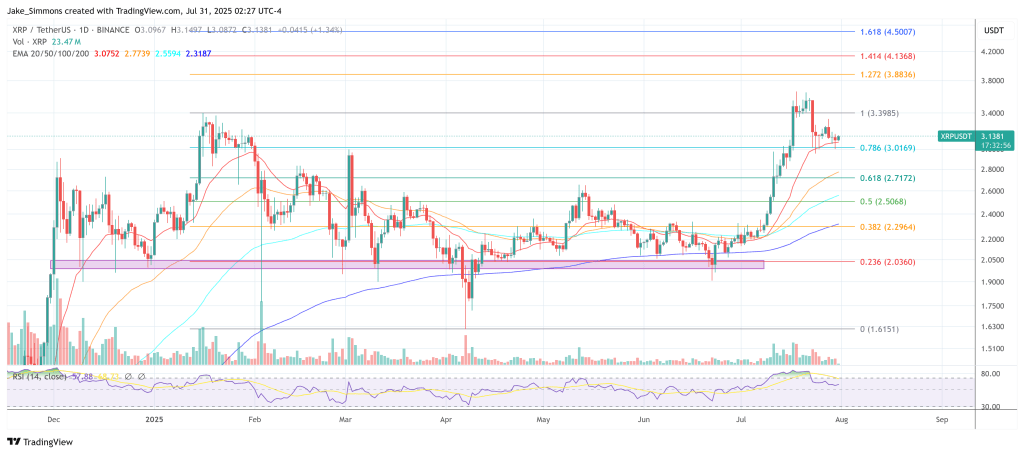

At the time of the press, XRP exchanged $ 3.13.

Star image created with dall.e, tradingView.com graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.