Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

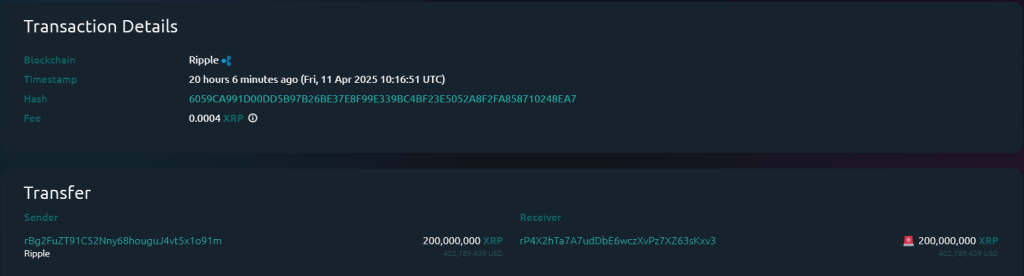

Ripple, based in San Francisco, transferred 200 million XRP tokens, worth around 400 million dollars, between portfolios controlled by the company. The massive movement has occurred today and was spotted for the first time by the whale alert of the cryptocurrency tracking service.

Related reading

Monetary track monitoring

The transaction initially seemed to be heading for an unknown destination when Whale Alert said that the funds passing to an unidentified address “RP4X2 … SKXV3”. But the Blockchain Bithump analysis platform later said that the shipping and reception portfolios belong to Ripple.

The reception portfolio was created by Ripple on October 2, 2023, with initial funding of 70 million XRP. Since its creation, this portfolio has only interacted with other addresses linked to undulations, strengthening the evidence that it was an internal transfer rather than funds moving to an entity or an external exchange.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 200,000,000 #Xrp (402,739,474 USD) transferred from #Ripple to an unknown wallet

– Whale alert (@whale_alert) April 11, 2025

Why the big money moves

According to the figure of the cryptographic community xrp_liquidity, which follows the movements of ripple token, the transaction represents the standard management of the treasury – Ripple simply moves the money between its own accounts. The 200 million XRP tokens remain intact at the reception address, not suggesting any immediate plan for their use.

The reception portfolio now contains approximately 290 million XRP chips, worth around $ 577 million during the current XRP price of $ 2.04 per token, based on Coingecko figures.

According to historical trends, funds can be used for various purposes in the commercial operations of Ripple. They can be used to finance the liquidity on demand (recently renamed undulation payments), the products negotiated on the financial stock market which reflect the value of XRP or give liquidity to the exchanges of cryptocurrency where XRP is listed.

The biggest financial image

The shipping portfolio did not violate its cash register with this transfer. It still contains 200 million XRP tokens. This portfolio had received 300 million XRP on April 2 from another address linked to Ripple, which had itself received 500 million XRP from the monthly Liberation of Ripple.

Ripple maintains most of its XRP participations in entire accounts, with scheduled versions occurring monthly. The version in April showed an unusual timing compared to the standard Ripple practice.

Related reading

Break with routine

Ripple broke out of its traditional first month calendar for its April tokens released. Instead of unlocking funds on April 1, the company returned 700 million XRP for the first time to the whole, then published 1 billion XRP on April 3.

This change of schedule goes against the established tradition of ripple of tokens on the first day of each month, although the company has not publicly commented on its reasoning for this change of synchronization.

Portfolio transactions are significant, because XRP is negotiated at more than $ 2 per token, which gives cryptocurrency an assessment so high that even normal transfers are worth several hundred million dollars.

These enormous transfers are generally followed closely by observers of the cryptography market, as they can sometimes be revealing of any potential movement of the future market or the strategic decision taken by the company.

Star image of Gemini Imagen, tradingView graphic