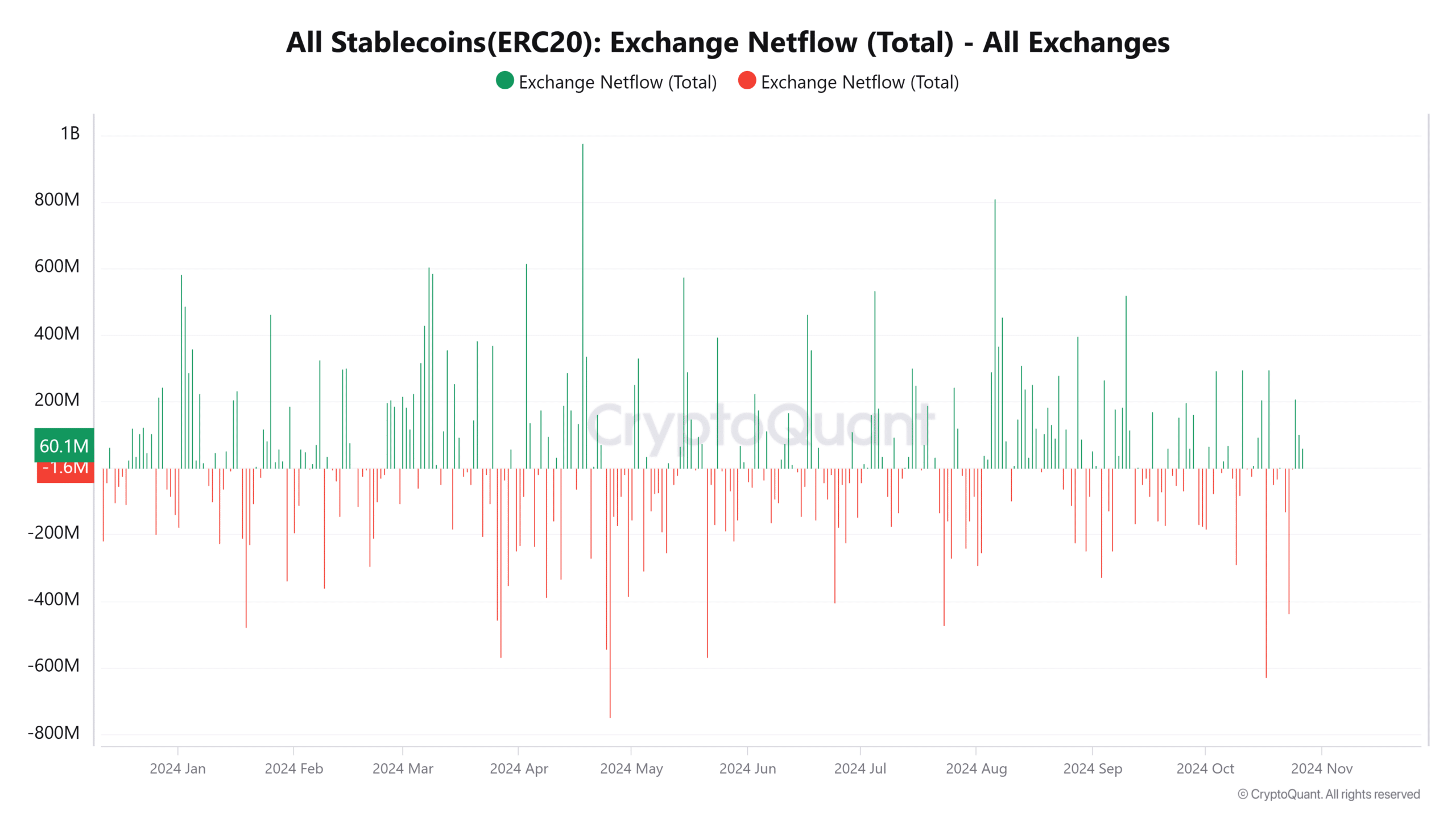

- USDT controlled over 70% of the total stablecoins in circulation.

- Recently, there have been more inflows showing buying sentiment.

The price of Bitcoin (BTC) continued its upward momentum, approaching the psychological milestone of $100,000.

One of the main factors driving this rise is the large influx of stablecoins into exchanges, which often signals incoming buying pressure.

Additional information on active addresses and Bitcoin exchange net flows provides a comprehensive view of the market dynamics propelling this rally.

Stablecoin inflows indicate high buying interest

Analysis of the stablecoin exchange net flow chart on CryptoQuant revealed a steady influx of stablecoins, especially over the past few weeks.

This trend suggests that investors are gearing up to acquire Bitcoin, as stablecoins are the primary gateway for cryptocurrency purchases.

Source: CryptoQuant

At the time of writing, an inflow of over $213 million has been recorded, signaling increased market activity.

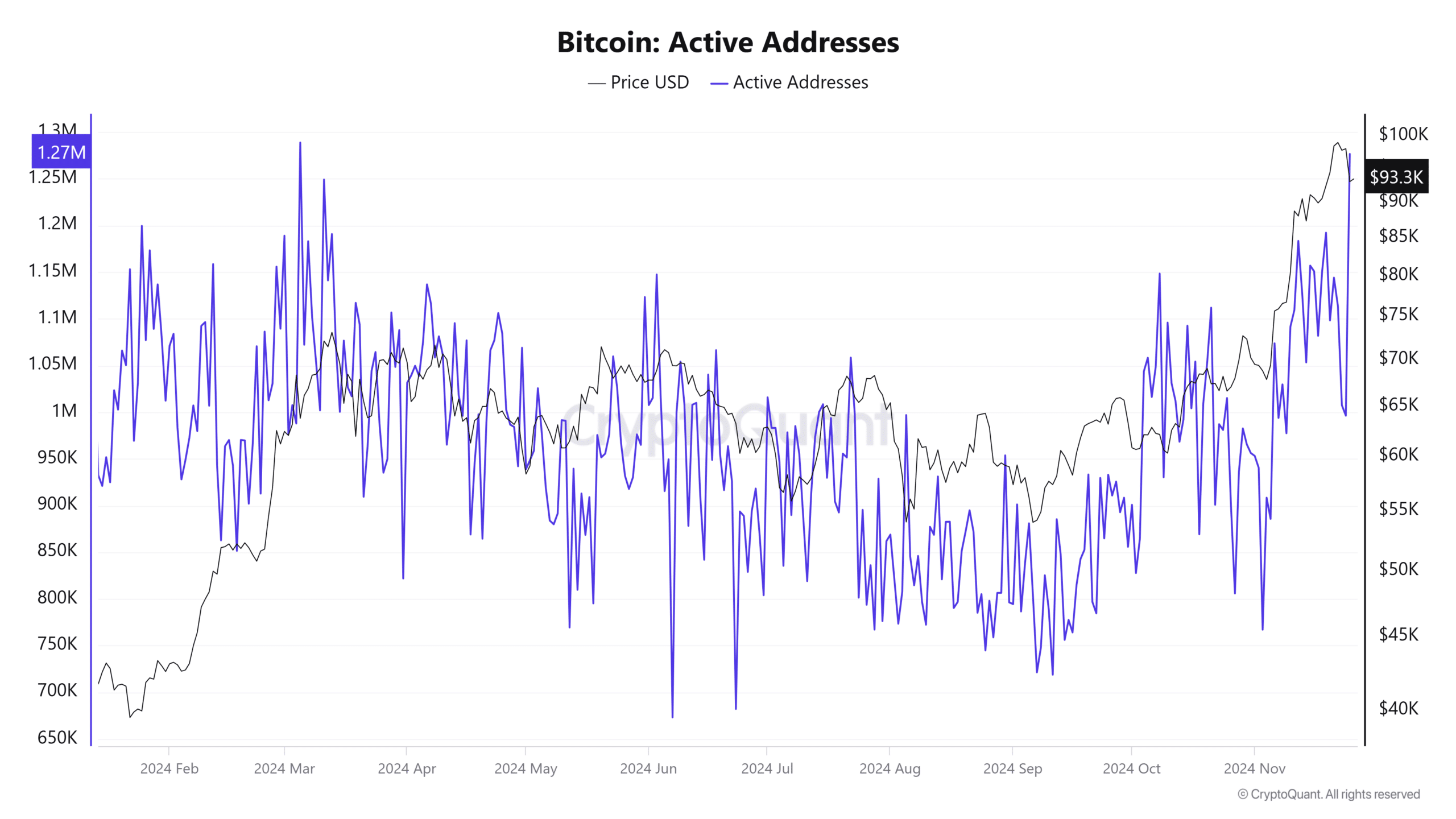

Active addresses increase as network activity increases

Bitcoin’s active addresses, a measure of network usage and activity, have steadily increased with its price and the influx of stablecoins.

Source: CryptoQuant

Analysis of active address data shows that it has reached approximately 1.27 million active addresses. This is the highest figure since March, indicating increased participation in the network.

This growth in active addresses suggests increased investor interest. This aligns with historical trends of price increases during periods of increased network activity.

Additionally, Bitcoin exchange net flow data presents a mixed story. While total inflows highlight increased trading activity, outflows have also increased, indicating accumulation and reduction in selling pressure.

This balance supports Bitcoin’s steady rise towards $100,000. As of this writing, the net flow was negative, with over 5,000 people.

Increasing purchasing power?

Technical analysis of Bitcoin price highlighted key Fibonacci retracement levels at $80,450 and $74,455, providing potential support zones in the event of a pullback.

The Parabolic SAR confirmed the uptrend, while the moving averages (MA) provided a solid foundation for continued price appreciation.

With increasing volume and consistently higher lows, Bitcoin’s rally remains well supported.

Source: TradingView

Read Bitcoin (BTC) Price Prediction 2024-25

Additionally, Bitcoin’s stablecoin supply ratio (SSR) remained low at 10.42, indicating robust purchasing power relative to Bitcoin’s supply.

Stablecoin metrics and other key indicators show that stablecoins will play a key role in Bitcoin’s attempt to reach $100,000.