Este Artículo También is respondable in Español.

Bitcoin (BTC) has been faced with increased volatility in recent weeks, initially driven by Donald Trump’s project price And later exacerbated by the latest data from the consumer price index (ICC). The inflation report dropped the BTC at $ 94,000 before successfully recovering certain losses. However, according to Crypto analyst Ali Martinez, Bitcoin must defend a critical price level to avoid a significant correction.

The analyst identifies the price level of critical bitcoin

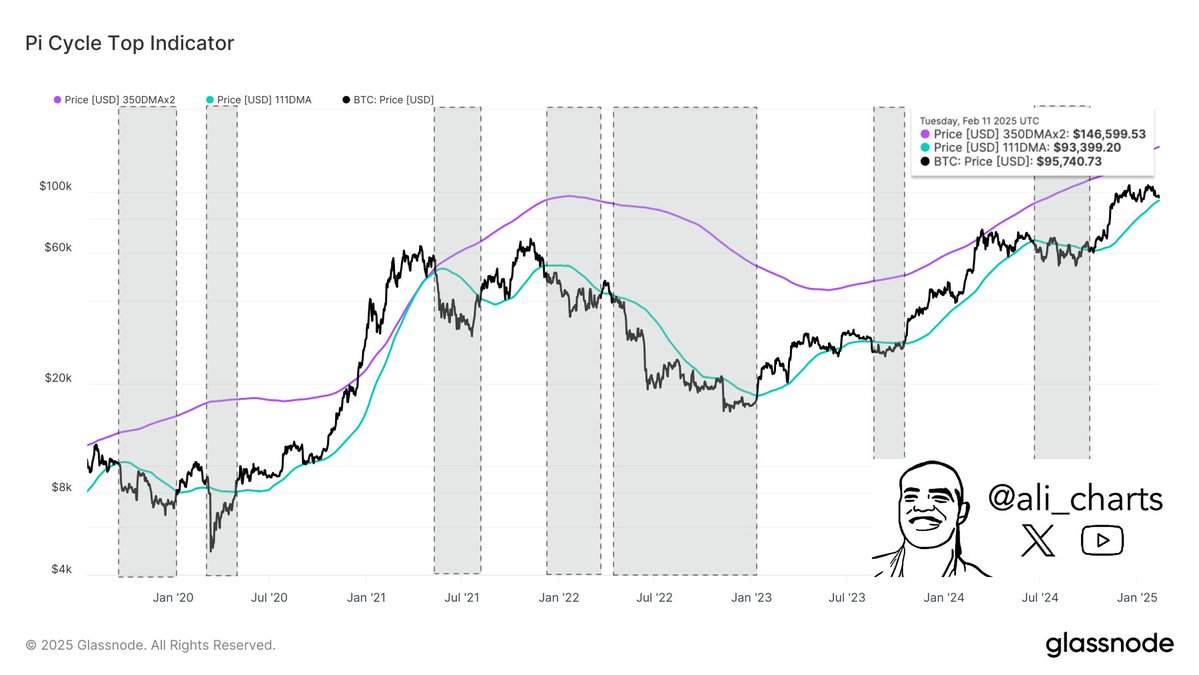

In an X job Shared earlier in the day, Martinez drew attention to the top PI cycle indicator. For the uninitiated, the upper PI cycle indicator is a Bitcoin market tool which aims to identify the peaks of the market cycle.

Related reading

The indicator follows the mobile average (MA) of 111 days and a multiple – generally 2x – of the 350 -day mobile average. When the 111 -day MA crosses the MA of 2x 350 days, it historically signals a top of the market.

According to Martinez, Bitcoin tends to undergo high price corrections when it falls below 111 days. Currently, this mobile average amounts to around $ 93,400. If BTC falls below this level, it could trigger a major movement down.

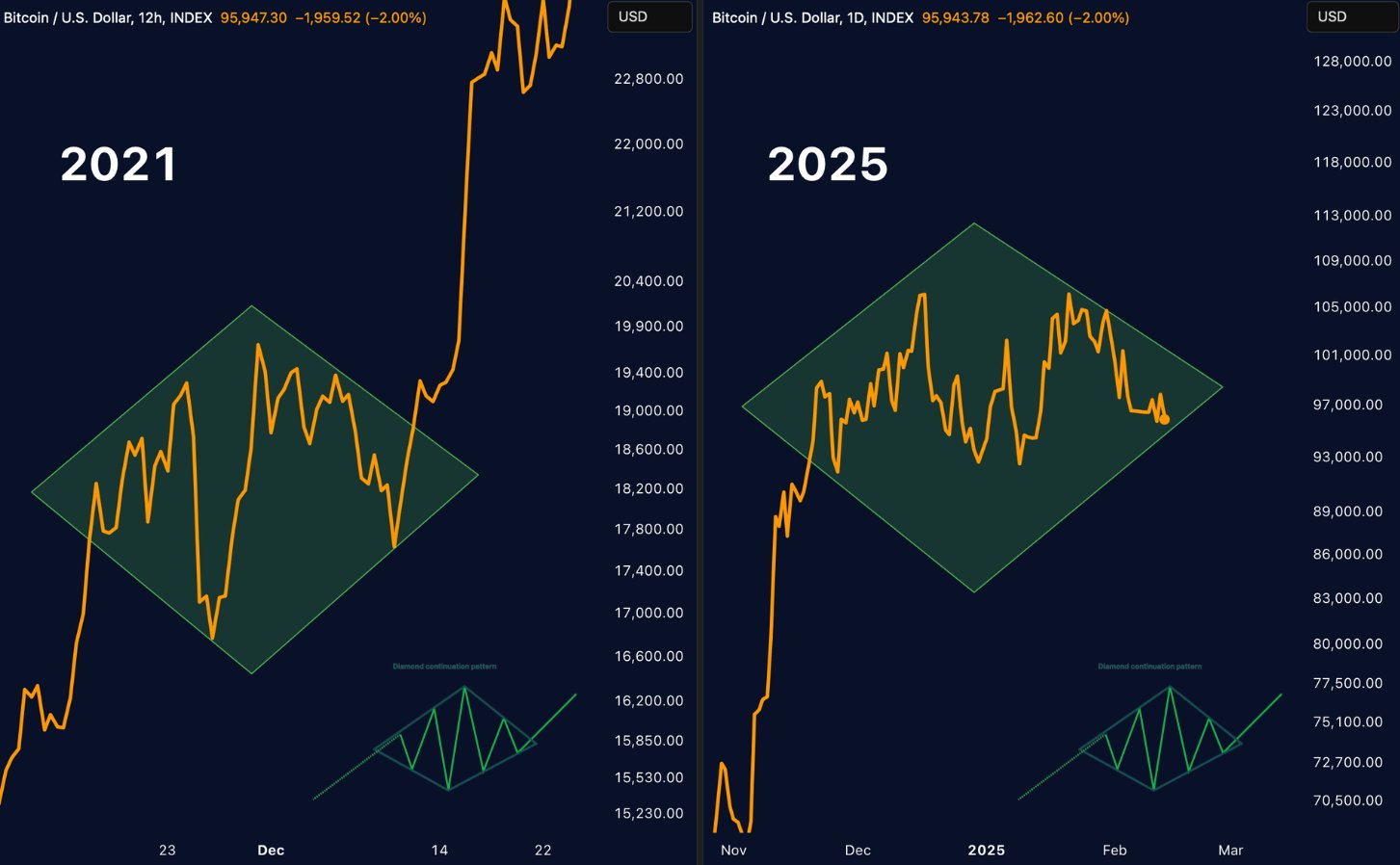

The Crypto Merlijn analyst, the merchant, shared their reflections on the current BTC prices action. The analyst shared the following chart which shows the similarity between the action of BTC prices in 2021 and 2025.

According to the graph, BTC is currently in the process of completing a bullish diamond pattern. A successful achievement of this model followed by a bullish escape can propel the BTC to new heights of all time (ATH) beyond $ 120,000.

Where is the BTC which then heads?

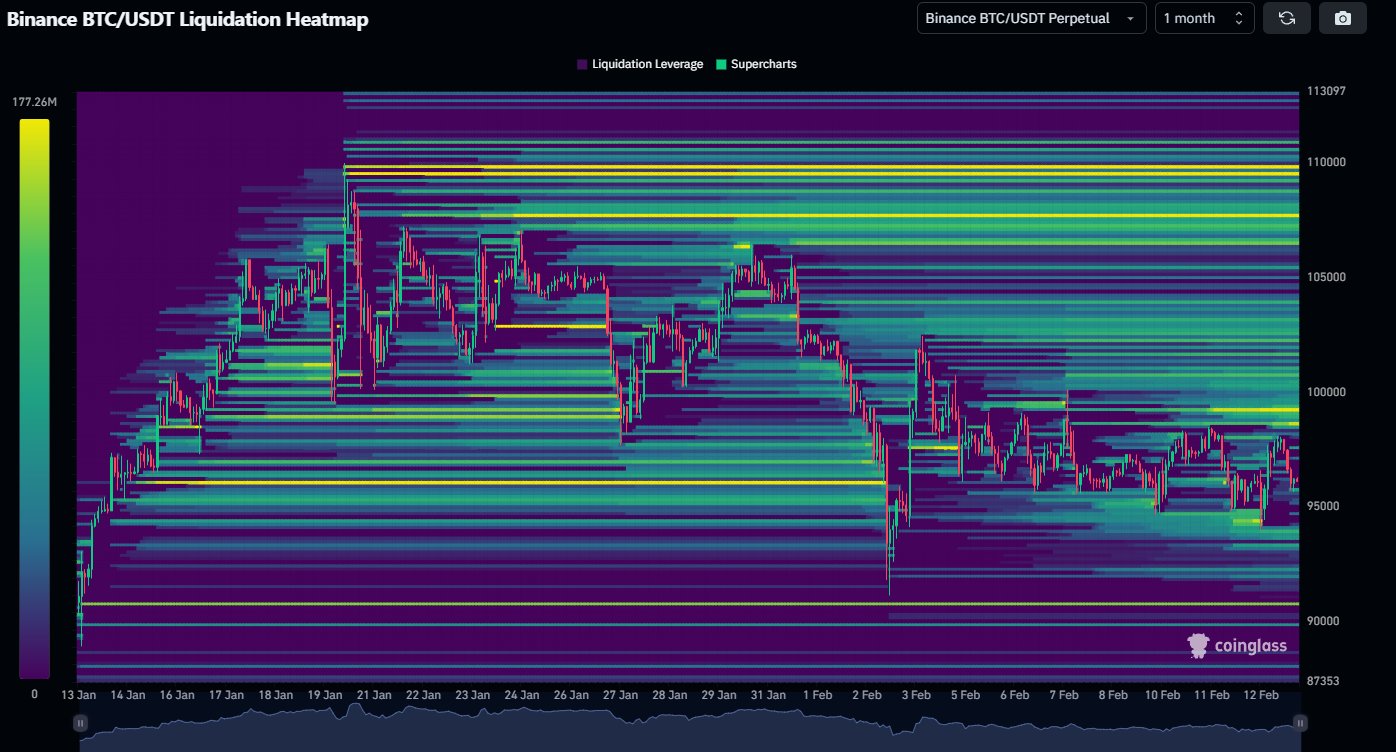

Crypto Investor Daan Crypto Trades also analyzed the latest Bitcoin price movement, especially in answer to CPI data. The report has confirmed that inflation remains hot in the United States, reducing the probability of new declines in interest rate of the Federal Reserve (Fed) in the near future. Daan noted:

Most of the liquidity below has been taken on the lower deadlines. There is a lot of unexploited liquidity sitting higher after all these lower summits in the past two weeks. If BTC can return this local downward trend, they could act as fuel for the higher trip.

The investor also warned that if BTC slides below $ 90,000, he could enter a “danger zone”. This level served as a key support area, with the bitcoin that bounced it several times. A decisive rupture below could increase the greater risk of sale.

Related reading

Despite the recent Bearish developmentsBitcoin held firm in the fork of $ 90,000. However, some market players remain careful Over the possibility of a drop to $ 80,000 if the sales pressure is intensifying. At the time of the press, the BTC is negotiated at $ 95,324, down 1% in the last 24 hours.

Star image of Unplash, X graphics and tradingView.com