By Omkar Godbole (all the time and unless otherwise indicated)

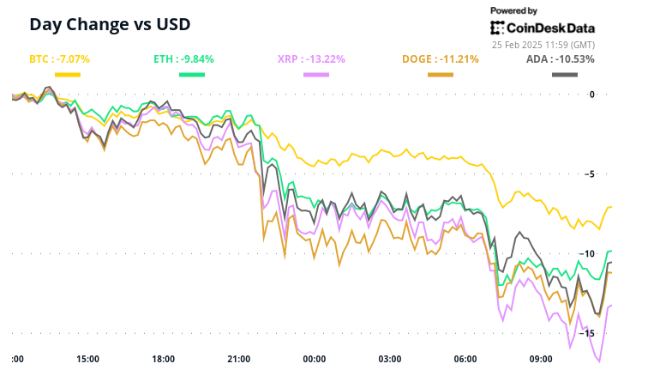

The cryptography market seeks to regain a balance after yesterday’s fall with chain indicators showing signs of capitulation in Bitcoin. Some tokens, such as Mkerdao MKR, stand out with a 20% gain in 24 hours, thanks to the DAO buyout and burning process.

IP, the native token of the Storal Blockchain protocol focused on decentralized intellectual property, is also in green, having increased by almost 40%. The token price has doubled in two weeks after being enrolled in the South Korean scholarships.

Other notable sub-Performances include Celestia TIA with XDC, QNT and Hype. The data followed by Blockchain Sleuth Lookonchain show that the whales bought the dip in the token of media. XRP, meanwhile, clings to a key level of Fibonacci, keeping the hope of the Bulls for larger living gains.

According to Matthew Hougan, Bitwise Asset Management investment director, the cryptography market digests the end of the recent frenzy of the same, which could be replaced by productive sectors such as stablescoins, real assets and deffi. “But until they start to make their presence feel, the loss of energy will create a trail on the market,” said Hougan on X.

On the macroeconomic front, optimism given after the November 4 elections is replaced by caution, as evidenced by the release of the confidence of American consumer. The gauge dropped to a hollow of eight months, and one -year inflation expectations were highest for 1.5 years, President Donald Trump’s prices were distinguished as the main concern in almost all household and business surveys.

The feeling of a reinforcement could keep up the risky risk assets for a while. Earlier this week, the head of the Central Bank of Belgium, Pierre Wunsch, warned that the ECB was likely to sleep in too much rate reductions. The Fed, for its part, is unlikely to make some soon. (Of course, the minutes of the January meeting have discussed the end of the quantitative tightening, but that does not mean quantitative relaxation.)

Speaking of key events to monitor, the Senate banking committee, led by senator Cynthia Lummis, is expected to revisit Crypto regulations at the hearing scheduled for Wednesday entitled “Exploration of Bipartisan legislative executives for digital assets”. “Stay alert!

What to look at

- Crypto:

- Macro

- February 26, 10:00 am: US Census Bureau publishes the new sales report in January.

- New sales of houses is. 0.68 m against prev. 0.698 m

- New prev home sales mother. 3.6%

- February 26-27: The first meeting of the G20 finance ministers of the G20 and the governors of central banks (Cape Town).

- February 27, 8:30 am: The American economic analysis office publishes the GDP of the first quarter (2nd estimate).

- Qoq basic PCE price is. 2.5% against Plan. 2.2%

- PCE Qoq price is. 2.3% against Plan. 1.5%

- QOQ GDP growth rate is. 2.3% against Plan. 3.1%

- February 27 at 8:30 am: The American Labor Department of the Unemployment Verses for Weekly Complaints for the Clos Week on February 22.

- Initial complaints on unemployment is. 221K against prev. 219K

- February 26, 10:00 am: US Census Bureau publishes the new sales report in January.

- Gains

- February 26: Mara Holdings (Mara), post -marchand, -0.13 $

- February 26: NVIDIA (NVDA), post-marketing, $ 0.85

Token events

- Votes and call governments

- Frax Dao discusses the upgrading of the protocol by rejoining FXS to Frax, making it the gas token on Fraxtal, implementing the hard Frax North Star fork and by introducing a tail emission plan with emissions and other progressive improvements.

- Dydx Dao votes on the distribution of $ 1.5 million in Dydx tokens from the Community Treasury to qualified users in season 9 as part of its incentive program.

- Unlocking

- February 28: Optimism (OP) to unlock 2.32% of the supply in circulation worth $ 33.97 million.

- March 1: DYDX to unlock 1.14% of the supply in circulation worth $ 5.76 million.

- March 1: Zetachain (Zeta) to unlock 6.48% of the supply in circulation worth $ 12.81 million.

- March 1: SU (SUI) to unlock 0.74% of the supply in circulation worth $ 68.90 million.

- March 2: Ethena (ENA) to unlock 1.3% of the supply in circulation worth $ 16.47 million.

- March 7: Kaspa (KAS) to unlock 0.63% of the supply in circulation worth $ 14.85 million.

- March 8: Berachain (Bera) to unlock 9.28% of the supply in circulation worth $ 70.90 million.

- Token lists

- February 26: Moonwell (well) to list on Kraken.

- February 27: Venice Token (VVV) will be listed on Kraken.

- February 28: Worldcoin (WLD) will be listed on Kraken.

Conferences

Talk about tokens

By Francisco Rodrigues

- Solana, often criticized on her inflationary monetary policy, is currently planning to implement a governance proposal to modify it, SIMD-0228.

- The proposal would introduce a model of dynamic emissions and focused on the ground token and potentially reduces inflation.

- The proposal would distance the blockchain from its current fixed emission model which saw the supply of ground circulation increase to around 500 million tokens.

- The Story of Story Protocol, IP, has rubbed the downward trend that has entered the cryptocurrency market in recent days. IP has surpassed the larger Coindesk 20 index while traders are betting on the tokenization of intellectual property.

- The industry ecosystem also rally on the cryptocurrency exchange purse after its $ 1.5 billion hack. The exchange launched a “war against Lazarus” to make Crowdsource the efforts of investigation against the group linked to North Korea.

Positioning of derivatives

- According to Velo Data. It is a sign of weakening of the bullish feeling. Ether’s base fell to just over 5%.

- Perpetual financing rates for TRX, AVAX, XLM, SHIB and OM are negative, reflecting a bias for short lowering positions.

- BTC, short -term ETH, dishes continue to negotiate a call bonus, reflecting fears of a continuous drop in prices.

Market movements:

- BTC is up 1% from 4 p.m. HE Tuesday at $ 89,19377 (24 hours: -0.11%)

- ETH is down 0.36% to $ 2,487.88 (24 hours: + 2.19%)

- Coindesk 20 is up 0.42% to 2,882.89 (24 hours: + 2.34%)

- The CESR ether composite rate rate increased from 29 BPS to 3.28%

- The BTC financing rate is 0.0005% (0.6% annualized) on OKX

- Dxy is up 0.17% 106.49

- Gold is down 0.24% to $ 2,913.89 / Oz

- The money is down 0.78% to $ 31.78 / Oz

- Nikkei 225 closed -0.25% to 38,142.37

- Hang Seng closed + 3.27% to 23,787.93

- FTSE increased by 0.54% to 8,715.19

- Euro Stoxx 50 increased by 1.14% to 5,510.13

- Djia closed Tuesday + 0.37% to 43,621.16

- S&P 500 closed -0.47% to 5,955.25

- The Nasdaq closed -1.35% to 19,026.39

- The S&P / TSX composite index closed + 0.21% to 25,203.98

- S&P 40 Latin America closed + 0.19% to 2,390.95

- The 5 -year American treasure rate increased from 2 BPS to 4.32%

- E-Mini S&P 500 Contracts in the long term increased by 0.5% to 5,999.75

- The term contracts on the NASDAQ-100 E-Mini increased by 0.82% to 21,321.50

- E-Mini Dow Jones Industrial Industrial Term Index increased from 0.27% to 43,808.00

Bitcoin statistics:

- BTC dominance: 61.11 (0.13%)

- Ethereum / Bitcoin ratio: 0.02793 (-0.75%)

- Hashrate (Mobile average at seven days): 746 EH / S

- Hashprice (spot): $ 52.40

- Total costs: 11.39 BTC / 1.1 million dollars

- CME Futures open interest: 164 970 BTC

- BTC at the price of gold: 30.5 oz

- BTC vs Gold Bourse Capt: 8.66%

Technical analysis

- Bitcoin’s hourly graph shows that the MacD histogram has been biased Haussier since Tuesday late. However, there has been little progress towards the increase in terms of price.

- The divergence between prices and the MACD, associated with the key levels in descending slopes, suggests a potential for another sales cycle before a significant background is reached.

- A convincing decision above $ 90,000 is necessary to invalidate the lowering prospects.

Cryptographic actions

- Microstrategy (MSTR): closed Tuesday at $ 250.51 (-11.41%), up 3.66% to $ 259.68 in pre-commercialization

- Coinbase Global (corner): closed at $ 212.49 (-6.42%), up 2.04% to $ 216.82

- Galaxy Digital Holdings (GLXY): closed at $ 20.09 CA (-7.84%)

- Mara Holdings (Mara): closed at $ 12.41 (-10.62%), up 2.86% to $ 12.77

- Riot Platforms (Riot): closed at $ 9.32 (-6.71%), up 2.79% to $ 9.58

- Core Scientific (CORZ): closed at $ 9.76 (-1.01%), up 3.28% to $ 10.08

- Cleanspark (CLSK): closed at $ 8.15 (-8.43%), up 1.96% to $ 8.31

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): closed at $ 17.04 (-11.25%), up 4.46% to $ 17.80

- Semler Scientific (SMLR): closed at $ 42.42 (-4.42%), up 2.5% to $ 43.48

- Exodus movement (Exodus): closed at $ 39.86 (-3.16%), down 1% to $ 39.46

ETF Flows

BTC ETFS spot:

- Daily net flow: – 937.7 million dollars

- Cumulative net flows: 38.09 billion dollars

- Total BTC Holdings ~ 1,157 million.

ETH ETFF SPOT

- Daily net flow: – $ 50.1 million

- Cumulative net flows: $ 3.02 billion

- Total of Holdings ~ 3.750 million.

Source: Wacky investors

Nightflow

Graphic of the day

- The net volume of sale in BTC on Tuesday has been the strongest since May 2021, according to data followed by Glassnode and Andre Dragosch, research manager for Europe in Bitwise.

- Perhaps the weak hands capitulated, leaving the market in a much healthier state.

While you slept

- XRP, BNB Edge above while Bitcoin Bulls Eirms Eirm $ 90,000 after Tuesday Blood Bath (Coindesk): Bitcoin rebounded at almost $ 89,000 with major cryptocurrencies XRP and BNB also showing signs of a cautious recovery.

- The Bitcoin Blood Blood Bath was the bottom, says the analyst (Coindesk): the signals on the chain suggest that limited later.

- The American FNB Bitcoin see record daily outings of more than $ 930 million while transactions lost shine against the 10 -year treasure ticket (Coindesk); Tuesday has marked the most steep redemption of a day for the Bitcoin FNB on the American list of the United States since their creation.

- Circle says that Stablecoin issuers should be registered in the United States (Bloomberg): Jeremy Allaire, co-founder of Stablecoin Emitter Circle, said that cryptocurrency tokens should be recorded in the United States

- Treasury yields bounce back slightly, the dollar underwent by American growth (Reuters): The 10 -year treasure yield has climbed 3 base points to 4.3271% after the American chamber adopted a budget bill which opens the way to 4.5 billions of dollars in tax discounts.

- The main SNUB G20 finance ministers as global cooperation are under tension (Financial Times): the G20 meeting of this week in South Africa is remarkable for the absence of finance ministers in the United States, China, Japan, India, Brazil and Mexico, which has made doubt about the efficiency of the forum.

In ether