Robert Kiyosaki is back in the headlines, doubling Bitcoin while taking another swing at the dollar and gold.

The rich poor daddy The author, never hesitates to call Fiat Money, a scam, now frames Bitcoin like the new gold – only leaner, faster and less linked to the governments he does not trust.

Why Robert Kiyosaki prefers bitcoin

The heart of Kiyosaki’s argument is rarity. Gold can be extracted, money can be drilled, but bitcoin is locked at 21 million forever.

Well, unless you are one of the .cwp-Coin-Stand SVG Path {avc-width: 0.65! IMPORTANT; }

Price

Volume in 24 hours

?

->

Price 7D

Developers, Peter Todd, who thinks that it should be rebuilt … No one says to Kiyosaki.

“I have gold and silver mines,” he said. “If the price is increasing, I’m just going to dig more. You can’t do that with Bitcoin.” This supply ceiling, in its opinion, is what distinguishes bitcoin in a world of assets subject to inflation.

Why Bitcoin is a better asset than gold or silver:

One of the reasons why I trust Bitcoin is that there are only 21 million.

I have gold and silver mines and oil wells.

If the price of gold, silver or oil increases, I will simply extract or pierce for more, in expansion.

I…

– Robert Kiyosaki (@Therealkiyosaki) May 7, 2025

Kiyosaki’s faith in Bitcoin goes hand in hand with its distrust of the Fed and the Treasury. He has spent years relaxing against what he calls “false money” – supported by anything other than promises and printing presses.

With crawling inflation and confidence in institutions, he considers the fixed Bitcoin supply as the antidote to an uncontrollable system.

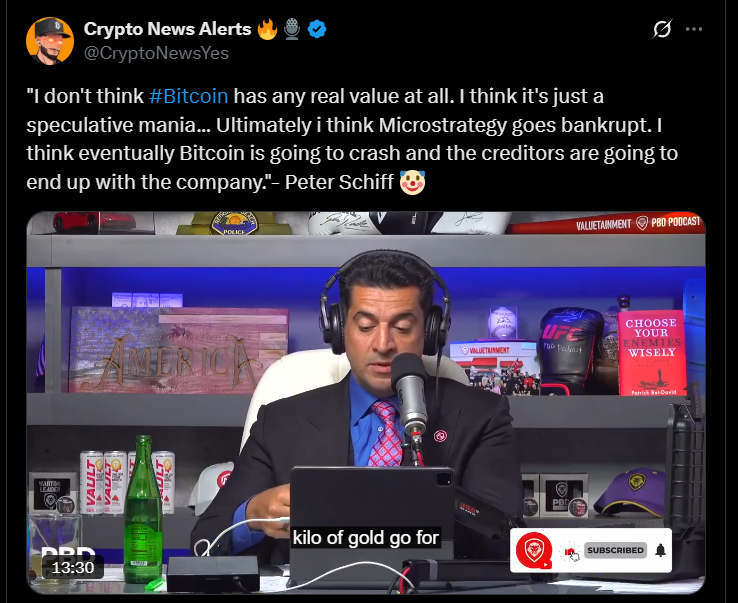

Peter Schiff’s counterpoint

The warning signs, says Kiyosaki, have been there for decades. Recalling the prophecy of Rich Dad, he says that we are bordering on the largest crash in modern history.

When it strikes, the Fed will likely reach the same old solution: printing in the background. This is why he holds Bitcoin.

However, not everyone is convinced of Bitcoin’s superiority. The long-standing critic of Bitcoin and defender of gold Peter Schiff remains one of his hardest detractors, qualifying the cryptocurrency to tear out. Schiff argues that the recent Rally of Bitcoin prices is preparing a path for an important crash.

“Gold is up of an additional $ 45, trading above $ 3,380 … The money is also starting to straighten,” noted Schiff in a press release, highlighting the strength of traditional precious metals.

Schiff has always rejected Bitcoin as speculative and unbearable, but he came to see his usefulness as digital gold.

Bitcoin vs Gold debate

Gold wins on the dashboard this year, but Bitcoin is not out of the fight. Despite a difficult start, the BTC is back above $ 98,000, made up of investors who believe that its real value comes into play when traditional systems are starting to crack.

While rumors of global economic uncertainty become stronger, the debate between digital and physical refuge will be at the front and center.

We will see if Bitcoin continues to convince more under the account of “digital gold”.

Discover: Crypto following 1000x: 10+ Crypto tokens which can strike 1000x

Join the 99Bitcoins News Discord here for the latest market updates

Key dishes to remember

-

Robert Kiyosaki is back in the headlines, doubling Bitcoin while taking another swing at the dollar and gold.

-

Despite clear decreases earlier in the year, Bitcoin recently returned above the $ 98,000 mark,

The post Robert Kiyosaki Champions Bitcoin on Gold and Silver appeared first on 99Bitcoins.