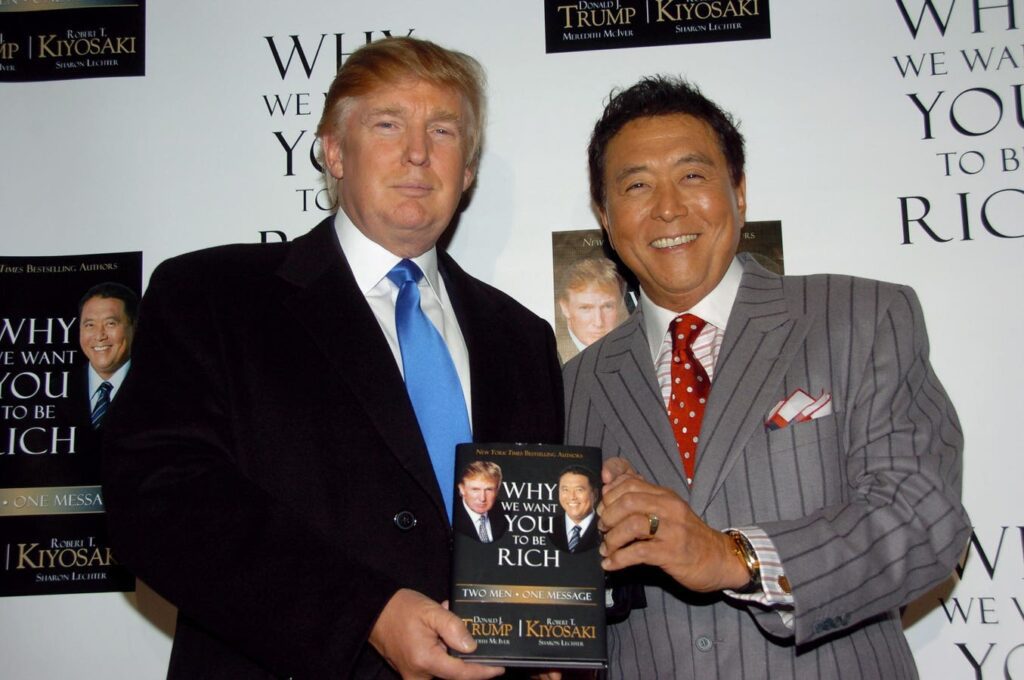

UNITED STATES – OCTOBER 12: Donald Trump and Robert Kiyosaki

The cryptocurrency market continues to spark bold predictions, with the latest coming from none other than Rich dad, poor dad author Robert Kiyosaki.

In a cryptic post on November 25, Kiyosaki said the price of Bitcoin could reach $500,000 by 2025, adding a curious caveat, “according to AI.” “Q: What is the price of bitcoin in 2025? A: $500,000 according to AI,” he wrote.

This is not the first time Kiyosaki has made ambitious Bitcoin predictions. Earlier this year, he predicted that the cryptocurrency could reach $350,000 by August 2024.

He also hinted at the possibility of Bitcoin reaching $10 million, although no specific timetable was given.

Kiyosaki’s record: bold calls and shifting deadlines

Kiyosaki has built a reputation as a staunch supporter of Bitcoin, often describing it as a hedge against the perceived instability of fiat currencies. However, his predictions often undermine their credibility.

Earlier this year, Kiyosaki predicted that Bitcoin would reach $1 million by 2030, thanks to advances in AI. “AI is going to shake up the world of money,” he said, adding that the changes would be “scary.”

Last year, Kiyosaki claimed that the cryptocurrency would surpass $350,000 by August, but his still-bullish stance is not yet aligned with reality.

While Kiyosaki’s predictions lean toward the extreme, other crypto advocates and analysts predict equally significant growth. Arthur Hayes, co-founder of BitMEX, speculated that Bitcoin could eventually reach $1 million, citing long-term inflationary pressures.

Earlier this year, ARK Invest CEO Cathie Wood also predicted that Bitcoin could reach $1.5 million by 2030 in a bullish scenario, increasing her previous estimate of $1 million by 50% .

What Wall Street thinks

On Wall Street, the discourse around Bitcoin has taken on a more structured tone.

Bernstein Research, a leading investment firm, recently set its Bitcoin price forecast up to $200,000 by 2025, driven by institutional adoption, Trump and regulatory clarity, in particularly around Bitcoin ETFs.

According to Gautam Chhugani and Mahika Sapra, analysts at Bernstein, the cryptocurrency could surpass $500,000 by 2029 and $1 million by 2033.

Their thesis is rooted in the idea that regulated Bitcoin ETFs are key to bringing traditional capital into the crypto space and could account for 15% of “digital gold” demand by 2033.

“ETFs have created a watershed moment for crypto,” Bernstein analysts said, marking the start of Bitcoin’s broader integration into traditional financial portfolios.