The SEC and CFTC have announced that they will work more closely to regulate crypto markets. Bitcoin remained near its recent range following the news, suggesting traders view this as a change in context rather than something to trade on immediately.

It is also part of a broader shift in the United States toward clearer rules rather than resolving issues through legal proceedings.

What the SEC and CFTC actually announced

Simply put, the two main market regulators in the United States have agreed to communicate more and plan together.

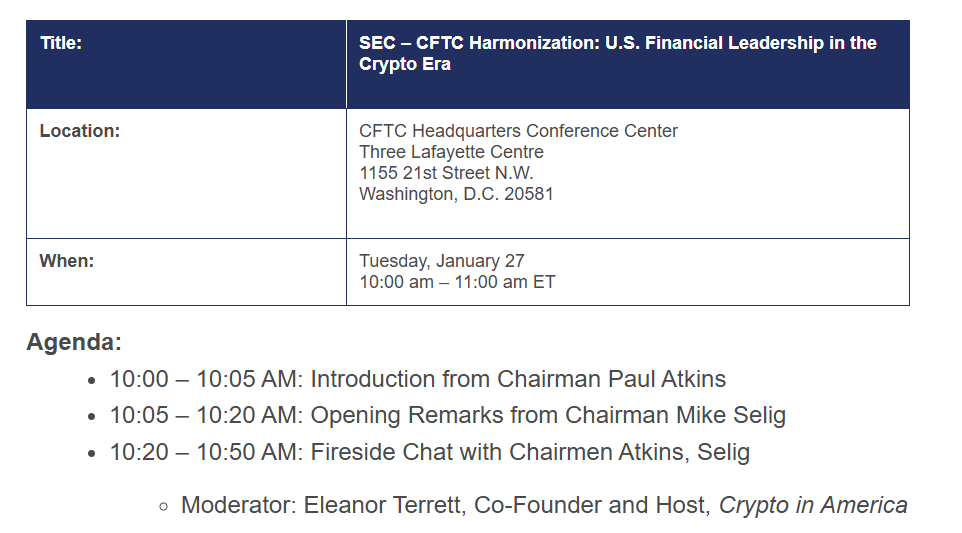

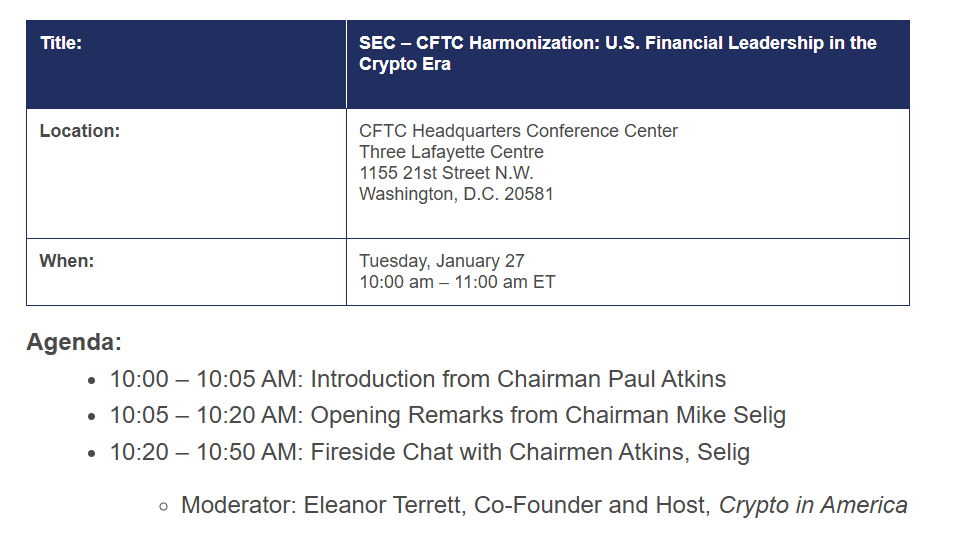

The Securities and Exchange Commission, which deals with stocks and other investments, and the Commodity Futures Trading Commission, which oversees things like gold and oil, said they would hold a harmonization event and coordinate future crypto oversight steps, according to the SEC.

NEXT WEEK: We are working in partnership with the @CFTC host a joint event on harmonization and American financial leadership in the crypto era.

The event, which will be held at CFTC headquarters, will be open to the public and broadcast live on our website.

– United States Securities and Exchange Commission (@SECGov) January 22, 2026

Crypto has been sitting between his responsibilities for years. This left exchanges and users uncertain who was actually in charge and this effort aims to reduce that guessing game.

DISCOVER: 9+ Best High-Risk, High-Reward Cryptocurrencies to Buy in January 2026

Why Clear Rules Help Everyday Users

When the rules are unclear, platforms become cautious. Exchanges delay listing new coins. The apps limit functionality for US users. This usually affects beginners first, as options diminish and protections become harder to understand.

Working together helps clear up this confusion. In 2025, the two agencies have already declared that registered exchanges can support certain spot crypto products, according to a joint statement from the services.

What this says about leadership in the United States

The SEC also established a dedicated crypto task force in 2025 to focus on drafting clearer guidance instead of relying on lawsuits. Markets tend to notice this kind of change in tone.

This cooperation also supports bills like FIT21, which attempt to clarify which types of cryptography fall under which regulator. These types of laws sound boring, but they decide where exchanges can operate and what kind of help users can get if they run into problems.

DISCOVER: Best new cryptocurrencies to invest in in 2026

Where risks still exist

Even with better coordination, gaps remain. Former CFTC Chairman Rostin Behnam said in early 2025 that the United States still does not have comprehensive digital asset coverage. This leaves room for scams and weak platforms.

For users, the basic security rules remain the same. Stick to well-known exchanges. Be careful with offers that promise easy profits. Clearer oversight is helpful, but it is no substitute for common sense.

As regulators align their approach, crypto is starting to look less chaotic and more supervised. This type of progress usually takes time to be reflected in prices, but it helps build the structure that long-term users rely on.

DISCOVER: More than 20 next cryptocurrencies that will explode in 2025

Follow 99Bitcoins on X for the latest market updates and Subscribe on YouTube for the daily expert market Analysis

The post SEC, CFTC Set to Work Together on Crypto Oversight appeared first on 99Bitcoins.