The United States Securities and Exchange Commission (SEC) has approved the first-ever exchange-traded funds (ETFs) to offer combined exposure to Bitcoin and Ethereum, opening new avenues for investment products in digital assets and potentially paving the way for future multi-asset funds. .

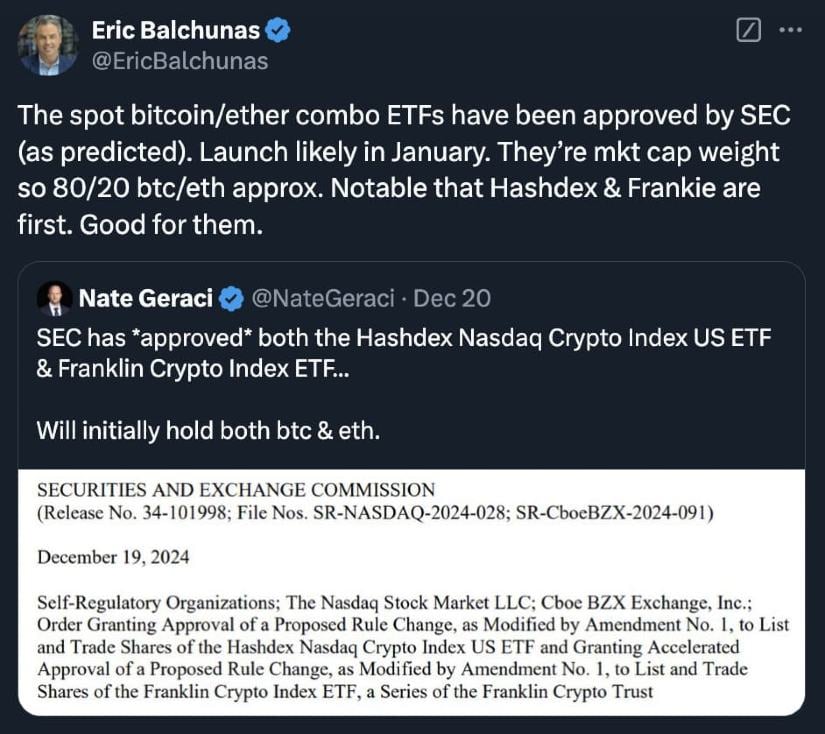

The regulatory green light, granted after several extensions and delays since June, will allow Nasdaq to list the Hashdex Nasdaq Crypto Index US ETF and the Cboe BZX Exchange to list the Franklin Crypto Index ETF. Both are expected to launch early next year, according to industry analysts. Unlike previous single-asset crypto ETFs, these funds will hold Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, with the initial allocation expected to hover around 80% Bitcoin and 20% Ethereum.

Funds must comply with continuous listing requirements, maintain transparency of their portfolio securities, and adhere to measures to prevent fraud and manipulation. Enhanced monitoring and sharing arrangements involving the sharing of trading data between exchanges were a key part of the regulator’s approval calculus, ensuring market integrity and investor protection.

An active crypto ETF landscape

The approval comes amid an increasingly active crypto-ETF landscape in the United States. BlackRock’s spot Bitcoin ETF, known as IBIT, currently leads the market with approximately $56 billion in assets under management (AUM) and daily volumes exceeding $4.4 billion. Fidelity’s FBTC and Grayscale’s GBTC follow closely, each managing around $20 billion in assets under management. Recent data from Coinglass indicated net outflows of around $671 million on December 19 among major funds, highlighting the fluid nature of investor sentiment.

Still, industry observers say dual Bitcoin-Ethereum products could attract a new wave of participants. Nate Geraci, president of ETF Store, noted that financial advisors value diversification, especially in an emerging asset class, and that a combined product provides a more balanced gateway into crypto.

Eric Balchunas, senior ETF analyst at Bloomberg, predicts a likely launch as early as January, noting that the fund’s holdings will be weighted by free float market capitalization, thus closely aligning them with actual market conditions.

Source: X

The SEC’s decision may also reflect a comfort level with cryptocurrency markets now considered to have “a regulated market of significant size,” often illustrated by correlations with exchange-traded Bitcoin futures on the Chicago Mercantile Exchange (CME). Surveillance sharing agreements, designed to flag suspicious trading patterns and deter manipulation, were at the heart of the regulator’s approval. This approach indicates that as long as products meet established commodity trust standards, more complex multi-asset crypto ETFs may be feasible in the future.

A Solana ETF?

The two-asset authorization follows Grayscale Investments’ recent filing to convert its Solana Trust into a cash ETF, suggesting a broader industry push to expand beyond single-asset offerings. Analysts say the SEC’s latest action portends a more receptive environment for innovation, potentially paving the way for funds featuring other cryptocurrencies like Litecoin or Hedera Hashgraph (HBAR) in the future.

The filings by Hashdex and Franklin Templeton referenced the changing appetite for digital assets as well as the efficiencies achieved by investing through a single regulated product. Observers believe these pioneering ETFs could serve both retail investors and institutions, simplifying entry into crypto markets that once required more complex custody and security measures.