Main to remember

- The SEC has recognized the modified file of Grayscale to convert its large capitalization fund to an Crypto ETF.

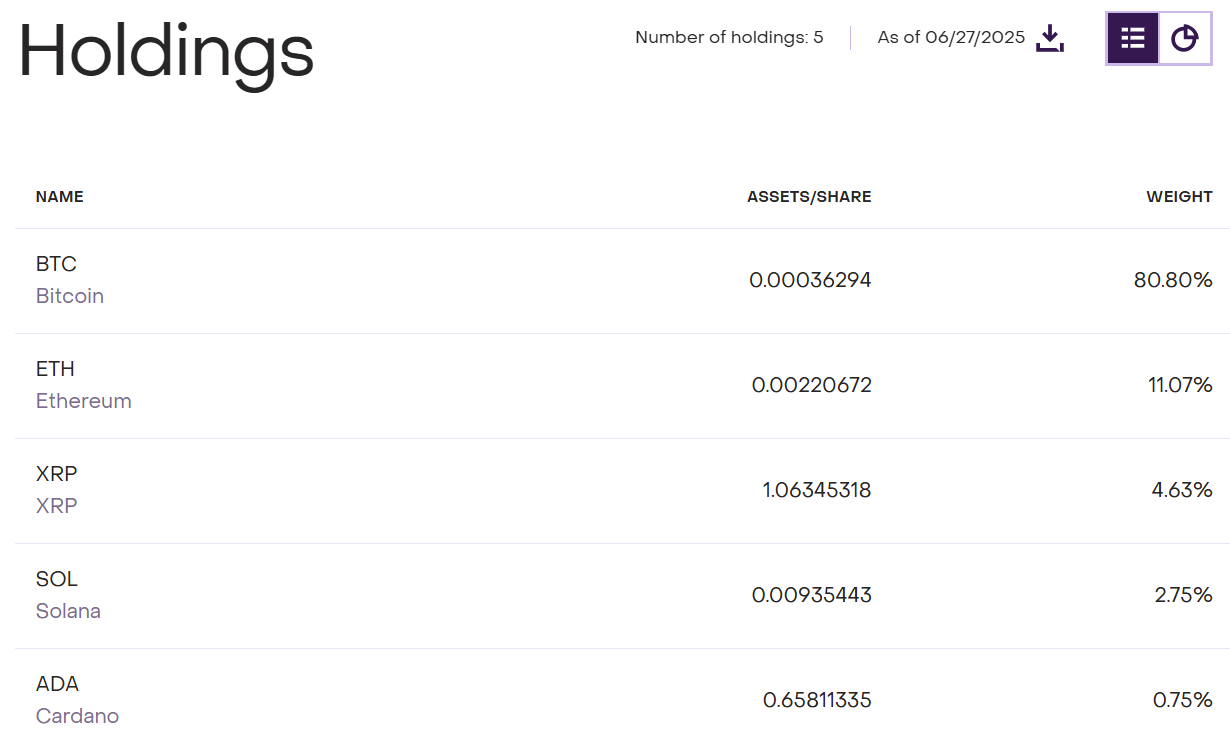

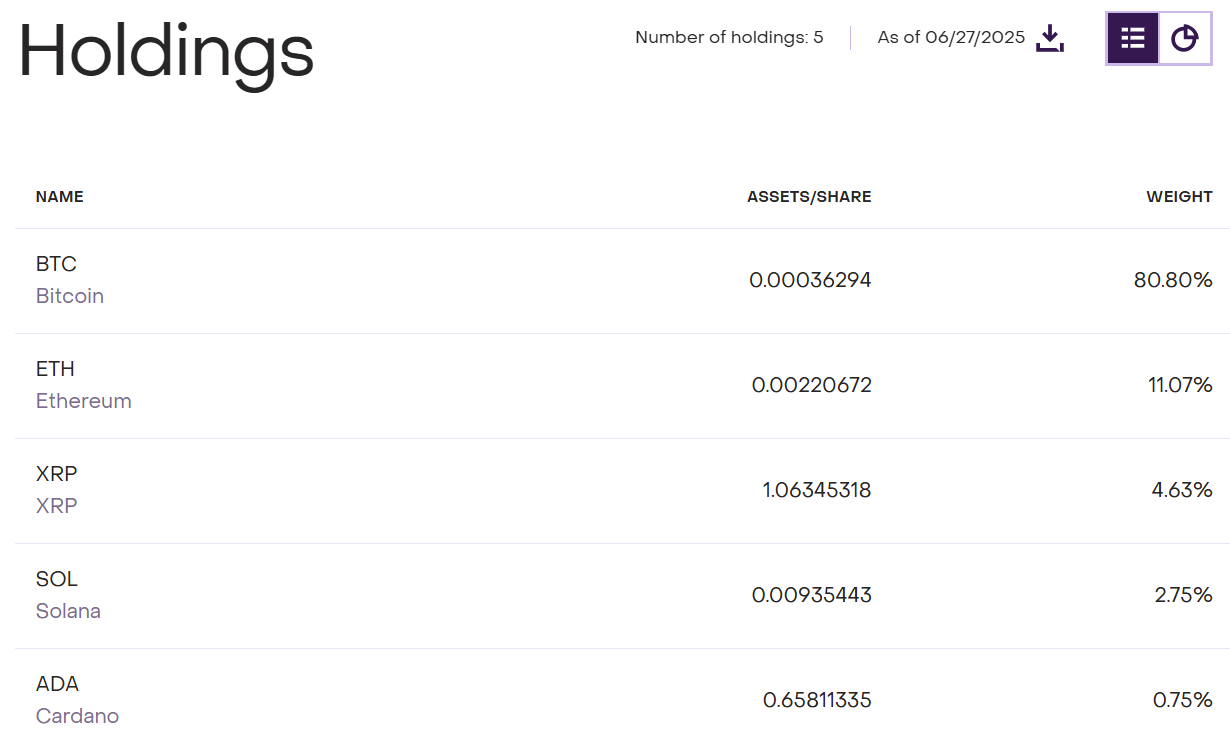

- The proposed ETF will follow the great cryptocurrencies, including BTC, ETH, XRP, Sol and Ada.

Share this article

The United States SEC has until Wednesday, July 2 to reign at Graycale’s request to convert its digital fund of large capitalization (GDLC) into a negotiated product in exchange (ETF), previously noted the analysts of Bloomberg ETF.

The Graycale GDLC fund is designed to follow a mixture of five main cryptographic active ingredients, with the Bitcoin volume (80.8%) and the rest is spread over Ethereum (11.07%), XRP (4.63%), Solana (2.75%) and Cardano (0.75%).

As of June 27, the fund had nearly $ 762 million in management under management, according to an update on the Grayscale website.

The S-3 revised Graycale file to convert GDLC to ETF Spot was recognized on Monday by the SEC.

Recognition occurs in the middle of an increased activity in the Crypto ETF space, the SEC currently evaluating several cryptography applications in cash of the main financial institutions. The deposit represents the latest grayscale efforts to extend its cryptographic investment offers beyond its flagship Bitcoin and Ethereum Trust products.

According to the president of the store ETF, Nate Geraci, the amendment reflects the continuous commitment of the dry with the gray levels concerning his proposed conversion of the GDLC fund.

Final deadline for dry this week on Grayscale Digital Large Cap Etf (GDLC)…

Contains BTC, ETH, XRP, Sol, & Ada.

Think * high probability * This is approved.

Would then be followed later by the approval of individual spot ETF on XRP, soil, ADA, etc.

– Nate Geraci (@nategeraci) June 29, 2025

Geraci thinks there is a good chance that the dry will be green. If GDLC is approved, it could open the way for punctual ETFs to a single asset linked to XRP, Solana, Cardano and others, which are subject to a larger examination calendar.

Share this article