- At press time, Sei had an optimistic short-term view.

- Volume indicators issued a warning that the highest levels might not be reached.

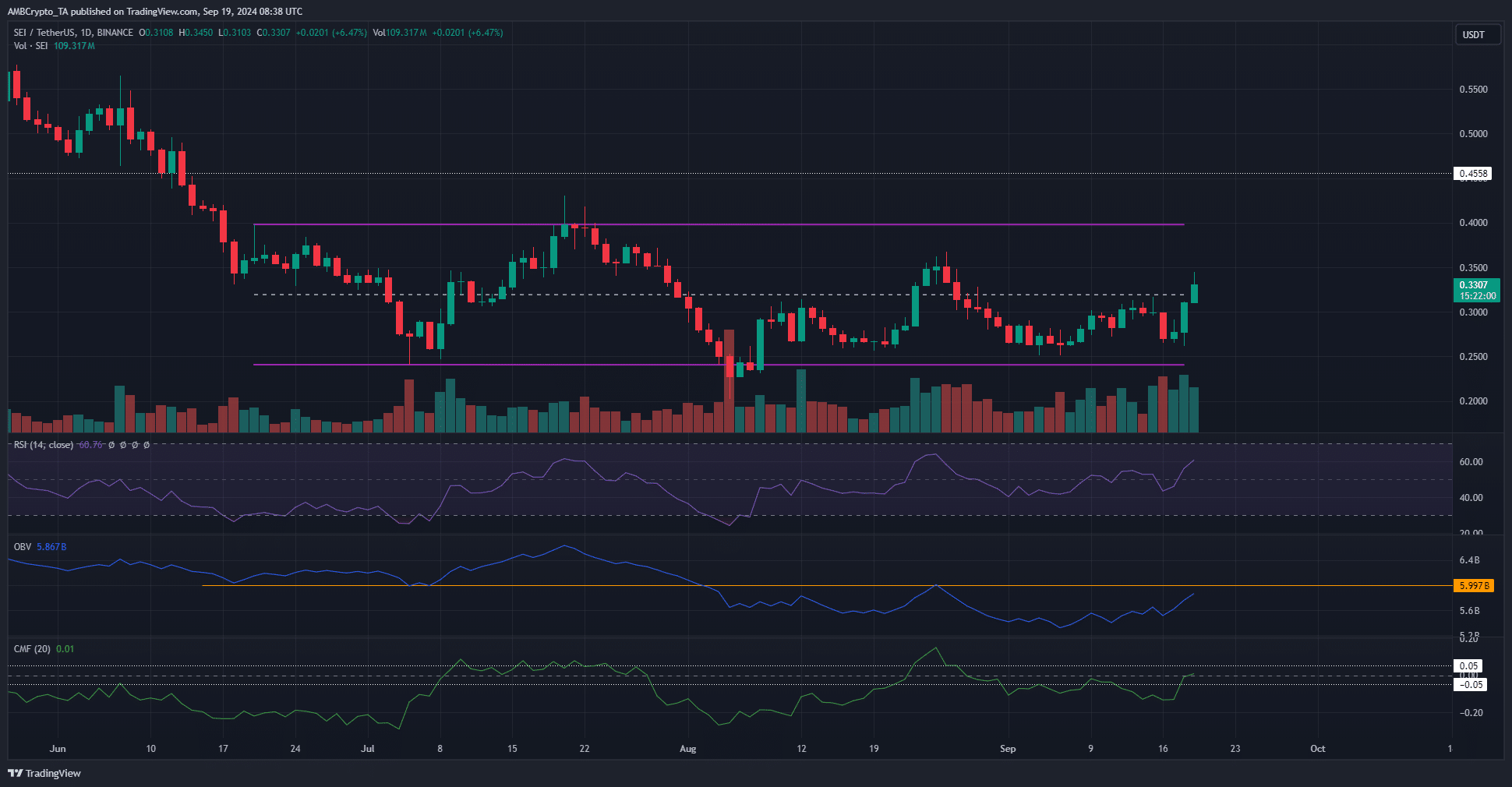

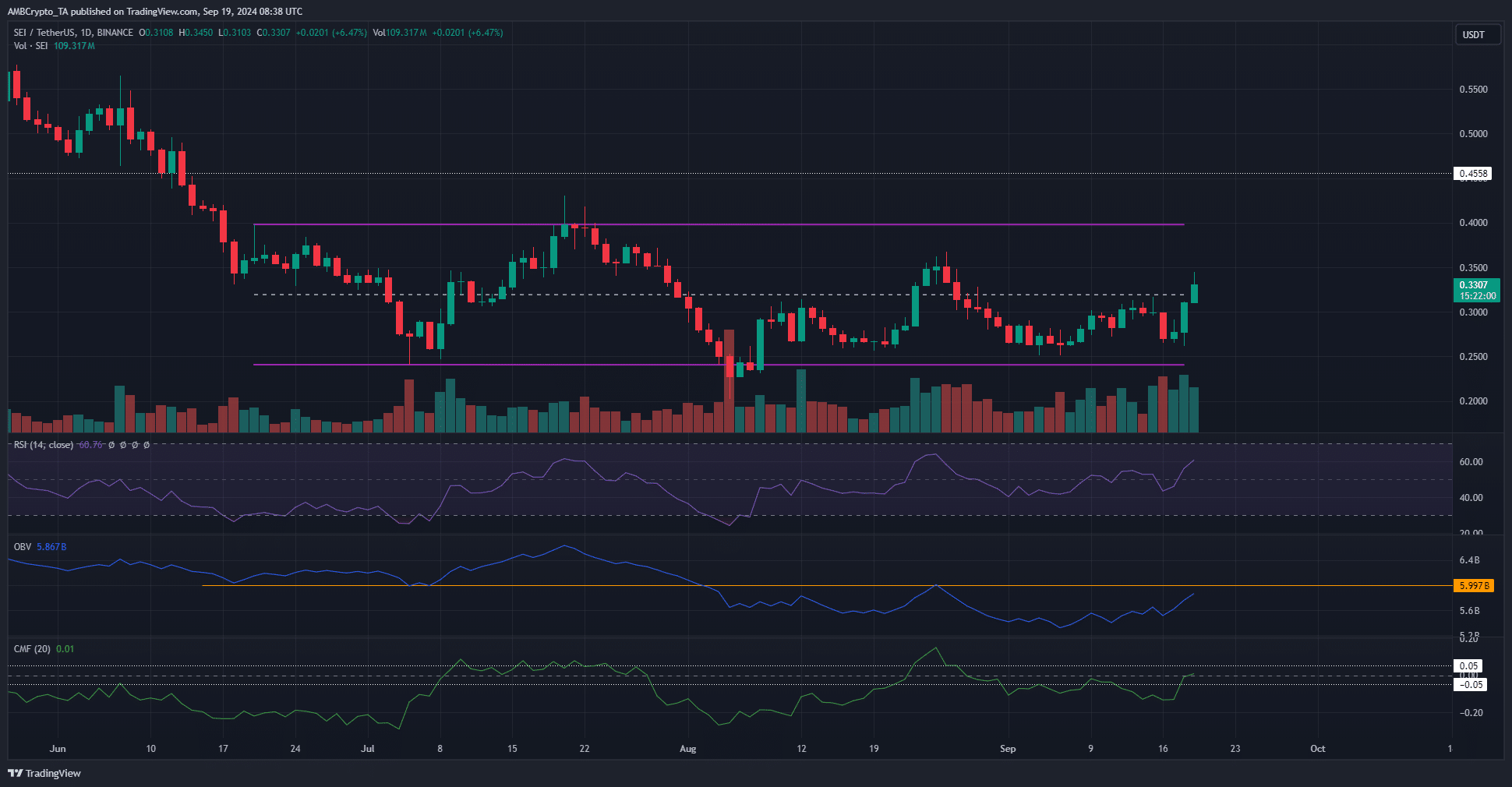

At the time of publication, Sei (SEI) was trading in a range of $0.242 to $0.4. The middle resistance at $0.32 was tested as resistance on September 15, but the bulls failed to break above this area.

This changed on September 19. Although the day’s trading session is not over yet, the resistance has been broken and the SEI crypto has a good chance of moving back up towards $0.4.

SEI Crypto Volume Indicators Advocate Caution

Source: SEI/USDT on TradingView

Price action on the daily chart was bullish. The price rebound from the local support zone of $0.262 was rejected at the median level, but a few days later the upward momentum was winning again.

The daily RSI has moved back above the neutral 50, indicating that buyers have been dominant in recent days. However, the OBV and CMF have failed to give a buy signal.

The OBV has yet to reach the local highs it reached towards the end of August. Until it breaks above that level, the $0.35 resistance is likely to push the bulls back.

Similarly, the CMF was at +0.01 and did not yet indicate significant buying pressure.

Not all magnetic basins will be retested

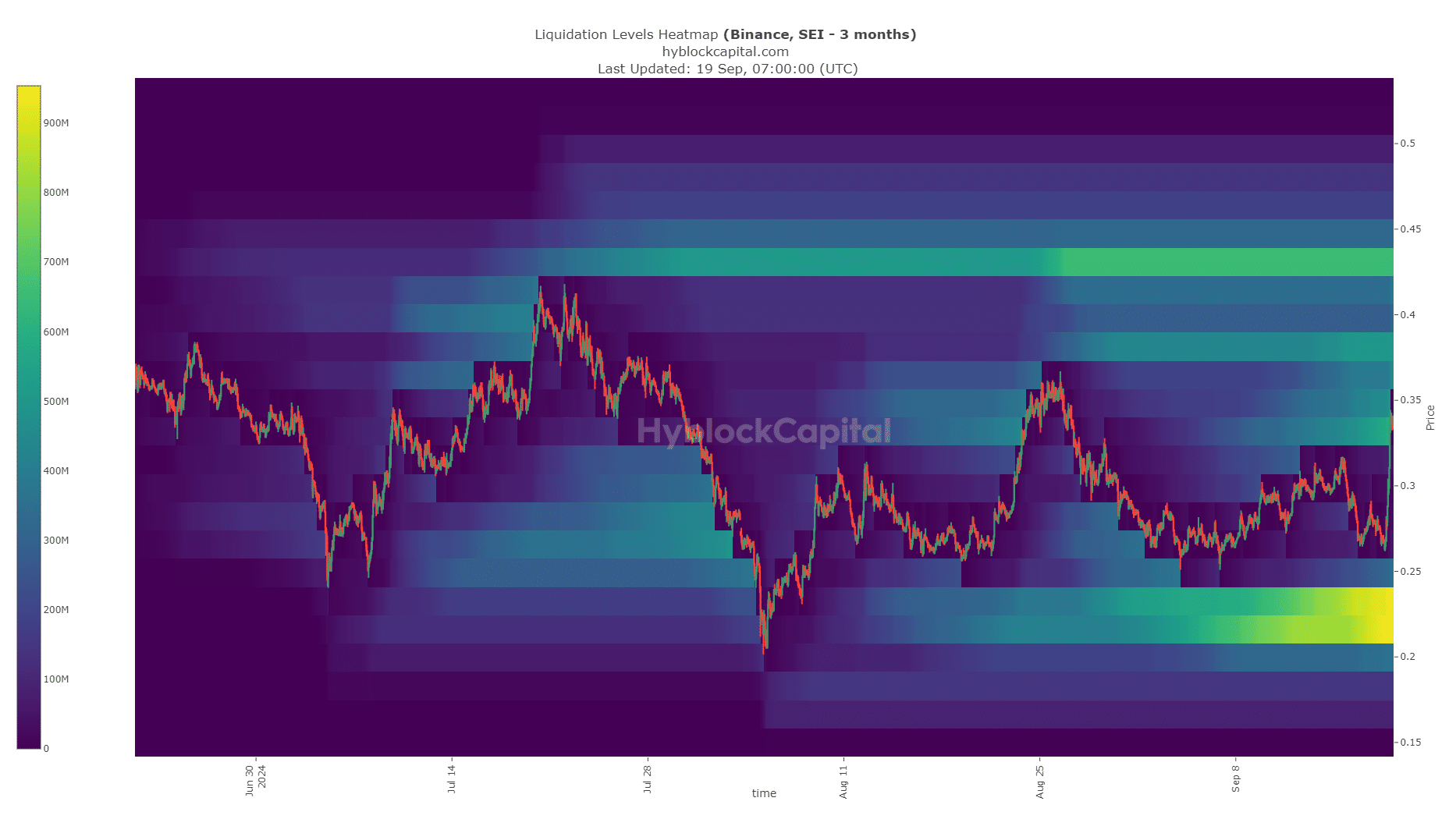

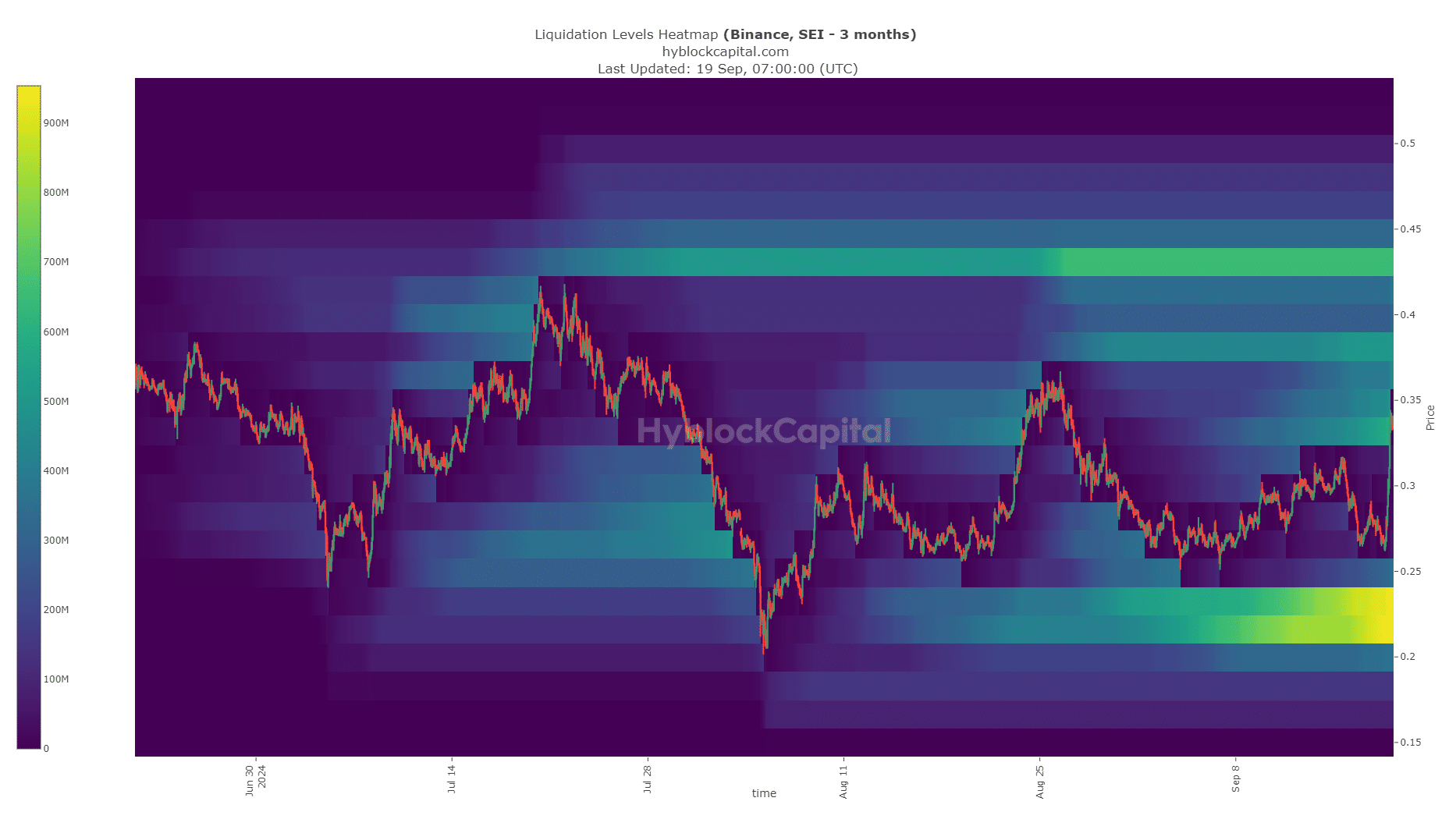

Source: Hyblock

AMBCrypto analyzed Hyblock’s liquidation heatmap data and discovered an intense pool of liquidity spanning from $0.216 to $0.232.

A few days ago, especially with the lack of upward momentum in the SEI crypto, it seemed likely that this area would be revisited.

Realistic or not, here is SEI’s market cap in terms of BTC

Instead, the Fed’s decision to cut rates by 50bps had a positive effect on Bitcoin (BTC), which in turn boosted sentiment behind SEI.

This price bounce means that the $0.43 liquidity pocket was the next magnetic zone for prices.

Disclaimer: The information presented does not constitute financial, investment, trading or other types of advice and represents the opinion of the author only.