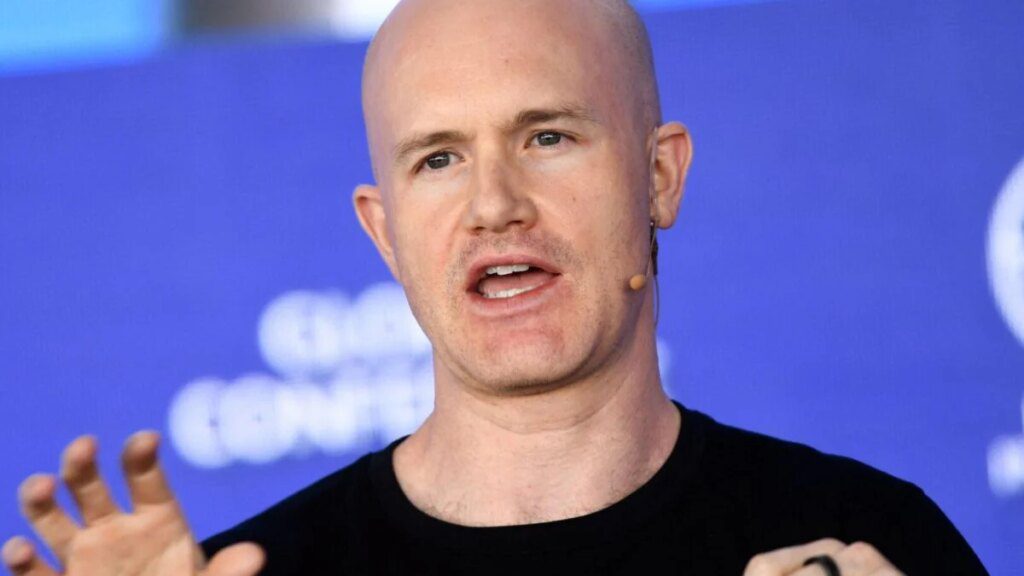

The Senate Banking Committee late Wednesday delayed final discussions around a bill aimed at creating greater regulatory clarity for crypto in the United States, aptly known as the Clarity Act. The decision came as Coinbase CEO and deep-pocketed political donor Brian Armstrong went public with his complaints about the bill.

The Senate Agriculture Committee had also already postponed its debates on its version of the bill until January 27. Both committees were initially expected to make annotations to their respective versions of the bill on Thursday.

Once finalized, the two versions will be combined and voted on by the full Senate. The House already passed its version of the Clarity Act last year, so the bill would be sent directly to President Trump’s desk for his final signature once passed by the Senate.

Notably, the Senate Banking Committee’s decision to push back deliberations on the Crypto Market Structure bill came after Coinbase CEO Brian Armstrong shared his disapproval of the Senate Banking Committee’s proposed bill on X. “We appreciate all of the hard work of the members of the Senate to achieve a bipartisan outcome, but this version would be far worse than the current status quo,” Armstrong said. “We’d rather have no bill than a bad bill. Hopefully we can all come up with a better bill.”

Armstrong later added that he is optimistic that a better bill can be put together, and Coinbase will continue to work with everyone to make that happen. According to a report from Wall Street firm Benchmark, Armstrong’s decision may be more of a negotiating tactic than anything else.

After reviewing the Senate Banking Bill over the past 48 hours, Coinbase unfortunately cannot support the bill as written.

There are too many problems, including:

– A de facto ban on tokenized actions

– DeFi bans, giving the government unlimited access to your finances…–Brian Armstrong (@brian_armstrong) January 14, 2026

Coinbase and others in the crypto industry are seeking regulatory clarity from the federal government regarding crypto because they believe it has not been provided by the Biden administration. Former SEC Chairman Gary Gensler is generally considered a villain among many crypto proponents because the SEC’s policy under his reign was in fact that every crypto asset except bitcoin operated as an unregistered security. That said, this position reversed sharply towards the end of Biden’s term, when exchange-traded funds for Ethereum were approved.

The new bill’s main areas of focus for the crypto industry include tokenization of stocks and other traditional assets, clear guidelines on when a crypto asset is considered a security, and protection for developers who fail to take custody of their users’ assets. While stablecoins received more clarity from the GENIUS Act last year, traditional banks now want these guidelines changed so as not to put themselves at a competitive disadvantage to the emerging crypto sector.

Indeed, according to CoinDesk, members of Congress are effectively dealing with competing lobbyists from the crypto industries and traditional banks and trying to find a way to make everyone happy. According to Open Secrets, the crypto lobby pumped $133 million into the 2024 election cycle in an effort to gain more favorable regulation from Washington, and now it’s time for the industry to get a return on that investment.

I have spoken with leaders in the crypto industry, the financial sector, and with my Democratic and Republican colleagues, and everyone is staying at the table and working in good faith.

As we take a brief pause before moving on to a mark-up, this market structure bill reflects months of…

– Senator Tim Scott (@SenatorTimScott) January 15, 2026

Developer protection is an area of interest for crypto users, particularly those who are philosophically aligned with the original philosophy of decentralization and permissionless finance that underpinned the original creation of Bitcoin. The developers behind the privacy-focused Bitcoin wallet Samourai Wallet were recently sentenced to four and five years in prison for developing software that allowed users to mix their bitcoin with others in an attempt to hide the origin of the funds.

While the former CEO of crypto exchange Binance received a pardon from President Trump for a sentence related to his involvement in relaxing anti-money laundering standards at his exchange, the developers of Samourai Wallet have yet to receive similar treatment from the president. Notably, the Binance CEO pardon was described as unprecedented corruption by a former DOJ official due to Binance’s ownership of a Trump-affiliated stablecoin known as USD1, which effectively generates tens of millions of dollars in revenue for the stablecoin issuer. The lack of pardon for the developers of Samourai Wallet so far creates an awkward situation for the president due to the optics in the context of the pardon of the former CEO of the crypto exchange. That said, President Trump previously said he would explore a possible pardon for Samourai Wallet developers.

The potential lack of protection for non-custodial wallet developers in the proposed crypto regulation bill has been a concern for a few months now. And the potential lack of such protections, in addition to the lack of a de minimis tax exemption for bitcoin payments, would further support the argument that Trump’s election primarily empowered large crypto institutions (and himself) rather than individual users involved in the so-called democratization of finance.

For now, the nonprofit cryptocurrency advocacy group Coin Center said, “While a small number of issues remain…we are very encouraged by the tremendous progress the Senate banking system has made.”