A company listed at NASDAQ has just moved to put its stock on Ethereum on the same day, Ether slipped below $ 4,000 in the middle of a new wave of liquidation.

Sharplink Gaming (Nasdaq: Sbet) announcement On Thursday, he will be token his ordinary actions recorded on the dry on the Ethereum blockchain, becoming the first American public company to issue equity over Ethereum natively.

This decision, in partnership with the superstate of Robert Leshner, comes when the Ethereum price fell below $ 4,000 on September 25.

The Gaming and Technology Company based in Minneapolis aims to test secondary trading in accordance with token actions on automated market manufacturers (AMMS).

Superstate will serve as a digital transfer agent of Sharplink as part of the agreement, while his “opening bell” platform will manage the chain program.

“Sharplink’s equity tokenization directly on Ethereum is more than a technical step, this is a declaration on the place where we think that the future of the world capital markets is directed,” said Joseph Chalom, the Sharplink CO-PDG.

Robert Leshner, founder and CEO of superstate, described the launch of “milestone” and declared that the company planned to work together to allow the trading of token public actions.

This development underlines how traditional companies experience blockchain infrastructure at a time when the cryptography market is under pressure. Ethereum is faced with a renewed sale pressure below the key levels.

Why did Ethereum drop below $ 4,000 in the middle of heavy liquidations?

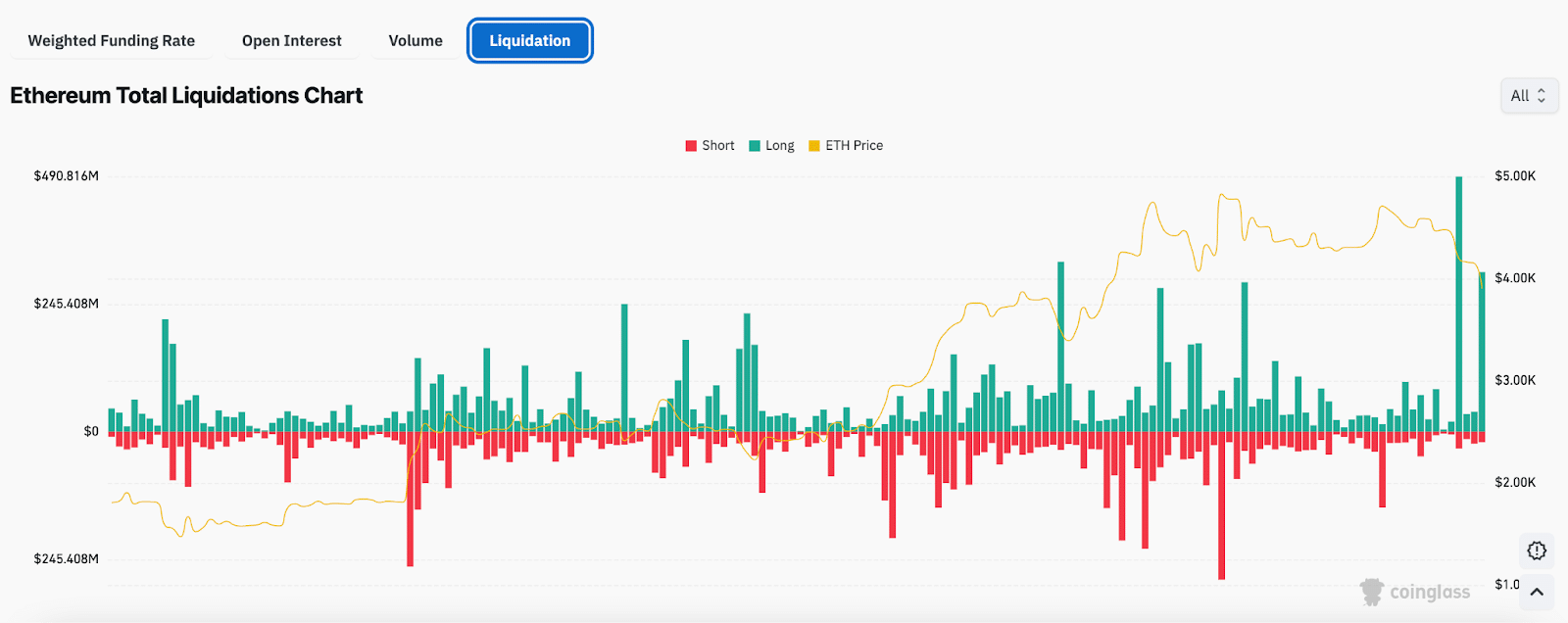

Ether fell below $ 4,000 on Thursday, while the derivative markets saw a fort taking place.

Rinsing data Shows that during the last 24 hours, long traders have been faced with around $ 332 million in liquidations, which increased to almost $ 718 million this week.

(Source: Coringlass))

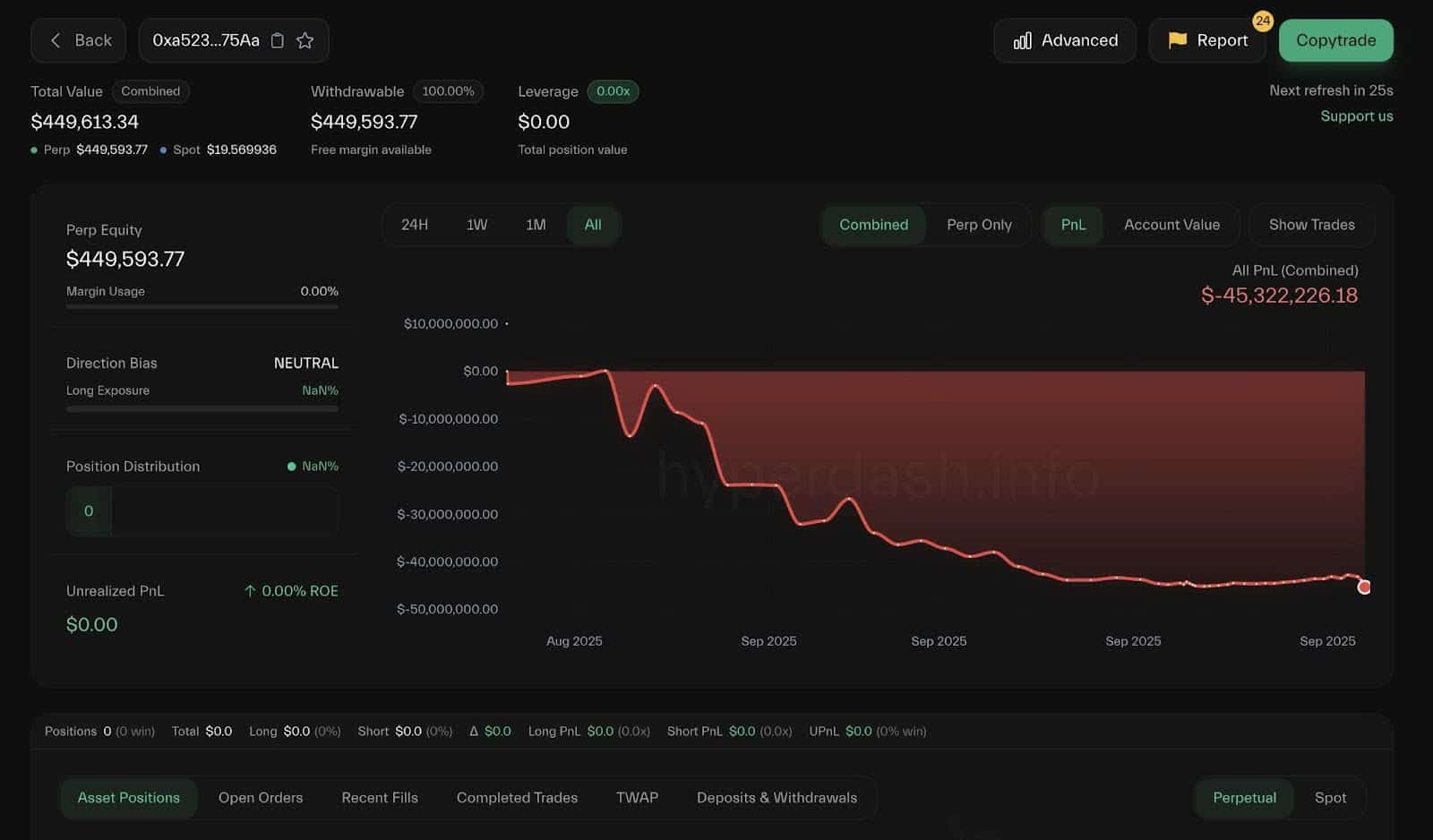

According to Lookonchain The data, a large portfolio, “0xa523”, took a single blow of $ 36.4 million.

ETH has just fallen below $ 4,000!

The largest loser, 0xa523, has just been wiped.

Son 9,152 whole $ ETh($ 36.4 million) The long position was completely liquidated.

Its total losses now exceed $ 45.3 million, leaving it less than $ 500,000 on its account. pic.twitter.com/jplqjl0cpy

– Lookonchain (@lookonchain) September 25, 2025

The graphics now suggest that ETH could review the range from $ 3,600 to $ 3,400 if the pressure continues.

At the same time, Sharplink goes ahead with an unusual experience: the equity of dry tokenization directly on Ethereum.

Source: X

The plan tests if the regulated actions can be held in self-slip portfolios and have finally negotiated automated merchants without violating the securities rules.

The company claims that the effort aims to “modernize the flows of capital” and to link its activities closer to the financial infrastructure of Ethereum.

Sharplink has also built an ETH treasure since June. It holds more than 838,000 ETH and won more than 3,800 ETH in stimulating awards at the end of September.

A Bitget note this week said The company collected 509 ETH in marketing the awards last week, without new purchases or buyouts, a sign that it focuses on the management of the treasure because it develops market tools on the channel.

Beyond Ethereum, new infrastructure works are continuing in the sector.

A block feature highlighted the push of the goat network for a 2 bitcoin layer using zero knowledge rollers, showing how technology scope is propagated to provide faster and wider complaint.

DISCOVER: 9+ best high -risk crypto and reward to buy in October 2025

Price prediction Ethereum: Can ETH price recover above $ 4,000 after high sales pressure?

The Sharp d’Ethereum removal attracted two contrasting hopes but full of hope on X.

Analyst Crypto Merlijn the merchant said ETH slipped around 16% of recent summits, landing what he calls a familiar “purchasing zone”.

$ ETh Bleed!

But look more closely: this is the exact purchasing area that we have torn the last time.

Panic of weak hands.

Strong hands of hands.We have already seen this manual

This is where massive gains are secure. pic.twitter.com/lxst5suaet– Merlijn the trader (@merlijntrader) September 25, 2025

Its graph shows the token testing the mobile average at 100 days (100 mA), a level that previously marked strong rebounds.

(Source: X))

He argued that if short -term traders can panic, long -term holders could consider this correction as a chance to accumulate. “Low hands panic. The load of strong hands,” he said, adding that a rebound in this area has led to a significant gathering.

Despite recent volatility, the ETH remains above its 50 MA and 100 MA, which suggests that the wider rise trend is still intact.

Meanwhile, Mister Crypto highlighted A different signal: an upward divergence between the price of Ethereum and the relative force index (RSI).

Haussier divergence on $ ETh! pic.twitter.com/6kllvw1whc

– Mister Crypto (@mistercrypto) September 25, 2025

ETH recently fell below $ 4,000, printing lower stockings, while the RSI has increased levels of occurrence around 27.37.

He said that the divergence often marks the end of a sale and the start of a rescue rally.

(Source: X))

If Momentum holds, Eth could try to retest the resistance nearby, although the analysts have warned that the wider feeling will decide if the rebound sticks.

Together, the two analyzes supervise the current fall as a possible turning point: one suggesting an accumulation of patients, the other pointing towards a technical configuration for a rebound.

DISCOVER: Best ICO ICO even to invest in 2025

Join the 99Bitcoins News Discord here for the latest market updates

The Post Sharpbet is playing the tokenization of actions while ETH Price loses $ 4,000 compared to 99Bitcoins.