Sharps Technology shares jumped 70% on Tuesday after the company announced a historic finance agreement of $ 400 million to build what it claims to be the largest Treasury in Solana (Sol) in the world.

This decision marks one of the most daring bets of the company on a blockchain -based treasury strategy and indicates increasing institutional confidence in the role of Solana as a layer of financial infrastructure.

The financing, structured as a private investment in public equity (PIP), brings together heavy donors, in particular Parafi, Pantera Capital and Monarq Asset Management.

The transaction, at a price of $ 6.50 per unit with stapled mandates exerted at $ 9.75, is expected to close on August 28 pending customary approvals. Some investors have also received preferred mandates to exercise once the agreement is ending.

Sharps Technology Eyes Leadership in Blockchain Finance with $ 400 million Solarna Play

In the announcement, the company noted that the product will also go for general purposes and a working capital, but the main objective remains establishing a large -scale soil treasure to capitalize on the growth of the network.

As part of the plan, sharp objects signed a memorandum of understanding with the Solana Foundation to buy for $ 50 million in a discount of 15% compared to the average market price of 30 days. The agreement shows a close alignment between the company and the Foundation while Solana continues to position itself as the blockchain of choice for institutional quality applications.

“Solana defines the standard for digital infrastructure, offering a layer of high -cost, low -cost and real -time regulation for everything, from first -rate actions to obligations to private assets,” said Alice Zhang, chief investment chief and member of Alice Zhang’s board of directors, Sharps Technology.

Zhang stressed that the time of the decision reflects the acceleration of Solana’s institutional adoption because it is positioned as the backbone of a global digital market.

To strengthen its position in the ecosystem, sharp objects also brought James Zhang, co-founder of Jambo and a leading figure from the Solana community, as a strategic advisor.

James spoke to Solana Breakpoint, Davos and Forbes events and described Solana as “Internet capital markets, the next evolution in global finance”.

James noted that Solana is currently leading all the big blockchains in the ignition yield, the chain revenues and the applications revenues, the yields of stimulum oscillating about 7%. “We believe that the creation of a treasure of digital assets will generate an important long-term value for shareholders of Sharps object technology,” he added.

Sharps, Galaxy, Defi Corp lead $ 1.5 billion + wave in the offers of the Solana Treasury

The shooting agreement comes in the middle of an intensification race for Solana treasury bills, with Mike Novogratz Galaxy Digital leading a separate $ 1 billion offer alongside Jump Crypto and Capital Multicoin.

Earlier in the day, companies were in advanced talks to lift around 1 billion dollars to acquire soil, with Cantor Fitzgerald as a main banker.

The plan consists in creating a new cash company for digital assets by taking over a public entity, which would make it the largest treasure focused on Solana to date. Supported by the Solana Foundation, the agreement could conclude in early September, although none of the companies involved has commented.

Meanwhile, Defu Development Corporation announced an increase in actions of $ 125 million, becoming the first American public company to adopt a cash strategy focused on the accumulation of Solana. The offer, at a price of $ 12.50 per share, is expected to close on August 28, 2025.

Solana has climbed strongly this year, bouncing down from April to exchange nearly $ 200, up 6.6% in the last 30 days. The renewed activity of the network, the dynamics of the developers and a wave of corporate cash accumulation fueled overvoltage.

According to the Strategic Sol Reserve Tracker, nine entities now hold 6.05 million soil, worth 1.21 billion dollars, or 1.05% of the supply in circulation, the first five controlling almost all reserves.

Solana leads crypto ecosystems with revenues of $ 1.3 billion, 8.9b of transactions in 2025

The Haussier bet on Solana occurs while the network strengthens its position as one of the most occupied and liquid ecosystems in the crypto.

In the first half of 2025, the applications based in Solana generated $ 1.3 billion in income, more than any other channel. The activity on the network was just as strong, with 8.9 billion transactions treated in the last quarter, $ 6 billion in daily negotiation volume and an average of 3.8 million daily active portfolios this year.

The interest of developers also increases. More than 7,500 new manufacturers joined Solana in 2024, the fastest growth rate among large blockchains. On the financial side, stimulation yields oscillate approximately 7%, the highest among the main proof networks, which makes Solana increasingly attractive as an actor.

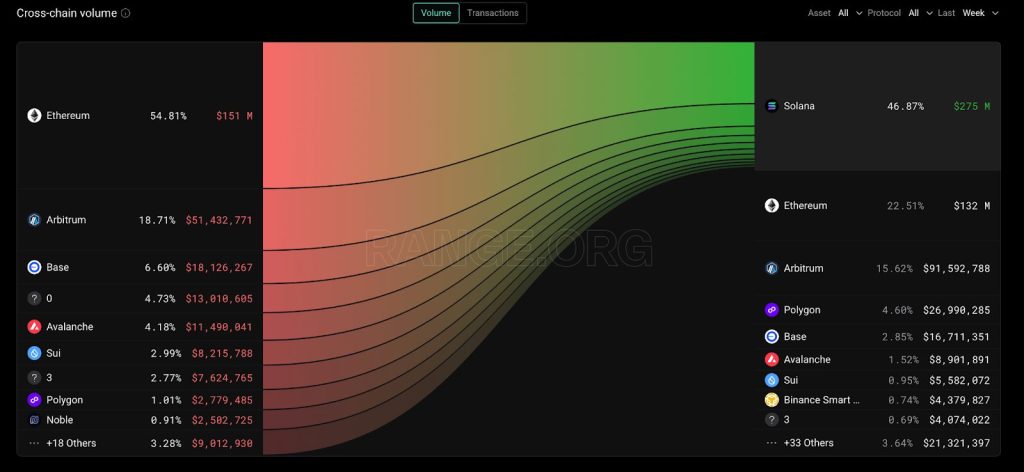

Capital is also underway. During last week, nearly $ 280 million was filled in Solana from other channels, including more than $ 155 million in Ethereum.

Solana Dapps now leads the daily income market, generating $ 6.06 million in the last 24 hours, ahead of a hyperliquid at $ 5.07 million and Ethereum at 3 million dollars.

Institutional interest maintains the pursuit. The FNB, ETPs and funds based in Solana recorded $ 12 million on entry last week, extending their sequence at 11 consecutive weeks, a net contrast with Bitcoin and Ethereum products, which experienced record outings of $ 1 billion and $ 440 million.

The Post Sharps Tech goes up 70% in turn after signing a Solana treasure agreement at $ 400 million – $ 1.5 billion in one day appeared first on Cryptonews.

NEW:

NEW: