- Shiba Inu burn rate spikes have historically only caused short-lived price increases

- Market sentiment highlighted slight optimism, but limited network growth could hamper sustained gains.

Shiba Inu (SHIB) The burn rate recently skyrocketed by a remarkable 254,078%, wiping out 5.63 billion tokens in a single day. However, despite this aggressive burn, SHIB only saw a modest 3.03% rise on the price charts. It was trading at $0.00001781 at press time.

Therefore, an urgent question arises: will this latest surge finally trigger a sustained rise in prices, or will it simply echo short-lived past gains?

Have previous burn rate spikes affected the price of SHIB?

Historically, Shiba Inu blight events have yielded mixed results for its price. According to AMBCrypto’s previous analysis, even significant burn rate spikes, such as a 6,700% increase seen earlier, have generally failed to create lasting momentum.

For example, a recent burn of over 324 million tokens sparked initial optimism. And yet, the rally quickly dissipated as sellers dominated. Therefore, while these events have sometimes fueled temporary gains, they rarely support upward pressure on SHIB.

SHIB Chart Analysis – What Does the Price Action Suggest?

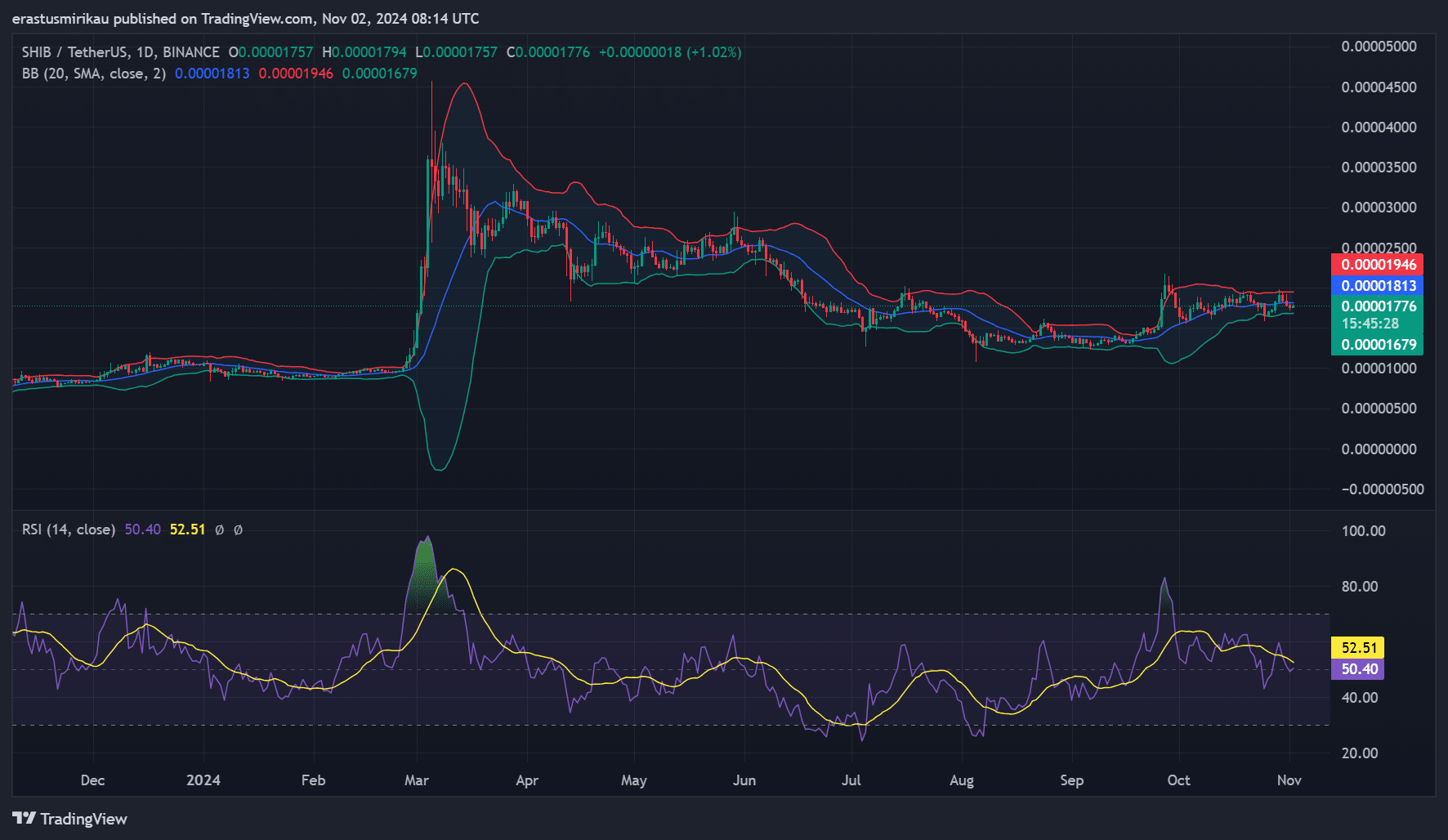

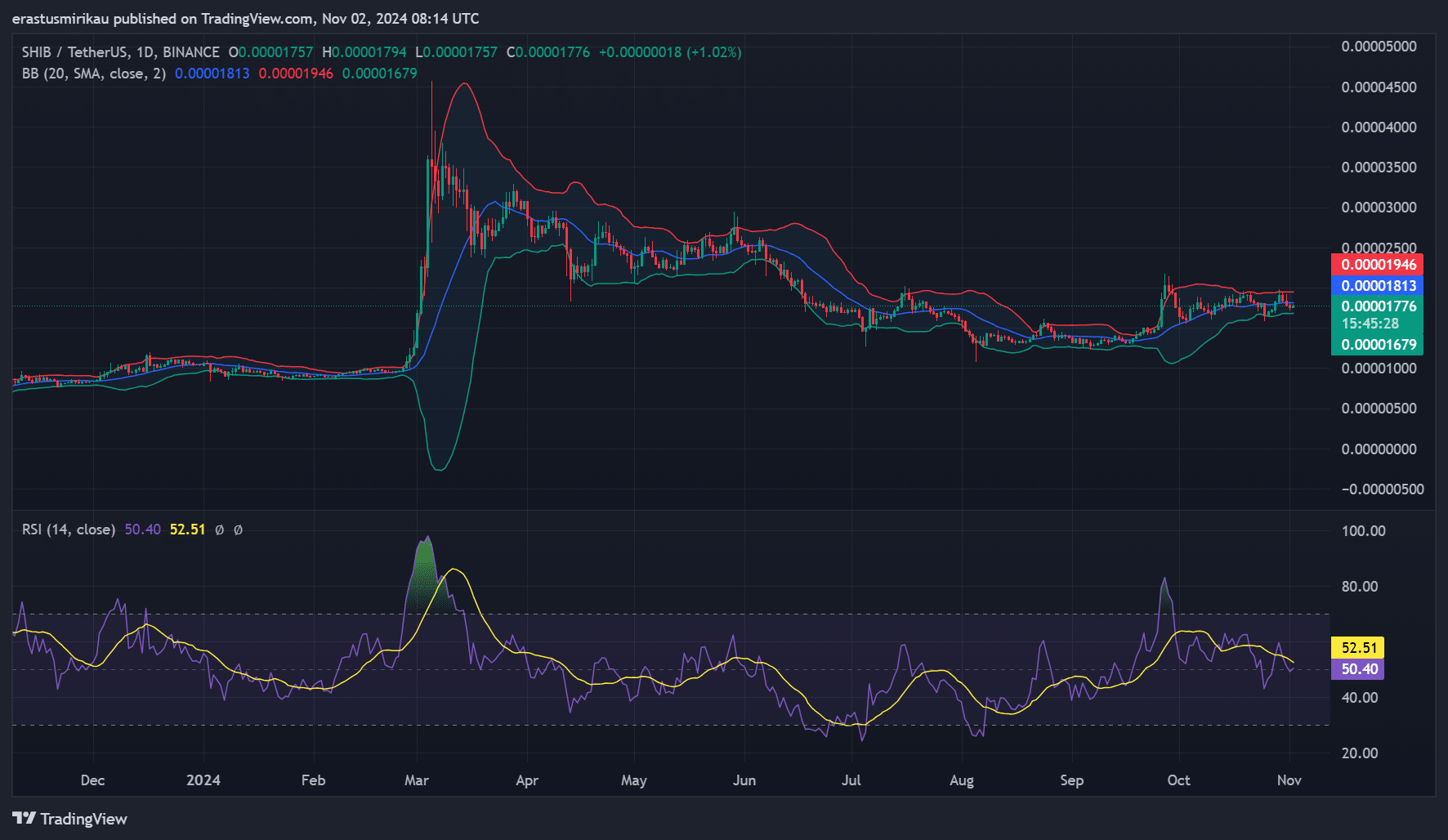

When analyzing SHIB’s charts, it became evident that price action remained relatively stable after the latest burn outbreak. At press time, SHIB was trading at around $0.00001776, with modest intraday fluctuations. The Bollinger Bands also revealed low volatility, suggesting limited price expansion.

Additionally, the RSI was positioned near 52.5, indicating a neutral position: neither overbought nor oversold.

This neutral technical setup seems to imply that despite the recent burn, SHIB does not have the buying momentum necessary to break through resistance levels or fuel a stronger upward trajectory.

Source: TradingView

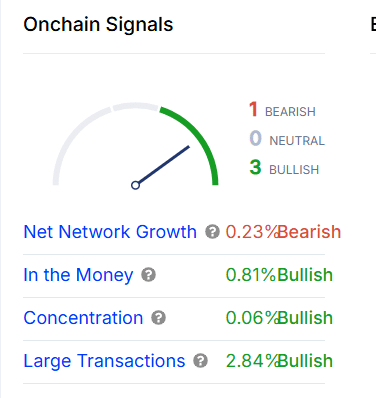

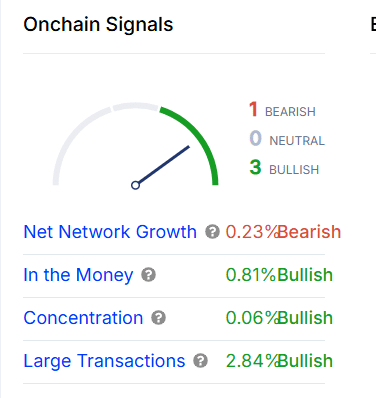

On-Chain Signals – Cautiously Bullish Outlook

Analysis of SHIB’s on-chain data revealed mixed, but slightly optimistic sentiment. In fact, key indicators were leaning toward a slight uptrend. For example, “In the Money” posted gains of 0.81%, while concentration increased slightly by 0.06% and large trades increased by 2.84%.

However, net network growth recorded a slightly bearish rating at -0.23%, indicating limited new address activity.

Therefore, while these indicators point to cautious optimism, the network’s lack of significant growth could constrain SHIB’s ability to sustain its gains.

Source: In the block

Market Sentiment – Open Interest Reflects Uncertainty

Finally, market sentiment around SHIB remains cautious, as evidenced by a 4.38% increase in open interest, which reached $47.37 million. An increase in OI often means increased commitment and potential future volatility.

However, the lack of strong price action alongside this rise suggests traders are still uncertain about a clear directional trend.

This cautious stance is consistent with historical trends whereby past peaks in burn rate had only a superficial impact on price.

Source: Coinglass

Is your wallet green? Check out the Shiba Inu Profit Calculator

Can this burn spark a lasting rally?

The latest wave of Shiba Inu burns demonstrated the community’s continued commitment to deflationary action. However, historical trends have revealed that fires alone rarely trigger lasting price increases for SHIB.

While an uptick in price and cautiously bullish on-chain data have highlighted the potential, the absence of solid purchasing power or a broader market shift will limit its impact.