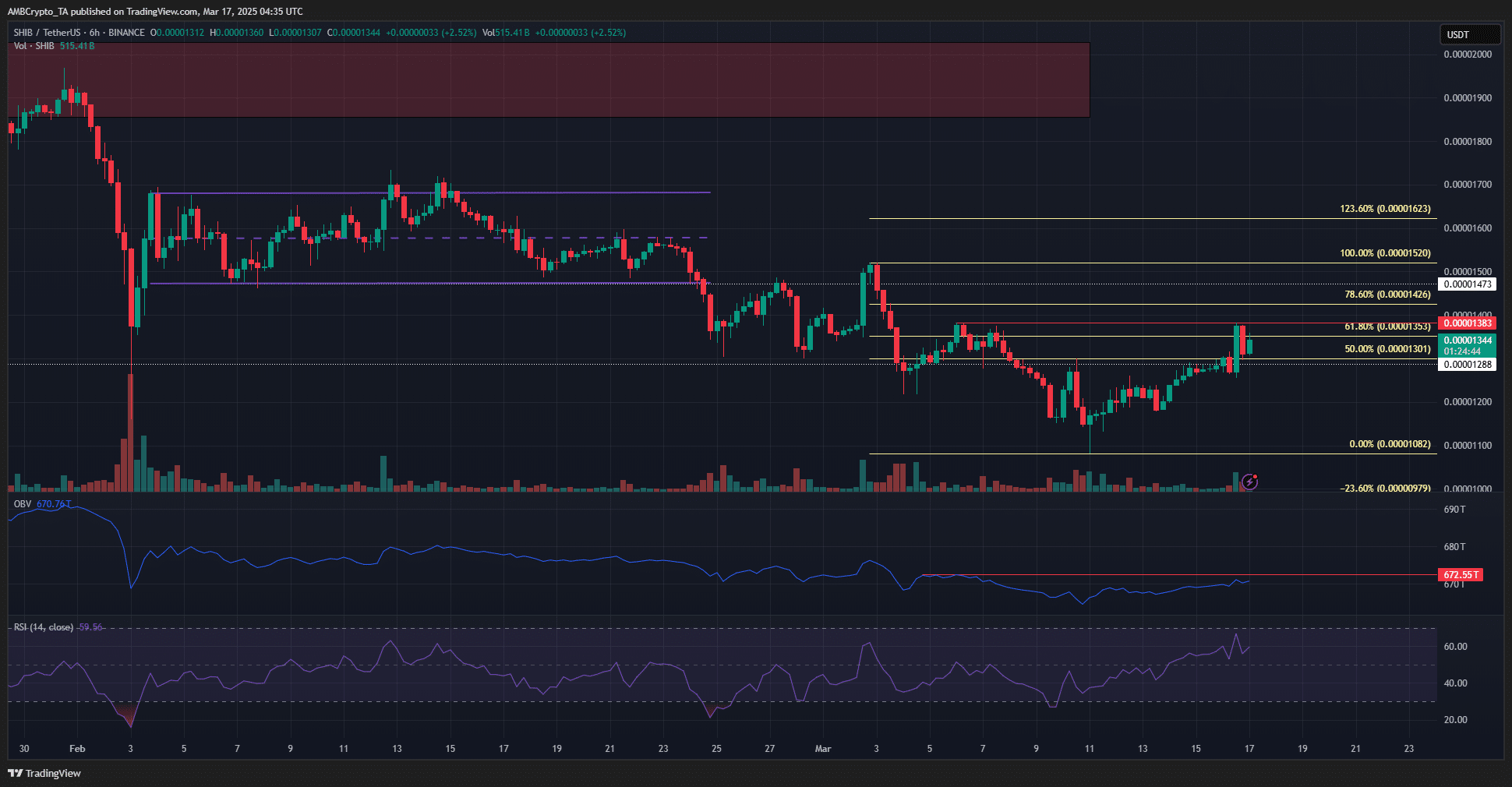

- The weekly action of Shiba Inu presented a highly lower bias.

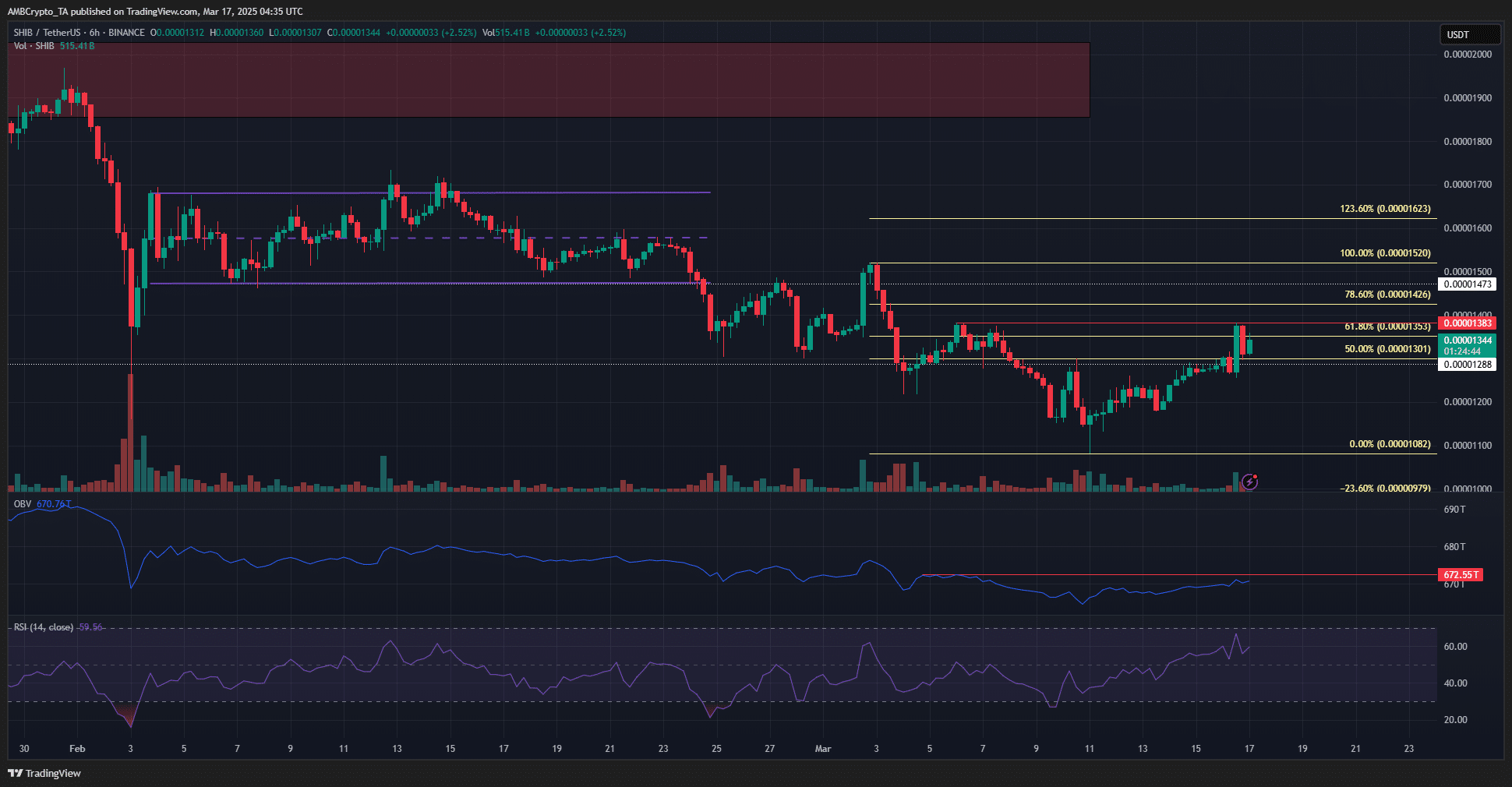

- The graph of the lower time has highlighted two key levels of Fibonacci retracement to watch.

Shiba Inu (Shib) fell below a long-term key level last week, but was trying to find his way over. However, prices’ action in recent months has indicated that the higher delay bias has been down.

The training of the Bitcoin range (BTC) in December began the downward Shiban movement. Other events have seen the optimistic conviction to the same eroded, a trend that has not yet been arrested.

Shiba Inu bulls probably have trouble

Source: SHIB / USDT on tradingView

On the weekly graph, Shiba Inu has a lower structure. It broke below 0.0000164, the lowest in November and at the time of the press floated just above the support of $ 0.00001288. He closed the first weekly session in March below this level, strengthening the lowering perspectives.

The rallies at the beginning of 2024 and November 2024 could not challenge the summits at the end of 2022. It was disappointing, because Bitcoin had many more capital of capital during the past year than in 2022. Hopes of capital rotation in the same could have been misplaced.

A rebound in weekly support described is expected. However, it would not be immediate. As in the summer of 2024, there could be a few weeks of consolidation before the next move.

Source: SHIB / USDT on tradingView

The 6 -hour graph has shown an exchange of sand near local resistance at $ 0.0000138 (red). The OBMO failed to pay a high level than earlier this month.

In addition, Fibonacci’s retrace levels have identified $ 0.0000135 and $ 0.0000142 as a key to key resistance areas.

This suggests that Shib is unlikely to increase more than 6% compared to its current price. The RSI reflected the bullish momentum after last week’s earnings, but the swing structure on the 6 -hour table remained down.

An escape greater than 0.0000127 and its retest as a support fueled recent gains. Similarly, a displacement greater than 0.0000152 could drive the next leg. However, the weekly graph does not indicate that such an escape is imminent.

Notice of non-responsibility: The information presented does not constitute financial investments, exchanges or other types of advice and is only the opinion of the writer