- Shiba Inu appreciated a lower structure on the daily delay

- The lack of purchase pressure and the accumulation of liquidation levels meant that the same could stay in the range this week

Shiba Inu (SHIB) seemed to make a breaking structure break on the 4 -hour table ten days ago. However, this break has failed since then, and the price has retested its local stockings twice. In its place, a range of lower delays has materialized, reflecting the lack of steering of Bitcoin (BTC) on the graphics.

Shiba Inu is consolidating in the range

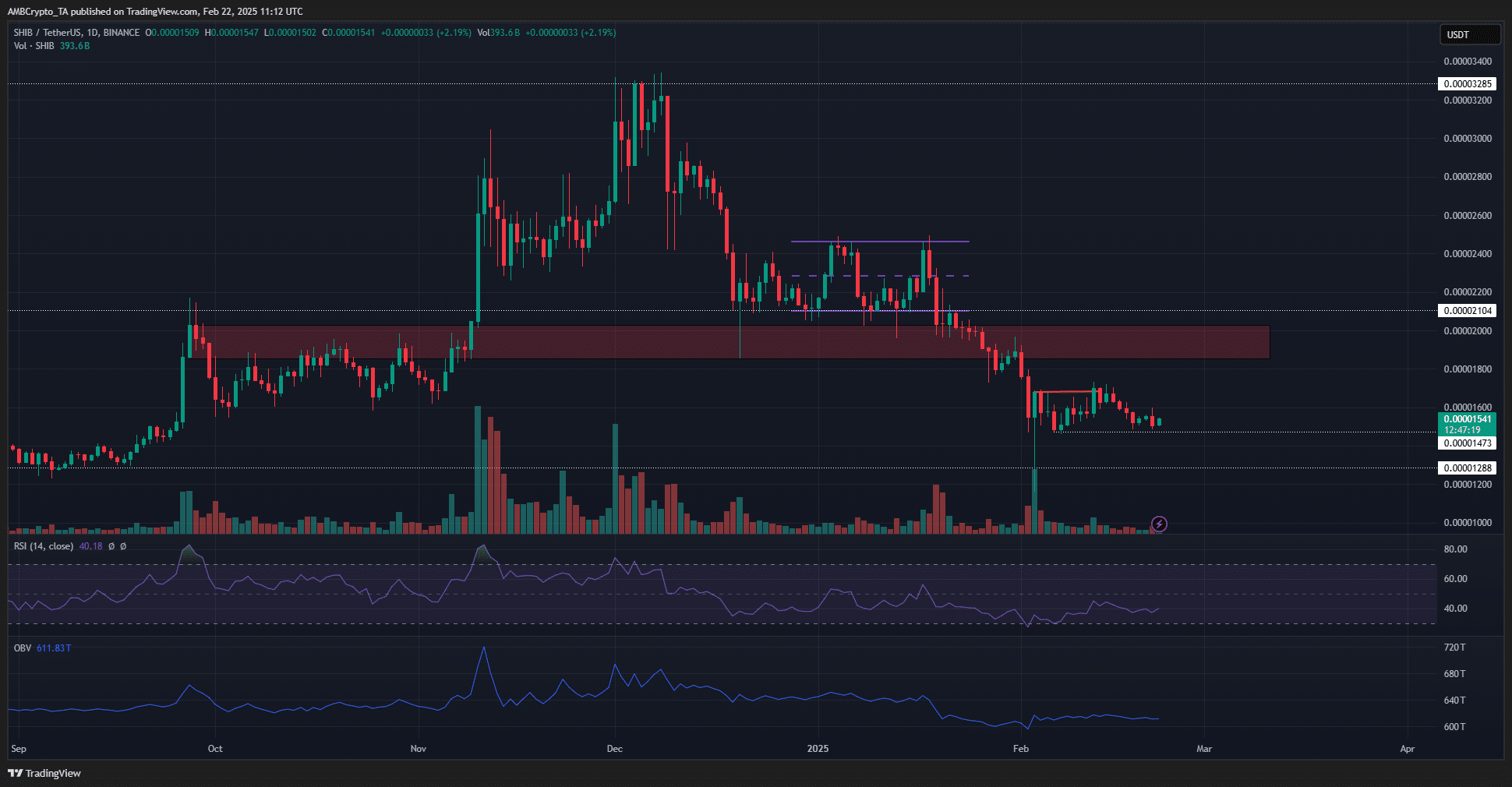

Source: SHIB / USDT on tradingView

The graphic for a day revealed that the swing structure was firmly down. A price step beyond the recent recent at $ 0.0000196 would be necessary to move the structure. In the current state of things, there seemed to be any evidence that such a decision would appear soon.

A local support area was also established at $ 0.0000147. Further south, the level of 0.0000128 was a significant level of support from September 2024.

At the time of the press, the daily RSI was down with a reading of 40. The OBR climbed higher after its losses in early February, signaling some purchase pressure. And yet, that was not enough to force the same to record new heights.

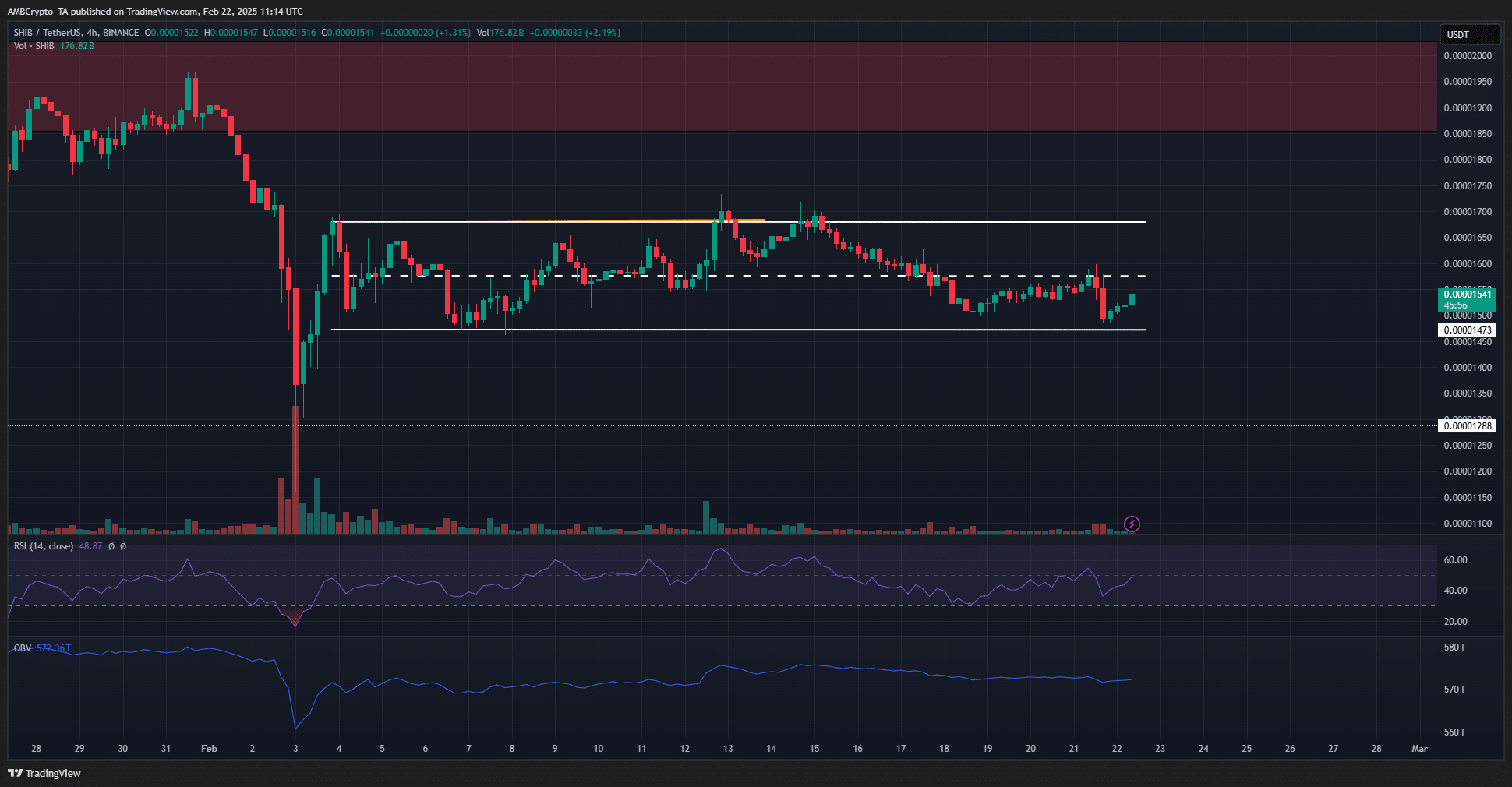

Source: SHIB / USDT on tradingView

The scope training was obvious over the 4 -hour period. This seemed to be a structure rupture (orange) on the H4 proved to mark the local summits at $ 0,000017. The mid -range level at $ 0.0000157 also seemed to emerge as a key to short -term resistance.

In addition, the RSI was lower on the 4 -hour table. In fact, he stayed below 50 in last week. A movement above 50, alongside a reversal of the mid -range resistance to the support, could allow traders to move for a long time – targeting the local resistance of 0.0000168.

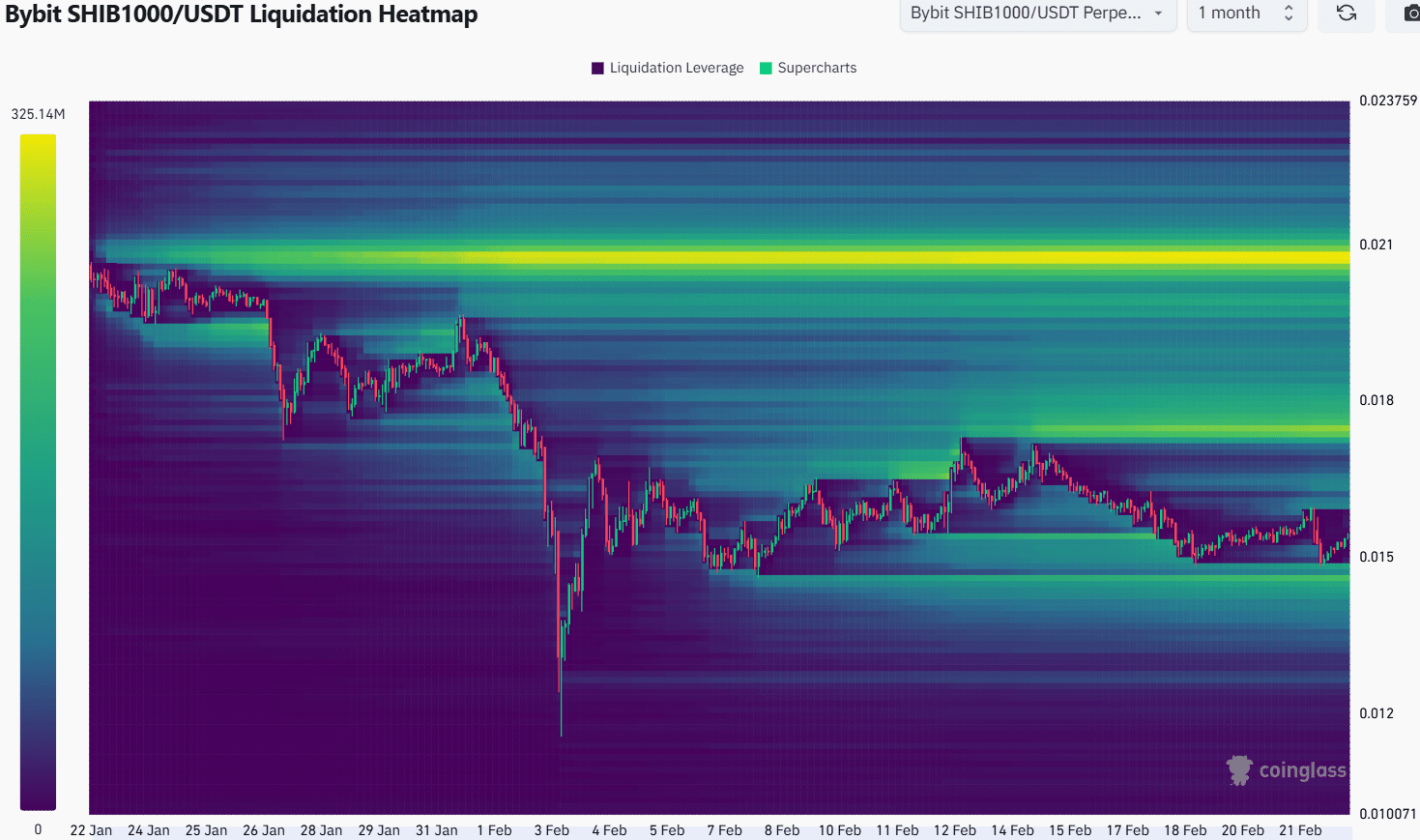

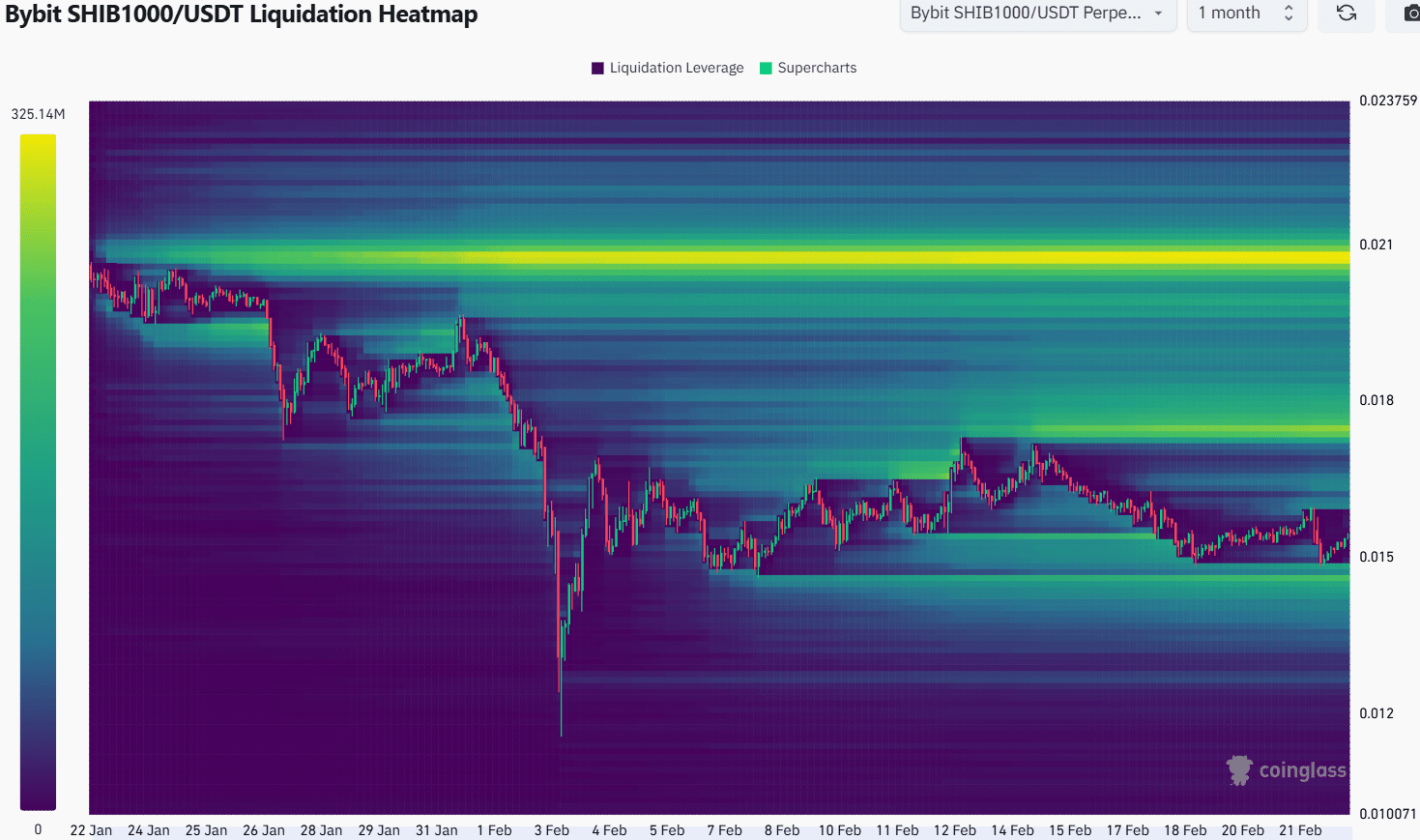

Source: Coringlass

The liquidation thermal card last month underlined the beach training. He revealed two liquidity clusters around $ 0.0000145 and $ 0.0000176, levels just beyond the extreme range marked on the 4-hour table.

The accumulation of liquidation levels around these prices implied that the price is likely to gravitate towards one, then the other, in the coming days. Consequently, a new test of $ 0.0000145 would be an opportunity to purchase, and the target of 0.000000175 of for -profit level.

Notice of non-responsibility: The information presented does not constitute financial investments, exchanges or other types of advice and is only the opinion of the writer