- The shib burning rate increased by 984% while a bull model targeted a potential rally of 70%

- The exchange outings increased and shortly the liquidations hiked, but the feeling was still slightly negative

Shiba Inu (Shib) has experienced a remarkable increase of 984% in its 24 -hour burning rate, marking one of the most aggressive token destruction events in recent weeks. Such a significant point could indicate a sharp increase in network activity and a commitment renewed by the Shibs community to reduce supply in circulation.

Burning mechanisms play an essential role in Shiba Inu’s deflationary strategy. And, such a spectacular increase often reinforces bullish expectations while the pressure of the food is starting to relax. At the time of the press, Shib was negotiated at $ 0,0000,1229, after a daily increase of 2.28%. Although this price movement may seem modest, the dynamics of underlying burns could define the higher long-term price performance bases if it is maintained.

Is Shiba Inu in place for a price escape of 70%?

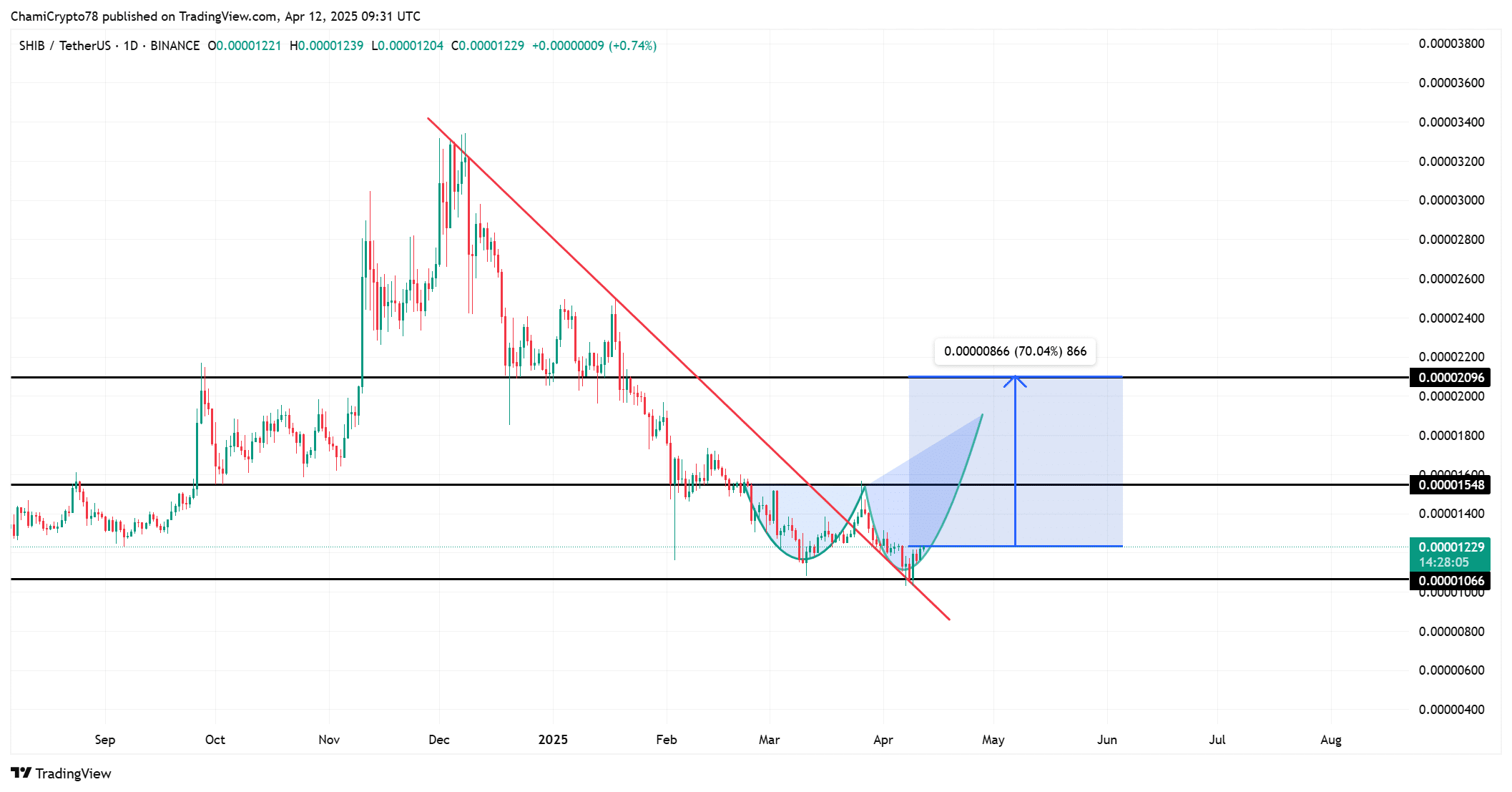

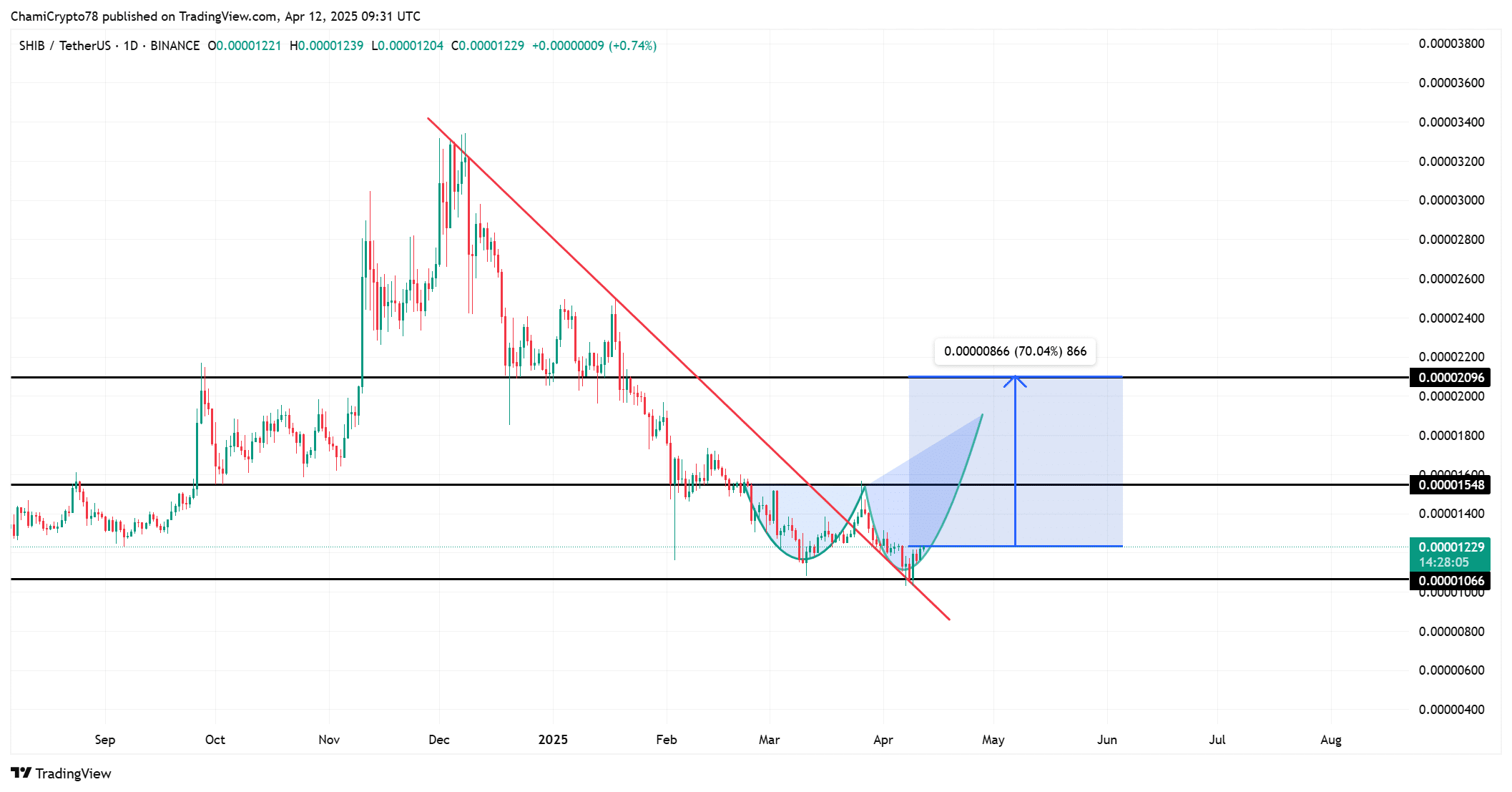

Shib recently broke out for a long -standing descending trend and has successfully completed a retest, confirming support for this level. This escape formed a well -defined cup and handle – an upward structure which generally precedes strong ascending movements.

SHIB could rally up to 0.0000002096, which represents a potential price increase of 70% compared to its press time levels. In addition, the formation of handle has highlighted the volatility of narrowing – a sign that a break could occur with a large quantity once the price will recover the level of 0.00001548.

Source: tradingView

Do sombrage whales accumulate in the form of exit exchanges of token?

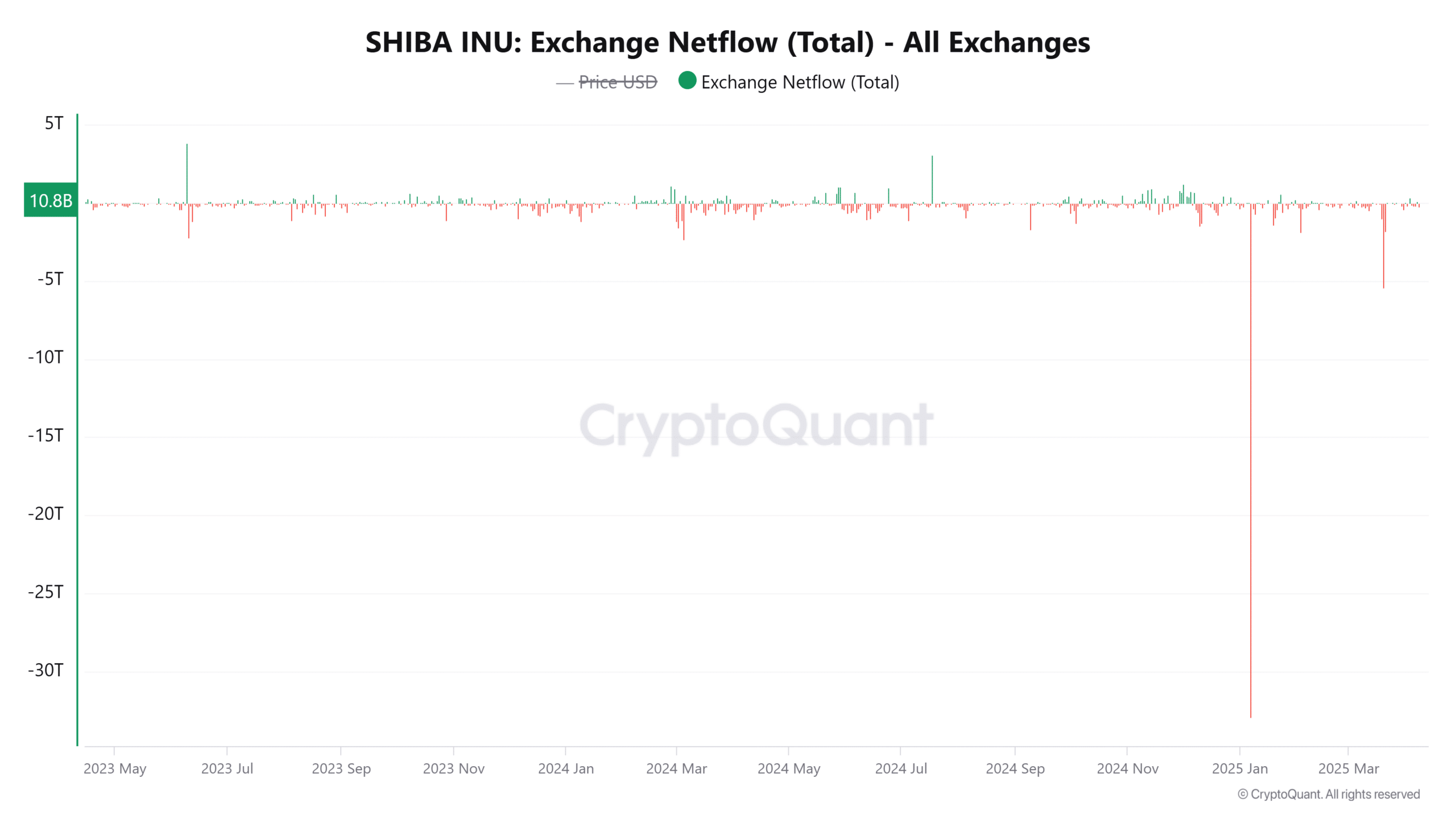

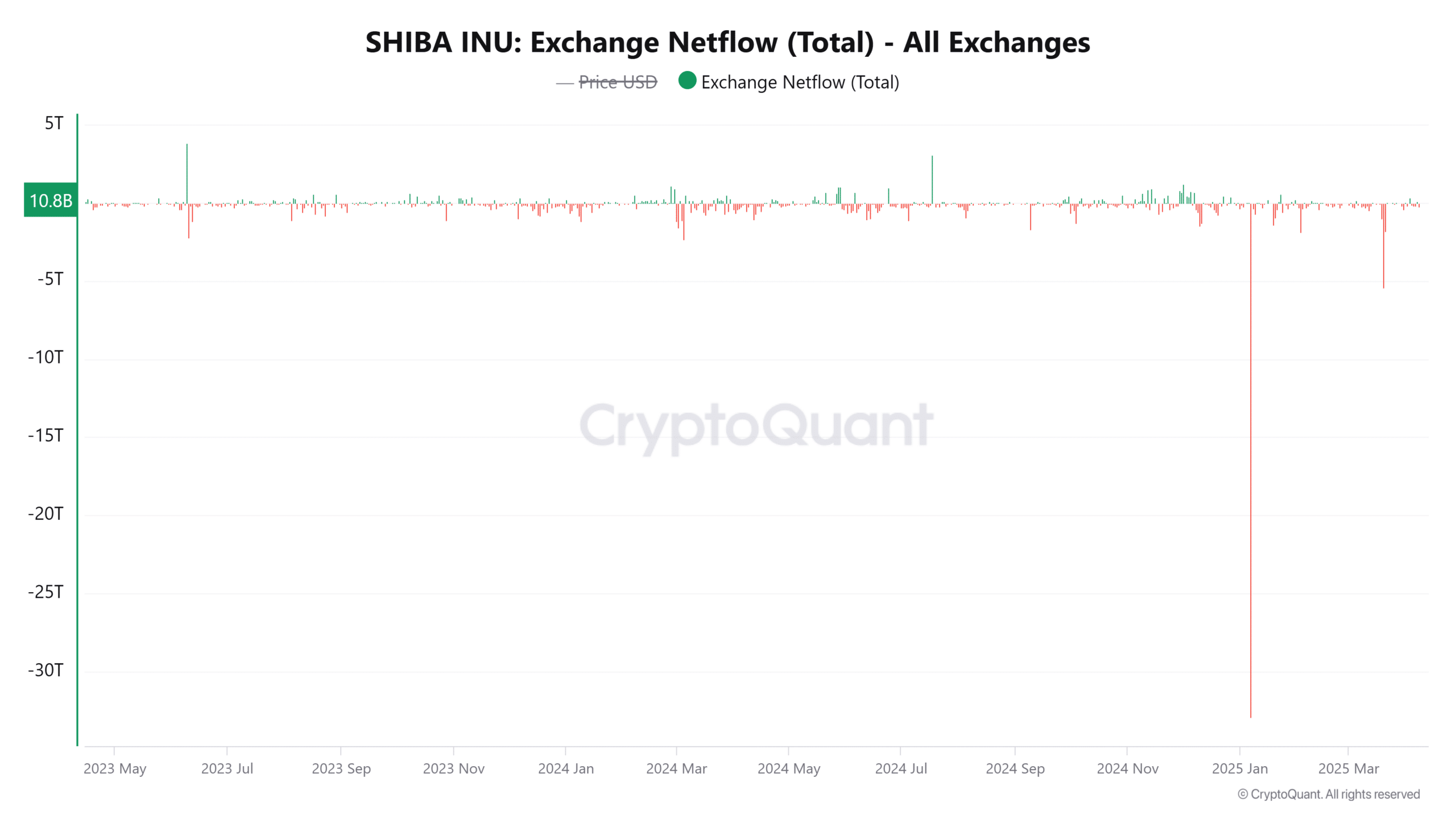

Netflow exchange data highlighted a sharp drop of 54.5 billion shib tokens in the last 24 hours, equivalent to a variation of -17.1%. This trend has confirmed that holders have removed their chips from exchanges, probably for long -term storage or strategic positioning.

Consequently, the sale pressure on the centralized platforms has dropped, while supporting the upward price action of the crypto. In addition, these outings seemed to line up with the models of historical accumulation observed before the main gatherings of Shib. This said smart money could be repositioned before a break.

Source: cryptocurrency

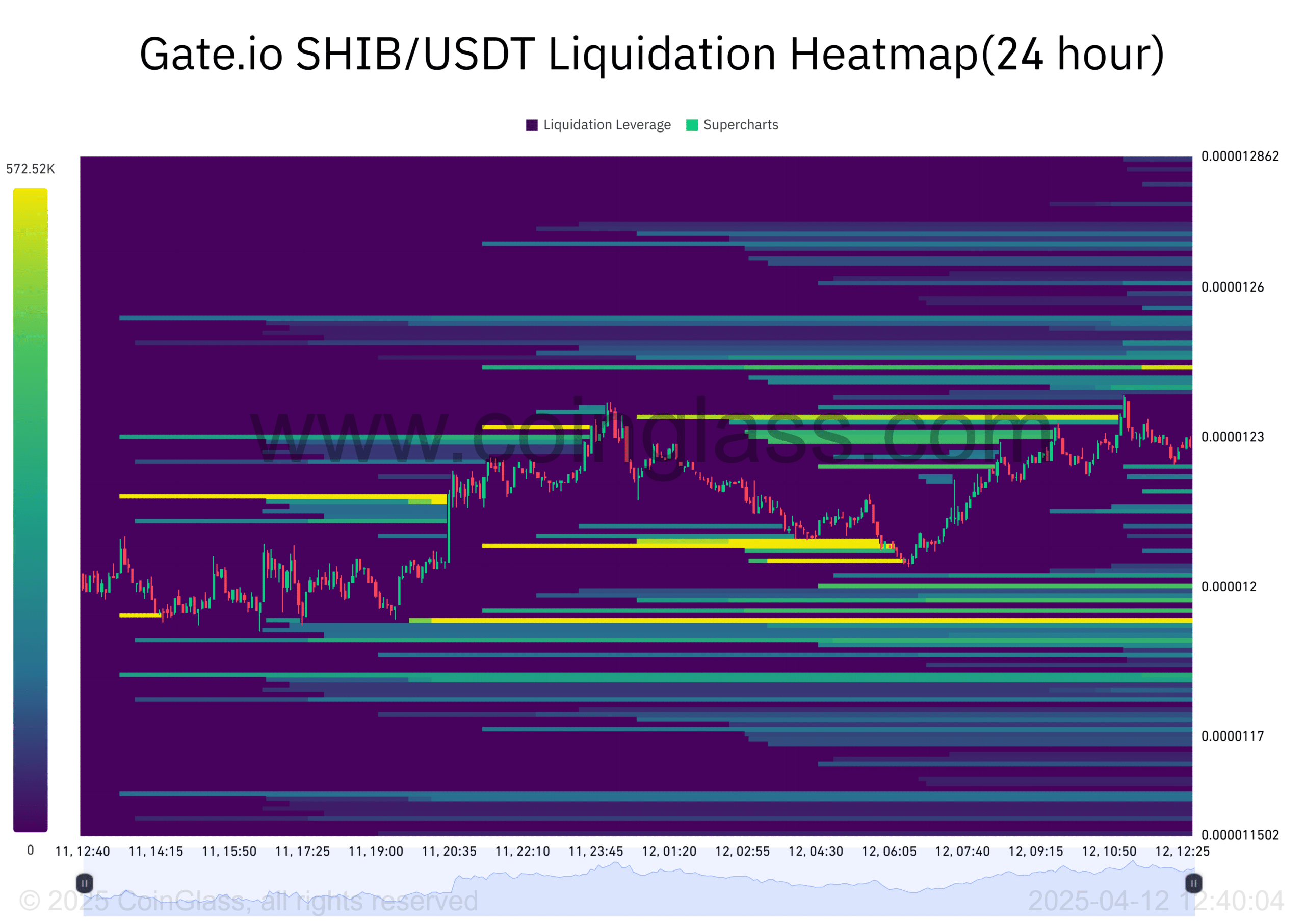

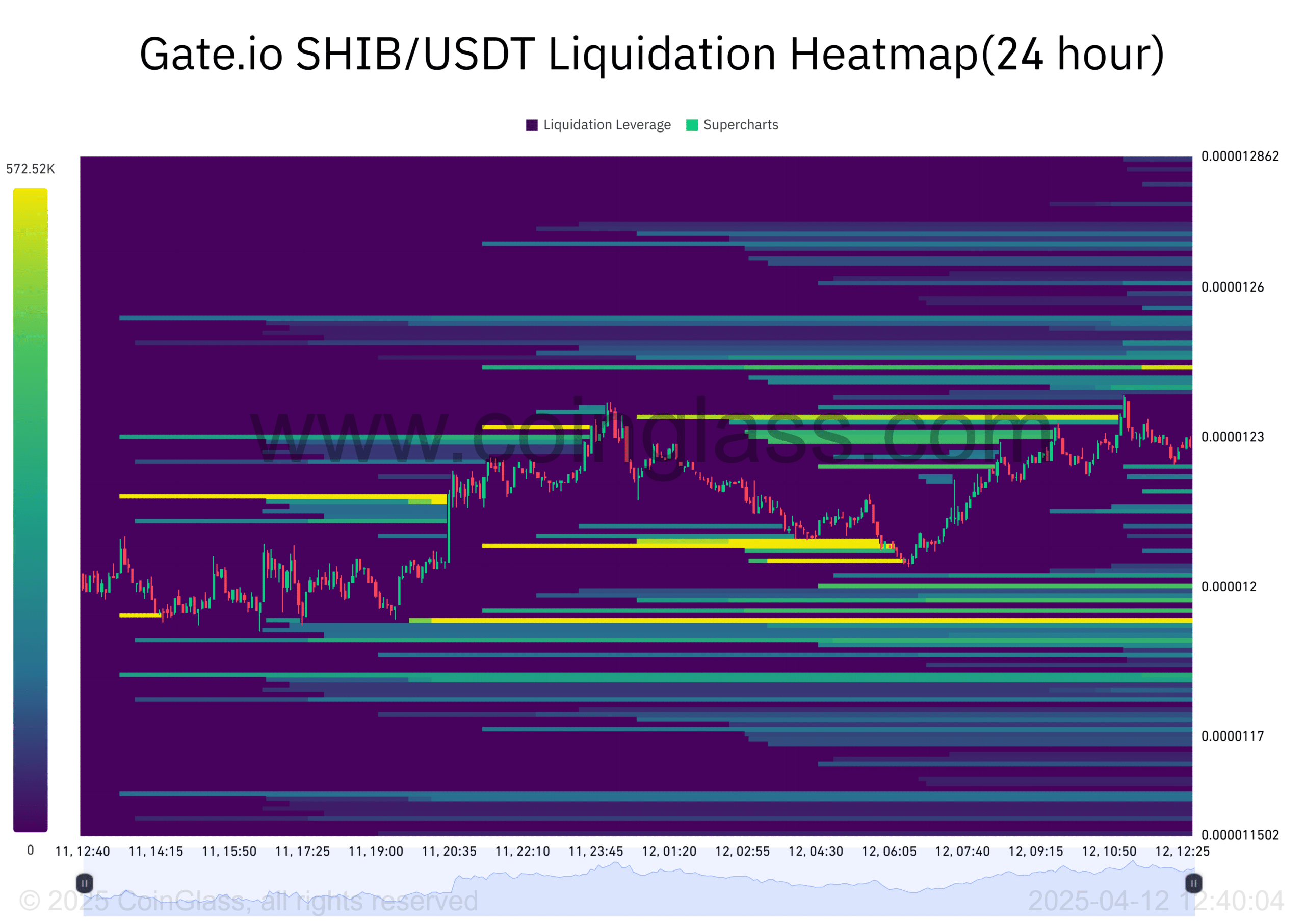

Can the liquidation clusters increase the bullish momentum?

The 24 -hour liquidation thermal card from Gate.io has highlighted the intense liquidation zones just below the press time price, in particular almost 0.00001200 $. These clusters revealed that many short positions have been wiped out – a sign that is mastered at these key levels.

Consequently, as Shib pushes above, the path of the slightest resistance could be due to the drop in sales pressure. In addition, the absence of large liquidation walls above TIMR price levels strengthens the optimistic case for more increases.

Source: Coringlass

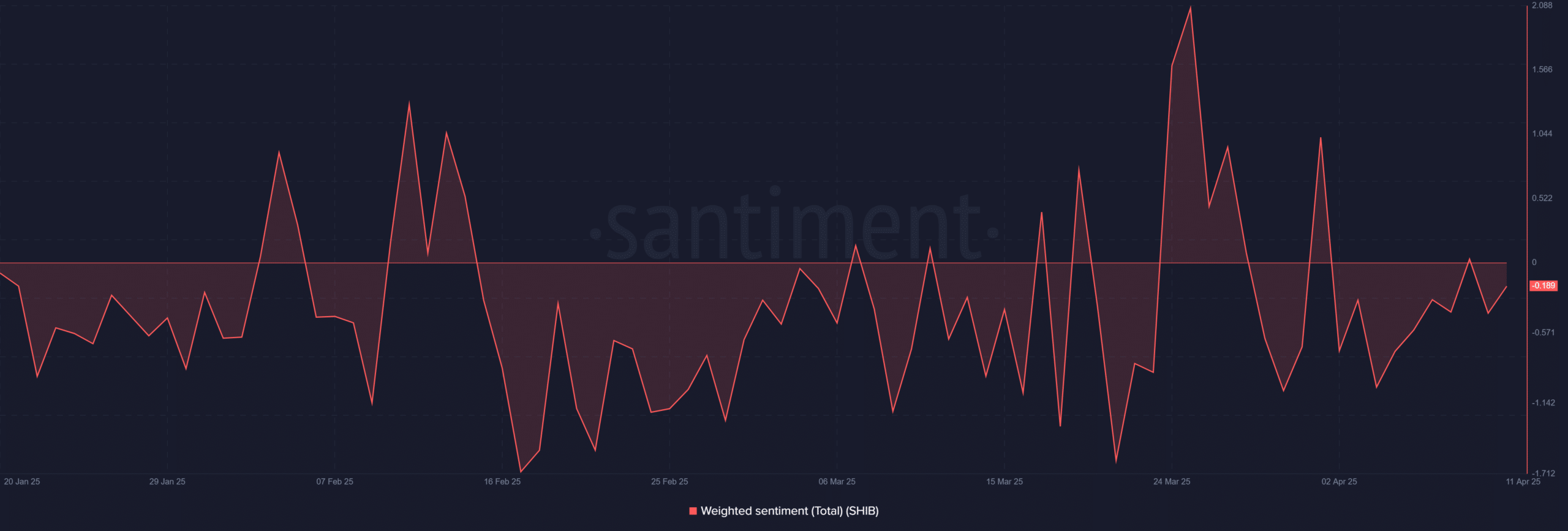

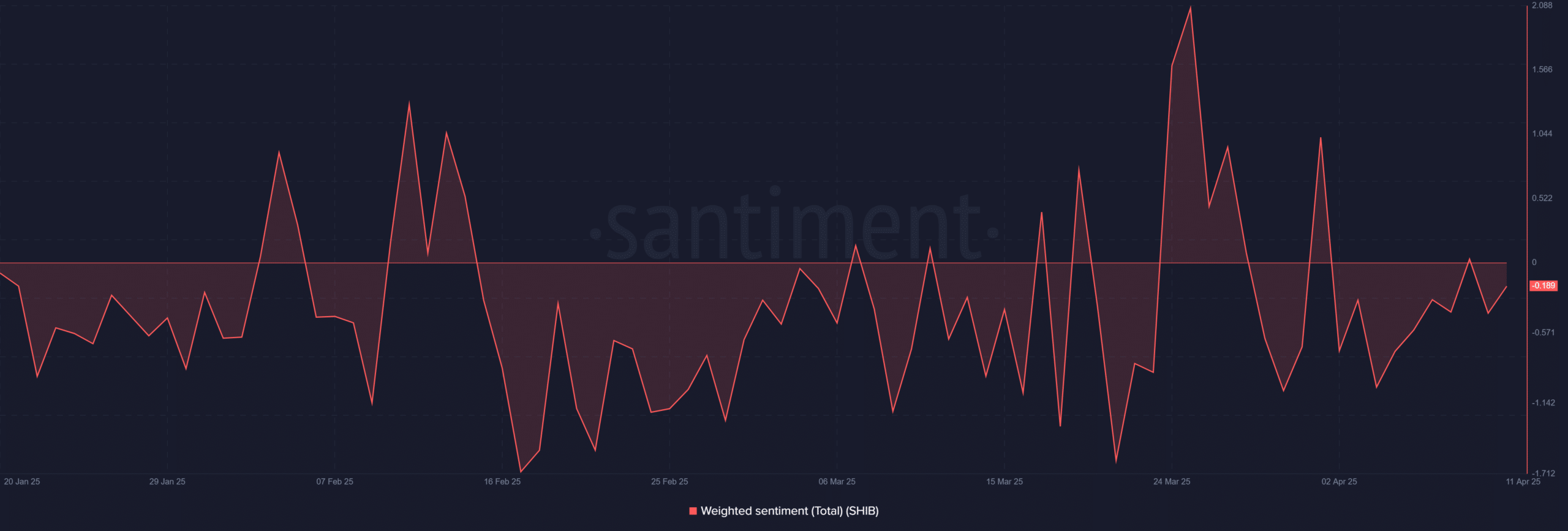

Why is Shib’s feeling still lagging behind despite the bullish signals?

When writing the editorial’s moment, the weighted feeling indicator of Santly had a slight negative reading of -0.189. This alluded to persistent skepticism among market players. However, the lowering feeling during bullish structural configurations often acts as an opposite indicator.

Historically, Shib has experienced net rallies whenever traders have doubted its strength, and the dominant configuration seems to reflect these conditions. Consequently, this emotional disconnection could fuel the more aggressive movements while latecomers are trying to take the trend.

Source: Santiment

Is a rally around 0.0000002096 on the horizon?

All critical metrics – technical models, burning activity, exchange outlets and liquidation structure – blinned at the time of the press. However, the feeling remains slightly negative, and this persistent prudence could still introduce short -term hesitations among traders.

Consequently, the SHIB route around 0.00002096 may require a consistent momentum and confirmation above the keys to resistance levels.