- Shiba Inu whales have been cautious in this market cycle by reducing their activity.

- However, a balance can still be achieved if this pressure is effectively combatted.

Shiba Inu (SHIB) has faced intense bearish pressure over the past 24 hours.

After jumping 8% to $0.00001739 to start the week after seven days of decline, most of those gains are gone, with SHIB now trading at $0.00001701.

A recent AMBCrypto report highlighted a market shift, noting that established coins are losing ground to newly minted memecoins.

If this trend continues, SHIB might not become the 100x opportunity for many expected to overtake Bitcoin by next year.

SHIB whales become cautious

SHIB whales holding 0.1% of the circulating supply represent approximately 60% of large holders; they hold a staggering 590 trillion SHIB tokens.

However, over the past 24 hours, SHIB whale activity has declined significantly, with significant trading volume down 35.41% and only 1.99 trillion SHIB moving.

Interestingly, while high accumulation often signals a market bottom, indicating dip buying opportunities, reduced whale activity could indicate a market top as their confidence in the short outlook SHIB term decreases.

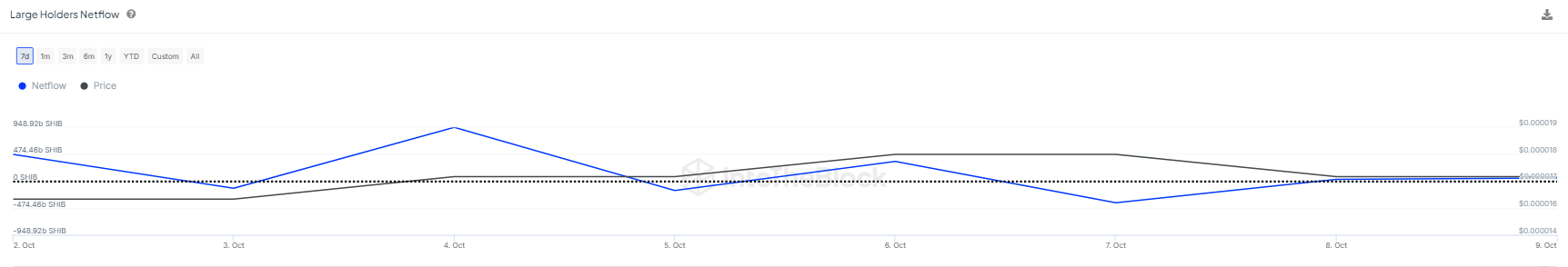

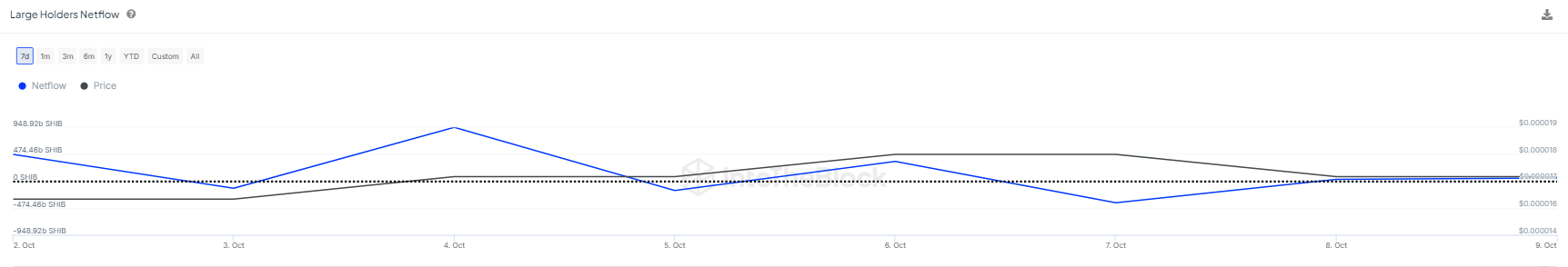

Source: DansLeBlock

Confirming this, large cohorts sent 90 billion SHIB to exchanges over the past two days, contributing to a 6% price decline.

Even if caution around whales has had an impact, the broader trend may not yet confirm an imminent withdrawal, as…

The bulls take back control

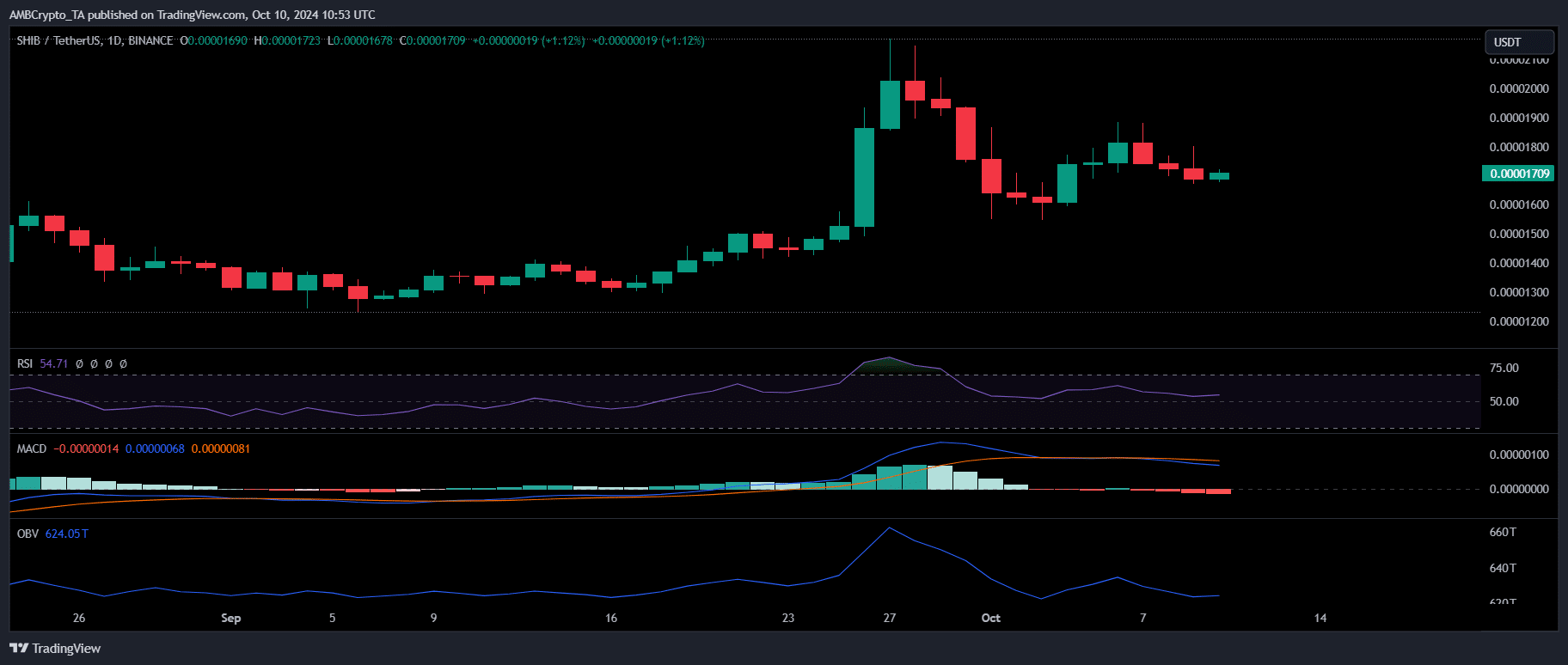

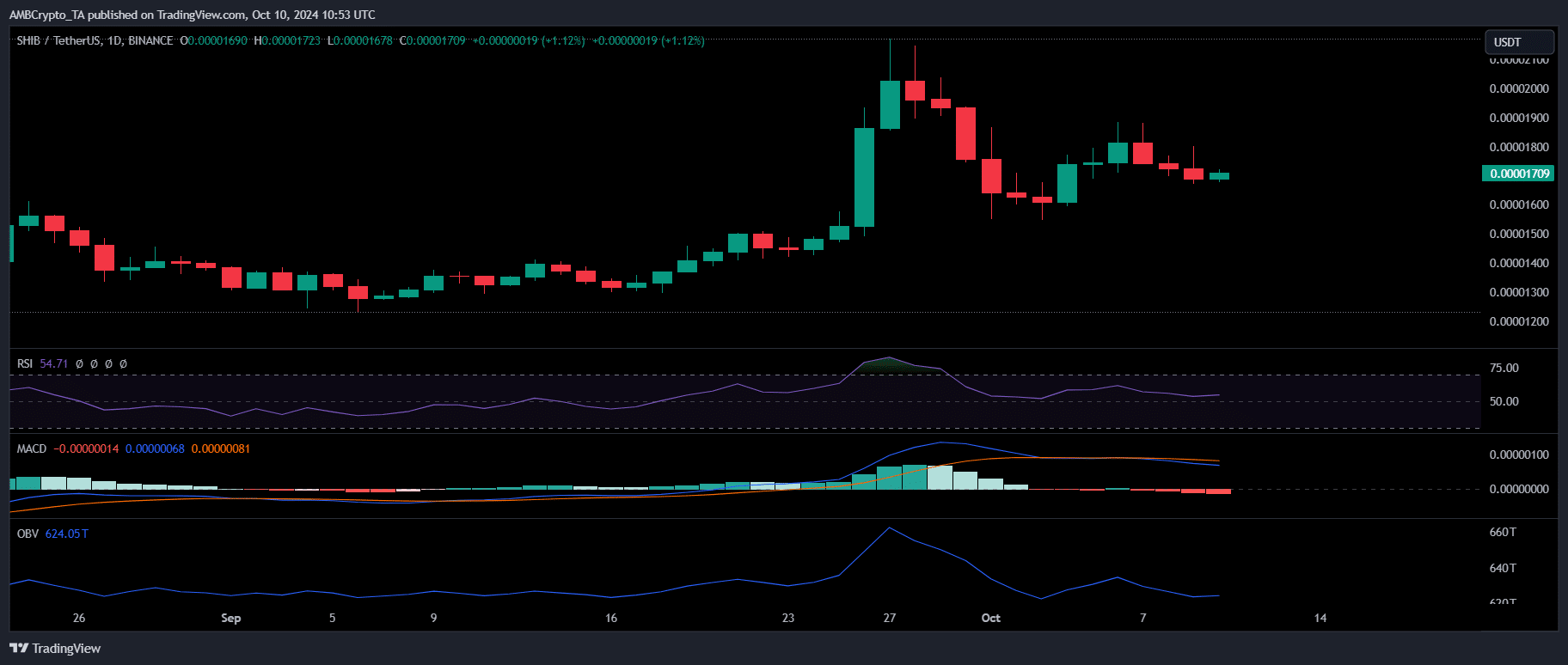

On the daily price chart, a bearish crossover in the MACD coincided with the decline as large Shiba Inu whales reduced their positions.

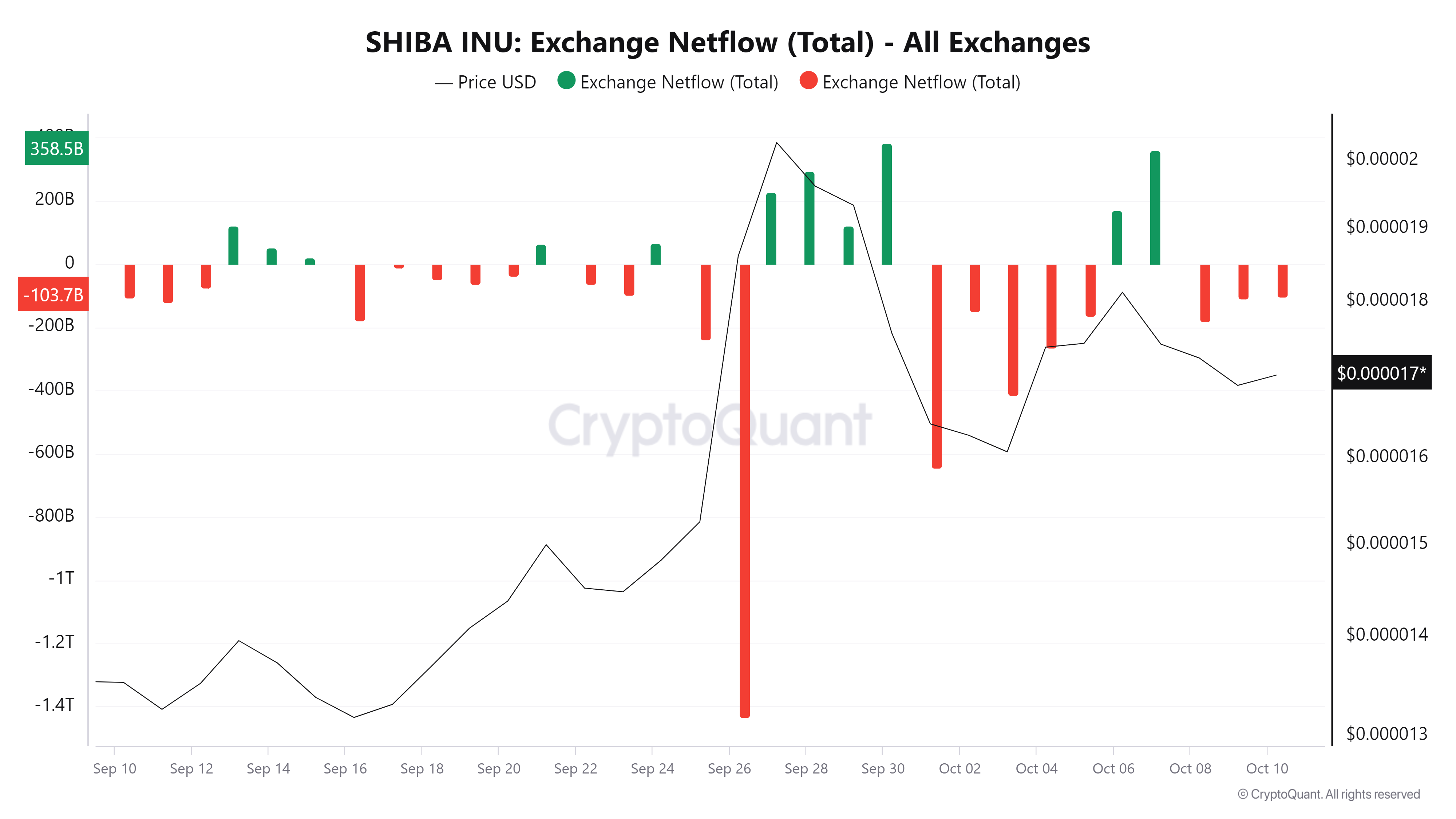

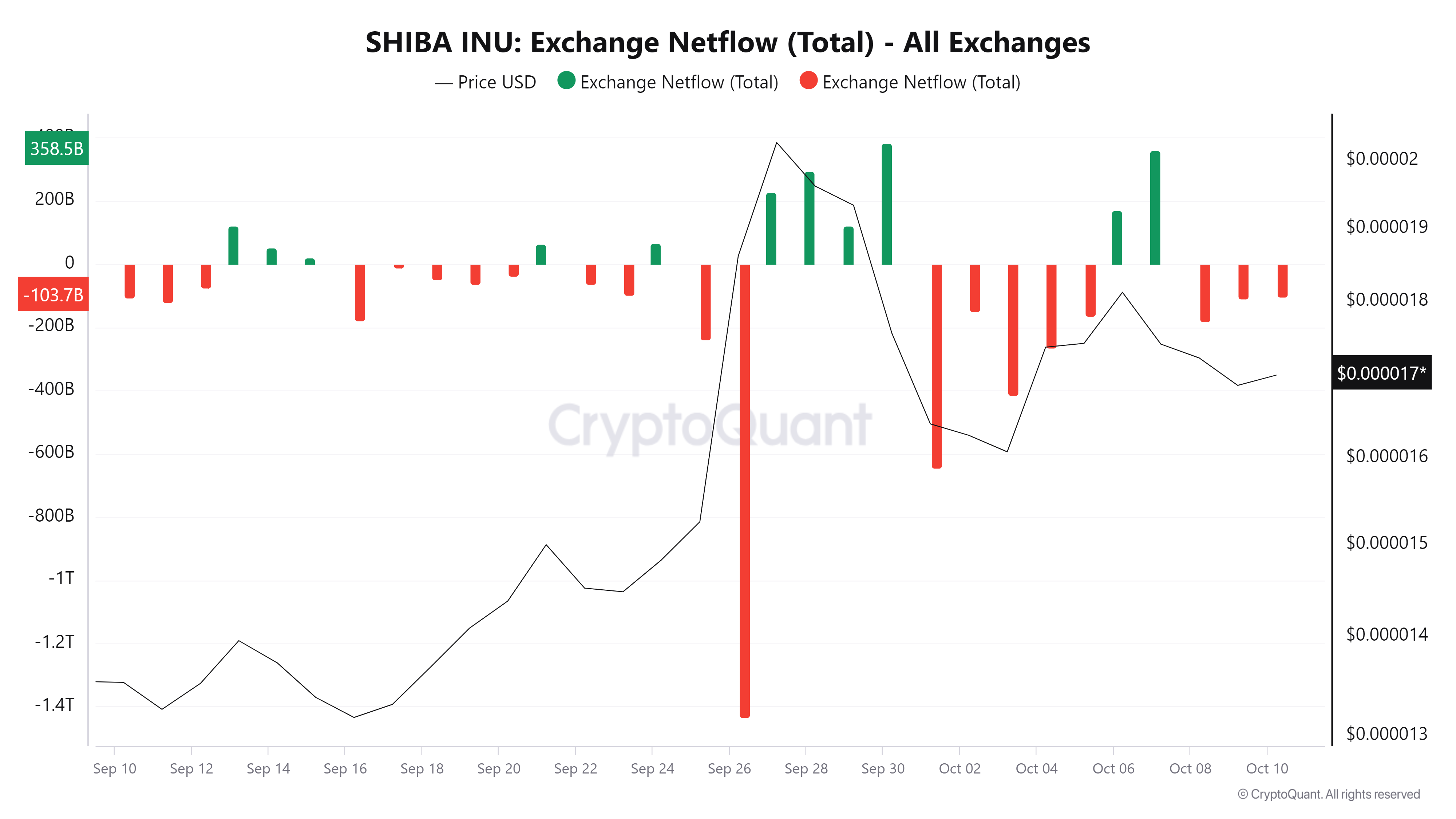

However, since then, the overall net flow has turned negative, suggesting that the bulls are stepping in and absorbing the pressure by allocating capital to SHIB.

CryptoQuant

This marks a pivotal moment for the recovery. Recent SHIB whale activity has caused its value to plummet, pushing many investors into a net loss.

Still, if the bulls maintain their support, it could restore confidence among those in a losing position and incentivize holders to support SHIB’s price correction – a critical step for an imminent reversal.

There is still room for growth

From a fundamental economic perspective, an increase in supply combined with high demand can lead to price equilibrium.

SHIB’s recent net outflows demonstrate bullish sentiment, indicating substantial potential for aggressive buying. This is also supported by the RSI, which is currently in a neutral phase.

Source: TradingView

However, the key factor is a steady upward trend, which largely depends on how holders position themselves following the SHIB whale sell-off.

Read Shiba Inu (SHIB) Price Forecast 2024-2025

If the bulls successfully counter the selling pressure with aggressive buying, a reversal could bring SHIB closer to its previous rejection level at $0.000020, a critical point for a potential breakout.

Conversely, given overall market volatility and SHIB’s increasing capital allocation to newly minted memecoins, consolidation in the $0.0000175 to $0.0000160 range appears more likely.