- Solice (SLC) jumped 28.33% in a week, attracting new interest despite a low market capitalization.

- Technical indicators signal bullish momentum, but declining volumes raise sustainability concerns.

Solice (SLC) was trading at $0.001098 at press time, reflecting an impressive 28.33% rise over the past 7 days. This rapid rise highlights renewed interest in SLC as it gains traction among traders.

The market cap remains stable at $47.42K, positioning Solice as a smaller player with significant growth potential.

With a total supply of 400 million SLC, this recent rally has brought new attention to the token, sparking curiosity about its future trajectory in the market.

Is SLC on the verge of a breakout?

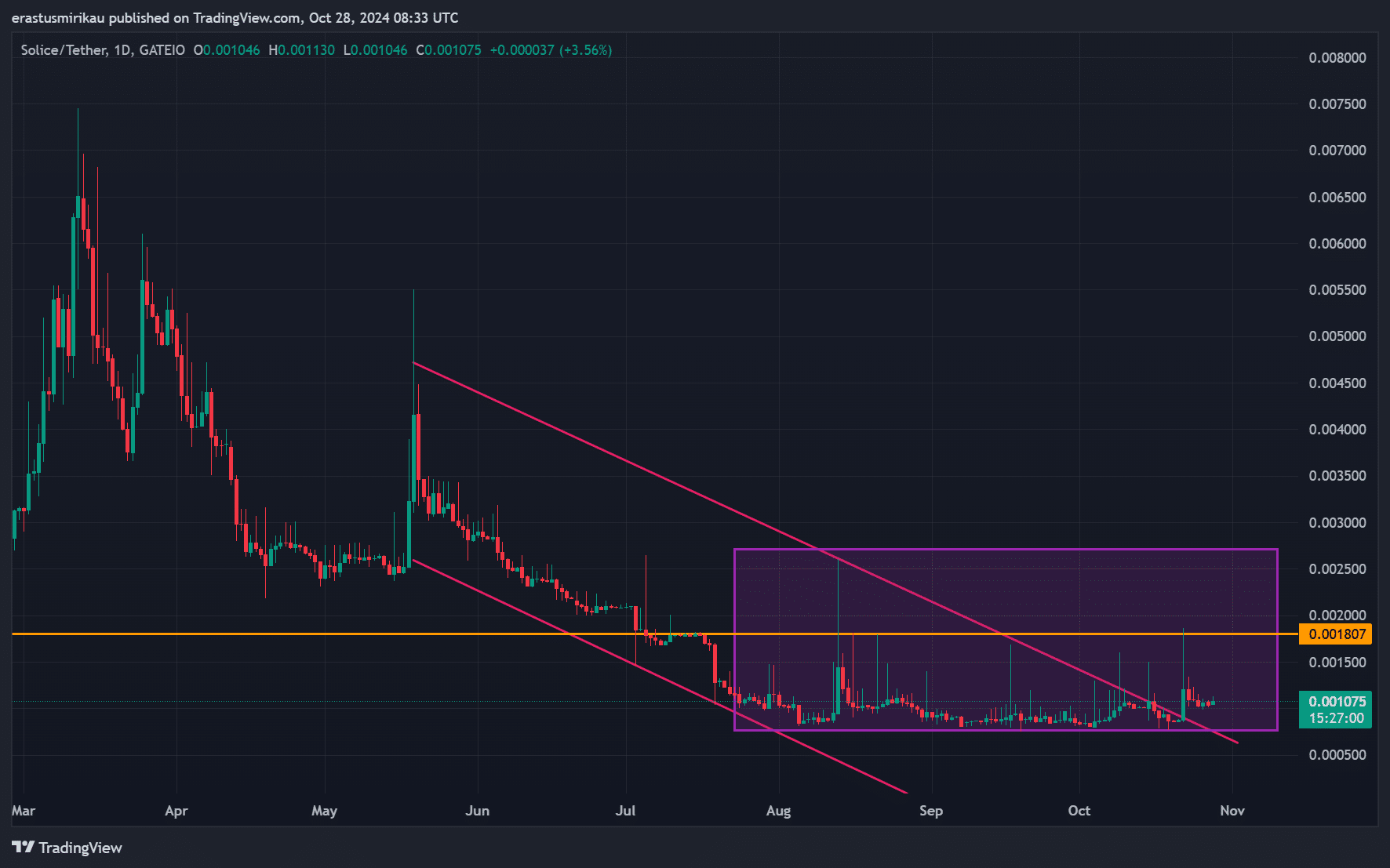

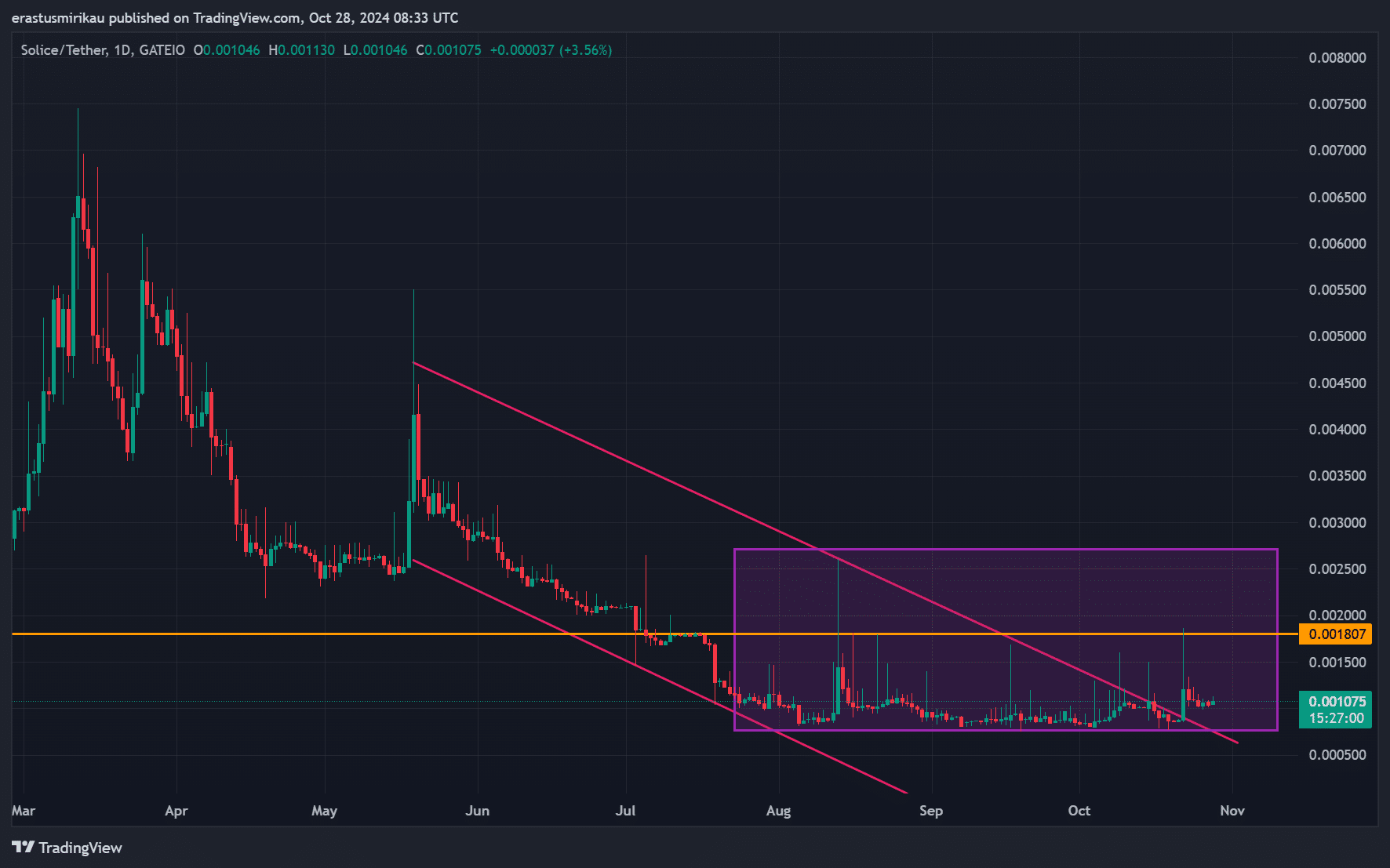

Looking at the SLC chart, we see the price attempting to break out of an established descending channel after a sell-off earlier this year. Recently, SLC has entered a consolidation phase, trading in a tight range, which often serves as a precursor to a breakout.

The key resistance level lies around $0.001807. If SLC manages to rise above this point, it could indicate stronger bullish momentum.

Source: TradingView

What do technical indicators reveal?

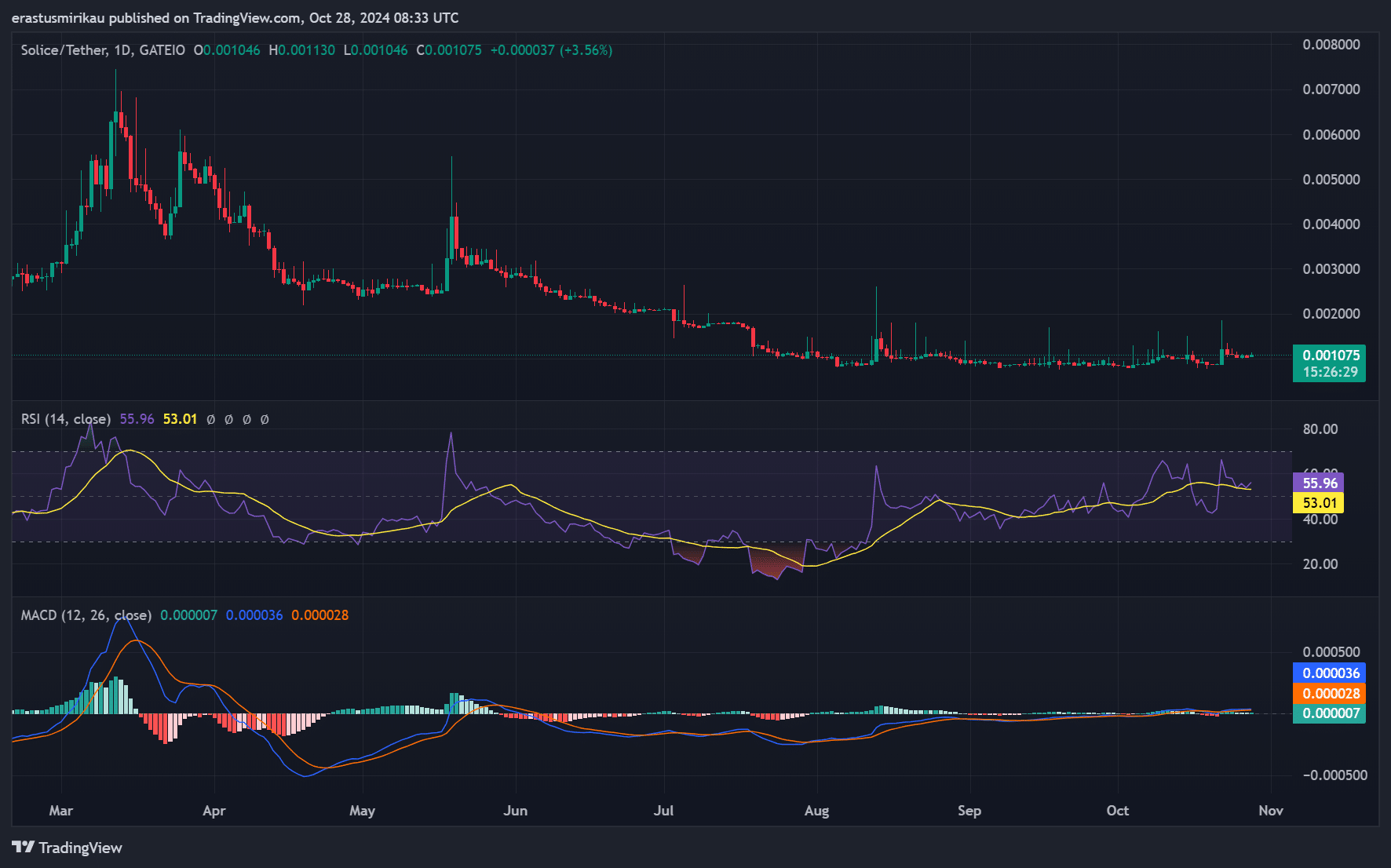

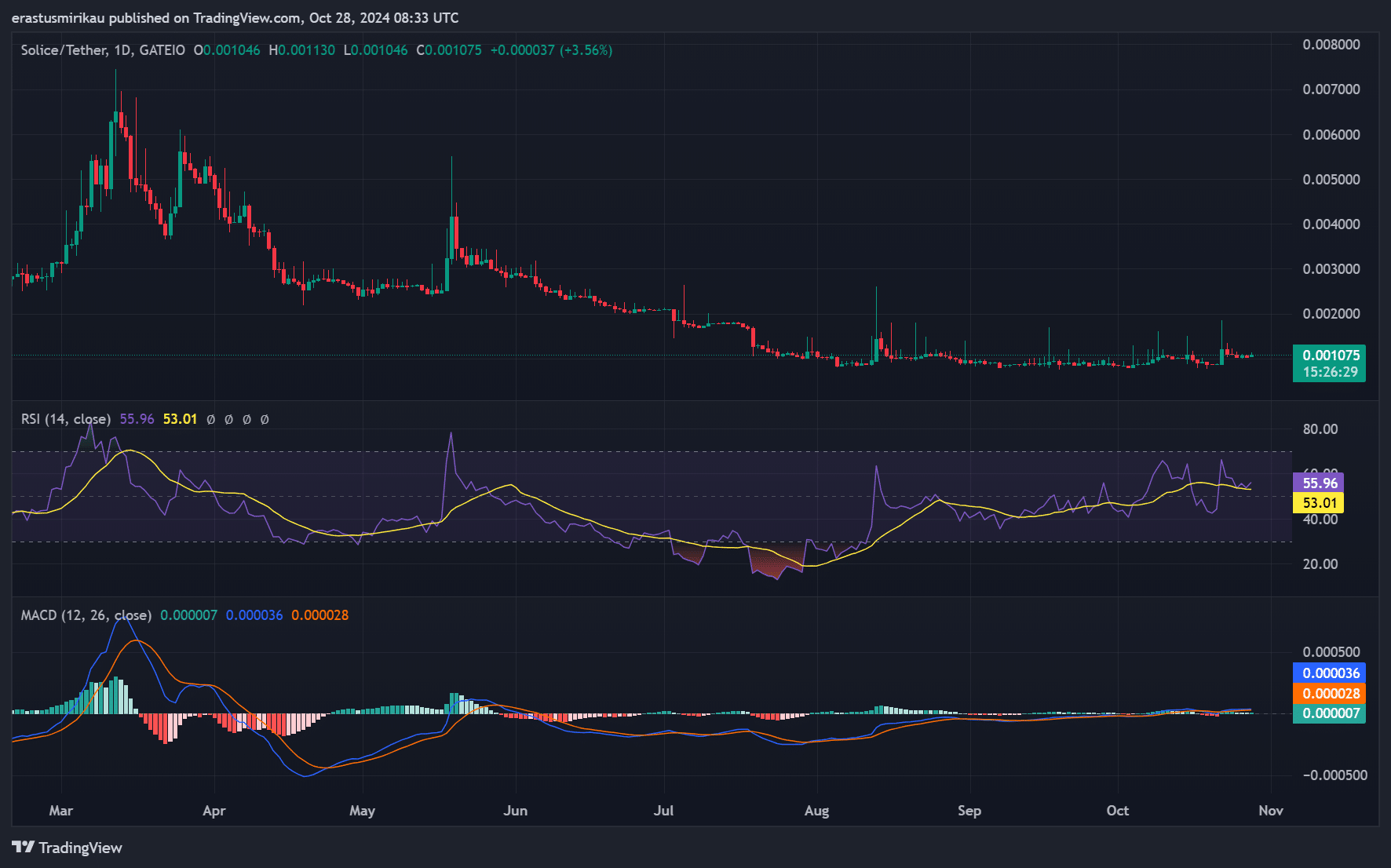

The Relative Strength Index (RSI) is currently at 55.96, suggesting buying interest is increasing. Therefore, even though SLC has not yet entered overbought territory, it could continue to attract buyers if the RSI remains above 50.

Additionally, the MACD (Moving Average Convergence Divergence) indicator displays a subtle bullish crossover, with the MACD line (blue) placing slightly above the signal line (orange). This crossover, although modest, may indicate the beginning of positive dynamics.

Therefore, if the MACD trend continues upward, it could strengthen the bullish outlook and attract more attention from traders.

Source: TradingView

Decline in trading volume: warning sign or pause?

Even though the price of SLC has increased, its trading volume tells a different story. Over the last 24 hours, volume decreased by 39.40%, standing at $1.3K. according to CoinGecko. This decline may indicate weakening buyer interest or simply reflect market consolidation following recent gains.

Typically, a decrease in volume during an uptrend can signal caution, as it suggests that fewer traders are supporting the rally. Therefore, for SLC to maintain its momentum, an increase in volume is crucial, especially if the price approaches and tests the critical resistance level.

Is SLC ready to continue its momentum?

Solice has shown significant growth, with an increase of 28.33% over the past week. The RSI and MACD indicators indicate continued upside potential, provided volume increases to support the rally.

However, the sharp decline in trading volume serves as a warning, suggesting that the current rally may lack strong support.

So, even though SLC is showing promising technicals, traders should closely monitor resistance levels and volume trends to assess whether this rally is lasting or just a short-lived spike.