Ethereum is trading below the $3,000 level as selling pressure continues to weigh on the broader crypto market. After weeks of unstable price action, ETH failed to regain key psychological and technical levels, reinforcing a fragile market structure.

Sentiment remains decidedly bearish, with fear, even apathy, beginning to dominate traders’ behavior. Volatility has reduced, participation has declined, and many analysts are increasingly pointing to a prolonged bear market scenario through 2026.

This lack of conviction is not limited to those in the retail sector. According to data shared by Lookonchain, two large whales dumped a total of 14,000 ETH, worth around $40.82 million, in the last two hours alone. Such aggressive selling in already weak conditions adds pressure on an asset that is struggling to attract sustained demand.

Although isolated whale activity alone does not define the broader trend, timing matters. Large distributions during periods of low liquidity often amplify downward movements and reinforce negative sentiment in the market.

Ethereum Whale Selling Responds to Long-Term Conviction

Arkham data shared by Lookonchain reveals new evidence of large-scale selling as Ethereum trades under sustained pressure. Address 0x2802 sold 10,000 ETH, worth approximately $29.16 million, at an average price of $2,915.5 via decentralized exchanges.

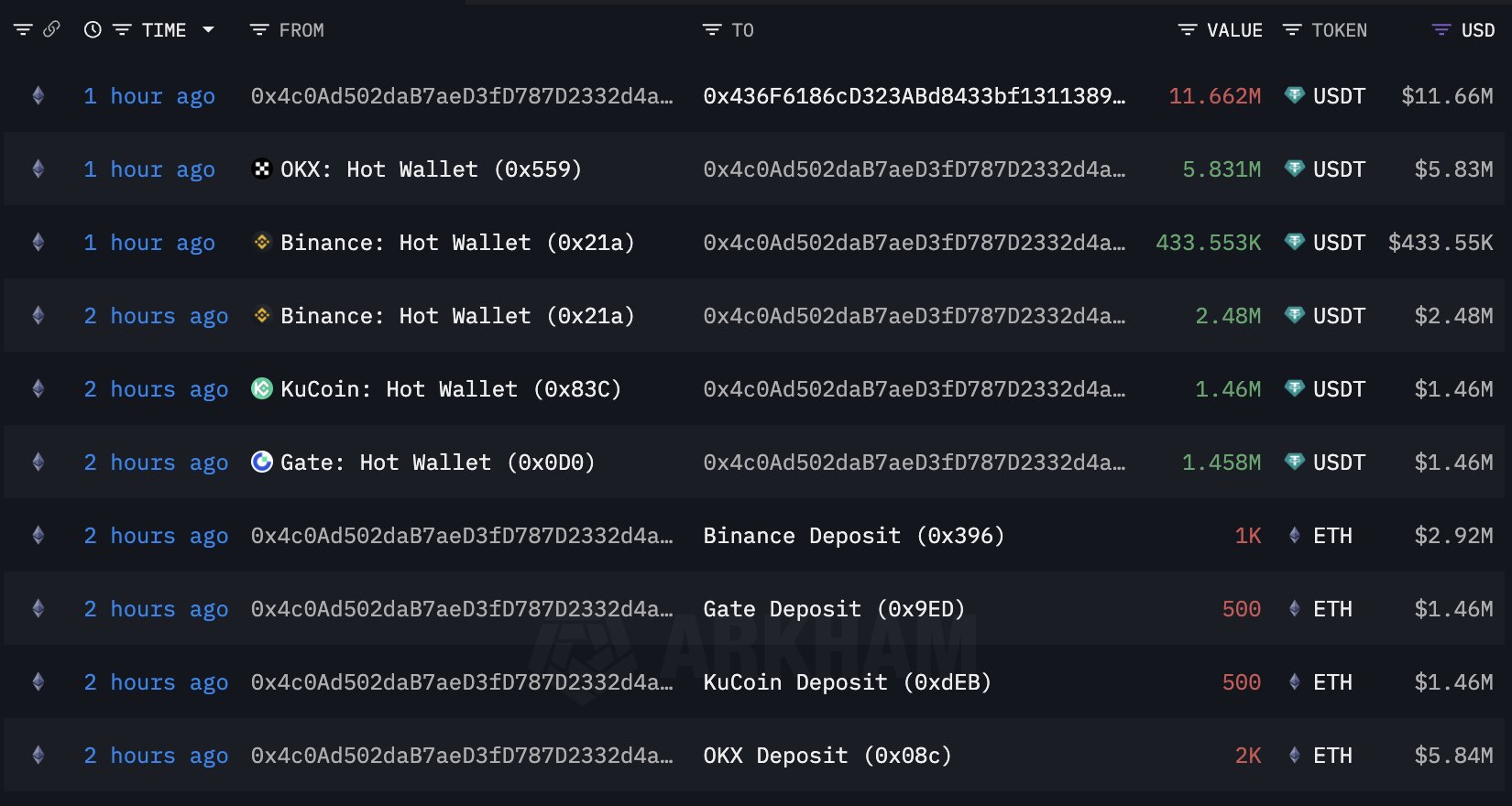

Shortly after, another whale, 0x4c0A, offloaded 4,000 ETH, worth approximately $11.66 million, spreading the sale across several centralized sites, including OKX, Binance, KuCoin, and Gate. The timing and coordination of these moves reinforces the current bearish tone, especially as liquidity remains low and general market sentiment is rather defensive.

In the short term, such activity adds to downward pressures and fuels uncertainty among small investors, who often interpret whale sales as a sign of deeper weakness to come. However, price action and sentiment don’t tell the whole story. Despite the decline, Ethereum’s fundamentals continue to strengthen at a pace rarely seen before. Institutional adoption is accelerating, not slowing down.

Most notably, JP Morgan recently announced the use of Ethereum to launch its first tokenized money market fund, a step that underscores the growing confidence in Ethereum as a settlement and financial infrastructure layer. Although markets may remain bearish in the near term, the divergence between price sentiment and fundamental progress is becoming increasingly difficult to ignore.

Ethereum Price struggles to hold key weekly support

Ethereum continues to trade under pressure on the weekly chart, with price now sitting around $2,950 after a sharp rejection from the $3,200-$3,300 region. This area previously served as a key pivot zone and has now clearly become resistance. The inability to reclaim it confirms that sellers remain masters of the medium-term structure.

From a trend perspective, ETH is consolidating around its 200-week moving average (red line), a historically important level that often determines whether corrections remain cyclical or evolve into deeper bearish phases. So far, this moving average is acting as dynamic support, preventing a more aggressive breakout. However, the momentum remains weak and the continued rise is limited.

The 50- and 100-week moving averages (blue and green lines) are beginning to flatten and converge, reflecting indecision and reduced trend strength. Volume also remains moderate compared to previous expansion phases, suggesting that there is neither heavy accumulation nor capitulation at current levels.

Structurally, ETH remains in a wide consolidation range between $2,500 and $3,300. A weekly close below the $2,800-$2,900 area would expose a decline towards the lower end of this range. Conversely, it will be necessary to recover $3,300 to reestablish bullish momentum. Until then, Ethereum remains technically fragile despite its long-term fundamentals.

Featured image from ChatGPT, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.